Our Application for a Refinance

advertisement

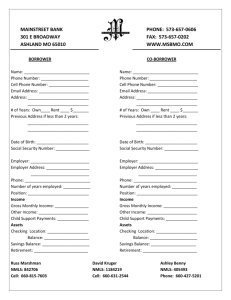

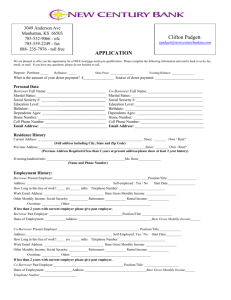

Mortgage Loan Questionnaire – Refinance Pre-approval * Instructions – Please fill out the entire questionnaire by typing directly onto this MSword document, re-save doc, re-attach to new e-mail, and return via e-mail to me ASAP. I. Terms of Loan & Property Information; Est. Mortgage Amount Est. Value Property Full Address Property County 1-4 Family, Coop, or condo Estimated monthly taxes, annual hazard insurance coverage, and/or monthly maintenance fees. Occupancy – Primary, 2nd Home, Investor Mortgage product (fixed, ARM, other) and term (30, 15 yr) desired E-mail contact info II. Borrower Information; Borrower Name Social Security # Home Phone # Birth Date Years of School Married, Unmarried, Separated Present Address (include city, state & zip) Years at present address Former Residence (if current is less than 2 years) Years at former residence # of Dependents & Ages Co-Borrower Name Social Security # Birth Date Years of School Married, Unmarried, Separated Present Address (if Same as Borrower, please indicate) Years at present address Former Residence (if current is less than 2 years ) Years at former residence III. Employment Information; Borrower Name of Employer Complete Address of Employer Self Employed - Yes or No Employment Dates (hire date to present) Years in this line of work/industry Position or Title Business Phone # Former Employers (if current is less than 2 years ) Former Title or position Former Employer complete address Employment dates (hire date to end date) Former Employer phone # Co-Borrower Employment Information Name of Employer Complete Address of Employer Self Employed - Yes or No Employment Dates (hire date to present) Years in this line of work/industry Position or Title Business Phone # Former Employers (if current is less than 2 years ) Former Title or position Former Employer complete address Employment dates (hire date to end date) Former Employer phone # IV. Monthly Income & Present Housing Expense; Gross Monthly Income Base Monthly Salary Overtime Bonuses Commissions Dividends / Interest Net Rental Income Borrower Co- Borrower Present Monthly Housing Expense Rent First Mortgage Second Mortgage Hazard Insurance Real Estate Taxes Other (mthly maint fees, Total common charges) Other Income V. Total Assets; Liquid & Reserve Assets – all sources of $ for transaction (note any Gift assets, 401K, brokerage Checking/savings, CD’s, and earnest money deposit down) Financial Institution/address Type of Account/Account # Account Balance VI. Liabilities; Name of Creditor Company Monthly Payment Balance TYPE = Installment, credit card, mortgage, alimony, child support. VII. Schedule of Real Estate Owned; Property Address – full address Type Home Market Value $ Balance of Mortgage & Liens VIII. Declarations Questions Are there any outstanding judgements against you? Have you been declared bankrupt in the past 7 years? Have you had a property foreclosed upon or given title or deed in lieu thereof in the last 7 years? Are you a party to a lawsuit? Have you directly or indirectly been obligated on any loan, which resulted in foreclosure, transfer of title in lieu of foreclosure, or judgement? Are you presently delinquent or in default on any Federal debt or any other loan, mortgage, financial obligation, bond or loan guarantee? Are you obligated to pay alimony, child support, or separate maintenance? Is any part of the down payment borrowed? Are you a co-maker or endorser on a note? Are you a U.S. citizen? Are you a permanent resident alien? Do you intend to occupy the property as your primary residence? Have you had an ownership interest in a property in the last three years? What type of property did you own – principal residence (PR), Second Home (SH), or investment property (IP)? How did you hold title to the home – solely by yourself (S), with your spouse (SP), or jointly with another person (O)? IX. Contact Information – Transactional Parties; Attorney – E-mail, and work # RealtorE-mail, work #, cell # Accountant – Email, and work # Mthly Mortgage Pymts Borrower Yes No Mthly Insurance, tax & maint pymts Co-Borrower Yes No X. Standard Documentation Checklist for Purchase/Refi; 1 – most recent 30 days paystubs, consecutive pay periods, all borrowers. 2 – 2013 & 2014 W-2 statements, all borrowers. 3 – Most recent, Consecutive 2-months worth of asset statements (401K, checking, savings, CD’s, IRA’s….). Each page of every asset statement needed. Most recent Quarterly end statement (if quarterly report). 4 – Tax returns for last 2 years filed (personal and business) may be required (ie. if self-employed, high-bonus earner, etc.). 5 – Copy of fully-executed sales contract (purchase) 6 – If applicable, name, address, relations to self of any gift-givers.