IA2

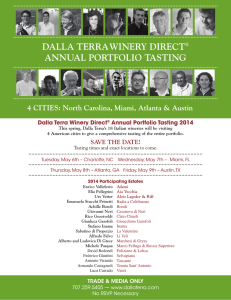

advertisement

Investment Analysis and Portfolio Management Lecture 2 Gareth Myles Return Return The reason for holding a security is to benefit from the return it offers The holding period return is the proportional increase in value measured over the holding period Asset with no dividend Initial wealth V0 is the purchase price p(0) Final wealth V1 is the selling price p(1) Return is: p1 p0 r p0 Return Example The price of Lastminute.com stock trading in London on May 29 2002 was 0.77 The price at close of trading on May 28 2003 was 1.39 No dividends were paid The return for the year of this stock is given by r 1.39 0.77 100 80.5% 0.77 Return Asset with dividend d is the dividend Return is p1 d p0 r p0 Multiple dividends d is the sum of dividends Return is p1 d p0 r p0 Return Example The price of IBM stock trading in New York on May 29 2002 was $80.96 The price on May 28 2003 was $87.5. A total of $0.61 was paid in dividends over the year in four payments of $0.15, $0.15, $0.15 and $0.16 The return over the year on IBM stock was r 87.57 0.61 80.96 0.089 80.96 Portfolio Return Two methods (i) The initial and final values of the portfolio can be determined, dividends added to the final value, and the return computed (ii) The prices and payments of the individual assets, and the holding of those assets, can be used directly Portfolio Return Total value A portfolio of 200 General Motors stock and 100 IBM stock is purchased for $20,696 on May 29 2002 The value of the portfolio on May 28 2003 was $15,697 A total of $461 in dividends was received The return over the year on the portfolio was 15697 461 20696 r 0.219 20696 Portfolio Return Individual assets Consider a portfolio of n assets The quantity of asset i in the portfolio is ai Initial price of asset i is pi(0) Final price of asset i is pi(1) Initial value of the portfolio is n V0 ai pi 0 i 1 Portfolio Return Final value of the portfolio is n V1 ai pi 1 i 1 If there are no dividends the return is n n ai pi 1 ai pi 0 r i 1 i 1 n ai pi 0 i 1 Portfolio Return Example Consider the portfolio in the table Stock A B C Holding 100 200 150 Initial Price 2 3 1 Final Price 3 2 2 The return on the portfolio is 100 3 200 2 150 2 100 2 200 3 150 1 r 100 2 200 3 150 1 0.052 Portfolio Return Including dividends The dividend payment from asset i is di The return on the portfolio is n n ai pi 1 di ai pi 0 r i 1 i 1 n ai pi 0 i 1 Portfolio Return Example Stock Holding Initial Price Final Price A 50 10 15 Dividend per Share 1 B C 0 3 100 300 3 22 6 20 The return on the portfolio is 50(15 1) 100(6) 300(20 3) 50(10) 100(3) 300(22) r 50(10) 100(3) 300(22) 0.122 Short Selling Short selling means holding a negative quantity Short 100 shares of Ford stock means that the holding of Ford is given by – 100 Dividends count against the return since they are a payment that has to be made Example On June 3 2002 a portfolio is constructed of 200 Dell stocks and a short sale of 100 Ford stocks. The prices on these stocks on June 2 2003, and the dividends paid are given in the table Short Selling Stock Initial Price Dividend Final Price Dell Ford 26.18 17.31 30.83 11.07 0 0.40 The return over the year on this portfolio is r = [200 x 30.83 + (-100) x 11.47 – (200 x 26.18 + (-100) x 17.31)] (200 x 26.18 + (-100) x 17.31) = 0.43 (43%) Portfolio Proportions The proportion of the portfolio invested in each asset can also be used to find the return Value of the investment in asset i is V i 0 The initial value of the portfolio is V0 Proportion invested in asset i is Xi V0i V0 These proportions must sum to 1 N NVi V Xi 0 0 1 i 1 i 1V0 V0 Portfolio Proportions If asset i is short-sold, its proportion is negative so Xi < 0 Example A portfolio consists of a purchase of 100 of stock A at $5 each, 200 of stock B at $3 each, and a shortsale of 150 of stock C at $2 each The total value of the portfolio is V0 =100 x 5 + 200 x 3 – 150 x 2 = 800 The portfolio proportions are XA =5/8, XB = 6/8, XC = -3/8 Portfolio Proportions Return The return on a portfolio is the weighted average of the returns on the individual assets in the portfolio N r X i ri i 1 This is the standard method of calculation The scale (total value) of the portfolio does not matter Portfolio Proportions Example Consider assets A, B, and C with returns 3 2 1 23 1 2 1 rA , rB , rC 1 2 2 3 3 1 The initial proportions in the portfolio are 200 600 150 XA , XB , XC 950 950 950 The return on the portfolio is 200 1 600 1 150 1 0.052 (5.2%) r 950 2 950 3 950 Portfolio Proportions Proportions must be recomputed at the start of each of the holding periods. Stock Holding p(0) p(1) p(2) p(3) A 100 10 15 12 16 B 200 8 9 11 16 The initial value of the portfolio is V0 = 100x10 + 200x8 = 2600 The portfolio proportions are 1000 5 1600 8 X A 0 , X B 0 2600 13 2600 13 Portfolio Proportions The portfolio return over the first year is 5 15 10 8 9 8 r 13 10 13 8 0.269 (27%) At the start of the second year the value of the portfolio is V1 =100x15 + 200x9 = 3300 Portfolio Proportions This gives the new portfolio proportions as 1500 5 1800 6 X A 1 , X B 1 3300 11 3300 11 The return over the second period can be calculated to be 5 12 15 6 11 9 r 11 15 11 9 0.03 (3%) Mean Return Mean return is the average of past returns Observe the return on an asset (or portfolio) for periods 1,2,3,...,T Let rt be the observed return in period t The mean return is T r r t t 1 T Mean Return Example Consider the following returns observed over 10 years Year 1 2 3 4 5 6 7 8 9 Return (%) 4 6 2 8 10 6 1 3 4 The mean return is r = 4 + 6 + 2 + 8 + 10 + 6 + 1 + 4 + 3 + 6 10 = 5% 10 6