Debt Issue Continuing Disclosure Submission in EMMA

advertisement

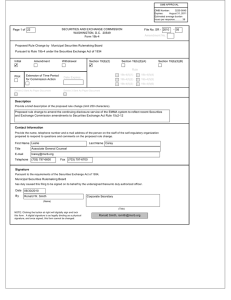

DEBT ISSUES CONTINUING DISCLOSURE SUBMISSION IN EMMA BY TODD MEIERHENRY HTTP://EMMA.MSRB.ORG What is Continuing Disclosure? Continuing disclosure consists of important information about a municipal bond that arises after the initial issuance of the bond. Why do we have to do this? It’s federal law. Rule 15c2-12 rule requires, for most new offerings of municipal securities, that the following types of information be provided to the MSRB’s EMMA system: Financial or operational information annual financial information concerning issuers or other obligated persons, or other financial information and operating data provided by issuers or other obligated persons; and audited financial statements for issuers or other obligated persons, if available Event notices principal and interest payment delinquencies; non-payment related defaults, if material; unscheduled draws on debt service reserves reflecting financial difficulties; unscheduled draws on credit enhancements reflecting financial difficulties; substitution of credit or liquidity providers, or their failure to perform; adverse tax opinions, Internal Revenue Service (IRS) notices or material events affecting the tax status of the security; modifications to rights of security holders, if material; bond calls, if material; tender offers; defeasances, release, substitution, or sale of property securing repayment of the securities, if material; rating changes; bankruptcy, insolvency, receivership or similar event; merger, consolidation, or acquisition, if material; and appointment of a successor or additional trustee, or the change of name of a trustee, if material; and notices of failures to provide annual financial information on or before the date specified in the written agreement. Who has to do this? Everyone who issues bonds must enter into a continuing disclosure agreement that will require provision of continuing disclosures to EMMA unless they fall within the exceptions: $1 million or less; where bonds are sold in $100,000 ($100,000 minimum denomination) and are sold to no more than 35 "sophisticated" investors; where bonds are sold in $100,000 minimum denomination and mature in nine months or less from initial issuance; or Voluntary Disclosures Some issuers provide additional items of information after the initial issuance, either under contractual arrangements or as a matter of practice. EMMA will display any of the following additional categories of continuing disclosure if submitted by an issuer or obligated person: Voluntary Disclosures Additional financial or operation information, including: quarterly/monthly financial information; timing of annual disclosure (120/150 days); change in fiscal year/timing of annual disclosure; accounting standard (GAAP-GASB/FASB); change in accounting standard; interim/additional financial information/operating data; budget; investment/debt/financial policy; and material provided to rating agency or credit/liquidity provider; consultant reports; and other financial/operating data. Voluntary Disclosures Additional event-based disclosures, including: amendment to continuing disclosure undertaking; change in obligated person; notice to investors pursuant to bond documents; certain communications from the IRS (other than those included under Rule 15c2-12); bid for auction rate or other securities; capital or other financing plan; litigation/enforcement action; change of tender agent, remarketing agent, or other on-going party; derivative or other similar transaction; and other event-based disclosures. In the News The Securities and Exchange Commission has been conducting a muni market review since last year, with a report targeted for release late this year that may recommend legislative or regulatory changes. The SEC also is updating its 1994 interpretive guidance on the continuing disclosure obligations of municipal issuers. Bond Buyer May 20, 2011 WHAT IS EMMA Since July 2009, the MSRB has served as the electronic repository for municipal bond-disclosure documents, through its Electronic Municipal Market Access, or EMMA, website. Issuers generally supply updates to financial or operating information or notices about specific events that may affect their bonds, such as unscheduled draws on debt service reserves. Register With EMMA All new users to MSRB Gateway must register to make continuing disclosure submissions. Municipal securities issuers, obligated persons and secondary agents must: Create and account in MSRB Gateway Select submission role(s) Accept the terms and conditions for making continuing disclosure submissions Issuers Designated agent Issuers DO NOT need to register if: Continuing disclosure submissions are being handled by an existing designated agent The issuer does not elect to control their securities and agent designations through EMMA. QUESTIONS & ANSWERS 1. What rule requires issuers and obligated persons to submit annual financial information and other continuing disclosure documents for public access on EMMA? Continuing disclosure submissions to EMMA are governed by Securities Exchange Act Rule 15c2-12. Under this rule, issuers and obligated persons are required to enter into contractual agreements to disclose annual financial information. QUESTIONS & ANSWERS 2. When was the requirement to submit continuing disclosure documents to EMMA effective? The revised SEC Rule 15c2-12 became effective July 1, 2009. QUESTIONS & ANSWERS 3. Are issuers still required to send information to state information depositories? Issuers are no longer required to send continuing disclosures under SEC Rule 15c2-12 to state information depositories, but they may still have requirements with regard to submissions under state laws, as applicable. QUESTIONS & ANSWERS 4. What material events must issuers disclose? Material events that must be disclosed under a continuing disclosure agreement that meet requirements of Rule 15c2-12 include the following, if material: (1) principal and interest payment delinquencies; (2) non-payment related defaults; (3) unscheduled draws on debt service reserves reflecting financial difficulties; (4) unscheduled draws on credit enhancements reflecting financial difficulties; (5) substitution of credit or liquidity providers, or their failure to perform;(6) adverse tax opinions or events affecting the tax-exempt status of the security; (7)modifications to rights of securities holders; (8) bond calls; (9) defeasances; (10) release, substitution, or sale of property securing repayment of the securities; (11) rating changes; and (12) failure to provide annual financial information as required. QUESTIONS & ANSWERS What types of continuing disclosure can be made to EMMA? EMMA accepts two broad categories of continuing disclosure: annual/periodic filings such as comprehensive annual financial reports, and event filings that report material events. QUESTIONS & ANSWERS How do submitters register to submit documents to EMMA? In order to submit documents to EMMA, all submitters must register in MSRB Gateway, the secure access point for EMMA and other MSRB applications. QUESTIONS & ANSWERS How do submitters input documents and other information into EMMA? EMMA supports two methods for accepting input: a set of web-based input screens accessible by web browser for accommodating individual submissions, and a secure, authenticated computer to computer connection for batch submissions. The submitter may elect to use either or both interfaces. For more information, please see MSRB Notice 2009-10. QUESTIONS & ANSWERS Does the EMMA website require a particular format for submitted continuing disclosure documents? Continuing disclosure documents must be submitted to the EMMA website as a word searchable portable document format (PDF) files that permit the document to be saved, viewed, printed and retransmitted by electronic means. QUESTIONS & ANSWERS Does the EMMA website provide notification to submitters when a document such as annual financial report is due to be posted? No QUESTIONS & ANSWERS What does it cost to submit documents to EMMA? There is no charge to submit continuing disclosure documents to EMMA. QUESTIONS & ANSWERS Can an agent or obligated person submit continuing disclosure documents on behalf of an issuer? Yes.