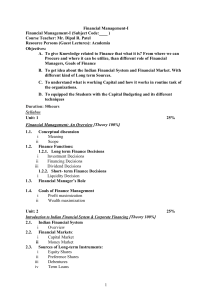

ON TARGET Clinical Budget Two

advertisement

ON TARGET

Preparing Departmental Clinical Budgets

CLINICAL BUDGET PRESENTATION

Learning Objectives

Discussion Items

• Discussion Item One – Understanding Budgeting

• Discussion Item Two – How to Budget

• Discussion Item Three – Types of Budgeting Approaches

• Discussion Item Four – Applying Budget Approaches

• Discussion Item Five – Inputting Department data into the Budget

Module

• Discussion Item Six – Capital Budget Process/Budget Projections

Understanding Budgeting

DISCUSSION ITEM ONE

• What is a Budget?

• It is a list of all Planned Expenses & Revenue.

• A Budget is an organizational plan stated in monetary terms

• What is budgeting?

• The process of making the list is Budgeting

• The purpose of Budgeting is to provide a

forecast of revenues and expenditures

• This is a model of how a business might perform financially speaking

if certain strategies, events and plans are carried out

How To Develop A Budget

DISCUSSION ITEM TWO

How to Develop a Budget

Information Gathering

• Good goals are specific, measurable, realistic and

timely.

• Specific goals are clearly defined. “Make money” is

not a specific goal. “Make 100K profit” is specific.

• Set measurable goals defined in terms where you

can easily see whether you have attained them, and

check your progress. “increase clinic time” is not

measurable” “Increase clinic time to 55 Percent” is.

• Realistic goals are things you can reasonably reach

given the resources and realities of your department

situation. “adding 20 plastic surgeons” is not

realistic” “adding 2” is.

• Timely goals are set with a specific timeline for

progress. Without a timeline; It’s difficult to gauge

how much money to put into your budget for any

given quarter.

Review any existing financial

documents for our department

• Take time to review documents from your

department as it is today, including your income

statement, outstanding debts, assets, liabilities

and a projections of immediate cash flow. Pull

out any current budgets you use for your

department, as they can serve as a starting point

for your new budget

• What are the specific costs associated with each

of your goals. This is where you would break

down each goal into an annual tangible amount

of money, and then break it down by month.

• Budget estimation is a complex practice, with

potentially disastrous consequences if you guess

wrong.

Types Of Budget Approaches

DISCUSSION ITEM THREE

Types of Budgeting Approaches

Incremental Budgeting

Incremental budgeting is the

simple approach to building a

budget. You start your budget with

what you did last year and amend

it for the changes that you expect

for this year. Administrators like

this approach because it is quick

and easy. However, it can be that

last year’s workload or activity is

actually quite different from this

year’s

An example of a Incremental

budgeting mistake

An Administrator estimates the

budget for building maintenance by

reviewing the expenditure from the

previous year. What he/she misses

is the fact that a new contract with

a different supplier at a different

price has been awarded, and that

a different program of maintenance

has been planned for the year

Applying Budget Approaches

DISCUSSION ITEM FOUR

Revenue Budget From Scratch

Projecting Physician Charges

Methodology

CPT – Codes with explanations and times

Example of gathering data to build your physician revenue template

90801 Psych Diagnostic Interview Exam, no time listed in CPT manual

90804 20-30 mins

90805 w/ Medical Eval and Mgt. 20-30 mins

90806 45-60 mins

90807 w/ Medical Eval and Mgt. 45-60 mins

90808 75-80 mins

90809 w/ Medical Eval and Mgt. 75-80 mins

90862 CPT manual does not list time but per psych encounter 20-30 mins

90846 Family Psychotherapy w/o pt, no time listed in CPT manual

90847 Family Psychotherapy w/ pt, no time listed in CPT manual

90870 Electroconvulsive therapy

Regression Analysis to Project Budget Line Items

Contract Template

Example of gathering contract information by physician to later input

into budget module

Inputting Department Data into the Budget Module

DISCUSSION ITEM FIVE

Practice Plan Budget

1. Select PP Budget from top menu

2. Sort list by Unit Name

3. Sort list by Account number

4. Sort list by Department Name

5. Sort list by Net Revenue Amount

6. Sort list by Total Expenditure Amount

7. Sort list by Net Income Amount

8. Name of the Unit

9. Account number

10. Name of Department

11. Quick access to reports related to a department

• Budget Report

• Income Statement

Practice Plan Budget – Clinical Revenue

1. Tab for Clinical Revenue screen

2. Tab for Other Revenue screen

3. Tab for Income Statement screen

4. Click +Revenue to add a revenue line

5. Doctor’s Name

6. Comment

7. Collection Rate Office

8. Collection Rate Hospital

9. Collection Rate Contract

10. Office Rate

11. Office Visits

12. Office Charges

13. Hospital Visits

14. Hospital Rate

15. Hospital Charge

16. Contract Revenue

17. Drug/Product Sales

18. Save Button

Practice Plan Budget – Clinical Revenue

1. Sort by Doctor Name

2 – 11 Summary of data entered by physician

12. Edit the physician revenue line

13. Deletes the revenue line

Practice Plan Budget – Other Revenue

1. Click on Other Revenue tab

2. Click +Other Revenue to add a revenue code

3. Select Revenue code from drop down menu

Practice Plan Budget – Income Statement

1. Click on Income Statement tab

2. Click on +Expenditure to add an Expenditure code

3. Select expenditure code from drop down menu

Salary – Practice Plan employees

1. Select Salary from top menu options

2. Select tab for Practice Plan to load list of Practice Plan employees

Salary – Practice Plan employees

Add/Edit Employee Info

Salary – Add/Edit Employee Info

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

Select the Home Department/Unit

First Name

Last Name

Hire Date

Employee number – must be 9 characters

Position number – must be 5 digit position number

Comment section –

Select correct Practice Plan Job Title

Employee Type – select PP (Practice Plan)

Position Type

Contract Type

Rank – does not apply to PP employees

Specialty – not required

Select Tenure option

Supervisor name

Base salary

Contract Salary – includes: time period budgeted; annual cell phone allowance; annual stipend

Pay rate – includes monthly stipend and cell phone allowance

Annual FTE

Grade/Step - applies to Classified

Merit Step - default to 0

Seniority Date - default to 1/1/1901 for all other employee types

Annual Stipend section: include BOTH annual stipend and annual cell phone allowance amount

Enter FICA code – select Y

Health Insurance – select appropriate Health Insurance plan for employee

Retirement Plan – select 5

SAVE/Update all entered data

Salary – Add Pay lines

1. Click +Payline to add a pay line

2. Account number – Enter the 11 digit account number – no dashes (xxxxxxxxxxx)

3. Earn Code – Select appropriate Earnings code for account line

Note: Only the Earning codes applicable to the Employee Type will appear in the drop-down

4. Start Date – Enter the account line start date (mm/dd/yyyy)

5. Stop Date – Enter the account line end date (mm/dd/yyyy)

6. FTE – Enter the account line FTE

7. Acct Amount - Enter the monthly amount to be paid on that account

8. Comment – enter comments if you wish

9. Save – click to save pay line information

10. Edit or Delete an account line

Salary – Data Checks

1. Verify the Total FTE for all pay lines equal the FTE in the employee information

2. The total monthly amount for all pay lines must EXACTLY equal the employee pay rate.

3. The total annual amount must be within .12 cents of the employee Contract Amount.

Earning Codes by Employee Type

• PP – Practice Plan

– PM1: Practice NFPRP

– PM2: Practice NFPRP Hourly

– PN1: Practice North

– PN2: Practice North Hourly

– PS1: Practice South

– PS2: Practice South Hourly

Health Insurance Plans

• Practice Plan employees {PP}

– HMO: Employee only

– HMO1: Employee + 1 dependent

– HMO2: Employee + 2 or more dependents

– PPO: Employee only

– PPO1: Employee + 1 dependent

– PPO2: Employee + 2 or more dependents

Conclusion

Budgets should be understandable and attainable. Flexibility and innovation is

needed to allow for unexpected contingencies.

Budgeting enhances flexibility through the planning process because alternative

courses of action are considered in advance rather than forcing less-informed

decisions to be made on the spot. As one factor changes, other factors within the

budget will also change. Internal factors are controllable by the departments

whereas external factors usually cannot be controlled.

Budgeting is planning for a result and controlling to accomplish that result.

Budgeting is a tool, and its success depends on the effectiveness to which it is

used by staff. A department may fail from sloppy or incomplete budgeting.

For any questions or concerns on Clinical Budgeting contact:

Kimberli Quinn

Email: Kquinn@medicine.nevada.edu

Phone: 775-784-6214