Fiscal Policy & the Multiplier

advertisement

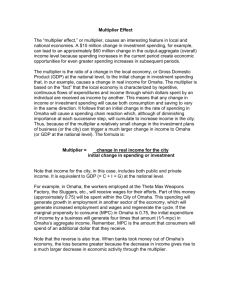

Fiscal Policy & The Multiplier AP Macroeconomics http://www.econosseur.com/fiscal-policy/ Where we came from… In a previous lesson, we learned about the tools embedded in the economy that respond to different phases of the business cycle. These tools are called “automated stabilizers” http://www.languageguide.org/images/im/tools.png Why are they automatic stabilizers? Do we put the economy on autopilot, and leave it to the automatic stabilizers? They adjust without action by Congress or the president They serve as stabilizers because they limit the increase in real GDP during expansions and reduce the decrease in real GDP during a recession. http://blog-pfm.imf.org/pfmblog/2009/02/whither-the-automatic-stabilizers.html Here are some examples of automatic stabilizers: 1) Income tax system 2) Unemployment compensation 3) Stock and bond returns Now… It’s time to use these models to analyze the effects of discretionary fiscal policy Previously, we saw that expansionary fiscal policy moves the AD curve to the right, and a contractionary fiscal policy moves it to the left. But simply knowing the direction of a shift is not enough. We want to know: BY HOW MUCH! How do we find out how much? We use the MULTIPLIER! When the government chooses to implement a fiscal policy, the initial amount spent is not all that counts. Every time the government spends, there is a chain reaction or a ripple effect. http://www.wix.com/blog/2012/05/3-great-reasons-to-list-prices-on-your-website/ Remind me…what is the multiplier? The ratio of change in real GDP caused by an autonomous change in aggregate spending to the size of that autonomous change. 1/(1-MPC) Any change in government purchases of goods and services is an example of an autonomous change in aggregate spending! http://mathfour.com/arithmetic/multiplication-tricks What about the MPC and government spending? Usually, households will only spend a portion lower of the original amount (that is, if they get money back in tax returns, they will usually save some of it). Thus, if the government expenditure is $50 million, and the MPC is .5, households will only spend $25 million in the first round, and so on. Remember: MPC = change in consumption/change in disposable income! http://weare1776.org/2084/world-news/government-spending-27-million-for-moroccan-pottery-classes-over-500-billion-for-defense/ Tax Multiplier Taxes affect the multiplier in a way different than does government spending. Once we add taxes into the mix, disposable income increases much less. Taxes reduce the size of the multiplier. The tax multiplier is always negative, and is as follows: -MPC/(1-MPC) or – MPS/MPS http://www.american.com:8080/archive/2008/june-06-08/taxlessons Discretionary Fiscal Policy According to Krugman, is “the direct result of deliberate actions by policy makers rather than” relying on automatic adjustment (p. 212). A good example is during a time of inflation, the government may reduce the amount of money in print and raise the interest rate. Another example is when, during times of depression or recession, the government increases spending. http://www.frumforum.com/the-problems-with-stiglitzs-depression/ And now… Some resources: http://www.reffonomics.com/ Morton workbook Activity 32 Works Cited Economics of Seinfeld. http://yadayadayadaecon.com/clip Krugman, Paul, and Robin Wells. Krugman’s Economics for AP. New York: Worth Publishers. Morton, John S. and Rae Jean B. Goodman. Advanced Placement Economics: Teacher Resource Manual. 3rd ed. New York: National Council on Economic Education, 2003. Print. Reffonomics. www.reffonomics.com.