NAMC Strategic Plan Presentation 2011/12

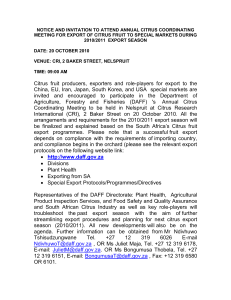

advertisement

NAMC Strategic Plan Presentation 2011/12 Presentation to the Parliament’s Portfolio Committee: Agriculture, Forestry and Fisheries 11 March 2011 Mrs Ntombi Msimang - Chairperson: NAMC Mr TR Ramabulana- CEO: NAMC Mrs S Muvhulawa- CFO: NAMC 1 The NAMC in brief Established in terms of an Act of Parliament (MAPA, 1996) to advise the Minister and other Directly Affected Groups on agricultural marketing policy Four main objectives: Increasing of market access for all participants Promotion of efficiency of the marketing of agricultural products Optimization of export earnings Enhancement of the viability of the agricultural industry 2 Members of the NAMC Council The current members are: Mrs NM Msimang (Chairperson) Dr ASM Karaan (Vice-Chairperson) Mr AD Young Prof JF Kirsten Mrs SE Moolman Mrs C Molo Mr DB Montshwe Mrs M Mannya Mrs M Gill 3 Council Committees Human Resources Mr A Young (Chairperson) Mrs L Moolman Mrs M Mannya Audit Committee Mr Paul Slack (Chairperson) Ms Mathebe Moja Mr Raymond Matlou Ms Mina Gill Prof J Kirsten 4 Employment Equity Senior Managers 2 Female African (5 %) 4 Male African (10 %) 2 Male White (5 %) Total Staff 13 Female African (28 %) 11 Female White (28 %) 14 Male African (36 %) 4 Male White (8 %) Realities in Agriculture The situation…Employment !!! Trends in employment by sector between 2001 and 2010 Trends in the agricultural sector’s share of the total employment between September 2000 and March 2010 Source: DAFF, 2010 Source: DAFF, 2010 7 Key realities Current market structure shaped to largely cater for existing mainstream market participants Market structure at the processing and retail level highly concentrated Inherited from previous regulated marketing regime and government support incentives Provides a breeding ground for a non-optimal competitive environment High entry barriers for smallholder farmers 8 Key actions Important paradigm shift (1) – Import Substitution Important paradigm shift (2) – Increase the size of the cake Review biofuel policy Realignment of export promotion policy and tools “Buying local is lekker” Leverage potential of quick wins Industries that could benefit include grain industry, meat industry, cotton industry, fish processing, forestry Develop new and expand existing development/incentive schemes Leverage contributions by private sector Leverage potential of institutional markets 9 Facts on Administered prices Agriculture Electricity tariff increase compared to CPI Tariff increase % 35 CPI - regulated prices Tariff increase for 2008, 2009 and 2010 higher than the Headline CPI 30 Percentage change 25 20 CPI higher than the electricity tariff increase 15 10 5 0 2007 Source: Eskom, 2011 2008 2009 2010 TOLL FEES - CLASS 3 VEHICLE ONE WAY R551 in 2010; 34.1% increase from 2006 to 2010 600 From Musina to Tswane FPM From Paarl to Tswane FPM From Durban to Tswane FPM From Nkomazi to Tswane FPM 550 Rand per one way trip 500 R516 in 2010; 39.1% increase from 2006 to 2010 450 400 R487 in 2010; 36.8% increase from 2006 to 2010 350 300 250 200 2006 Own calculations based on SANRAL, 2011 2007 2008 2009 2010 R366 in 2010; 37.1% increase from 2006 to 2010 % contribution to total cost of production Average % contribution of regulated fuel, labour and electricity cost to total production cost of animal feed Labour, fuel and electricity % contribution to Total Cost of Production, Sales, Admin and Transport 56% 54% 52% 50% 48% 46% 44% 42% 2001 2002 2003 Own calculations based on data from AFMA, 2011 2004 2005 2006 2007 2008 2009 2010 Regulated fuel, labour and electricity cost for the production of a kilogram poultry 2008 to 2009 up 28.2% 2009 to 2010 up 18.6% Cost per kg produced index 2008=100 160 150 Electricity Transport Water 140 2008 to 2009 up 16% 2009 to 2010 up 33.9% 130 120 110 2008 to 2009 up 6.2% 2009 to 2010 down 2.4% 100 90 80 2008 2009 Own calculations based on data from role players in the industry, 2011 2010 Job Creation (NAMC, Statutory Measure And Agricultural Trusts) Major projects to drive job creation Project Investment Value R Total Employment opportunities 2011/12 Total Employment Opportunities 2012 - 2014 Critical reforms required to realise the jobs National Red Meat Development Project (NRMDP) R42 million over 5 years Project team 12 people Project Manager, Project Implementation manager, Livestock Coordinators/Field Officers, Admin Assistant, Auctioneer-ing programme Project team 4 Additional Livestock Coordinators/Field Officers 1. 2. 3. 4. 5. 6. 6 Custom feeding programmes 18 herdsmen 14 Additional custom feeding programmes 42 herdsmen Local level organisers/representatives 20 people Local level organisers/representatives 40 people 5 Auctioneering companies 20 people Add. auctioneering companies 30 people Farmers benefitting 5000 Farmers benefitting 12-13000 Funding must be secured Baseline study Infrastructure Market information Training Designing tailor made programmes per custom feeding programme 16 Major projects to drive job creation Project` Company Investment Total /SOE/Go- Value Employment vernment R opportunities 2011/12 Total Employment Opportunities 2012 - 2014 Critical reforms required to realise the jobs Vineyard development scheme NAMC (in collaboration with the wine industry and department of agriculture in the Northern Cape and Free State) R62 million for 570 ha of vineyard Permanent – 61 Seasonal – 100 Permanent – 124 Seasonal – 200 Funding required for: 1. Infrastructure 2. Operating capital 3. Training and extension services 4. Market linkages Grain crop development scheme NAMC (in collaboration with the grain industry and cooperatives/ agribusiness) R140 million Permanent – 200 Seasonal – 300 Permanent – 200 Seasonal – 300 Funding required for: 1. Operational and risk mitigation funding 2. Training and extensions services 3. On farm storage 4. Mechanisation 17 JOB CREATION Deciduous Fruit Trust- tree planting project, +- R5,1 million CASP funds administered in 2010 Total = R12,2 million. 1st Phase = 1,000 Ha by 2014 – 600 Ha in the Western Cape in partnership with WCDA. Winter Cereal Trust- Commercialisation of and promotion of wheat production amongst developing farmers in the Free State, Western and Southern Cape. Total expenditure for the development project is R4 067 549. Maize trusts- funding to the grain farmer development association to assist small holder farmers in soil preparation, input costs, harvesting and storage of grain. Oil and protein seed trust- assist 165 emerging farmers to plant 15 100ha of sunflower. A total of 1250 temporary job opportunities will created during the season. 18 Trade TradeProbes (6 annually) Product and country profiles Trade related topics Publication on Fruit Trade Flows (weekly’s) and Fruit Flow reports Collaborative trade studies, e.g. Determining the scope and nature of Non-tariff Measures prevalent in selected international markets South Africa’s way ahead: Cape to Cairo? Comparative analysis…: European markets for SA emerging table grape growers Export promotion activities Hong Kong, Singapore, Malaysia Users and uses Users: Government Departments, NGO’s, Industry Associations, Companies, Press Uses: Export promotion, lowering transactions costs, policy guidelines, better informed exporters, increased exports 19 Trade - Export promotion activities Background Objectives Promotional activities in three countries, namely Hong Kong, Singapore, Malaysia Several Hyper- and Supermarkets participated, e.g. Giant , Shop N Save, Cold Storage In total 499 Hyper- and Supermarkets participated Increase sales and awareness of the total range of South African fruit and vegetables available at the time of the World Cup in particular during the last 2 weeks of the World Cup. Grow sales and the range of South African product from after the World Cup till end of October. Actions In store displays In store competitions Press advertising Point of sale material Aggressive bulk displays Hard and soft copies of newspaper adverts, copies of pictures of displays and point of sale materials and some of the winning displays 20 Trade - Export promotion activities Results The total U$ purchases for the group from South Africa, for 2010 vs the purchases for 2009, grew from ± U$14 million to ± U$18 million in 2010 A 28.5% sales growth in U$ terms Total Container Volume for 2010: +108 Containers Vs 2009 Volume A 48% increase in volume 21 Export promotion through statutory levy funding.. (Wine) WOSA (Wines of South Africa) promotes South African wines, mainly in EU, but also in USA, Canada, key African countries such as Angola and Nigeria, as well as India, China, Japan and South Korea In 2008, SA exported over 400 mil litres, Export strategy – Enhancing SA’s image Developing new markets Assisting in building capacity Improved infrastructure for exports via Wine-on-line Current budget app R37 mill / annum 22 Export promotion through statutory levy funding .. (Deciduous Fruit) Deciduous fruit Apples, pears, plums, apricots, peaches and nectarines A Market Development Campaign in the UK and Germany Producer funded (R20 mil / annum) as well as grant from DTI (R10 mil / annum) Volume growth target of 10-15 % over 5 years has been set 23 Export promotion through statutory levy funding .. (Grapefruit) Citrus Growers Association Consumer campaign in UK and Japan “South African Grapefruit’ Beautiful country, beautiful fruit” Funded by statutory levies – app R9 mil / annum 24 MERC focus areas Information Exchange Background This is a complex issue due to the structure of the primary and secondary agricultural sector Several companies found guilty for non-compliance Competition Act Thereafter some of these companies pulled out of industry associations This amongst others mean they are not willing so share information Problem: This information necessary to, for example, calculate GDP, Consumer Spending, Logistics Planning,, Employment Numbers, etc No case law in South Africa to provide guidance The road ahead Compile document for the Competition Commission spelling out detailed needs at the industry and country level Workshop the document with Competition Commission Set guidelines for industry on information exchange Work on proper public agricultural information system 25 Training Making Markets Matter Training Course Its an intensive 5 day business development training workshop for African agribusinesses, In partnership with University of Stellenbosch and Cornell University 80 agribusinesses attended the Course The farmers were trained on the following issues Cash flow management, Marketing strategy, financial analysis AgriBiz Training course for Women As a follow up to the above training course, the NAMC designed a 3 day training course specifically for women that are involved in agriculture The course offers training in marketing, financial and strategic management . 30 women entrepreneurs attended The NAMC is conducting an after care programme so that participants can implement what they have learnt from the course into their businesses Statutory Measures The MAPA act provides for the following statutory Measures: Levies Records and returns Conducting of pools Control of exports Registrations Appointment of inspectors 27 Existing statutory measures INDUSTRY Administrating body Statutory Measures Levy Registration Records & Returns Citrus (export only) Citrus Growers Association Cotton Cotton SA Dairy Milk SA Deciduous fruit (pome & stone) Deciduous Fruit Producers Trust Dried fruit Deciduous Fruit Producers Trust Grains (Maize, Oilseeds, Sorghum, and Winter Cereals) The South African Grains and Information Services (SAGIS) Lucerne Lucerne Seed Organisation Mangoes Subtrop Milk Milk Producers’ Organisation Mohair Mohair SA Pork SA Pork Producers’ Organisation Potato Potatoes SA Poultry and eggs Southern African Poultry Association Red meat Red Meat Industry Forum 28 Existing statutory measures (cont...) INDUSTRY Administrating body Statutory Measures Levy Registration Records & Returns Sorghum Sorghum Trust Table Grapes SA Table Grape Industry Wine SAWIS, Winetech and Wosa Winter Cereals Winter Cereal Trust Wool Cape Wools SA 29 FUNCTIONS FINANCED THROUGH STATUTORY LEVIES Functions Amount spent R Percentage of total levy expenditure % Administration 16 759 976 6 Transformation 61 832 155 22 Export Promotion 33 114 219 12 Research 90 169 729 33 Information 24 264 856 9 Production development 2 832 839 1 Plant improvement 2 658 981 1 39 319 855 14 5 924 738 2 276 877 338 100 Local promotion Quality control TOTAL 30 New applications Bee / honey industry Proteas Pecan nuts Olives Rooibos tea Maize 31 Budget Allocation: 2011/12 – 2013/14 The NAMC has received an MTEF budget allocation letter for the period from DAFF. The budget allocations are as follows: 2011/12: 2012/13: 2013/14: R 35 899 000 R 30 115 000 R 32 220 000 32 Budget Allocation Cont’ This resulted in the following percentage fluctuation for the period: From 2010/11 – 2011/12: From 2011/12 – 2012/13: From 2012/13 – 2013/14: The decrease of R5 million in 2012/13 is due to the following: The NAMC has in the previous financial year received additional funding to expand the export promotion programme that will afford 100 emerging agribusinesses the opportunity to participate in international trade. 15% increase 16% decrease 7% increase. This funding was for the MTEF period 2009/10 – 2011/12 only. 33 Budget Allocation Cont’ Other source of Income The NAMC is anticipating to generate income from the investment of the grants to be received from DAFF at the beginning of the financial year 2011/12. The following are the projected interest to be generated: 2011/12: R 1 350 000 2012/13: R 1 200 000 2013/14: R 1 400 000 Total Income for the MTEF period then results in: 2011/12: 2012/13: 2013/14: R 37 249 000 R 31 315 000 R 33 620 000 34