Control accounts notes

advertisement

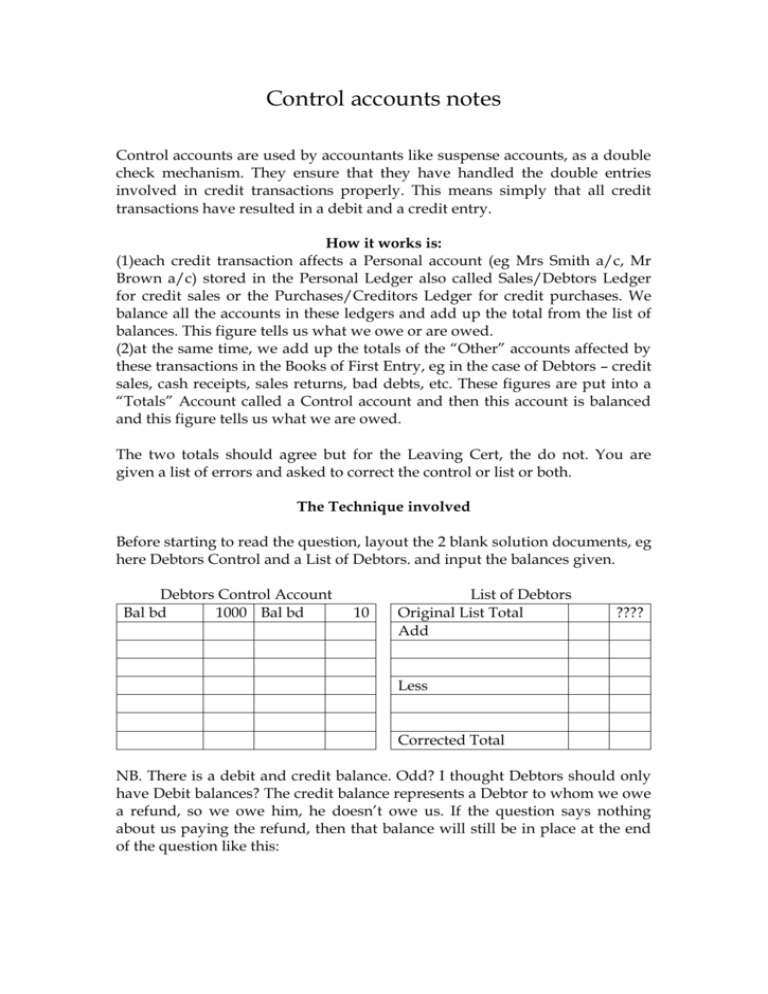

Control accounts notes Control accounts are used by accountants like suspense accounts, as a double check mechanism. They ensure that they have handled the double entries involved in credit transactions properly. This means simply that all credit transactions have resulted in a debit and a credit entry. How it works is: (1)each credit transaction affects a Personal account (eg Mrs Smith a/c, Mr Brown a/c) stored in the Personal Ledger also called Sales/Debtors Ledger for credit sales or the Purchases/Creditors Ledger for credit purchases. We balance all the accounts in these ledgers and add up the total from the list of balances. This figure tells us what we owe or are owed. (2)at the same time, we add up the totals of the “Other” accounts affected by these transactions in the Books of First Entry, eg in the case of Debtors – credit sales, cash receipts, sales returns, bad debts, etc. These figures are put into a “Totals” Account called a Control account and then this account is balanced and this figure tells us what we are owed. The two totals should agree but for the Leaving Cert, the do not. You are given a list of errors and asked to correct the control or list or both. The Technique involved Before starting to read the question, layout the 2 blank solution documents, eg here Debtors Control and a List of Debtors. and input the balances given. Debtors Control Account Bal bd 1000 Bal bd 10 List of Debtors Original List Total Add ???? Less Corrected Total NB. There is a debit and credit balance. Odd? I thought Debtors should only have Debit balances? The credit balance represents a Debtor to whom we owe a refund, so we owe him, he doesn’t owe us. If the question says nothing about us paying the refund, then that balance will still be in place at the end of the question like this: Debtors Control Account Bal bd 1000 Bal bd 10 List of Debtors Original List Total Add ???? Less Bal cd 10 Bal bd 10 Corrected Total Like suspense, you must know what should have been done to be able to correct the mistake. The questions you must ask your self are: 1. Does the error affect the Personal Account, the Control account, or both? If you are not sure ask yourself if this means that the Mrs Smith a/c is wrong or the other a/c (eg Sales, Sales, Returns, Cash, etc) 2. To fix the error in either the Control or the Personal a/c do I need to increase or decrease. To increase the List, you Add (simple eh!!!), and to increase or decrease the Control, use the BookKeeping Key from Suspense. Examples: Sales Daybook over totted (added up too much) by €120 A Debtors receipt was entered as €800 not €80 in the Personal account Goods returned €75 were entered in the Sales Day Book as €85 and as €7 on the Debit in the Personal a/s Try these, solutions below DON’T CHEAT !!!!!!!! Debtors Control Account Bal bd 1000 Bal bd 10 Sales 120 Sales DB 85 Sales Ret 75 Bal cd Bal bd 10 Bal cd 1010 720 Bal bd 720 1010 10 List of Debtors Original List Total Add Cash Receipt 720 Less Sales Returns 792 (82) Corrected Total 710 72