View Extended Abstract

advertisement

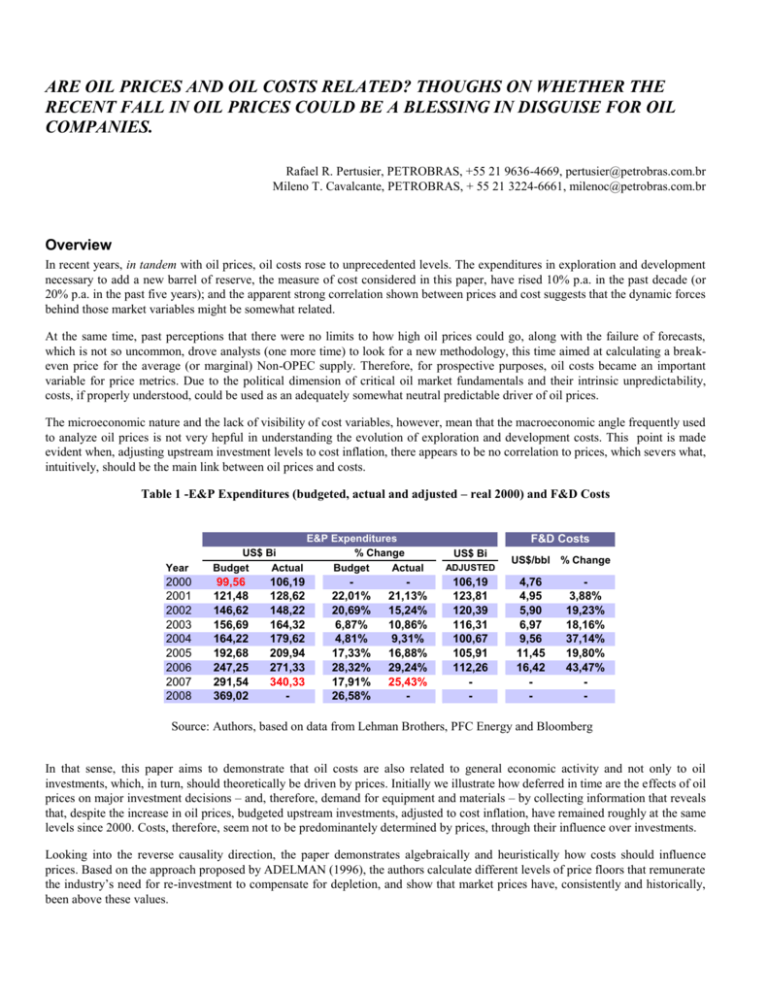

ARE OIL PRICES AND OIL COSTS RELATED? THOUGHS ON WHETHER THE RECENT FALL IN OIL PRICES COULD BE A BLESSING IN DISGUISE FOR OIL COMPANIES. Rafael R. Pertusier, PETROBRAS, +55 21 9636-4669, pertusier@petrobras.com.br Mileno T. Cavalcante, PETROBRAS, + 55 21 3224-6661, milenoc@petrobras.com.br Overview In recent years, in tandem with oil prices, oil costs rose to unprecedented levels. The expenditures in exploration and development necessary to add a new barrel of reserve, the measure of cost considered in this paper, have rised 10% p.a. in the past decade (or 20% p.a. in the past five years); and the apparent strong correlation shown between prices and cost suggests that the dynamic forces behind those market variables might be somewhat related. At the same time, past perceptions that there were no limits to how high oil prices could go, along with the failure of forecasts, which is not so uncommon, drove analysts (one more time) to look for a new methodology, this time aimed at calculating a breakeven price for the average (or marginal) Non-OPEC supply. Therefore, for prospective purposes, oil costs became an important variable for price metrics. Due to the political dimension of critical oil market fundamentals and their intrinsic unpredictability, costs, if properly understood, could be used as an adequately somewhat neutral predictable driver of oil prices. The microeconomic nature and the lack of visibility of cost variables, however, mean that the macroeconomic angle frequently used to analyze oil prices is not very hepful in understanding the evolution of exploration and development costs. This point is made evident when, adjusting upstream investment levels to cost inflation, there appears to be no correlation to prices, which severs what, intuitively, should be the main link between oil prices and costs. Table 1 -E&P Expenditures (budgeted, actual and adjusted – real 2000) and F&D Costs Year US$ Bi Budget Actual 2000 2001 2002 2003 2004 2005 2006 2007 2008 99,56 121,48 146,62 156,69 164,22 192,68 247,25 291,54 369,02 106,19 128,62 148,22 164,32 179,62 209,94 271,33 340,33 - E&P Expenditures % Change Budget Actual 22,01% 20,69% 6,87% 4,81% 17,33% 28,32% 17,91% 26,58% 21,13% 15,24% 10,86% 9,31% 16,88% 29,24% 25,43% - F&D Costs US$ Bi ADJUSTED 106,19 123,81 120,39 116,31 100,67 105,91 112,26 - US$/bbl % Change 4,76 4,95 5,90 6,97 9,56 11,45 16,42 - 3,88% 19,23% 18,16% 37,14% 19,80% 43,47% - Source: Authors, based on data from Lehman Brothers, PFC Energy and Bloomberg In that sense, this paper aims to demonstrate that oil costs are also related to general economic activity and not only to oil investments, which, in turn, should theoretically be driven by prices. Initially we illustrate how deferred in time are the effects of oil prices on major investment decisions – and, therefore, demand for equipment and materials – by collecting information that reveals that, despite the increase in oil prices, budgeted upstream investments, adjusted to cost inflation, have remained roughly at the same levels since 2000. Costs, therefore, seem not to be predominantely determined by prices, through their influence over investments. Looking into the reverse causality direction, the paper demonstrates algebraically and heuristically how costs should influence prices. Based on the approach proposed by ADELMAN (1996), the authors calculate different levels of price floors that remunerate the industry’s need for re-investment to compensate for depletion, and show that market prices have, consistently and historically, been above these values. Figure 1 – Oil Prices and Costs Causality Direction ECONOMIC ACTIVITY OIL COSTS OIL INVESTMENTS OIL PRICES Therefore, in separating the dynamics of prices and costs, the authors analyze the feasibility of market scenarios that can affect those variables in opposite directions, with straight and far-from-common-sense consequences on oil companies’ profitability. Methods The paper confronts macro and micro economic approaches to explaining oil costs in relation to prices. It devises a method of calculating the average Non-OPEC finding and development cost and assumes market behaviour premises in order to analyse how different combinations of price and cost dynamics can affect oil companies. Results The paper finds that, despite recent strong correlation, oil prices and costs do not explain each other as generally assumed. Alternatively, they are indirectly correlated through economic activity, which, in certain circumstances, might be surpassed by the effects of oil market fundamentals (other than economics) on oil prices in a different dynamic than on costs, making it possible to occur an inflexion of the observable and intuitive correlation. That being, scenarios can be built to analyze the possibility of the combination of high prices / low costs and of low prices / high costs. Conclusions Based on the authors own understanding of future prospects for the oil market, the paper concludes that the recent global economic slowdown will probably bring about a decrease in finding & development costs, but that oil prices might rebounce in a few years time and, most importantly, even amongst week economic conditions. This, in turn, should create exceptionally favourable economic conditions for oil companies that, through privileged access to capital in a credit-constrained market, can accelerate its investments expenditures in order to bear its fruits if the relation between oil and costs reverse. Companies that understand the individual and combined dynamics of costs and prices will be better positioned with regards to investment decisions and the market’s competitive environment, which can be of crucial importance depending on their exposure to different cost structures. References ADELMAN, M. A. (1996).The Genie Out of the Bottle. World Oil since 1970. The MIT Press, Cambridge GRIFFIN, James & TEECE, David (1982). OPEC Behaviour and World Oil Prices. George Allen & Unwin (Publishers), London. PERTUSIER, Rafael R. (2009) Ship of Fools: Thoughts on the Recent Fall in Oil Prices. InfoPetro, Institute of Economics, Federal University of Rio de Janeiro (Portuguese language) PERTUSIER, Rafael R. (2008) F&D Costs and Other Less Important Fundamentals: Where Are They Driving the Oil Markets to? – presentation to the Oxford Institute for Energy Studies in 02/26/2008

![499-2169-1-PB[85708]](http://s2.studylib.net/store/data/026104304_1-61d73374292838ed564838409be6ff46-300x300.png)