Summary: Home Affordable Modification Agreement

advertisement

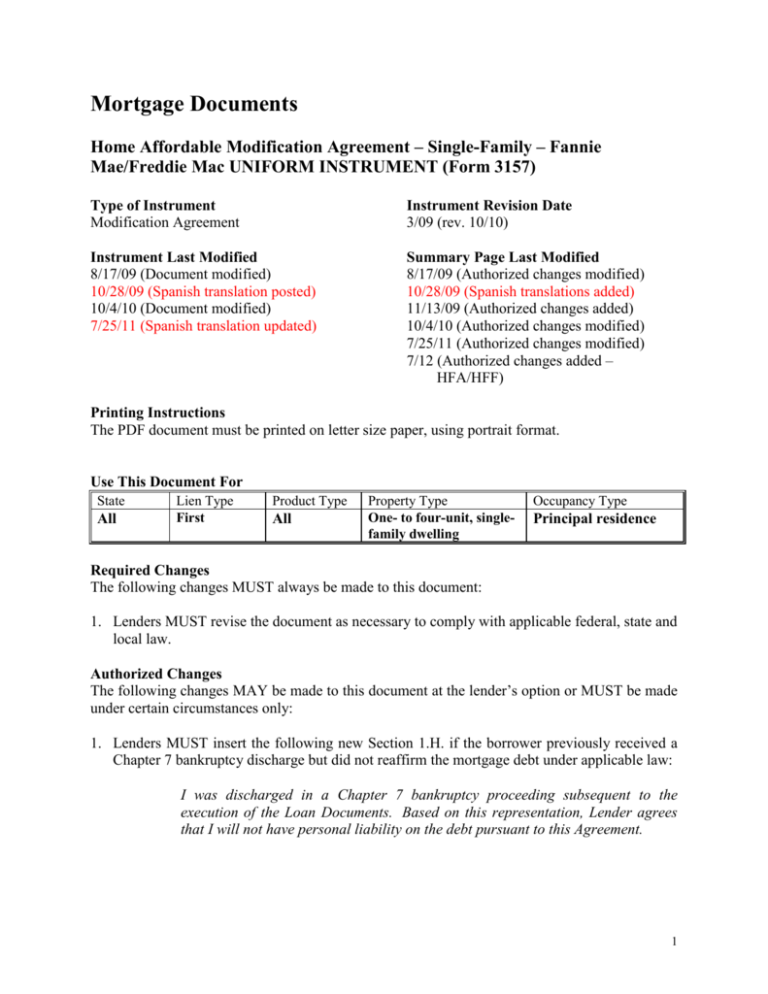

Mortgage Documents Home Affordable Modification Agreement – Single-Family – Fannie Mae/Freddie Mac UNIFORM INSTRUMENT (Form 3157) Type of Instrument Modification Agreement Instrument Revision Date 3/09 (rev. 10/10) Instrument Last Modified 8/17/09 (Document modified) 10/28/09 (Spanish translation posted) 10/4/10 (Document modified) 7/25/11 (Spanish translation updated) Summary Page Last Modified 8/17/09 (Authorized changes modified) 10/28/09 (Spanish translations added) 11/13/09 (Authorized changes added) 10/4/10 (Authorized changes modified) 7/25/11 (Authorized changes modified) 7/12 (Authorized changes added – HFA/HFF) Printing Instructions The PDF document must be printed on letter size paper, using portrait format. Use This Document For State All Lien Type First Product Type All Property Type One- to four-unit, singlefamily dwelling Occupancy Type Principal residence Required Changes The following changes MUST always be made to this document: 1. Lenders MUST revise the document as necessary to comply with applicable federal, state and local law. Authorized Changes The following changes MAY be made to this document at the lender’s option or MUST be made under certain circumstances only: 1. Lenders MUST insert the following new Section 1.H. if the borrower previously received a Chapter 7 bankruptcy discharge but did not reaffirm the mortgage debt under applicable law: I was discharged in a Chapter 7 bankruptcy proceeding subsequent to the execution of the Loan Documents. Based on this representation, Lender agrees that I will not have personal liability on the debt pursuant to this Agreement. 1 [Spanish Translation] Obtuve una eliminación de deuda en virtud de un procedimiento de quiebra bajo el Capítulo 7 con posterioridad a la suscripción de los Documentos del Préstamo. En base a esta declaración, el Prestador acuerda que no tendré responsabilidad personal por la deuda en virtud de este Acuerdo. 2. Lenders MUST insert the following at the end of the first sentence in Section 3.B., after the word, “Loan” if the terms of the loan modification include principal forgiveness: and less Principal in the amount of $_______ which has been forgiven. [Spanish Translation] y menos Principal por la suma de $_______, el que ha sido condonado. 3. Lenders MUST amend the document as follows if the terms of the loan modification include a principal deferral: (a) Revise the document as necessary to comply with applicable federal, state and local law governing mortgage loans with balloon payments. (b) Delete the existing Section 3.C. and replace it with the following new Section 3.C.: C. $____________________ of the New Principal Balance shall be deferred (the “Deferred Principal Balance”) and I will not pay interest or make monthly payments on this amount. The New Principal Balance less the Deferred Principal Balance shall be referred to as the “Interest Bearing Principal Balance” and this amount is $____________. Interest at the rate of _______% will begin to accrue on the Interest Bearing Principal Balance as of _______________ and the first new monthly payment on the Interest Bearing Principal Balance will be due on ______________. My payment schedule for the modified Loan is as follows: Years Interest Rate Interest Rate Change Date [1-5] [2.00%] 00/00/0000 Monthly Principal and Interest Payment Amount $0000.00 [6] [3.00%] 00/00/0000 $0000.00 Estimated Monthly Escrow Payment Amount* Total Monthly Payment* Payment Begins On Number of Monthly Payments $000.00, may adjust periodically May adjust periodically $000.00, may adjust periodically May adjust periodically 00/00/0000 [60] 00/00/0000 [12] 2 [7] Years Interest [4.00%] Rate [5.00%] Interest Rate 00/00/0000 Change Date 00/00/0000 [9[40]] [1-5] [6.00%] 00/00/0000 [2.00%] 00/00/0000 Monthly $0000.00 Principal and $0000.00 Interest Payment $0000.00 Amount $0000.00 [6] [3.00%] 00/00/0000 $0000.00 [8] Estimated May adjust periodically Monthly Escrow May adjust Payment periodically Amount* May adjust periodically $000.00, may adjust periodically May adjust periodically Totaladjust May periodically Monthly Payment* May adjust periodically May adjust periodically $000.00, may adjust periodically May adjust periodically Payment 00/00/0000 Begins On 00/00/0000 Number of [12] Monthly Payments [12] 00/00/0000 00/00/0000 [Insert Remaining [60] months] 00/00/0000 [12] 3 [7] [4.00%] 00/00/0000 $0000.00 [8] [5.00%] 00/00/0000 $0000.00 [9[40]] [6.00%] 00/00/0000 $0000.00 May adjust periodically May adjust periodically May adjust periodically May adjust periodically May adjust periodically May adjust periodically 00/00/0000 [12] 00/00/0000 [12] 00/00/0000 [Insert Remaining months] *The escrow payments may be adjusted periodically in accordance with applicable law and therefore my total monthly payment may change accordingly. The above terms in this Section 3.C. shall supersede any provisions to the contrary in the Loan Documents, including but not limited to, provisions for an adjustable, step or simple interest rate. I understand that, if I have a pay option adjustable rate mortgage loan, upon modification, the minimum monthly payment option, the interest-only or any other payment options will no longer be offered and that the monthly payments described in the above payment schedule for my modified Loan will be the minimum payment that will be due each month for the remaining term of the Loan. My modified Loan will not have a negative amortization feature that would allow me to pay less than the interest due resulting in any unpaid interest to be added to the outstanding principal balance. [Spanish Translation] C. La suma de $____________________ del Nuevo Saldo del Principal se diferirá (el “Saldo del Principal Diferido”) y no pagaré intereses ni realizaré pagos mensuales sobre esta suma. Se hará referencia al Nuevo Saldo del Principal menos el Saldo del Principal Diferido como el “Saldo del Principal que Devenga Intereses” y dicha suma asciende a $____________. El Saldo del Principal que Devenga Intereses comenzará a devengar intereses a la tasa del _______% a partir del _______________ y el primer nuevo pago mensual sobre el Saldo del Principal que Devenga Intereses vencerá el ______________. Mi programa de pagos correspondiente al Préstamo modificado será el siguiente: 4 Años Tasa de Interés Fecha de Cambio de Tasa de Interés [1-5] [2,00%] 00/00/0000 Monto del Pago Mensual de Principal e Intereses $0000,00 [6] [3,00%] 00/00/0000 $0000,00 [7] [4,00%] 00/00/0000 $0000,00 [8] [5,00%] 00/00/0000 $0000,00 [9[40]] [6,00%] 00/00/0000 $0000,00 Monto del Pago en Reserva Mensual Estimado* Pago Mensual Total* Fecha de Comienzo de Pago Cantidad de Pagos Mensuales $000,00, se podrá ajustar periódicamente Se podrá ajustar periódicamente Se podrá ajustar periódicamente Se podrá ajustar periódicamente Se podrá ajustar periódicamente $000.00, se podrá ajustar periódicamente Se podrá ajustar periódicamente Se podrá ajustar periódicamente Se podrá ajustar periódicamente Se podrá ajustar periódicamente 00/00/0000 [60] 00/00/0000 [12] 00/00/0000 [12] 00/00/0000 [12] 00/00/0000 [Indicar meses restantes] *Los pagos en reserva podrán ajustarse periódicamente de conformidad con la ley aplicable y, por ende, mi pago mensual total podrá modificarse en consecuencia. Los términos precedentes de esta Sección 3.C. prevalecerán sobre cualesquiera disposiciones en contrario contenidas en los Documentos del Préstamo, incluyendo, sin limitación, alguna disposiciones relativas a tasas de interés ajustables, escalonadas o simples. Entiendo que, si tengo un préstamo hipotecario con tasa de interés ajustable y opción de pago, una vez efectuadas las modificaciones, la opción de pago mensual mínimo, la opción de pago de intereses únicamente, o cualquier otra opción de pago, dejará de ofrecerse, y que los pagos mensuales descritos en el programa de pagos precedente para mi Préstamo modificado constituirán el pago mínimo que será exigible cada mes por el plazo restante del Préstamo. Mi Préstamo modificado no tendrá una característica de amortización negativa que pudiera permitirme pagar una suma inferior a los intereses exigibles resultando que cualquier interés no pagado se adicione al saldo del principal pendiente. (c) Insert after Section 3.E. the following new Section 3.F.: F. I agree to pay in full the Deferred Principal Balance and any other amounts still owed under the Loan Documents by the earliest of: (i) the date I sell or transfer an interest in the Property, (ii) the date I pay 5 the entire Interest Bearing Principal Balance, or (iii) the Maturity Date. [Spanish Translation] F. Yo acuerdo pagar la totalidad del Saldo de Principal Diferido y cualquier otra suma aún adeudada en virtud de los Documentos del Préstamo en una de las siguientes fechas, la que ocurra primero, (i) la fecha en que Yo venda o transfiera un derecho sobre la Propiedad; (ii) la fecha en que Yo pague la totalidad del Saldo de Principal que Devenga Intereses o (iii) en la Fecha de Vencimiento. 4. Lenders MUST delete the existing Section 4.D. if, under applicable law, a servicer may not establish an escrow account for the subject mortgage loan, and change, as necessary, any cross-references to other paragraphs in Section 4 in the document. As an alternative, lenders MAY delete Section 4.D. and replace it with “Intentionally Deleted” as follows: D. Intentionally Deleted. [Spanish Translation] D. Eliminado intencionalmente. 5. Lenders MUST delete the existing Section 4.D. if the original loan documents did not include standard Fannie Mae/Freddie Mac Uniform Instrument provisions for escrow items 1 and replace it with the following: D. Funds for Escrow Items. I will pay to Lender on the day payments are due under the Loan Documents as amended by this Agreement, until the Loan is paid in full, a sum (the “Funds”) to provide for payment of amounts due for: (a) taxes and assessments and other items which can attain priority over the Mortgage as a lien or encumbrance on the Property; (b) leasehold payments or ground rents on the Property, if any; (c) premiums for any and all insurance required by Lender under the Loan Documents; (d) mortgage insurance premiums, if any, or any sums payable to Lender in lieu of the payment of mortgage insurance premiums in accordance with the Loan Documents; and (e) any community association dues, fees, and assessments that Lender requires to be escrowed. These items are called “Escrow Items.” I shall promptly furnish to Lender all notices of amounts to be paid under this Section 4.D. I shall pay Lender the Funds for Escrow Items unless Lender waives my obligation to pay the Funds for any or all Escrow Items. Lender may waive my obligation to pay to Lender Funds for any or all Escrow Items at any time. Any such waiver may only be in writing. In the event of such 1 For an example of the standard Fannie Mae/Freddie Mac Uniform Instrument escrow account provisions, refer to Section 3 of the Uniform Covenants in the Uniform Security Instruments which can be obtained from the Legal Documents page on www.efanniemae.com and the Single-Family Uniform Instruments page on www.freddiemac.com. 6 waiver, I shall pay directly, when and where payable, the amounts due for any Escrow Items for which payment of Funds has been waived by Lender and, if Lender requires, shall furnish to Lender receipts evidencing such payment within such time period as Lender may require. My obligation to make such payments and to provide receipts shall for all purposes be deemed to be a covenant and agreement contained in the Loan Documents, as the phrase “covenant and agreement” is used in the Loan Documents. If I am obligated to pay Escrow Items directly, pursuant to a waiver, and I fail to pay the amount due for an Escrow Item, Lender may exercise its rights under the Loan Documents and this Agreement and pay such amount and I shall then be obligated to repay to Lender any such amount. Lender may revoke the waiver as to any or all Escrow Items at any time by a notice given in accordance with the Loan Documents, and, upon such revocation, I shall pay to Lender all Funds, and in such amounts, that are then required under this Section 4.D. Lender may, at any time, collect and hold Funds in an amount (a) sufficient to permit Lender to apply the Funds at the time specified under the Real Estate Settlement Procedures Act (“RESPA”), and (b) not to exceed the maximum amount a lender can require under RESPA. Lender shall estimate the amount of Funds due on the basis of current data and reasonable estimates of expenditures of future Escrow Items or otherwise in accordance with applicable law. The Funds shall be held in an institution whose deposits are insured by a federal agency, instrumentality, or entity (including Lender, if Lender is an institution whose deposits are so insured) or in any Federal Home Loan Bank. Lender shall apply the Funds to pay the Escrow Items no later than the time specified under RESPA. Lender shall not charge me for holding and applying the Funds, annually analyzing the escrow account, or verifying the Escrow Items, unless Lender pays me interest on the Funds and applicable law permits Lender to make such a charge. Unless an agreement is made in writing or applicable law requires interest to be paid on the Funds, Lender shall not be required to pay me any interest or earnings on the Funds. Lender and I can agree in writing, however, that interest shall be paid on the Funds. Lender shall provide me, without charge, an annual accounting of the Funds as required by RESPA. If there is a surplus of Funds held in escrow, as defined under RESPA, Lender shall account to me for the excess funds in accordance with RESPA. If there is a shortage of Funds held in escrow, as defined under RESPA, Lender shall notify me as required by RESPA, and I shall pay to Lender the amount necessary to make up the shortage in accordance with RESPA, but in no more than 12 monthly payments. If there is a deficiency of Funds held in escrow, as defined under RESPA, Lender shall notify me as required by RESPA, and I shall pay to Lender the amount necessary to make up the deficiency in accordance with RESPA, but in no more than 12 monthly payments. 7 Upon payment in full of all sums secured by the Loan Documents, Lender shall promptly refund to me any Funds held by Lender. [Spanish Translation] D. Fondos correspondientes a Partidas en Reserva. Pagaré al Prestador en la fecha de vencimiento de los pagos a ser efectuados de conformidad con los Documentos del Préstamo, conforme fueran modificados por este Acuerdo, hasta el pago total del Préstamo, un monto (los “Fondos”) para proveer para el pago de montos adeudados por: (a) impuestos y contribuciones y otras partidas que pudiesen adquirir prioridad sobre la Hipoteca como gravamen o cargo sobre la Propiedad; (b) pagos de arrendamientos o rentas de terrenos sobre la Propiedad, si hubiere; (c) primas por todos los seguros exigidos por el Prestador en virtud de los Documentos del Préstamo; (d) primas del seguro hipotecario, si alguno, o cualquier monto que deba pagar al Prestador en lugar del pago de las primas del seguro hipotecario de conformidad con los Documentos del Préstamo; y (e) cualquier cuota, cargo y contribucion extraordinaria a la asociación comunitaria que el Prestador exija sean depositadas en reserva. Estas partidas se denominan “Partidas en Reserva”. Presentaré inmediatamente al Prestador todas las notificaciones de montos a pagar conforme a la presente Sección 4.D. Pagaré al Prestador los Fondos correspondientes a las Partidas en Reserva, salvo que el Prestador me dispense de mi obligación de pagar los Fondos correspondientes a cualquiera o todas las Partidas en Reserva. El Prestador me podrá dispensar de mi obligación de pagar al Prestador los Fondos correspondientes a cualquiera o todas las Partidas en Reserva en cualquier momento. Dicha dispensa solamente podrá realizarse por escrito. En el caso de dicha dispensa, pagaré en forma directa, en el momento y lugar que corresponda, los montos adeudados por cualquier Partida en Reserva respecto de la cual el Prestador haya dispensado el pago de Fondos y, si el Prestador lo exige, presentaré al Prestador los recibos de dicho pago dentro del plazo que el Prestador exija. Mi obligación de efectuar dichos pagos y de presentar los recibos se considerará, a todo efecto, como un convenio y acuerdo incluido en los Documentos del Préstamo, según la frase “convenio y acuerdo” se utiliza en los Documentos del Préstamo. Si estoy obligado a pagar las Partidas en Reserva en forma directa, en virtud de una dispensa, y no efectúo el pago del monto adeudado para una Partida en Reserva, el Prestador podrá ejercer sus derechos conforme a los Documentos del Préstamo y este Acuerdo y pagar dicho monto, y entonces Yo estaré obligado a reembolsar al Prestador cualquiera de dichos montos. El Prestador podrá revocar la dispensa en relación con cualquiera o todas las Partidas en Reserva en cualquier momento, mediante una notificación cursada de conformidad con los Documentos del Préstamo. Ante dicha revocación, pagaré al Prestador la totalidad de los Fondos, en los montos que en ese momento se exijan conforme a la presente Sección 4.D. El Prestador podrá, en cualquier momento, cobrar y retener los Fondos en un monto (a) que resulte suficiente para permitirle al Prestador aplicar los Fondos en 8 el momento especificado conforme a la Ley de Procedimientos de Liquidación de Bienes Raíces (“RESPA”), y (b) que no supere el monto máximo que un prestador puede exigir conforme a RESPA. El Prestador estimará el monto de los Fondos adeudados sobre la base de los datos actuales y los estimados razonables de los gastos de futuras Partidas en Reserva o de cualquier otro modo, en conformidad con la ley aplicable. Los Fondos se mantendrán en una institución cuyos depósitos se encuentren asegurados por una agencia, instrumentalidad o entidad federal (incluido el Prestador, si es una institución cuyos depósitos están asegurados de ese modo) o en cualquier Federal Home Loan Bank. El Prestador aplicará los Fondos para el pago de las Partidas en Reserva a más tardar en la fecha especificada conforme a RESPA. El Prestador no me cobrará por retener y aplicar los Fondos, realizar un análisis anual de la cuenta de reserva, ni por verificar las Partidas en Reserva, salvo que el Prestador me pague intereses sobre los Fondos y que dicho cobro esté permitido conforme a la ley aplicable. Salvo que se celebre un acuerdo por escrito o que la ley aplicable exija el pago de intereses sobre los Fondos, no se le exigirá al Prestador que me pague intereses ni ingresos sobre los Fondos. El Prestador y Yo podemos acordar por escrito, no obstante, que se paguen intereses sobre los Fondos. El Prestador me entregará, sin cargo, una contabilidad anual de los Fondos, conforme lo exige RESPA. Si existe un sobrante de los Fondos que se mantienen en reserva, según se define conforme a RESPA, el Prestador me rendirá cuentas por los fondos excedentes de conformidad con RESPA. Si los Fondos que se mantienen en reserva son insuficientes, según se define conforme a RESPA, el Prestador me notificará según lo exigido por RESPA, y Yo pagaré al Prestador el monto necesario para compensar dichos fondos insuficientes de acuerdo con RESPA, pero en no más de 12 pagos mensuales. Si se produce una deficiencia en los Fondos que se mantienen en reserva, según se define conforme a RESPA, el Prestador me notificará según se exija conforme a RESPA, y Yo pagaré al Prestador el monto necesario para compensar dicha deficiencia de acuerdo con RESPA, pero en no más de 12 pagos mensuales. Al efectuarse el pago total de todos los montos garantizados por los Documentos del Préstamo, el Prestador me reembolsará en forma inmediata cualesquiera Fondos que se encuentren en su poder. 6. Lenders MUST add Mortgage Electronic Registration Systems, Inc. (MERS) to the signature lines at the end of the document as follows if the Modification Agreement must be recorded, the original mortgage loan was registered with MERS, and MERS was named in the security instrument as the nominee for the lender: 9 _______________________________ Mortgage Electronic Registration Systems, Inc. – Nominee for Lender [Spanish Translation] _______________________________ Mortgage Electronic Registration Systems, Inc. – Persona designada para el Prestador 7. Lenders MUST revise the document as necessary if a term extension is not permitted under the applicable pooling and servicing agreement or other investor servicing agreement, and the mortgage loan is reamortized with a balloon payment due at maturity. Such revision must comply with applicable federal, state and local law. 8. Lenders MUST insert the following new Section 4.P. if the original loan was a first-lien home equity loan or line of credit and the borrower has the right to borrow new funds under the home equity loan or line of credit: P. If my Loan Documents govern a home equity loan or line of credit, then I agree that as of the Modification Effective Date, I am terminating my right to borrow new funds under my home equity loan or line of credit. This means that I cannot obtain additional advances, and must make payments according to this Agreement. (Lender may have previously terminated or suspended my right to obtain additional advances under my home equity loan or line of credit, and if so, I confirm and acknowledge that no additional advances may be obtained.) [Spanish Translation] P. Si mis Documentos del Préstamo gobiernan un préstamo sobre el capital acumulado en la vivienda o línea de crédito, Yo acuerdo que a partir de la Fecha de Vigencia de las Modificaciones, Yo doy por terminado mi derecho a pedir prestado nuevos fondos bajo mi préstamo sobre el capital acumulado en la vivienda o línea de crédito. Esto significa que no puedo obtener adelantos adicionales, y debo hacer los pagos de conformidad con este Acuerdo. (El Prestador pudo haber terminado o suspendido previamente mi derecho de obtener adelantos adicionales bajo mi préstamo sobre el capital acumulado en la vivienda o línea de crédito, y de ser así, Yo confirmo y reconozco que no podré obtener adelantos adicionales.) 9. Lenders MUST amend the document as follows if the borrower is using loan proceeds funded by the federal Hardest-Hit Funds program and administered by a state Housing Finance Agency to reduce the unpaid principal balance of the mortgage: 10 a. Insert the following as a new Section 1.H.: H. My state Housing Finance Agency (“HFA”) has determined that I qualify for a mortgage assistance program (“HFA Program”) using federal Hardest Hit Funds to pay down a portion of the unpaid principal balance of my Mortgage (“HFA Funds”). The HFA Funds are to be applied first to reduce the accrued and unpaid interest on the Note as of the Modification Effective Date and any other authorized amounts advanced by the Lender and secured by the Mortgage, then to reduce the unpaid principal balance of the Mortgage. b. Insert the following as a new Section 2.B.: B. Unless and until the Lender has received confirmation from the HFA of final approval for assistance under the HFA Program and the Lender has received the HFA Funds, the HFA Funds will not be applied to reduce the amounts set forth in Section 1.H.; and c. Replace the existing Section 3.B. with the following new Sections 3.B.: B. The modified principal balance of my Note will include all amounts and arrearages that will be past due as of the Modification Effective Date (including unpaid and deferred interest, fees, escrow advances and other costs, but excluding unpaid late charges, collectively, “Unpaid Amounts”) less any amounts paid to the Lender but not previously credited to my Loan, and less $____________, representing the amount of the HFA Funds. The new principal balance of my Note will be $__________ (the “New Principal Balance”). I understand that the HFA Funds will be applied first to the Unpaid Amounts, then to the outstanding principal balance. I understand that any remaining Unpaid Amounts not reduced by the HFA Funds will be added to the outstanding principal balance, and that any such Unpaid Amounts may accrue interest based on the interest rate in effect under this Agreement. I also understand that this means interest may now accrue on any unpaid Interest that may be added to the outstanding principal balance, which would not happen without this Agreement. d. Insert the following as a new Section 4.P.: P. That I am in compliance with the requirements of the HFA Program, and that I will comply with the covenants, agreements, and requirements of the HFA Program and any related documentation. I will execute such other documents that are reasonably necessary to consummate the transaction offered under the HFA Program, and will cooperate fully with Lender and the HFA to ensure that the preconditions of this Agreement are satisfied. e. Adjust section numbering as necessary. 11 10. Lenders MAY include at the bottom of each page “initial lines” on which borrowers may insert their initials to acknowledge that all pages of the document are present. If these lines are added, lenders MUST require the borrowers to initial the lines on each page of the document. 11. Lenders MAY adjust cross-references to section, paragraph, or page numbers, if needed to reflect changes in section, paragraph, or page numbers that result from adding, modifying, or deleting certain language in accordance with another authorized change. Other Pertinent Information Any special instructions related to preparation of this document, use of special signature forms, required riders or addenda, etc. are discussed below. 1. If the borrower is an inter vivos revocable trust, we may require: a special rider, a different signature form for the trustee signature, and a special signature acknowledgment for the settlor/credit applicant(s). Lenders are responsible for making any modifications, including the use of different terminology, needed to conform to the signature forms customarily used in the applicable jurisdiction and will be held fully accountable for the use of any invalid signature form(s). - Each of the trustees must sign this document in a signature block substantially similar to the following, which should be inserted in the Borrower signature lines. ___________________________, Trustee of the __________________________ Trust under trust instrument dated ___________________________, for the benefit of _____________________________ (Borrower). [Spanish Translation] ___________________________, Fiduciario del Fideicomiso __________________________ en virtud del instrumento de fideicomiso de fecha ___________________________, en beneficio de _____________________________ (Deudor). 12