F301 Spring 2005 Syllabus - Indiana University Northwest

advertisement

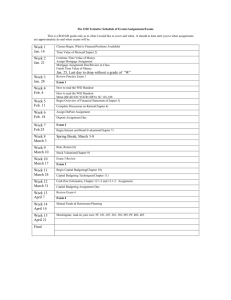

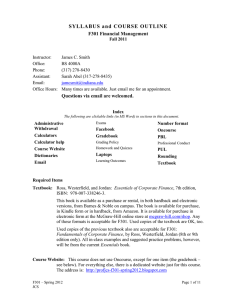

INDIANA UNIVERSITY NORTHWEST Division of Business and Economics F301 - Financial Management Spring 2005 Instructor: Dr. Bala Arshanapalli Office: Room 331 Lindenwood Hall Telephone: (219) 980-6919 E-Mail : barshana@iun.edu Web Address: http://www.iun.edu/~bnwbga/bala.htm Office Hours: M W 12:00 – 2:15 P.M. and M 4:00 – 6:00 P.M. and by appointment Textbook: Foundations of Finance, Keown, Martin, Petty and Scott, Version 2, 2004 Prereqs: A201, A202, E103, E104, M118, M119, E270, & A106 Automatic W Date March 24, 2005 Descriptions: Fundamental tools of analysis for the financial management of the firm. Sources and uses of funds analysis for capital budgeting and working capital management. Course Objective: The objective of this course is to familiarize the student with the fundamental tools of analysis for the financial manager of the corporation. In order to do this we must develop in the first part of the course specific analytical techniques applied in managerial finance. We will reinforce this knowledge by utilizing these techniques in solving problems. Next, we will discuss the three major financial decisions of the firm: its investment policy (capital budgeting), its financing policy (capital structure decisions), and its dividend policy. In the last part of the course, if time permits, we will deal with the administration of the current assets and liabilities (working capital management). We will consider these subject areas in the context of the objective of all financial management decision making, i.e. maximization of the wealth of the stockholder. Performance Evaluation: There will be Four exams including a final exam (cumulative). Three exams will count for sixty percent, and the final exam for 20 percent of the final grade of the course. I will allow you to drop one of the three exams. Since I will allow you to drop one exam (not the final exam) there will be NO makeup exams for any reason. In addition, quizzes and class participation will count for the remaining 20% of the final grade and how I will award these points will be at my discretion. Grading: Grades are awarded on the basis of the following scale: A = 90 - 100 B = 80 - 89 C = 70 - 79 D = 60 - 69 F = 59 and below Rules: Students should expect to devote at least nine hours per week to each three semester hour course generally three hours in class and six hours for homework, term papers, and other Assignments. Some courses require more, hours, and in some cases, the efforts may be Concentrated during certain portions of the semester. Page 3 F301 Syllabus Tentative Course Outline and Assignments Week Subject Chapter(s) 1& 2 Introduction, Financial Statements & Taxes 1,3 3&4 Time Value of Money 5 4 Test # 1 5 Bond Valuation 7 6 Stock Valuation 8 7&8 Risk and Return 6 8 TEST #2 9 Capital Budgeting I 9 10 Capital Budgeting II 10 11 Cost of Capital 11 12 TEST #3 13 Capital Structure 12 14 Dividend Policy 13 15 International Finance 17 Finals