Chapter 4: Income Statement and Related Information

advertisement

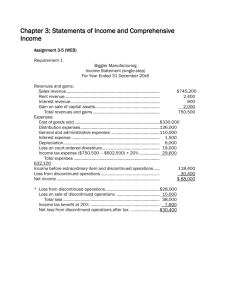

Chapter 4 Page 1 of 14 Chapter 4: Income Statement and Related Information (REMEMBER: ALWAYS put headings on your financial statements, especially during the EXAMS. Points are subtracted if the financial statements do not list the company name, financial statement, date/time period. Also, ALWAYS date your journal entries.) The purpose of this chapter is to examine the different types of revenues, expenses, gains, and losses that affect the income statement and related information. 1) Income Statement: Report that measures the success of enterprise operations for a given period of time. Provides investors and creditors with info that helps them predict the amounts, timing, and uncertainty of future cash flows. (Objective #2 in our Basic Objectives from Chapters 1 and 2.) a Usefulness of the Income Statement: Income information is useful for: i) ii) iii) Information about the various components of income – revenues, expenses, gains, and losses – is helpful for assessing the likelihood that particular cash flows will continue in the future. b Limitations of the Income Statement: Net Income is an _________________ that reflects assumptions made. Users should be aware of its limitations. i) Items that cannot be measured reliably are not reported in the income statement. For example: (1) (2) ii) iii) c Quality of Earnings: If managers are focused on meeting financial targets, such as analysts’ forecasts to the detriment of good business practices, the quality of earnings and the quality of financial reporting will erode. Chapter 4 Page 2 of 14 Earnings management: It has a negative effect on earnings quality if it distorts the information that makes the current year (1) misrepresentative of a company’s true state and (2) less useful for predicting future earnings and cash flow. 2) Format of the Income Statement: Transaction approach: focuses on the income-related activities that have occurred during the period. That is, net income results from revenue, expense, gain, and loss transactions. (Capital maintenance approach is the most common alternative. Here, income for the period is determined based on change in equity, after adjusting for investments by owners or dividends. However, the components of income are not evident in the capital maintenance approach.) a Elements of the Income Statement: i) Revenues: ii) Expenses: iii) Gains: iv) Losses: v) Gains and Losses: Some examples: b Single-Step Income Statement: LN: Aggregate Data. i) Just two groupings exist: _________________________________________ The single step is subtracting ______________________________________. Sometimes income tax is reported as the last item before net income (to show its relationship to income before income tax.) Example on page 130. Chapter 4 Page 3 of 14 ii) Example Format: SINGLE STEP FORM: Company Name Income Statement For the Year Ended 12/31/xx Revenues and Gains: Net Sales Other Revenue (e.g., Interest, Dividend revenue, Rent) Total Revenues and Gains: Expenses and Losses: Cost of goods sold Selling expenses General and Administrative expenses Depreciation expense Interest expense xx xx xx xx xx xx xx xx Total Expense and Losses xx Income from Continuing Operations xx THE REST OF THIS INCOME STATEMENT FOLLOWS THE SAME APPROACH AS THE MULTI-STEP INCOME STATEMENT. iii) Primary Advantage of Single Step IS: The presentation is simple and no implication exists about the importance of any one type of revenue or expense item. c Multiple-Step Income Statement: example on page 132. i) Further Classifications Included: (1) Separate operating and non-operating company activities presented. For example, “Income from Operations” is presented and then “Other Revenues and Gains” and “Other Expenses and Losses” are presented. (2) Expenses are classified by functions (e.g., COGS, selling, and administration.) ii) Relationships Recognized: (1) Recognizes Operating transactions separately from non-operating transactions. (2) Matches Costs and expenses with related revenue. (3) Highlights intermediate components of income useful for computation of ratios used to assess enterprise performance. Chapter 4 Page 4 of 14 iii) Intermediate Components of the Income Statement: (1) Possible Sections/Subsections of Multi-Step Income Statement (page 129) (a) Operating Section: (i) Sales or Revenue Section: Includes sales, discounts, allowances, returns, and other related info. (ii) Cost of Goods Sold Section. (iii)Selling Expenses. (iv) Administrative or General Expenses. (b) Non-operating Section. (i) Other Revenues and Gains. (ii) Other Expenses and Losses. (c) Income Tax. (d) Discontinued Operations. (e) Extraordinary Items. (f) Earnings Per Share. (2) To arrive at net income on the multi-step income statement, three subtotals are presented: (a) (b) (c) Disclosing income from operations highlights the difference between regular and irregular or incidental activities. Irregular or incidental revenues are disclosed elsewhere in the income statement. Chapter 4 Page 5 of 14 iv) Example Format: MULTI-STEP FORM: (Be able to do this on your own.) Company Name Income Statement For the Year Ended 12/31/xx Sales Revenue Cost of Goods Sold Operating Expenses Selling expenses Sales salaries and commissions Advertising expense Postage and stationery Telephone and Internet expense General and Administrative expenses Officers’ salaries Office salaries Depreciation expense Miscellaneous office expenses Income from operations Other Revenues and Gains Rental Revenue Other Expenses and Losses Income from continuing operations before income tax Income tax Income from continuing operations Discontinued Operations Income before extraordinary items of accounting change Extraordinary items Net Income Earnings per common share Note: You will not always have all of these sections. For example, if there are no DE items (discontinued ops, extraordinary items), after other expenses and losses, you would have Income before income tax, income tax, net income. Also, the phrase “Income from continuing operating” is used only when gains or losses on discontinued operations occurs. Otherwise, “Income from Operations”. Chapter 4 Page 6 of 14 d Condensed Income Statements: Include only the totals of expense groups in the income statement and prepare supplementary schedules to support the total. Page 133 shows a condensed version of the more detailed multiple-step statement presented on page 132. The condensed version is more commonly found in practice. (Notice the reference to “see Note D” in Illustration 4-3 on page 133. This refers to the supporting schedule for selling expenses shown in Illustration 4-4 on page 134.) Knowing how much detail to include in the Income Statement always presents a problem. We want simple, summarized statements that lead readers to important factors. However, we want to disclose results of all activities. Certain basic elements are always included but they can be presented in various formants. 3) Reporting Irregular Items: Income measurement follows an all-inclusive approach. In other words, most items, even irregular ones, are recorded in income. Prior period adjustments (i.e., errors in prior years’ income measurement) are NOT included in income. Because these items have affected earnings already reported in a prior period, they are not included in current income but recorded as adjustments to retained earnings. The accounting profession currently uses a modified all-inclusive concept and requires application of this approach in practice. Irregular items are required to be highlighted so that the reader of financial statements can better determine the long-run earnings power of the enterprise. The items fall into six general categories (p136): Above the Line: (1) (2) (3) (4) Below the Line: (5) (6) Where “Line” = “Income from continuing operations”. Chapter 4 a Page 7 of 14 Discontinued Operations: i) Occurs when (1) (2) ii) Segment Disposal: a segment is one which represents a: (1) (2) iii) Disposals of assets that do not qualify as disposals of a segment of a business include the following: (1) Disposal of part of a line of business. (2) Shifting production or marketing activities for a particular line of business from one location to another. (3) Phasing out of a product line or class of service. iv) Important Dates: (1) Measurement Date: (2) Disposal Date: (3) Phase-Out Period: v) Generally reported in a separate income statement category for the gain or loss from disposal of a component of a business. vi) The results of operations of a component that has been or will be disposed of are also reported separately from continuing operations. The effects of discontinued operations are shown net of tax as a separate category, after continuing operations but before extraordinary items. (See Illustration 4-6 on page 136. Also, see sample format for Multi-Step Income Statement given above.) vii) The phrase “Income from continuing operations” is used only when gains or losses on discontinued operations occur. viii) Form: Chapter 4 Page 8 of 14 Note: (1) (2) ix) Example 1: Measurement date and disposal date are in the same period. (Recognize all gains and losses.) Ball Corp. decided on June 1, 2000 to dispose of a segment. From January 1 to June 1, the segment had income of $50,000. Ball sold the segment on October 1, 2000 for a loss of $30,000. Income during the phase-out period was $10,000. The tax rate is 40%. Chapter 4 Page 9 of 14 x) Example 2: Measurement date is October 1, 2000. Disposal date is May 1, 2001. Realized Income/Loss on Operations [1] 10/1 to 12/31 1. 2. 3. 4. 5. Estimate Income/Loss on Operations [2] 1/1/01 to 5/1/01 Estimated Gain/Loss on Disposal [3] 5/1/01 What do we report in 2000? What do we report in 2001? Chapter 4 Page 10 of 14 b Extraordinary Items: i) Nonrecurring material items that differ significantly from the entity’s typical business activities. ii) Shown net of taxes on income statement in a separate section. (See Illustration 4-7 on page 138 and format for Multi-Step income statement given above.) iii) See page 137 for list of gains/losses that are NOT extraordinary items. List includes such gains/losses as gains/losses on disposal of a component of an entity and effects of a strike, including those against competitors and major suppliers. These are NOT extraordinary items. iv) Only rarely does an event/transaction clearly meet the criteria for an extraordinary item. The environment in which the entity operates must also be considered. Examples: (1) Extraordinary items: (2) NOT Extraordinary items: v) Considerable judgment must be used when determining whether an item is extraordinary. c Changes in Accounting Principle: Chapter 4 Page 11 of 14 i) Include as a retrospective adjustment to financial statements. Recast the prior years’ statement on basis consistent with newly adopted principle. Record cumulative effect of change for prior periods as an adjustment to beginning retained earnings of earliest year presented. ii) Disclose change in the footnotes. Changes violate the ______________ concept; however, the change should be justified. Retrospective approach preserves ________________ across years. iii) See example on pages 140-141 (Illustrations 4-10 and 4-11.) d Unusual Gains and Losses: Restructuring charge: e Changes in Estimates: i) Occasionally a company will need to change an accounting estimate. ii) iii) iv) Examples: Chapter 4 Page 12 of 14 f Correction of Errors (Prior Period Adjustments): i) Occasionally companies make errors when reporting items such as revenue, stock options, and allowance accounts. ii) Record correcting entries in accounts and treat as prior period adjustments. In other words, adjust beginning balance of retained earnings. Record in year discovered. iii) See example on page 142. g Summary of Irregular Items: Know Illustration 4-12 on page 142. 4) Special Reporting Issues: a Intraperiod Tax Allocation: Allocation of tax within a period (i.e., let the tax follow the income.) In other words, relate tax expense for a given year to the specific items on the income statement. Used for: (1) income from continuing operations, (2) discontinued operations, and (3) extraordinary items. A separate tax effect is associated with each irregular item. i) Extraordinary Gains: See example (Illustration 4-13) on page 143. ii) Extraordinary Losses: See example (Illustration 4-14) on page 144. b Earnings Per Share: The numerator is also referred to as income available to common stockholders. c i) Required to be disclosed in the income statement. ii) If the company has a discontinued operation, extraordinary item, or a change in accounting principle, per share amounts must be reported for these line items either on the income statement or in the notes to the financial statements. (See Illustration 4-17 on page 145.) Retained Earnings Statement: i) Net income increases R/E. ii) Net loss decreases R/E. iii) Cash and Stock Dividends decrease R/E. iv) Prior Period Adjustments and Changes in Accounting Principle: (1) (2) (3) (4) Chapter 4 Page 13 of 14 v) Example Format: Balance, January 1 Company Name Statement of Retained Earnings For the Year Ended 12/31/xx xx Add: Net Income Less: Dividends Balance, December 31 xx xx xx vi) Restrictions of Retained Earnings: (1) Appropriated (Restricted) Retained Earnings: (2) Unappropriated (Unrestricted) Retained Earnings: (3) d Comprehensive Income: i) Comprehensive Income Defined: (1) Keeps track of items that bypass the income statement. (2) Includes all changes in equity during a period except those resulting from investments by owners and distributions to owners. It includes all revenues and gains, expenses and losses reported in net income, and in addition it includes gains and losses that bypass net income but affect stockholders’ equity. These items are referred to as other comprehensive income. (3) Other Comprehensive Income = foreign currency translation gain/loss + unrealized gain/loss on AFS securities + excess of additional pension liability over unamortized prior service cost + changes in market value of a futures contract that is a hedge of an asset reported at fair value. (4) Earnings per share information related to CI is NOT required. Chapter 4 Page 14 of 14 ii) Comprehensive Income Presentation: Presented in one of three ways. (1) Second Income Statement: See Illustration 4-19 on page 148. (2) Combined Income Statement: (3) Statement of Stockholders’ Equity: See Illustration 4-20 on page 148. Balance Sheet Presentation: See Illustration 4-21 on page149.