Contents - University of Zululand | "Welcome"

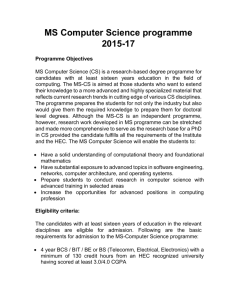

advertisement