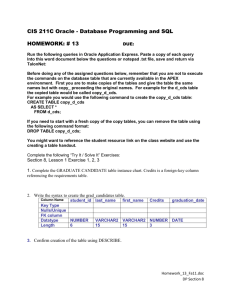

Assignment 2

advertisement

Database Programming and Administration

Assignment 2

Luke Randall

Rob Howard

Thomas McGannon

10185864

10100000

10181651

Oracle Username: ljrandal

Luke Randall/Rob Howard/Thomas McGannon

Page 1 of 13

Table of Contents

1. Instructions ............................................................................................................................................ 3

1.1 Running the Program ...................................................................................................................... 3

1.2 Modifying Parameters ..................................................................................................................... 5

2. Overview of Task .................................................................................................................................. 6

3. Design of the Solution........................................................................................................................... 8

3.1 Overview ......................................................................................................................................... 8

3.2 Function Diagrams ........................................................................................................................ 10

3.3 Assumptions .................................................................................................................................. 11

3.4 Functions and Procedures ............................................................................................................. 11

3.5 Views ............................................................................................................................................ 12

3.6 Entity-Relationship Diagram ........................................................................................................ 13

Luke Randall/Rob Howard/Thomas McGannon

Page 2 of 13

1. Instructions

1.1 Running the Program

Logging In

1. To login using iSQL Plus, navigate to http://smaug.it.uts.edu.au:7777/isqlplus) and enter

your username and password.

2. You should now see the screen in Figure 1. You can now proceed to enter commands.

Figure 1 - iSQL Plus

Running a Daily Settlement

1. To run the daily settlement for today, run FSS_Settlement.DailySettlement with no

parameters. This can be accomplished from iSQL Plus by typing in the commands

below and then pressing the execute button. Ideally this should be scheduled.

Note: To run the daily settlement for a past date, pass that date to the DailySettlement

procedure in the format DDMONYYYY, for example 10JUN2006.

BEGIN

exec FSS_Settlement.DailySettlement;

END;

Luke Randall/Rob Howard/Thomas McGannon

Page 3 of 13

2. The daily deskbank file will now have been produced in the storage directory specified

in the reference table.

Running a Monthly Settlement

1. To run the monthly settlement for the specified month, run the commands listed below.

Note that the parameter must be in the format MONYYYY, for example JUN2006.

BEGIN

exec FSS_Settlement.MonthlySettlement(MONYYYY);

END;

2. The monthly deskbank file will now have been produced in the storage directory

specified in the reference table.

Running the Daily Banking Summary

1. To run the daily banking summary, run the commands listed below. Note that the

parameter must be in the format DDMONYYYY, for example 10JUN2006.

BEGIN

exec FSS_Settlement.DailyBankingSummary (DDMONYYYY);

END;

2. The daily banking summary will now have been created in the storage directory

Running the Monthly Banking Summary

1. To run the monthly banking summary, run the commands listed below. Note that the

parameter must be in the format MONYYYY, for example JUN2006.

BEGIN

exec FSS_Settlement.MonthlyBankingSummary (MONYYYY);

END;

2. The monthly banking summary will now have been created in the storage directory.

Luke Randall/Rob Howard/Thomas McGannon

Page 4 of 13

Running the Monthly Client Statements

1. To generate the monthly statement for a particular client, run the commands listed

below. Note that the date parameter must be in the format MONYYYY, for example

JUN2006. The ClientID parameter should be numeric.

BEGIN

exec FSS_Settlement.MonthlyClientStatement (MONYYYY, ClientID);

END;

2. The monthly client statement for the selected client will now be created in the storage

directory.

Running the Fraud Report

1. To generate a fraud report, run the command listed below.

BEGIN

exec FSS_Settlement.FraudReport;

END;

1.2 Modifying Parameters

The program can be modified in a number of ways simply through the database environment.

These modifications are done in the FSS_ALL_REFERENCE view. This view consists of a

ReferenceID (which must be unique), a reference name, a reference value and a comment.

To modify single values (eg: the storage directory), modify the Reference value.

The following is a sample list of parameters that can be modified from this table:

Holiday Run Flag: This is either Y or N, which refers to whether or not the program

is to be run on holidays (as defined by FSS_HOLIDAYS) and weekends.

DIR: This is the full path to the storage directory where all output files (deskbank

files and reports) will be stored.

FEE1: This refers to the percentage of total turnover charged to merchants on

transactions.

Luke Randall/Rob Howard/Thomas McGannon

Page 5 of 13

2. Overview of Task

The task at hand is to implement a Financial Settlement System for a Smartcard Transaction

Centre. A limited trial deployment of a Smartcard System has been underway for some time now,

and this deployment is now moving into the next phase of deployment.

The next phase will involve the number of merchants being increased. This means that there is a

requirement that the settlement process be automated in order to maximise efficiency and

minimise delay. During the trial period the merchants were reimbursed manually, but this is no

longer feasible or desired.

During the initial phase merchants were also not charged any fee on Smartcard transactions. There

is a requirement that fees are now implemented, so that merchants will be automatically debited a

set percentage fee at the end of each month.

At the end of each day, assuming the transactions for each merchant are above the minimum

settlement amount, they will be settled. This involves a daily Deskbank file being created – which

is sent to the bank in order to credit the merchants accounts with the required amount. A daily

settlement report must also be able to be produced for the accountants. This is simply a humanreadable version of the daily Deskbank file.

At the end of each month, all outstanding transactions will be settled (ie: those which were below

the minimum settlement amount), as well as fees will be debited from the merchants’ accounts. A

monthly Deskbank file must be produced containing these transactions. Again, a human-readable

monthly settlement report must also be produced for the accountants.

To ensure accountability and traceability, monthly statement reports will be generated for each

merchant at the end of each month. These statements will show the deposits into their bank

accounts during the month as well as the amount of fees for the service.

Finally, to aid in fraud detection a fraud report will be able to be created. This will list those cards

Luke Randall/Rob Howard/Thomas McGannon

Page 6 of 13

(and the transactions from those cards) where the old value of the current transaction is greater

than the new value of the previous transaction.

Luke Randall/Rob Howard/Thomas McGannon

Page 7 of 13

3. Design of the Solution

3.1 Overview

The daily settlement procedure works by looping through all the non-settled transactions

from the beginning of the month to the date given. If a non-settled transaction is found, then

the program will loop through all unsettled transactions of that client and produce a total

transaction amount. If the total transaction amount is greater then the minimum required

amount the transactions are marked as settled and inserted into the daily settlement table.

As the loop continues, if another transaction of the same client is found, it will be ignored as

the previous settlement would have marked it as settled.

By the end of the procedure, any non-settled transactions which have a transaction total

above the minimum amount will be settled.

The daily deskbank file and daily bank summary will then be printed to a file.

The monthly settlement procedure is similar to the daily settlement, however captures the

total transaction amounts of all settled and non-settled transactions. If an account has not

been settled it will deduct the monthly fee from the total which it must CREDIT the

merchant. Otherwise it will DEBIT the merchant the monthly fee.

The monthly deskbank file and monthly bank summary will then be printed to a file.

Both the daily and monthly procedures check to see if they are already running before they

start. If they are already running, the procedures will exit without performing any tasks.

The Deskbank files are generated completely using Dynamic SQL. The layout of the

Deskbank file is defined in the ljrandal.FSS_DESKBANK_REF table. This table defined the

padding, justification, order, field size, field name/value and datasource of each field. The

RecordType field is used to indicate whether the field is for the Header , Footer (7) or the

data rows (1). If text is in the FieldValue field, it is assumed that this is hardcoded. If this

field is NULL then it is assumed that the field listed in the FieldName is used from the table

specified in the DataSource Field. Note that only one table can be used as a data source.

The TimeFrame field determines whether the field applies for the daily Deskbank ('D'), the

monthly Deskbank ('M'), or both ('B'). Modifying any of these fields will take effect in all

Luke Randall/Rob Howard/Thomas McGannon

Page 8 of 13

future generated Deskbank files.

Luke Randall/Rob Howard/Thomas McGannon

Page 9 of 13

3.2 Function Diagrams

Luke Randall/Rob Howard/Thomas McGannon

Page 10 of 13

3.3 Assumptions

A month is defined by a Gregorian month, not a 30 day period.

The program can be run more than once per day. If this assumption is incorrect, when

the value of "ONCPD" in fss_local_reference (named "Once Per Day Only") is

changed to 'Y', the program will be disallowed from executing more than once per

day.

3.4 Functions and Procedures

Public

dailySettlement

monthlySettlement

…

…

Luke Randall/Rob Howard/Thomas McGannon

Page 11 of 13

dailyBankSummary

monthlyBankSummary

monthlyClientStatement

outputDailyDeskbank

outputMonthlyDeskbank

fraudReport

…

…

…

…

…

…

Private

getReferenceValue

setReferenceValue

canExecute

getNewTransactions

cleanUp

addLog

printSummaryFooter

printSummaryHeader

outputDBHeaderFooter

outputDeskbankContent

…

…

…

…

…

…

…

…

…

…

3.5 Views

Luke Randall/Rob Howard/Thomas McGannon

Page 12 of 13

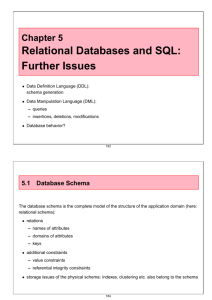

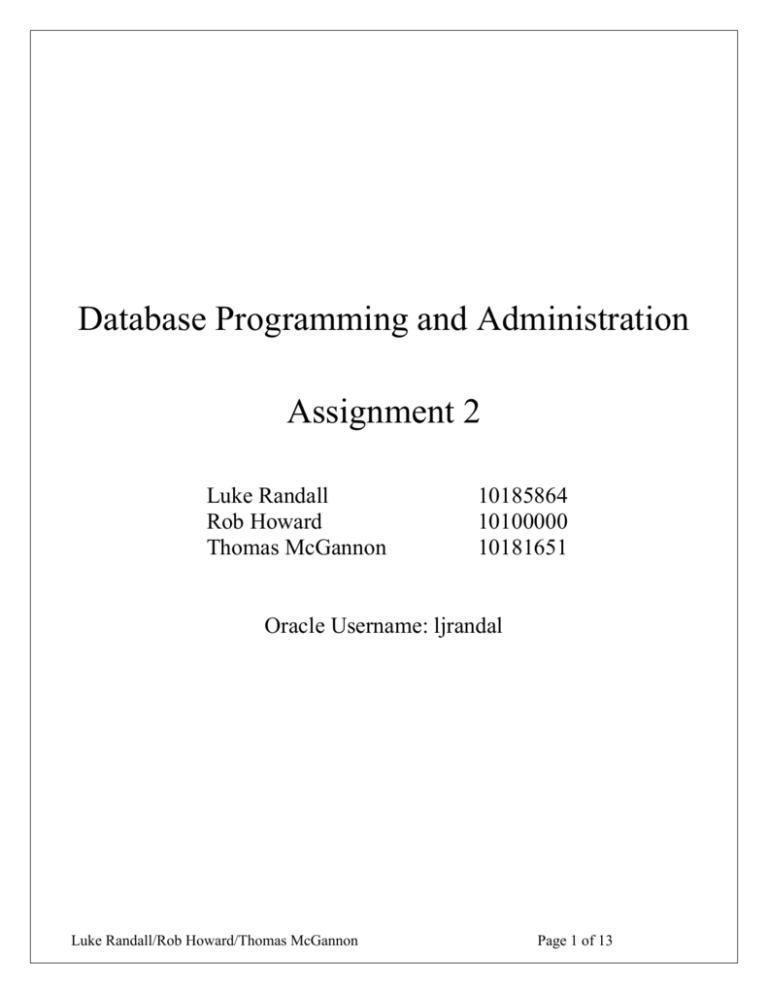

3.6 Entity-Relationship Diagram

FSS_ALL_REFERENCE

FSS_MONTHLY_SETTLEMENT

FK1

CLIENTID

CLIENTNAME

CLIENTBANKBSB

CLIENTBANKACCNR

CLIENTTOTAL

DOWNLOADDATE

LODGEMENTREF

TRANSACTIONTYPE

SETTLEMENTDATE

MERCHANTID

REFERENCEID

REFERENCENAME

REFERENCEVALUE

REFCOMMENT

NUMBER

VARCHAR2(85)

VARCHAR2(6)

VARCHAR2(10)

NUMBER

DATE

VARCHAR2(15)

VARCHAR2(15)

DATE

NUMBER

VARCHAR2(5)

VARCHAR2(25)

VARCHAR2(50)

VARCHAR2(255)

FSS_LOCAL_REFERENCE

PK

REFERENCEID

FSS_REFERENCE

VARCHAR2(5)

PK

REFERENCENAME VARCHAR2(25)

REFERENCEVALUE VARCHAR2(50)

REFCOMMENT

VARCHAR2(255)

REFERENCEID

VARCHAR2(5)

REFERENCENAME VARCHAR2(25)

REFERENCEVALUE VARCHAR2(50)

REFCOMMENT

VARCHAR2(255)

FSS_DAILY_SETTLEMENT

FSS_MERCHANT

PK

MERCHANTID

NUMBER

MERCHANTFIRSTNAME

MERCHANTLASTNAME

MERCHANTSTREETNR

MERCHANTSTREETNAME

MERCHANTSUBURB

MERCHANTSTATE

MERCHANTPOSTCODE

MERCHANTTELEPHONENR

MERCHANTFAXNR

MERCHANTBANKBSB

MERCHANTBANKACCNR

MERCHANTACCOUNTTITLE

MERCHANTSTATUS

VARCHAR2(35)

VARCHAR2(50)

VARCHAR2(15)

VARCHAR2(35)

VARCHAR2(35)

VARCHAR2(3)

VARCHAR2(4)

VARCHAR2(15)

VARCHAR2(15)

VARCHAR2(6)

VARCHAR2(10)

VARCHAR2(32)

VARCHAR2(1)

FK1

CLIENTID

CLIENTNAME

CLIENTBANKBSB

CLIENTBANKACCNR

CLIENTTOTAL

DOWNLOADDATE

LODGEMENTREF

TRANSACTIONTYPE

SETTLEMENTDATE

MERCHANTID

NUMBER

VARCHAR2(85)

VARCHAR2(6)

VARCHAR2(10)

NUMBER

DATE

VARCHAR2(15)

VARCHAR2(15)

DATE

NUMBER

FSS_DESKBANK_REF

FSS_DAILY_TRANSACTIONS_VIEW

TRANSACTIONNR

CLIENTID

CLIENTNAME

CLIENTBANKBSB

CLIENTBANKACCNR

CLIENTTOTAL

DOWNLOADDATE

TERMINALID

PROCESSED

PROCESSEDDATE

RECORDTYPE

FIELDNAME

FIELDVALUE

FIELDSIZE

FIELDORDER

TIMEFRAME

PADDINGCHAR

JUSTIFICATION

DATASOURCE

NUMBER

NUMBER

VARCHAR2(86)

VARCHAR2(6)

VARCHAR2(10)

NUMBER

DATE

VARCHAR2(10)

CHAR(1)

DATE

VARCHAR2(1)

VARCHAR2(50)

VARCHAR2(100)

NUMBER

NUMBER

CHAR(1)

CHAR(4)

VARCHAR2(4)

VARCHAR2(30)

FSS_ORGANISATION

FSS_RUN_TABLE

FSS_HOLIDAY

PK

FSS_DAILY_TRANSACTIONS_VIEW

TRANSACTIONNR

DOWNLOADDATE

TERMINALID

CARDID

TRANSACTIONDATE

CARDOLDVALUE

TRANSACTIONAMOUNT

CARDNEWVALUE

TRANSACTIONSTATUS

ERRORCODE

MERCHANTID

MERCHANTNAME

MERCHANTBANKBSB

MERCHANTBANKACCNR

NUMBER

DATE

VARCHAR2(10)

VARCHAR2(17)

DATE

NUMBER

NUMBER

NUMBER

VARCHAR2(1)

VARCHAR2(25)

NUMBER

VARCHAR2(86)

VARCHAR2(6)

VARCHAR2(10)

RUNID

TERMINALID

FSS_TERMINAL_TYPE

VARCHAR2(10)

PK

FK2

FK1

TERMINALTYPE

SAMID

TERMINALSTATUS

MERCHANTID

TYPENAME

VARCHAR2(3)

VARCHAR2(10)

VARCHAR2(1)

NUMBER

VARCHAR2(3)

TYPENAME

VARCHAR2(3)

TYPEDESCRIPTION

TERMINALPREFIX

TYPESTATUS

MINTRANAMT

MAXTRANAMT

CREATEDBY

CREATEDDATE

VARCHAR2(50)

CHAR(24)

VARCHAR2(1)

NUMBER

NUMBER

VARCHAR2(10)

DATE

FSS_TRANSACTION

PK

FSS_SMARTCARD

PK

DATE

DATE

VARCHAR2(15)

VARCHAR2(255)

FSS_TERMINAL

PK

CARDID

VARCHAR2(17)

DATEISSUED

ISSUEVALUE

CARDSTATUS

CURRENTVALUE

DATE

NUMBER

VARCHAR2(1)

NUMBER

FK2

FK3

TRANSACTIONNR

NUMBER

DOWNLOADDATE

TERMINALID

CARDID

TRANSACTIONDATE

CARDOLDVALUE

TRANSACTIONAMOUNT

CARDNEWVALUE

TRANSACTIONSTATUS

ERRORCODE

DATE

VARCHAR2(10)

VARCHAR2(17)

DATE

NUMBER

NUMBER

NUMBER

VARCHAR2(1)

VARCHAR2(25)

Luke Randall/Rob Howard/Thomas McGannon

ORGNR

NUMBER

ORGNAME

ORGSTREETNR

ORGSTREET

ORGSUBURB

ORGSTATE

ORGPOSTCODE

ORGPHONENR

ORGENQUIRYNR

ORGBSBNR

ORGBANKACCOUNT

ORGACCOUNTITLE

COMMENTS

VARCHAR2(50)

VARCHAR2(25)

VARCHAR2(50)

VARCHAR2(35)

VARCHAR2(3)

VARCHAR2(6)

VARCHAR2(18)

VARCHAR2(12)

VARCHAR2(6)

VARCHAR2(10)

VARCHAR2(26)

VARCHAR2(255)

VARCHAR2(10)

RUNSTART

RUNEND

RUNOUTCOME

REMARKS

HOLIDAY_DATE DATE

PK

FSS_DAILY_TRANSACTIONS

PK

TRANSACTIONNR

NUMBER

DOWNLOADDATE

TERMINALID

CARDID

TRANSACTIONDATE

CARDOLDVALUE

TRANSACTIONAMOUNT

CARDNEWVALUE

TRANSACTIONSTATUS

ERRORCODE

PROCESSED

PROCESSEDDATE

DATE

VARCHAR2(10)

VARCHAR2(17)

DATE

NUMBER

NUMBER

NUMBER

VARCHAR2(1)

VARCHAR2(25)

CHAR(1)

DATE

FSS_LOG

OCCURRED

COMPONENT

SEVERITY

MESSAGE

DATE

VARCHAR2(100)

VARCHAR2(50)

VARCHAR2(300)

Page 13 of 13