Acquiring's New Colossus

advertisement

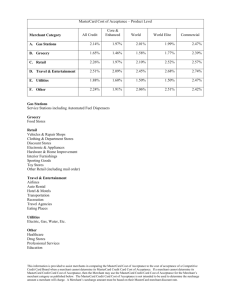

Acquiring’s New Colossus Scale? Thanks to its October acquisition of number-two merchant acquirer National Processing Inc., Bank of America Corp.’s Merchant Services unit has got scale to the tune of nearly $300 billion in annualized charge volume. A presence in just about every significant merchant category? BofA now has that, too. Referrals for card-processing services coming in from business customers at 7,500 bank branches? Yup. Guaranteed success in a low-margin, highly competitive industry? Definitely not. There’s no question, however, that BofA’s he-man acquiring unit has the necessary heft to be a player as the acquiring business continues its long consolidation trend. The Charlotte, N.C.-based bank now ranks behind only First Data Corp.’s merchant unit in terms of charge volume. BofA was the number-nine acquirer before its $1.4 billion acquisition of National Processing, handling $80 billion in charge volume in 2003 on 1.2 billion transactions. In that year, National Processing, better known as NPC for the acronym of its chief subsidiary, National Processing Co., processed $177 billion in volume on 4.3 billion transactions. So where will BofA, the nation’s largest retail bank with more than $500 billion in deposits, take its puffed-up acquiring unit in 2005 and beyond? Mark D. Pyke, National Processing’s former chief operating officer who is now president of BA Merchant Services, as the combined operation is now known, sees his 2,500-employee unit as having competitive offerings for the largest merchants to the smallest, and it has different ways of reaching them. “We use a multiple-distinction strategy to reach merchants,” he says, noting that NPC can reach them not only through branches, but also through independent sales organizations, telesales, and its joint venture with Netherlands-based ABN AMRO’s U.S. banking unit. BA Merchant Services is based in Louisville, Ky., NPC’s old headquarters. Pyke won’t reveal BofA’s 2004 charge volume or number of merchant locations, though NPC had 700,000 before the merger. Carla Cooper, an analyst who follows payment processors for Milwaukee-based Robert W. Baird & Co., sees the NPC acquisition as “compelling” because of the economies of scale it creates for BofA. Such massive scale could force other big banks, many of whom sold their merchant portfolios in the 1980s and 1990s, to take a new look at acquiring as a must-have service. “That puts pressure on the industry to respond,” she says. Indeed, a sizable independent such as Atlanta-based Global Payments Inc., which has a profitable business built on relationships with medium-sized and small merchants through ISOs as well as an expanding presence in the fast-growing money-transfer business, could be a very attractive target for BofA, according to Steve Mott, a former MasterCard executive who is now principal of BetterBuyDesign, a payments consultancy in Stamford, Conn. “Some banks now have the scale to offer more services than just commodities,” he says. Some of those enhanced services could include micropayments and other offerings primarily available through the Internet, such as electronic checks, according to Mott. BofA was an early leader in offering Internet payment options to merchants as the Web became a force in retailing in the mid-1990s, Mott says. “It’s probably going to be a major area of differentiation in the future,” he notes. While Pyke says BA Merchant Services is following its merchants onto the Web, the Internet isn’t the only fast-growing payments sector. Quick-service restaurants are now gaining critical payment mass for BofA, whose merchants include Yum! Brands Inc., owner of the KFC, Pizza Hut, and Taco Bell names, among others. “It’s growing not only percentage-wise, but also volume is now significant,” says Pyke. BofA, meanwhile, has made banking services to Hispanics a major priority, partly by offering money transfers and debit cards to customers who previously handled their financial affairs through check-cashing outlets. In fact, the bank in February announced it was dropping all fees for money transfers from Chicago to Mexico and eventually would do likewise throughout its entire system. While BofA’s money-transfer service is consumer-oriented and currently aimed at getting Hispanics into the company’s approximately 5,900 branches, money transfer clearly is a market that has merchant processors interested because of the potential for more transaction volume. For example, within the past two years, Global Payments has bought DolEx Dollar Express in the U.S. and a Spanish money-transfer firm to augment its growing card-processing business in Eastern Europe. Meanwhile, there’s no evidence so far that Pyke will deviate from NPC’s long-term strategy of diversifying beyond price-sensitive national merchants—NPC’s bread-and-butter for many years—and adding higher-margin small and regional merchants. BA Merchant Services’ portfolio includes Target Corp., Exxon Mobil Corp., BP PLC, and grocery giants Safeway Stores Inc. and Albertson’s Inc. Once the leading acquirer for the high-volume but notoriously low-margin and somewhat risky airline industry, NPC by the time of the acquisition was down to only one carrier, bankrupt but still airborne United Airlines Inc. That contract expires in November. Before the BofA buyout, Cleveland-based bank holding company National City Corp., which owned 83% of National Processing, assumed ownership of the merchant relationship and NPC’s chargeback risk for United’s transactions, according to Pyke. (Ironically, BofA last year became the processor for another bankrupt NPC airline client, US Airways Inc. BofA issues US Airways’ Dividend Miles cobranded credit and debit cards.) NPC has moved into the smaller merchant market through ISO relationships and acquisitions. In 2003, it bought Bridgeview Payment Solutions, and in 1999 acquired a portfolio from Heartland Payment Systems. In 2001, it took a 70% ownership stake in ABN AMRO U.S.’s merchant business. “We leverage the large nationals to give us the scale; we have been successful at growing the regional business at a faster pace,” says Pyke. Of course, other acquirers are on the prowl for ISOs and smaller banks’ merchant portfolios. But no one has the ability to reach small-business prospects like BofA. In addition to referrals from the bank’s 5,900 branches concentrated on the East and West coasts and in the southern tier of states, the merchant unit will get referrals from National City’s 1,600 branches, most in the Midwest, under a 10-year agreement. Looks like NPC’s new market muscle is only likely to grow more potent. A Snapshot of the New BA Merchant Services Headquarters: Louisville, Ky. President: Mark D. Pyke Merchant Locations: 700,000 plus 2004 Charge Volume: $290 billion* 2003 NPC Charge Volume: $177 billion 2003 NPC Merchant Transactions: 4.3 billion Referring Branches: 7,500 (5,900 through BofA, 1,600 through National City) *Estimate Sources: BofA, NPC, Digital Transactions 7-Eleven’s Slow-But-Steady Vcom Strategy If the future of electronic transactions can embodied by an “ATM on steroids,” that vision is proving slow to arrive. Convenience-store titan 7-Eleven Inc.’s avowed goal is to put its towering, nine-foot-tall, doeverything Vcom machines in all of its 5,800 North American stores. But, roughly six years into the project, the Dallas-based chain has deployed just 1,050 Vcom kiosks and still considers itself in a prerollout learning phase. It may be years before the rollout happens. The chain isn’t shipping the strapping, Web-enabled, $45,000-per-copy kiosk to any more stores until trial-and-error testing sorts out what services customers want, says Rick Updyke, 7-Eleven vice president for business development. Figuring out the market may take some time, analysts say, considering the breadth of what 7-Eleven hopes to accomplish. Updyke, responding via e-mail to written questions from Digital Transactions, says the Vcom target audience includes just about everybody--the banked as well as the unbanked. While the chain plays its plans close the vest, observers aren’t looking for any big moves this year. Says Adam Sindler, an associate vice president at Morgan Keegan in Memphis, Tenn. “Learning is a priority – rolling it out is not,” he says. “I don’t think we’ll see anything major (in growth in the number of kiosks) in 2005.” Still, the chain’s caution may be warranted. Other retailers have struggled with similar high-tech projects. Last year, for example, Target Stores Inc. shut down an ambitious smart-card program that included Web-connected kiosks in its stores. And, while the project has proceeded more slowly than expected, 7-Eleven says no Vcom kiosks have been removed because of low volume. Some machines have been moved, however, to concentrate them in markets, the company says. Having kiosks in all or most of the stores in a market raises customer awareness and increases convenience, according to analysts. To introduce prospective customers to the kiosks, the chain has used television, radio, point-ofpurchase displays, direct mail, event marketing, and even greeters. The future could hold cross-promotions with companies that provide goods and services on the kiosks, the company says. Meanwhile, Vcom—which stands for “virtual commerce”—is proving to be a case study on how retailers can automate just about any in-store financial transaction. Other convenience stores offer some of the services of the Vcom kiosk but few, if any, can match the “full-blown” centrally located, multifunctional approach of the Vcom kiosks, which even dispense coins, says Chris Klein, executive vice president of marketing for Mosaic Software Inc., which supplies Vcom programming. “7-Eleven just happens to be doing the whole enchilada with lots of different products and services,” he says. Indeed, “ATM on steroids,” a 7-Eleven description, fits the machines’ breadth of transaction capability as well as their size. Right now, the kiosks offer the usual ATM functions, while also cashing payroll and government checks, with the help of CashWorks Inc,. and selling Western Union money orders. The machines are facilitating funds transfers, collecting bill payments, allowing customers to manage Verizon Communications residential phone services and dispensing and recharging MasterCard-branded 7-Eleven ECash prepaid debit cards. Before April 15, the company was touting the Vcom kiosks’ acceptance of checks issued by H&R Block in anticipation of income-tax refunds. At least some kiosks are selling auto insurance, analysts say. Customers can even key in a series of transactions and run them in sequence in a single session, says Klein. A user might, for example, cash a paycheck, use some of the money to buy a money order, transfer a bit to relatives, add a few dollars to a debit card, and still receive some cash, Klein says. Check cashing and money transfers, in particular, have boosted sales and traffic in the stores equipped with Vcoms, says Updyke. The company does not know the size of the increases and declines to speculate. For now, all of the kiosks have all of the functions, but bill payment is being localized and other functions eventually may vary from market to market. The most important functions to 7-Eleven’s Vcom strategy are ATM services, check cashing, and money transfers. The chain recently bought the ATM network American Express Co. was operating in 7Eleven stores. As a result, the retailer handles 100 million ATM transactions annually, while selling money orders worth $4.5 billion each year. More functions await implementation. The convenience chain plans to add expanded bill payment by eMoney Systems and stored-value capabilities through Alliance Data Systems, as well as banking and deposit services provided in conjunction with other partners, the company says. When it comes to what customers want to do on these machines, 7-Eleven has apparently learned some lessons already. A stab at somewhat upscale retailing that 7-Eleven billed as a “shopping mall in a box” was launched with the help of Cyphermint Inc. in time for the 2003 holiday shopping season. Is it still around? “We decided to focus on financial services,” is the company’s terse reply. Participating merchants, rounded up mostly by Cyphermint, according to Cyphermint chief executive Joseph Barboza, included 1-800Flowers.com, eBags.com, FreeJewelry.biz, TopWebBuys.com, and U.S. Health Services. The Vcoms and their attendant costs aren’t a trivial investment for 7-Eleven, which owns the machines. They feature 15-inch liquid-crystal displays and cameras to catch the images of people cashing checks. Customer-service telephones attached to the kiosks can put customers in touch with customer-service representatives, who speak both English and Spanish, for help. According to financial reports filed for fiscal 2003, the most recent available, by the end of that calendar year 7-Eleven had used a capital-lease program to raise $55 million needed for the Vcom project. Partners pay to participate in Vcom and had committed to $140 million in fees, the report says. About half of the machines have been deployed to company-operated locations, with franchisees getting the rest. Now, with plenty of merchants struggling to automate in-store transactions, slow-butsteady may prove the right approach for 7-Eleven’s do-it-all box. Discover Makes News, But What’s Next? You didn’t hear much about Discover Financial Services Inc. last year while American Express Co. was grabbing the headlines with its agreements with credit card titans MBNA Corp. and Citigroup Inc. to issue cards on its network. But that doesn’t mean the Riverwoods, Ill.-based unit of Morgan Stanley wasn’t keenly pursuing bank card business of its own. No sooner had the Supreme Court in October let stand a ruling that allowed banks to issue on the AmEx and Discover networks than Discover sued Visa and MasterCard (AmEx followed with its own lawsuit weeks later) and announced it was shelling out $311 million to buy the Houston-based Pulse electronic funds transfer network. And now that Discover has signed Wal-Mart Stores Inc. and GE Consumer Finance to come up with a mega-deal of its own, some of the closed-mouthed company’s strategy is becoming clear. Two key elements: 1) Get third party processors certified on the network so potential bank issuers will have a ready-made channel into Discover’s data center; 2) Set up shop in one fast-growing market AmEx isn’t in, debit cards. The Wal-Mart agreement, under which the world’s biggest merchant will use GE to issue co-branded cards on Discover’s network, sets the stage nicely for Discover in its efforts to pry issuing agreements out of banks and match AmEx’s clout. “It’s a big-league contract,” says James D. Higgins, a former Discover executive and now a Hoffman Estates, Ill.-based payments consultant. “It proves the legitimacy of Discover as an alternative rail to the card associations.” But what’s next? Harit Talwar, who as an executive vice president at Discover runs the company’s network, plays that card close to the vest, referring repeatedly in an interview with Digital Transactions to Discover’s strategy of offering “choice” for the first time in the card marketplace. But Discover’s announcement late in January that First Data Corp. had become the first third-party account processor to certify on its network pulled back the curtain somewhat on Discover’s plan. First Data will process the new Wal-Mart accounts for GE, and, though it says it has no plans to co-market Discover to its other bank card clients—it processes 370 million domestic card accounts—even Talwar says such third-party deals with other processors are likely. Leading candidates, he says, include the processors it has already made deals with to handle Discover-branded stored-value cards. These include names like Metavante, Stored Value Systems, and Wild Card. Meanwhile, Pulse gives Discover instant credibility in PIN debit and a sure-footed opening position in signature debit. The switch already processes Visa and MasterCard signature-debit transactions for 250 of its 4,000 members. Attracting these and other banks to issue the cards may not be the problem some observers have predicted, pointing to Discover’s low credit card merchant fees compared to the bank card networks. Stan Paur, who runs Pulse, insists Discover’s interchange on signature debit will be “competitive” with what Visa and MasterCard offer, though specifics of the offer haven’t been worked out yet. Still, there’s no shortage of skeptics. Many say Discover can’t compete with AmEx when it comes to card value, brand recognition, and issuer revenue. For banks, “the likelihood of saying yes to AmEx is high, and the likelihood of saying yes to Discover is low,” says one payments consultant, who predicts Wal-Mart, which he says is unique in its antipathy toward the bank card associations, may well be the last of the big-time issuers for Discover. M-Commerce Studios And Carriers Scramble To Bring TV Shows to Mobile Phones Fox Broadcasting is to roll out one-minute “mobisodes” (mobile episodes) of “24,” its hit TV show, on Europe’s Vodafone network. Starting in February, Verizon subscribers were able to get mobisodes of the show on their phones, too. Fox is not alone. Some viewers are apparently abandoning TV for the Internet and video games, and studios and other media outfits are rushing to the fledgling market for mobile video. In the last month Fox, Warner Bros., and ESPN have all signed deals to bring everything from sports highlights to comic books to the small screen. Industry analysts say the mobile video market will generate just $32.7 million this year, but that could jump to $1.9 billion by 2008. “The business model is far from clear,” says John Burris, director of wireless data services at Sprint. “But this is a real business. A lot of content players want in.” Telcos and media giants hope to duplicate the success of video services overseas. Mobile users in Japan and Korea already watch TV on their handsets, and Vodafone offers sports highlights in Europe. Such services have been limited so far in the U.S. because the rollout of high-speed networks has lagged behind other countries. However, MobiTV has signed up roughly 100,000 customers who pay $10 a month for more than 20 cable channels. Verizon and Fox won’t reveal the per-mobisode price for “24,” but Warner expects to charge as much as $5.99 for each snippet of “The OC Insider.” Others plan to sell ads. Mobliss, a Seattle marketing firm that makes original programs, is working with Nike and Coca-Cola to cram product placements into its shows. “We’re not sure it’s a real business yet,” says Sony Pictures Chairman Michael Lynton. “But we’re watching closely to see how Fox does with ‘24.’” Taiwan Transit Selects MasterCard’s PayPass Technology MasterCard contactless PayPass technology will be the new payment vehicle for mass-transit riders in seven cities in southern Taiwan. The card, OneSMART PayPass Chip Combi Card, will be issued to an unspecified number of consumers, who will be able to use it to pay for transportation on buses, intercity coaches, trains, and ferries. Customers can also use the card for parking. The Transportation Bureau of the Kaohsiung city government is coordinating the project on behalf of the other six cities. The card will have both contact and contactless chips, with the payment portion of the card using MasterCard credit, debit, and stored-value functions. MasterCard, in conjunction with Mondex Taiwan, will provide the payment and e-purse product for issuers and acquirers. Cathay United Bank, E. Sun Bank, and Bank of Kaohsiung will issue the cards and promote them. MasterCard says work on the project has already begun. Valista Rolls out an On-the-Street Top-up Product Valista has launched “TopupPlus Streetseller,” providing operators with the most cost-effective distribution method for prepaid credit in markets where people do not have a banking relationship and prefer to pay for airtime using cash. Globe Telecom, a leading mobile operator in the Philippines, has successfully implemented the Streetseller platform, branded as “AutoloadMax.” The same product, branded “EasyRecharge,” is also live in India with Airtel, a subsidiary of Bharti, the leading Indian mobile provid er. Ideal for developing markets such as Asia, Africa, South America. and Central Europe, where mobile phone penetration is high but large proportions of the population remain unbanked, TopupPlus enables small denominations of top-up to be purchased on the street or in corner shops. The product eliminates point-of-sale set-up and distribution and stocking costs associated with other recharge methods, such as scratch cards and e-vouchers, by using the mobile handset as the POS and the communication medium. The product requires no infrastructure investment by the operator and carries no registration requirement for consumers, and a distribution channel encompassing hundreds of thousands of points of sale can be enabled at low cost in an extremely short period. The mobile operator sells airtime in large amounts to distributors who in turn sell it to sub -distributors who target the end-user on the street, who top-up for small amounts using cash. When transferring to the consumer, the reseller enters the user’s mobile phone number, credit amount, and PIN to authenticate himself. The consumer receives the credit to his prepaid balance and both parties receive an SMS confirmation that the transaction has taken place. Qpass’s ucp morgen Deal Stretches Its Reach in Digital Content Qpass Inc. has acquired ucp morgen, headquartered in Vienna, Austria. ucp morgen is a provider of both content and content-delivery software. The acquisition accelerates Qpass’s global market expansion and broadens the company’s product line encompassing the management of the entire digital supply chain. ucp morgen enables tens of millions of mobile subscribers in North America and Europe to shop for and purchase digital products and services. Customers include T-Mobile International (UK, Germany, Austria, The Netherlands, Czech Republic), Hutchison 3G, HT Mobile, Danger Inc., and several mobile Internet portals. With the acquisition, 300 content providers and aggregators provide 500,000 applications and digital products, which are integrated to and selling through Qpass. “Ucp morgen is a strong company with solid products that enable the marketplace for digital media and services,” says Qpass chief executive Chase Franklin. “This strategic combination is an additional step of a long-term plan by Qpass to provide operators, portals, and content providers with the means to rapidly grow revenues and deliver innovative new services. We are especially pleased with the cross pollination that we get from this acquisition in both the European and American markets. ” The articles in this section are published by arrangement with Mobile Payments World, an online-only newsletter published 22 times a year in the UK by European Card Review, Europe’s leading payments card magazine. More details: www.mobilepaymentsworld.com.