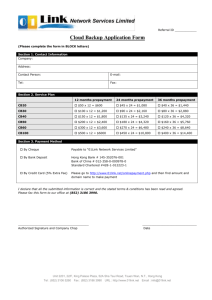

Table 2

advertisement

【2002 年中華民國住宅學會第十一屆年會論文集】 場次:B1-2 The Structural Design of Asset Securitization Taiwan, and the Price and Prepayment Risk Analysis of Asset-Backed Securities -Mortgage Securitization as an Example 我國資產證券化之架構設計與 相關證券價格及提前清償風險之分析研究 ---以不動產抵押權證券化為例 Tsoyu Calvin Lin* (林左裕) Abstract Key Words: Mortgage Securitization, Mortgage-Backed Security (MBS), Capital Adequacy Ratio (CAR), Prepayment Risk, Stripped MBS, Convexity This study firstly explores the effect of mortgage securitization on capital adequacy ratio and current ratio of the banking industry in Taiwan. Secondly, the price movement of mortgage securities in relation to prepayment speed is studied through numerical simulation. Finally, the structural design of mortgage securitization system and different schemes for issuing MBSs are proposed. Results show that mortgage securitization can significantly reduce the operation risks of the banking industry in Taiwan. Further, as the interest rate declines, the price movement of the MBS is different from that of callable bonds, due to the partial prepayment of mortgagors. The higher the prepayment speed is, the closer the MBS pricing behavior to callable bonds. * Assc. Professor, Dept. of Finance, ChaoYang University of Technology, 朝陽科技大學財金所副教授。 Add.: #168, Gi-Feng E. Rd., Wu-Feng, Taichung, Taiwan, 中縣霧峰鄉吉峰東路 168 號 Tel: 886-4-2332-3000 x 4212 or 7092, Fax: 886-4-2374-2333 E-mail: tcalvin@cyut.edu.tw The author is grateful for the assistance provided by Mr. Ta-Chun Lin for the data collection of the banking industries, and Mr. Tseng-Chi Tseng for the simulation analysis. - 61 - 【2002 年中華民國住宅學會第十一屆年會論文集】 The Structural Design of Asset Securitization Taiwan, and the Price and Prepayment Risk Analysis of Asset-Backed Securities ---Mortgage Securitization as an Example 1. Introduction As the real estate market in Taiwan slumped since 1992, banks’ non-performing loan (NPL) ratio rose accordingly. The stability of financial system has encountered unprecedented challenge. Banks’ average NPL ratio in Taiwan has dramatically risen from 1% in 1993 to 7% in 20011. As the expectation toward overall economic growth still remains pessimistic, the banking industry in Taiwan has started to harshly scrutinize lending process in order to avoid any risky loan and keep up the capital adequacy ratio (CAR) required by the Bank for International Settlement (BIS). However, harsh scrutiny of the loan requisites has not only blocked the capital inflow of normally operated companies, causing them bankruptcy, but also put the decreasing pressure to the current low interest rates due to over supply of the capital. This might eventually lead to the similar “liquidity trap” situation encountered in Japan during the 1990s. The financial disorder encountered in Taiwan is like Japan, called “domestic financial debacle”, which is caused by the previous high economic growth and the resulting asset price inflation. As the asset price bubble burst, the banking industry which originated the loans and facilitated the inflation of the bubble has contracted the lending activities to prevent the decline of the capital adequacy ratio. The contracting behavior has inevitably jeopardized the overall economy growth and financial stability. The decrease of investment and the resulting slow economy growth in the long term might cause economic recession that has happened in Japan. One of the solutions to prevent the lending contraction and the consequential - 62 - 【2002 年中華民國住宅學會第十一屆年會論文集】 recession is asset securitization. As the banking industry is able to sell the loans in the form of securities to the capital markets, banks can thus transfer the risks of lending to the securities investors, and consequently alleviate the pressure of the lending contraction behavior. Normally-run companies will then be able to operate through the planned capital structuring without unexpected disturbance. economy can thus continue to grow with the liquidity of capital. The As the example of the United States, the mortgage securitization in the 1960s had successfully bailed out the troubled S&Ls. By the end of 2001, over 80% of the single-family mortgages securitized and sold to the capital markets, and the outstanding traded volume of MBS have outnumbered 2500 billions. 700 billions. Other asset-backed securities (ABSs) were over The total amount of MBSs and other ABSs have accounted for over 20% of the overall bond markets (Coles, 1999; Kuhn, 1990). On the contrary, Japan’s banking industry has been trapped by the NPLs since early 1990s. The speed of financial innovation system in Japan was much slower than the slowdown of the economy, missing the golden opportunity of financial innovation and consequently leading to liquidity trap and long-run recession. The outstanding mortgage loans by the end of 2001 in Taiwan was over NT 2600 billion dollars (1USD = 33 NTD in 2001). If 70% of the of the mortgages can be securitized and sold to capital market from banks’ assets, around NT 1800 billion dollars will become liquid in the banking system through securitization, equivalent to 20% of the GNP in Taiwan in 2001. Therefore, asset securitization will be one of the major directions to solve the malfunction of the financial markets in Taiwan. Should the secondary mortgage markets be successfully developed, and the liquidity and default risks of mortgages be reduced through government guarantee or insurance companies, the capital supply of mortgage loans will consequently be sufficient. Lending risks originally assumed by the banking industry can thus be - 63 - 【2002 年中華民國住宅學會第十一屆年會論文集】 transferred to MBS investors. No more temporary subsidized low-rate mortgages provided by the government will be necessary in order to bail out the banking industry for the sake of financial stability, mostly due to the large amount of illiquid and non-performing mortgage loans in the assets of the banking industry. This study firstly explores the effect of mortgage securitization on capital adequacy ratio and current ratio of the banking industry in Taiwan. Seven government-owned banks in Taiwan are sampled for the empirical analysis. Secondly, the price and prepayment risk analysis of mortgage-backed securities (MBS) and stripped securities are studied through numerical simulation. The “implied model” is employed as the prepayment assumption in the simulation simply to observe the pattern of the price movement of mortgage securities. Finally, the structural design of mortgage securitization system and different schemes for issuing mortgage securities are proposed for countries like Taiwan that opt to introduce the system. 2. The Influence of Mortgage Securitization on the Risks of the Banking Industry in Taiwan In this section, we investigate the impact of mortgage securitization on the risks of the banking industry in Taiwan. The risks of the banking industry are measured by capital adequacy ratio, which is required by the Banks for the International Settlement (BIS), and liquidity ratio. We collected data in early 2000 regarding lending activities from financial reports of seven government-owned banks in Taiwan including the Bank of Taiwan, Taiwan Land Bank, Taiwan Corporative Bank, Chang-Hwa Commercial Bank, the First Commercial Bank, Hwa-Nan Commercial Bank, and Taiwan Business Bank. It is expected that mortgage securitization can significantly reduce the risks of lending activities, i.e., raise the capital adequacy ratio - 64 - 【2002 年中華民國住宅學會第十一屆年會論文集】 and the current ratio. The calculation of capital adequacy ratio is shown in Table, and the current ratio is shown in Table 2. Table 1 The Capital Adequacy Ratio of Seven Government-Owned Banks in Taiwan Unit: Million of New Taiwan Dollar Equity Risk-based Housing Housing Capital (A) Assets Mortgages Mortgages × Adequacy Ratio Risk Weighting (CAR) = A/B Bank (B) (50%) Bank of Taiwan 166,401 879,343 179,062 89,531 18.9% Taiwan Land Bank 82,393 738,575 475,327 237,663 11.2% Taiwan Corporative Bank 77,923 785,535 479,029 239,514 9.9% Chang-Hwa Bank 67,646 737,368 280,103 140,051 9.2% First Commercial Bank 78,594 801,807 240,005 120,002 9.8% Hwa-Nan Bank 73,015 685,933 351,159 175,579 10.6% Taiwan Business Bank 51,856 574,246 277,895 138,947 9.0% Sources:Various Government-Owned Banks in Taiwan, 2000. Table 2 The Current Ratio of Seven Government-Owned Banks in Taiwan Unit: Million of New Taiwan Dollar Bank Current Current Mid-Term Long-Term Current Assets Liability Mortgages Mortgages Ratio (CR) Bank of Taiwan 548,562 199,117 98,294 236,067 2.75 Taiwan Land Bank 307,565 73,978 133,894 498,634 4.16 Taiwan Cooperative Bank 425,766 244,019 143,648 461,080 1.74 Chang-Hwa Bank 229,607 175,081 66,561 183,517 1.31 First Commercial Bank 289,277 151,902 93,203 208,535 1.90 Hwa-Nan Bank 307,880 149,511 62,255 182,151 2.06 Taiwan Business Bank 178,626 63,178 97,952 213,176 2.83 Source:Taiwan Economic Journal, 2000. - 65 - 【2002 年中華民國住宅學會第十一屆年會論文集】 Herein we specify the definition of financial data as follows. 1. Capital Adequacy Ratio (CAR) = Equity / Risk-Based Assets 2. Capital Adequacy Ratio after Securitization (CARS) = Equity / 〔Risked-Based Assets – (Mortgages * Risk Weight (50%) *Securitization Ratio) 3. Current Ratio (CR) = Current Assets / Current Liability 4. Current Ratio after Securitization (CRS) =〔Current Assets + (Mid- and Long-term Mortgages) * Securitization Ratio〕/ Current Liability Method We employ the regression model for analysis and use Ordinary Least Squares (OLS) to estimate parameters. The model is described as follows: Model 1: MCASij a j b j Sij ij i 1,2,3100% , j 1,27 where MCARSij = (CARSij – CARj) / CARj, representing the change of capital adequacy ratio of bank j after i% assets being securitized CARSij:the capital adequacy ratio of bank j after i% assets being securitized CARj:the capital adequacy ratio of bank j before securitization Sij:the ratio of assets being securitized of bank j εij:the error term of bank j Model 2: MCRS ij cij dij Sij ij , i 1,2,3,100% , j 1,2,7 where MCRSij=(CRSij – CRj) / CRj, representing the change of current ratio of bank j - 66 - 【2002 年中華民國住宅學會第十一屆年會論文集】 after i% assets being securitized; CRSij: the current ratio of bank j after i% assets being securitized; CRj:the current ratio of bank j before securitization Sij:the ratio of assets being securitized of bank j εij: the error term of bank j Analysis Result As shown in Table 3, the ratio of asset securitization is positively correlated with the change of capital adequacy ratio. That is, as the ratio of mortgage securitization increases, the capital adequacy ratio will increase accordingly, especially for Taiwan Land Bank and Taiwan Cooperative Bank. This is because that these two banks hold more mortgages as assets than the others, the change of capital adequacy ratio is thus more significant after securitization. The change of current ratio also positively correlates with the ratio of securitization, as shown in Table 4. As the ratio of mortgage securitization increases, the current ratio increases correspondingly, especially for Taiwan Land Bank. It may be attributed to the fact that Taiwan Land Bank hold more mid- and long-term mortgages than others. - 67 - 【2002 年中華民國住宅學會第十一屆年會論文集】 Table 3 The regression result of the change of capital adequacy ratio and the ratio of asset securitization Dependent Variable:MCARS Bank Taiwan Bank Taiwan Land Bank Taiwan Cooperative Bank Chang-Hwa Bank First Commercial Bank Hwa-Nan Bank Taiwan Business Bank Independent Variable Intercept Ratio of Asset Securitization -0.002 0.11 (-10.9515)*** (356.8792)*** -0.028 0.47 (-10.0544)*** (98.37309)*** -0.024 0.43 (-10.1294)*** (105.0612)*** -0.008 0.23 (-10.611)*** (181.7577)*** -0.005 0.18 (-10.7694)*** (236.262)*** -0.016 0.34 (-10.3402)*** (129.356)*** -0.014 0.32 (-10.3989)*** (138.097)*** Source: Analysis results partly from Lin and Lin (2001). Note:Numbers in the parentheses are the T value, ***represents significance level of 1%. - 68 - 【2002 年中華民國住宅學會第十一屆年會論文集】 Table 4 The regression result of the change of current ratio and the ratio of asset securitization Dependent Variable:MCRS Independent Variable Bank Ratio of Asset Securitization Intercept Bank of Taiwan 3.55E-17 0.61 (1.379931) (1.38E+16)*** 0 2.06 0 (2.63E+16)*** -1.7E-15 1.42 (-9.35277)*** (4.53E+15)*** -5E-16 1.09 (-7.37142)*** (9.39E+15)*** 9.95E-16 1.04 (9.06985)*** (5.53E+15)*** -3.6E-16 0.79 (-7.284)*** (9.47E+15)*** -7.1E-16 1.74 (-8.38202)*** (1.2E+16)*** Taiwan Land Bank Taiwan Cooperative Bank Chang-Hwa Bank First Commercial Bank Hwa-Nan Bank Taiwan Business Bank Source: Analysis results partly from Lin and Lin (2001). Note:Numbers in the parentheses are the T value, ***represents significance level of 1%. From the analysis above, it is clear that mortgage securitization can significantly raise the capital adequacy ratio as well as the current ratio of the banking industry. Therefore, banks in Taiwan can thus reduce operation risks and increase capital efficiency and asset liquidity through asset securitization. In the following sections, this paper further investigates the price movement of the mortgage securities in relation to interest rate and prepayment risks, and proposes the structural design of the securitization system. - 69 - 【2002 年中華民國住宅學會第十一屆年會論文集】 3. Simulation Analysis of the Price Movement of Mortgage Securities in Relation to Prepayment Mortgages are usually prepayable, but some contracts may require prepayment penalty. Prepayment may be caused by economic or non-economic factors. Economic prepayments include declining interest rates, disappeared tax shield, or the appreciation of real estate value. Non-economic factors comprise the termination of partnership, housing turnover, divorce, or the growth of family size. The prepayment behavior can be divided into full prepayment and partial prepayment. The mortgage refinancing behavior and housing turnover are usually full prepayment. seasonality. Partial prepayment behaviors mostly are correlated with In Taiwan, most partial prepayments occur at the end of lunar year as employees receive bonus from the companies they work. This is different from the peak prepayment season in spring and summer in the United States. Issuers of MBSs should thus evaluate and apply appropriate prepayment models for pricing mortgages or MBSs accurately. The impact of declining interest rates on prepayment is more obvious for fixed-rate mortgages (FRM). As the market interest rate declines, borrowers tend to take advantages of the lower cost of capital and refinance. As shown in Figure 1, the prepayment volume of FNMA mortgages dramatically increased in 1998 as the 30-year mortgage rate fell below 7%. - 70 - 【2002 年中華民國住宅學會第十一屆年會論文集】 Source:Antczak (2000); Merrill Lynch, Fannie Mae, Bloomberg (2000), Mortgage Pool #250060, Originated in June, 1994. Original Mortgage Amount US$335,820,595。 - 71 - 30-Year Market Mortgage Rate (%, Right Axis) ----- Prepayment Volume (Dollars, Left Axis) Figure 1 The Relationship between the Market Mortgage Rate and Prepayment Volume of FNMA Mortgages in the U.S. (1994-2000) 與市場房貸利率之關係圖 (1994-2000) 【2002 年中華民國住宅學會第十一屆年會論文集】 There have been a great number of prepayment models developed and applied to forecasting the prepayment behavior, including 12-year average maturity, a multiple of FHA experience, PSA model, SMM model, and such conditional prepayment rate (CPR) methods as simple regression model, logistic model (Navratil, 1985), and proportional hazards model (Green and Shoven, 1986). Becketti (1989) indicates that refinancing, relocation, and default are direct causes of MBS prepayments, and the relative coupon is the most important factor in the decision to refinance. If the current mortgage rate begins to fall below the rate on the existing mortgage, the borrower would be better off with a mortgage at the new rate. Tuckman (1995) summarizes that mortgage prepayment models can be categorized into three approaches. They are static cash flow model, implied model and prepayment function model. The static cash flow model assumes that the prepayment is related to mortgage age. PSA and FHA models are typical examples of this approach. The major advantage of the static cash flow model is that it allows for a yield calculation. However, it may provide misleading price-yield and duration-yield curves due to the fixed cash flow assumption of this model. The implied model simply estimates mortgage durations, assuming that the duration of a mortgage changes slowly over time as the interest rate changes. The major drawback of this model is that mortgage durations may change rapidly over time. Taking into accounts of such variables as interest rate spread between mortgage and market rates, age of mortgages, seasonings, yield curve, and burnout effect, the prepayment function model is considered the most popular among sophisticated practitioners. Monte Carlo simulation is often employed for approaching the mortgage price (Broadie et al., 1997; Bolye, 1977). To MBS investors, borrowers’ prepayment is similar to the call option of corporate bonds. The relation between MBS prices and interest rates can be - 72 - 【2002 年中華民國住宅學會第十一屆年會論文集】 illustrated in the following simulation. In the absence of empirical data of mortgage prepayment experience in Taiwan, we simulate a amortization mortgage pool of $1million, 9% coupon rate and 30-year maturity as an example. The “implied model” is employed as the prepayment assumption for the observation of the price movement of mortgage securities. We assume that the average maturity of the mortgage pool is 13 years and the current mortgage rate is 10%. As the spread of the mortgage coupon rate over the market rate increases 1%, the average maturity of the mortgage is assumed to decrease 2 years. The simulation result is shown in Figure 2. As the market rates increase, the prices of the vanilla bond without any provision and the mortgage pass-through securities (MPTS) both decline accordingly. As the market rates decline, the prices of the bonds rise. The relation between the bonds and the interest rates is like a curve convex to the origin point, called convexity. Yet as the interest rate declines, the rising trend of the MPTS price slows down due to the increase of the prepayment. The price compression of the MPTS is called negative convexity, which is different from the pricing behavior of the vanilla bonds. Thus, the MBS investors are like buying a callable bond and short for a call option. The call option is mortgagors’ privilege of prepayment anytime. The MBS price can therefore be shown as the following equation: PMBS = P noncallable bond - P call option The value of the callable option in the equation above is the prepayment value in Figure 2, which can be obviously perceived as the price of the vanilla bond subtracting the MPTS price. As the interest rate declines and the prepayment speed increases accordingly, the rise of the MPTS price slows down due to prepayment. On the contrary, the price of the MPTS declines, like the vanilla bond, as the interest rates increase and prepayment rate declines. - 73 - As a result, MBS investors are 【2002 年中華民國住宅學會第十一屆年會論文集】 rewarded as higher yield for the tradeoff of assuming the prepayment risks. Therefore, the U.S. government guaranteed MBS---GNMA, has higher yield than T-bonds of similar maturity. Figure 2 The Relation of the Prices of Vanilla Bond, MPTS and Prepayment Option versus Changing Interest Rate 1600000 MPTS Vanilla Bond Prepayment Option 1400000 1200000 1000000 800000 Price 600000 400000 200000 0 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% 16.00% -200000 Interest Rate We further use the same example to simulate the relation between the negative convexity of the MPTS and prepayment behavior in greater detail. The relation between MPTS prices of different prepayment rates (B, C, and D) and interest rates can be shown in Figure 3. As the interest rate rises, the prices of MPTSs, callable bonds and vanilla bonds without any provision all decline. As the interest rate declines, the price of the vanilla bond (as the curve A in Figure 3) increases; the price increasing trend of the callable bond (as the curve E in Figure 3) and MPTSs of different prepayment speed (as the curve B, C, D in Figure 3) slow down as the prepayment rate escalates. MPTSB、C、D are assumed that as the spread of mortgage - 74 - 【2002 年中華民國住宅學會第十一屆年會論文集】 coupon rate over the market interest rate increases 1%, the average maturity of the mortgage pool will decrease 1, 2 and 3 years, respectively. The different levels of negative convexity of these three MPTSs can be obviously observed in Figure 3. In general, as the interest rate declines below the coupon rate of callable bonds, the callable bonds may all be redeemed. However, the slowdown of MPTS’ price increasing trend (called realistic prepayment) is different from that of callable bonds (called optimal prepayment) (Tuckman, 1995). The reason can be attributed to the factors that effect mortgage prepayment do not only include the change of interest rates, but also housing value, mortgage balance, refinancing costs or penalty, information costs and others. Further, the mortgage prepayment behavior can be divided into full and partial prepayment. Therefore, the realistic (partial) prepayment of the mortgages keeps the MPTS price increasing, but the trend slows down. As the interest rate continues to decline and causes prepayment to increase, the MPTS price will eventually decline and approach callable bonds. MPTS with the greatest prepayment rate (D) has the greatest negative convexity and requires highest yield, and vice versa. - 75 - 【2002 年中華民國住宅學會第十一屆年會論文集】 Figure 3 The Relation of prices of Bonds, MTRTs, P Os and I Os versus Changing Interest rate and Prepayment Effect IOb 1,600,000 1,500,000 POb A 1,400,000 1,200,000 1,100,000 1,000,000 B: MPTSb B 1,300,000 A: Vanilla Bond IOc C D 900,000 Price 800,000 700,000 PO c POd E POc IOb C: MPTSc 600,000 500,000 POb IOd 400,000 300,000 200,000 POd IOc 100,000 D: MPTSd IOd 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% E: callable bond 16.00% Market Interest Rate We further compare the price movement of stripped MBSs---Interest Only (IO) and Principal Only (PO) of different prepayment rates as the interest rate changes. The movement of PO prices (e.g., POb、c and d)can be observed in Figure 3. As the prepayment rate increases (e.g., POd), the volatility of PO price increases. On the other hand, investors of IO do not receive repayments of principal. receive interests of mortgage balance. They only As the interest rates decreases and the prepayment rate increases, mortgage balance and the corresponding interests decrease accordingly. The price of IO consequently decreases. Yet the declining interest rate increases IO’s present value. The interest rate movement thus has different impact on IO’s price. As shown in Figure 3, the prices of IOb、c and d all decline as the interest rate surges or slumps. At the period of very low interest rate, the prepayment effect is greater than the discounting effect, so that IO’s price declines. The greater is the prepayment rate (IOd), the lower the IO price. During the period - 76 - 【2002 年中華民國住宅學會第十一屆年會論文集】 of very high interest rate, IO’s price also tends to decline due to the fact that the discounting effect is greater than the prepayment effect. Only during the period of stable interest rate, IO’s price is relatively higher and remains stable. Therefore, the prices of strips, especially IO, are significantly influenced by the movement of interest rates. IO is thus suitable for investors of risk pursuing tendency or hedging purposes since it assumes high risk and requires high yield. It is clear from Figure 4 and the analysis above, as the higher is the prepayment rate, the larger the price volatility of IO and PO. The direction of prepayment’s impact on PO is consistent. The higher is the prepayment rate, the sooner the principal repayments to be received. The price of PO thus increases, and vice versa. Therefore, the higher prepayment rate of the PO is (as the POd in Figure 4), the steeper of the price curve and the longer the duration of PO. The direction of prepayment’s impact on IO is also consistent. The higher is the prepayment rate, the lower the IO price, and vice versa. But as the interest rate increases to an extremely high level, the prepayment rate will decline, and the IO price will decline due to the discounting effect. Therefore, the higher is the prepayment rate (e.g., IOd in Figure 4), the larger the amount of price decrease and the greater the convexity, as shown in Figure 4. We further compare the price movement of MPTSs of different mortgage coupons (13% and 9%) as the interest rate changes under the same prepayment scenario. In Figure 5, as the interest rate declines below 13%, the increasing trend of the 13%-coupon MPTS price starts to slow down, and eventually approachs $1million (i.e., the face value) as the interest rate keeps decreasing. However, the price of 9% MPTS still keep increasing as the interest rate descends, as long as the interest rate is higher than 9%. The increasing trend of the 9%-coupon MPTS price does not stop until the interest rate falls below 9%. From this figure, it is clear that mortgages or - 77 - 【2002 年中華民國住宅學會第十一屆年會論文集】 MBSs of high coupon assume higher prepayment risks caused by interest rates than those of low coupon. In Figure 6, we compare the price movement of IOs and POs of different mortgage coupons as the interest rate changes. The prices of 13%-coupon and9%-coupon POs are both negatively correlated with interest rates due to the early receipt of principals. Apparently, the 13%-coupon PO enjoys higher price appreciation caused by prepayment. As the interest rate is low enough to cause full or optimal prepayment of all the mortgages, the price of 13%-coupon PO will approach $1million (the face value). For IOs, the price of 13%-coupon may move towards zero should full prepayment occur as the interest rate is low enough. This also indicates that the prepayment risk is higher for the IOs with higher coupon. The analysis above has shown that IOs and POs are risky investments since the embedded option components are greater than in the underlying security, and their returns are more dramatically affected by changes in the market rate volatility and the sensitivity of prepayment rates to changes in interest rates. The value of mortgage securities are thus more stable than its IO and PO components viewed in isolation (Asay and Sears, 1989). Due to the sophisticated behavior of IOs and POs, it is suggested that mortgage strips should used as a useful hedging tool rather than an investment vehicle (Carlson and Sears, 1998; Becketti, 1988). - 78 - 【2002 年中華民國住宅學會第十一屆年會論文集】 Figure 4 The Price Volatility of IOs and POs at Different Prepayment Rates (9% mortgage coupon, b: low prepayment rate, d: high prepayment rate) Iob 1,000,000 900,000 Pob 800,000 700,000 600,000 Price Iod 500,000 400,000 300,000 Pod 200,000 100,000 0% 2% 4% 6% 8% 10% 12% 14% 16% Market Interest Rate Figure 5 The Comparison of Price Volatility of MPTSs of Different Mortgage Coupons 1,400,000 MPTS--13% 1,200,000 1,000,000 800,000 MPTS--9% Price 600,000 400,000 200,000 0 0% 2% 4% 6% 8% 10% Interest Rate - 79 - 12% 14% 16% 【2002 年中華民國住宅學會第十一屆年會論文集】 Figure 6 The Comparison of Price Volatility of IOs and POs of Different Mortgage Coupons 1,200,000 1,000,000 800,000 Price IO---13% PO---13% 600,000 IO---9% PO---9% 400,000 200,000 0 0% 2% 4% 6% 8% 10% 12% 14% 16% Interest Rate 4. The Structural Design of Mortgage Securitization, and Various Issuance Schemes According to Risk Segmentation Figure 7 is the design of mortgage placement and securitization process for a newly-developed secondary mortgage market. Assuming that there are $10 million mortgages in a bank’s asset and 10% of those are non-performing loans, banks can repossess or auction these NPLs, or securitize them through issuing zero-coupon bonds; or sell these NPLs together with normal performing loans to mortgage brokerage companies. The bank can sell the other 90% normally performing loans to brokerage companies and then securitize them through issuing MBSs of different risk levels. In this example, the mortgage brokerage companies are assumed to purchase $9 million mortgages from banks and then issue MBSs, receiving $7.38 million back in cash. Other revenues will come from the issuance of junior bonds and notes, and servicing fees (Oldfield, 1997). Since the overcollateralization rate of the AA-class MBSs is 167%, there should be no doubt in the marketability and liquidity of the MBS trading. - 80 - 【2002 年中華民國住宅學會第十一屆年會論文集】 Besides issuing derivative MBSs like IOs, POs and CMOs, mortgages can be securitized through dividing the cash flows into various securities of different risk levels in order to increase marketability (Books and Najafi, 1989; Hu, 1988). The last section of this study tends to provide several structural schemes of issuing mortgage securities according to risk segmentation for newly developed countries of this system. MBSs can usually be segmented as senior debts and junior debts according to risk differential. These designs are illustrated as follows. (1). Issuing MBSs of Different Coupon Rates Taking the mortgage pool of $100 million, 10% coupon rate as an example, we can divide the $100 million principal into a senior debt of $70 million, 7% coupon, and a junior debt of $30 million, 17%. Should default occur, the loss is firstly absorbed by the junior debt. As shown in Figure 8, the coupon reduction value of the senior debt ($21 million) is transferred to the junior debt. - 81 - The increased interest 【2002 年中華民國住宅學會第十一屆年會論文集】 rate (7%) is added to the original coupon 10%, equaling to 17%. The high return of the junior debt is the tradeoff of its high risk. Thus, the junior debt can be viewed as an investment vehicle of high return and risk. Figure 8 The MBS Design as Senior and Junior Debt according to the Risk Level (2). Issuing Vanilla Bonds and IO The cash flow of mortgages can be divided into different mortgage securities through splitting the interest and principal payments. At the current interest rate of 8%, for example, the 10-year, 10% coupon, $100 million non-amortization mortgage pool can be divided into two bonds of different risks through splitting the interest payments. One is the senior bond of 10-year, 8% coupon, $100 million, and the other is the junior bond of 2% IO strip. The mortgage price is the present value - 82 - 【2002 年中華民國住宅學會第十一屆年會論文集】 through discounting the future cash flows, as shown in Figure 9. Figure 9 The MBS Design as Vanilla Bond and IO Strip through Splitting Interest Payments (3). Issuing Vanilla Bonds and PO The mortgage payments can also be divided into two bonds of different risks through splitting the principal repayments. As an example of the aforementioned 10-year, 10% coupon, $100 million non-amortization mortgage pool, the payments can be divided into a senior bond of 10-year, 10% coupon, 80 million mortgage and a junior bond of 10-year, 20 million PO at the current rate of 12.5%. The mortgage price is still the sum of the present value of the discounted future cash flows, as shown in Figure 10. - 83 - 【2002 年中華民國住宅學會第十一屆年會論文集】 Figure 10 The MBS Design as Vanilla Bond and PO Strip through Splitting Principal Payments 5. Conclusion As the prices of global assets remain sluggish, financial institutions will have to keep assuming the real estate market risks, interest rate risks and default risks through holding the long-term mortgages in assets. The increasing non-performing loan ratio in Taiwan also jeopardizes the stability of the financial markets. After the establishment of asset management companies, mortgage securitization will be the indispensable track besides the repossession and auction of the non-performing loans. Asset securitization can not only reduce lenders’ risks through transferring the risks to ABS or MBS investors, but also can increase lending institutions’ capital adequacy ratio and current ratio. The behavior of shrinking lending tendency of the financial institutions can consequently be reduced. This study investigates the effect of mortgage securitization on the operation risks of the banking industry in Taiwan, analyzes the prices and risks of the mortgage related securities in relation to prepayment risk, and proposes the structural design of - 84 - 【2002 年中華民國住宅學會第十一屆年會論文集】 mortgage securitization. Results of this study show that mortgage securitization can significantly raise the capital adequacy ratio and current ratio, and that the higher the prepayment speed is, the closer the MBSs to callable bonds and the higher the prepayment risk. However, the over-priced real estate value and under-estimated mortgage default rate may reduce the marketability of MBSs, and thus endangering the mortgage securitization system. Therefore, such systems as mortgage insurance, real estate appraisal, and the mortgage and MBS credit rating are crucial to reduce investors’ uncertainty and in turn increase the marketability. As an example of the United States, government mortgage insurance or guarantee serves as a critical element to the success of the mortgage securitization system. We suggest that the mortgage guarantee or insurance system in Taiwan to be implemented, starting from such groups as military servicemen, government employees and teachers with stable income and low default rate. Under the circumstances without government guarantee, the mortgage brokerage companies may issue MBSs which volume is lower than the original mortgage as overcollateralization in order to increase the credit rating (Lederman, 1990). With the mortgage guarantee system, the band of investors can thus be expanded to the reserves of the posting system, insurance companies and international funds. Especially for the life insurance companies, long-term mortgages and MBSs are good investment vehicles to match their long-term capital structure. Since the mortgage securitization has not yet been implemented in Taiwan, experiences from other countries are thus very important. Besides the discussion of related regulation and taxation, the technique of designing the system and pricing MBSs in Taiwan has just initiated. This study tends to investigate the effect of securitization system on the risks of banking industry, simulate the price movement of - 85 - 【2002 年中華民國住宅學會第十一屆年會論文集】 mortgage securities in relation to various prepayment levels, and propose a structural design of mortgage securitization and various issuance schemes. The following researchers may further model domestic mortgage prepayment and default experiences, and propose related models to predict the prepayment and default behaviors for pricing mortgages and MBSs more accurately. Note 1. The non-performing loan ratios are official figures cited from the “Financial Statistics Monthly of the ROC in Taiwan”. It is considered under-estimated by the practitioners. However, the increasing trend is correct. References Antczak, S., Primer on Mortgage-Backed Securities, Fixed Income Strategy, May, Merrill Lynch & Co., May, 2000, 10. Asay, M. R. and T. D. Sears, Stripped Mortgage-Backed Securities---Basic Concepts and Pricing Theory, Housing Finance Review, 1989, 8, 199-232. Becketti, S., The Prepayment Risk of Mortgage-Backed Securities, Economic Review of the Federal Reserve Bank of Kansas City, 1989, 74:2, 406-420. Becketti, S., The Role of Stripped Securities in Portfolio Management, Economic Review of the Federal Reserve Bank of Kansas City, May, 1988, 20-31. Bolye, P. P., Options: A Monte Carlo Approach, Journal of Financial Economics, 1977, 4:3, 323-338. Books, R. P. and J. Najafi, Elements of Design for a Commercial Mortgage Security:An Issuer’s Primer, Housing Finance Review, 1989, 8, 3-29. Broadie, M., P. Glasserman, and G. Jain, Enhanced Monte Carlo Estimates for American Option Prices, The Journal of Derivatives, Fall, 1997, 25-44. Carlson, J. H. and T. D. Sears, Stripped Mortgage Pass-Throughs: New Tools for Investors, in F. J. Fabozzi (Ed)., The Handbook of Mortgage-Backed Securities, Probus Publishing, Chicago, IL., 1998. Coles, A., Securitization: What Is Different about the USA? Housing Finance International, 1999, 13:3, 9-13. Financial Statistics Monthly of the ROC in Taiwan (2001) April, Ch.14, “The Balance - 86 - 【2002 年中華民國住宅學會第十一屆年會論文集】 of Consumer Loans and Housing Mortgages” (in Chinese), The Interior Department of the Government of the ROC. Green, J. and J. B. Shoven, The Effects of Interest Mortgage Prepayments, Journal of Money, Credit, and Banking, Feb. 1986, 41-59. Hu, J. C., Derivative Mortgage Securities: An Overview, Journal of Real Estate Finance and Economics, 1988, 1, 95-115. Kuhn, R. L., Mortgage and Asset Securitization, Volume V of the Library of Investment Banking, Irwin, Homewood, IL., 1990. Lin, T. C. and T.C. Lin, The Study on Mortgage Securitization in Taiwan---from the Viewpoints of Banks’ Managers, and the Effects on the Operation Risks of the Banking Industry, Unpublished Working Paper, 2001. Navratil, F. J., The Estimation of Mortgage Prepayment Rates, Journal of Financial Research, Summer, 1985, 107-117. Oldfield, G. S., The Economics of Structured Finance, The Journal of Fixed Income, 1997, 7:2, 92-99. Tuckman, B., Fixed Income Securities---Tools for Today’s Management, John Wiley and Sons, N.Y., N.Y., 1995. - 87 -