Commonwealth of Pennsylvania Employee Pay Statement.

advertisement

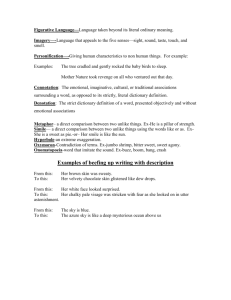

Date Last Changed April 20, 2004 - Modified Instructions from Adobe version to HTML version and changed content to reflect new accompanying literal sample paycheck. Author. Bruce Bickel Editors. Sandra Marsiglia, David Boyle Instructions for reading HTML Version of Commonwealth Employee Self Service (E S S) pay statement. If you read nothing else, at least read to the end of the introduction section. Commonwealth of Pennsylvania Employee Pay Statement. All Commonwealth employees will be able to access and read an employee pay statement created in Adobe format in early October 2004. Until that date, appropriate Human Resource personnel will pull and mail that statement electronically in an HTML readable format to those employees using screen reader software. The layout for both formats is identical, the only difference is whether you read it using Adobe reader or an HTML browser. These instructions will permit employees using JAWS version 4.5 or higher to read and interpret that pay statement in HTML format until the actual E S S statement is available to all employees. Additional instructions are available for any of the JAWS or HTML related functions referenced in this document for both the JAWS user and their supervisor, if needed. For example, instructions for JAWS commands to navigate through a document, routing JAWS cursors, how to change your JAWS verbosity and punctuation options, optimum JAWS settings for listening to the pay statement, how to use the find and search function in HTML, etc. are all available in JAWS readable formats. For help of any sort which is technology related please contact Bruce Bickel at Integrated Enterprise Systems by email at bbickel@state.pa.us or by phone at 717 214-6614. For help about any of the pay statement spelling, wording, or amounts whether deductions reimbursements or other fields you should directly contact either your supervisor or your local Agency Human Resources representative. Introduction. If you care about nothing else except what you got paid, search for the field “Payment Amount.” The second field on the next line after the pay date will be Net Pay Amount for this pay statement. The HTML formatted E S S employee pay statement is in several sections. The format of the pay statement is very similar to the printed pay statement employees will receive by mail along with their paycheck, or if on direct deposit along with their employee pay statement. If you are not familiar with Employee Self Service, also known as E S S, you need to know that you can find out what you will get paid, including overtime and other reimbursements such as travel expenses, and any unexpected deductions such as extra taxes, up to five days before the actual date of pay. The pay statement itself is laid out in rectangular blocks and can be very confusing the first time you try to read through or interpret it. But, it will appear in almost identical format for each employee every pay. So like every other document, once you become familiar with the pay statement it will be far easier to understand. Date Last Changed April 20, 2004 - Modified Instructions from Adobe version to HTML version and changed content to reflect new accompanying literal sample paycheck. Author. Bruce Bickel Editors. Sandra Marsiglia, David Boyle Some lines have lots of data and some very confusing odd sounding words. We suggest that the first time you attempt to read the pay statement you do it one line at a time. For those lines which are longer or have confusing words on them try reading the lines one word at a time. In some cases, you may need to read the words one letter at a time. Again, repetition will bring comfort and familiarity. A sample pay statement accompanies these instructions but every employee’s pay statement is unique, so yours may be slightly different. Literal & Dynamic Fields. The pay statement includes both literal and dynamic fields and any line may contain one or both of these types. Literal fields are those fields that are there all the time. They would appear if you got a blank form with no data at all on it. An example of a literal field is on the first line of every employee self service pay statement which reads: “Personnel Number.....” All literal fields on the pay statement when mentioned in these instructions are surrounded by quotation marks and are italicized. Dynamic fields are those fields that appear only for this specific pay statement or for this specific pay date. If the statement were blank there would be no dynamic fields. Examples of dynamic fields are your name, your Agency Name, tax names and amounts, and deduction names and amounts. IMPORTANT REMINDER. If you have questions about any of the fields or what they represent or their amounts whether deductions, reimbursements, or other fields, you should address those questions directly to your supervisor or your local Agency Human Resources representative. As a general rule, the dynamic fields which appear on your pay statement will remain the same for you from statement to statement except for year to date amounts and dates. Reading your pay statement. First open it. Your HTML formatted pay statement will be either emailed to you or provided to you on a transportable media such as a computer diskette. The first step to read your pay statement is to open the pay statement. If you do not know how to save an email attachment and open it those instructions are available for JAWS users. Remember it is important to know you can copy your pay statement to a diskette or other media and take it home to your home computer. You can also rename it and save each statement with a unique name on your work computer. Date Last Changed April 20, 2004 - Modified Instructions from Adobe version to HTML version and changed content to reflect new accompanying literal sample paycheck. Author. Bruce Bickel Editors. Sandra Marsiglia, David Boyle Navigating your Pay Statement. The information in the employee pay statement and its various sections are contained in rectangular boxes. These boxes are created using the “Vertical Bar” character for the left and right vertical sides. And the top and bottom horizontal lines are created using the “Underline” character. Depending on your JAWS Verbosity or Punctuation settings on some lines you may hear JAWS say “vertical bar”, “underline”, “blank” or nothing. Setting the Punctuation Level in JAWS to “some” is suggested. You can jump past all non data lines by using the Keyboard Command Control + Down Arrow. The pay statement is set up in sections but these sections do not have headings. If you wish to jump to a specified section you will need to search for the first literal field in that section. In order, the sections and the first literal field are: Employee information Summary - “Personnel Number” This pay summary - “Pay Date” Taxes summary - “Taxes” (Note: the first occurrence of the literal “Taxes” is in the this pay summary section.) Deductions summary - “Deductions” Other compensation summary - “Non Cash Compensation” Reimbursements summary - “Reimbursements” Check summary - “Direct Deposit Bank” State paid benefits summary - “State Paid Benefits” Federal Taxable Wages summary - “Federal Taxable Wages” Garnishment information summary - “Garnishment Type” Payroll Area summary - “Payroll Area” The balance of these instructions will address each of these sections in order. Employee information Summary – “Personnel Number” Within this rectangular box information on the left side is employee name and address and the right side contains employee work and tax status information. Lines may contain either Literal or Dynamic fields or both. In order the lines read as follows. Your Name (first, middle initial, and last) “personnel number” your employee ID number The first line of your street address Your Agency Name The second line of address or city state zip “pay period” The start and stop date of this pay period The last line of your address if city state zip has not already been read, otherwise this field is blank “Fed tax status:” Your federal tax status Date Last Changed April 20, 2004 - Modified Instructions from Adobe version to HTML version and changed content to reflect new accompanying literal sample paycheck. Author. Bruce Bickel Editors. Sandra Marsiglia, David Boyle “Fed tax allowances:” The number of federal tax allowances you are claiming, “period:” pay period number and year of pay stub “B/U:” your bargaining unit ID, “Group:” your group ID if present, “level:” level if present In the accompanying sample the lines read as follows. |John T. Doe |Personnel Number..... 00012345| |123 Anywhere Street |Departmental Payroll Area 3 | |My Town PA 17111 |Pay Period.. 03/20/2004 – 04/02/2004 | | |Fed Tax Status: Single | | |Fed Tax Allowances: 02 Period: 08/2004| |B/U:J1 Group: 04 Level: 20 | | || This pay summary - “Pay Date” Remember, if you have questions about any of the fields or what they represent or their amounts you should address those questions directly to your supervisor or your local Agency Human Resources representative. This applies to ANY section of the pay statement. The first line in the pay summary section contains title headers for the data appearing in the next line. They are. “Pay Date Payment Amount = Gross + Reim. – Taxes - Deds.” This is your pay date followed by the net calculated pay amount which is gross plus reimbursements less taxes less deductions. The next lines are those actual dynamic fields in order. The next line contains title headers for the data appearing in the following lines. They are. “Gross Current Pay Rate Hrs/Unt Amount Year to date” The next lines are those actual dynamic fields in order. There will be one line for each payment type. Read the exceptions summary section for an explanation of why all money amounts may not be present. In the accompanying sample pay statement there will be lines for “normal working hours”, “Holiday/Comp lieu Holiday”, “Overpayment Offset Amt”, “Overtime pay-straight”, “Overtime pay time & ½”, “Overtime Pay - Double Time”, “Shift Diff Pay – straight”, and “Shift Diff Pay – Dble NP” The last line contains “Total Gross” followed by the check total gross amount, followed by year to date total gross amount. Taxes summary. Second occurrence of “Taxes” The first line in the tax section is a series of header literals describing the tax names and amounts for this check and year to date. Normally there are levels within the dynamic tax lines for federal, state, and local taxes. For some employees who live out of state this may be slightly different. The literal fields are. “Taxes Amount Year to Date” Date Last Changed April 20, 2004 - Modified Instructions from Adobe version to HTML version and changed content to reflect new accompanying literal sample paycheck. Author. Bruce Bickel Editors. Sandra Marsiglia, David Boyle The last line in the tax section is a total line. It reads. “Total Taxes” followed by amounts for this check and year to date. It is important to note that for this section and all the remaining sections, if there are no dynamic fields, there will be no total line for the section. In the accompanying sample the following dynamic tax types appear. Federal Federal TX withholding tax. TX EE Social Security Tax TX EE Medicare Tax State Pennsylvania TX withholding tax TX EE Unemployment tax Local Corry TX withholding tax Local Summit Township TX EE Occupation Tax Deductions summary. “Deductions” The first line in the deductions section is a series of header literals describing the deduction names and amounts for this check and year to date. The literal fields are. “Deductions Amount Year to Date” The last line in the deductions section is a total line. It reads. “Total Deductions” followed by amounts for this check and year to date. If there are no dynamic fields, there will be no total line for this section. In the accompanying sample the following dynamic deduction type appears. Deferred Compensation St Emp Comb Appeal (SECA) AFSCME – 13 Union Dues Full cov class AA/cat 0 Other compensation summary. “Non Cash Compensation” The first line in the non cash compensation section is a series of header literals describing the non cash compensation names and amounts for this check and year to date. The literal fields are. “Non Cash Compensation Amount Year to Date” The last line in the non cash compensation section is a total line. It reads. “Total Non Cash Compensation” followed by amounts for this check and year to date. If there are no dynamic fields, there will be no total line for this section. In the accompanying sample there are no dynamic non cash compensation fields. Date Last Changed April 20, 2004 - Modified Instructions from Adobe version to HTML version and changed content to reflect new accompanying literal sample paycheck. Author. Bruce Bickel Editors. Sandra Marsiglia, David Boyle Reimbursements summary. “Reimbursements” The first line in the reimbursements section is a series of header literals describing the reimbursements names and amounts for this check. The literal fields are. “Reimbursements Amount” The last line in the reimbursements section is a total line. It reads. “Total Reimbursements” followed by amounts for this check. If there are no dynamic fields, there will be no total line for this section. In the accompanying sample there are no dynamic reimbursements. Check summary. “Direct Deposit Bank” The first line in the check summary section is a series of header literals describing the purpose of the section. The literal fields are. “Direct Deposit Bank / Check Amount” The following lines in the check summary section contain a literal followed by the dynamic amount of the direct deposits or check. It reads. “Net Payment” followed by the amount of this payment. Up to three different bank Direct Deposits may be made for every pay. In the accompanying sample the following Check Summary information appears: “Net Payment” 926.62 State paid benefits summary. “State Paid Benefits” The first line in the state paid benefits section is a series of header literals describing the state paid benefits and amounts for this check. The literal fields are. “State Paid Benefits Amount” In the accompanying sample the following dynamic state paid benefits appear. TX ER Social Security Tax TX ER Medicare Tax ER Basic Life Annuitant Med Hospital ER Workers Comp Benefit PR Highmark BC/BS POS ER - SERS Federal Taxable Wages summary. “Federal Taxable Wages” The first line in the federal taxable wages section contains title headers for the data appearing in the next line. They are. Date Last Changed April 20, 2004 - Modified Instructions from Adobe version to HTML version and changed content to reflect new accompanying literal sample paycheck. Author. Bruce Bickel Editors. Sandra Marsiglia, David Boyle “Federal Taxable Wages Amount Year To Date” This is the total federal taxable portion of your check followed by the year to date taxable amount. The next line contains the literal “Current Period Results” followed by those actual dynamic fields in order. Garnishment information summary. “Garnishment Type” The first line in the garnishment information section contains title headers for the data and amounts appearing in the next line. They are. “Garnishment Type Beg Balance Total to Date Remain Balance” In the accompanying sample there is no dynamic garnishment information. Payroll Area summary. “Payroll Area” The only line in the payroll area summary section contains the payroll area literal followed by the dynamic payroll area field. In the accompanying sample this information is: “Payroll Area” followed by the dynamic field T3. Exceptions Not every pay statement will always have money amounts in both the current pay statement amount field and year to date total amount field. If there is no entry for a specific reimbursement or deduction for the current pay that may have previously appeared on an earlier pay statement you will hear only one amount, not two. That is because zero amounts are not announced. Where there is only one amount, instead of two, it will be the year to date field amount. O P T or Occupational Privilege Tax is a good example. In the Harrisburg locality this $10 tax deduction will be taken on the first pay of the calendar year. On that pay you will notice two $10 amounts, one for the current pay and one for the year to date pay. After the first paycheck this deduction line will always appear, but will only have one amount announced which will be the year to date amount. An example of this exception is in the accompanying sample in the Taxes section and the lines read: |local Summit Township| |TX EE Occupation Tax 10.00| Since there is only one money amount 10.00 this is a year to date amount.