مبادئ محاسبة 1

University of Jordan/ Aqaba

Accounting department

COURSE OUTLINE

Course Title: ACC 101— Accounting Principles I

Course Credits: 3 credit Hours

Instructor: Ghassan Obeidat

Office Phone No. :35092

Office Number: B 33

Class Time : 9-11 (Sunday, Tuesday, and Thursday)

E-mail:

Web Site:

Office Hours: 10 – 11 (Sunday, Tuesday, and Thursday)

11 – 12:30 (Monday and wednsday)

Prerequisites : None

Course Description:

An introductory course in accounting which includes the recording and reporting of business transactions, completing the accounting cycle, and preparation of financial statements. Through exercises and problems, the students gain an understanding of the accounting process and the steps which result in financial statements.

Course Objectives:

The objective of this course is to provide students with:

1.

A framework of financial accounting concepts.

2.

The basic steps in the recording process according to accrual basis.

3.

Steps needed to complete the accounting recording process for both service and merchandising organizations.

4.

Procedures needed to prepare financial statements.

5.

A wide range of problem material that reinforces the student’s knowledge of quantitative techniques, concepts, analysis and procedures and illustrates the extension of basic concepts governing the preparation and communication of the financial date and information relevant to decision making.

Learning Outcomes:

After completing this course the student must demonstrate the knowledge and ability to:

Explain what accounting is and determine the users of accounting information.

Explain the meaning of GAAP and cost principle.

State the basic accounting equation and understand the effects of business transactions.

Understand the four financial statements and how they are prepared.

Define the account, debits and credits and how they are used in recording business transactions.

1

Explain the use of journals, ledgers and the trial balance.

Understand the time period assumption, the accrual basis, revenue recognition principle and matching principle.

Identify the major types of adjustments and explain the need for adjusting entries and prepare them.

Prepare a worksheet and completing the accounting cycle through closing the books.

State the required steps in the accounting cycle in their proper sequence.

Classify the balance sheet's elements.

Identify the difference between a service firm and a merchandiser, with respect to their accounting cycle.

Understand how to record merchandising transactions under both, perpetual and periodic inventory systems.

Prepare a multiple-step income statement and compare it with a single-step.

Explain the possible differences in cash balance per books and cash balance per bank.

Prepare bank reconciliation and its accompanying adjusting entries.

Understand the need for estimating uncollectible receivables.

Distinguish between the methods and bases used to value accounts receivables.

Teaching Methods:

The course will be based on the following teaching and learning activities:

Lectures covering the theoretical part.

On-classroom training on practical accounting procedures.

Teaching Resources and Textbook:

Handouts provide more discussion and illustration to understand the material.

However, your major reference should be the text book.

Textbook: Waygandt, Kieso and Kimmel, ACCOUNTING PRINCIPLES, John Wiley and Sons Inc., 10 th edition, 2009.

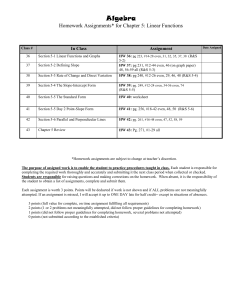

Evaluation Plan:

Students are evaluated based on various assessment methods, and a student will pass this course by gaining at least 50% of the course requirements, and they are categorized as follows:

Mid Term exam (30%) and Final exam (50%).

Assignments, quizzes, class attendance and participation (20%).

You will pass this course by gaining at least 50% of the course requirements .

Students will be examined in theory and its application. Exam questions may consist of multiple choices, short and long problems. All materials covered in the text, handouts, homework, or lectures are required. No make-up exams.

Absences result in grade of zero for that particular exam. Cheating results in immediate class failure at least!

2

Course plan:

Ch.1

Ch.4

Ch.5

: Accounting for merchandising

Operations.

Ch.9

: Accounting in

Action.

Ch.2

process.

Ch.3

: Adjusting the accounts.

: Completion of the accounting cycle.

Ch.8

: The recording

: Internal control and cash.

: Accounting for receivables.

What is accounting?

The building blocks of accounting

Using the building blocks

Financial statements

Problems practice and solving assignments, P1-1A, P1-2A, P1-4A,

P1-5A.

The account

Steps in the recording process

The recording process illustrated

The trial balance

Problems practice and solving assignments, P2-1A, P2-3A, P2-4A.

Timing issues

The basics of adjusting entries

The adjusted trial balance and financial statements

Problems practice and solving assignments, P3-1B, P3-2B.

Using a worksheet

Closing the books

Summary of the accounting cycle

Classified balance sheet

Problems practice and solving assignments, BE4-1, BE4-8, BE4-9,

P4-1B.

Mid Exam

Merchandising operations

Recording purchases and sales of merchandise

Completing the accounting cycle

Forms of financial statements

Periodic inventory system

Determining CGS under a periodic system

Worksheet for a merchandiser

Problems practice and solving assignments, E5-13, E5-14, P5-1A, P5-

2B.

Use of bank

Bank reconciliation

Problems practice and solving assignments, P8-3A, P8-3B.

Valuing accounts receivable

Disposing accounts receivable

Problems practice and solving assignments, BE9-4, BE9-6, BE9-7.

Final comprehensive Exam

Good Luck

Week 1

Week 2

Week 3

Week 4

Week 5

Week 5

Week 6

Week 7

Week 8

Week 9

Week 10

Week 11

Week 12

Week 13

Week 14

Week 15

Week 16

3