Document

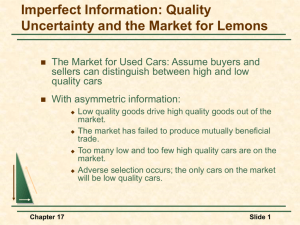

advertisement

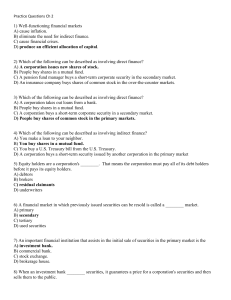

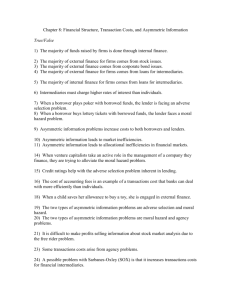

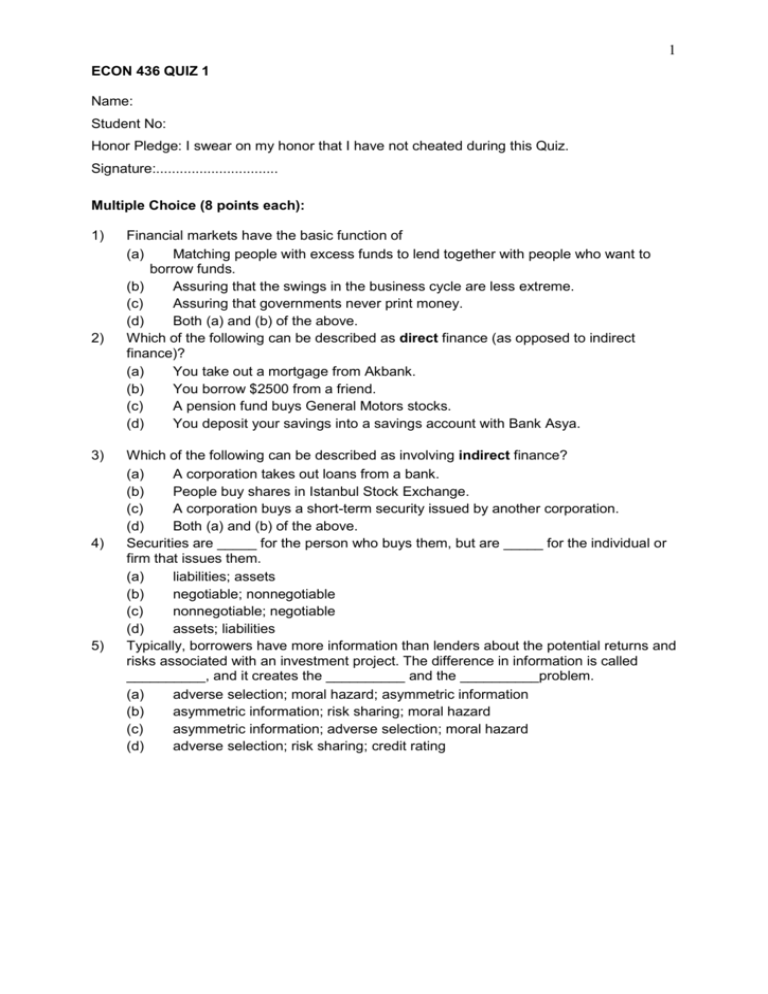

1 ECON 436 QUIZ 1 Name: Student No: Honor Pledge: I swear on my honor that I have not cheated during this Quiz. Signature:............................... Multiple Choice (8 points each): 1) 2) 3) 4) 5) Financial markets have the basic function of (a) Matching people with excess funds to lend together with people who want to borrow funds. (b) Assuring that the swings in the business cycle are less extreme. (c) Assuring that governments never print money. (d) Both (a) and (b) of the above. Which of the following can be described as direct finance (as opposed to indirect finance)? (a) You take out a mortgage from Akbank. (b) You borrow $2500 from a friend. (c) A pension fund buys General Motors stocks. (d) You deposit your savings into a savings account with Bank Asya. Which of the following can be described as involving indirect finance? (a) A corporation takes out loans from a bank. (b) People buy shares in Istanbul Stock Exchange. (c) A corporation buys a short-term security issued by another corporation. (d) Both (a) and (b) of the above. Securities are _____ for the person who buys them, but are _____ for the individual or firm that issues them. (a) liabilities; assets (b) negotiable; nonnegotiable (c) nonnegotiable; negotiable (d) assets; liabilities Typically, borrowers have more information than lenders about the potential returns and risks associated with an investment project. The difference in information is called __________, and it creates the __________ and the __________problem. (a) adverse selection; moral hazard; asymmetric information (b) asymmetric information; risk sharing; moral hazard (c) asymmetric information; adverse selection; moral hazard (d) adverse selection; risk sharing; credit rating 2 6) A life insurance contract may restrict the insured from riding motorcycles that are faster than 200 km/hour. The insurer includes this clause in the insurance contract to protect against (a) fraud. (b) moral hazard. (c) adverse selection. (d) risk sharing. 7) A common stock is a claim (right) on a corporation’s (a) debt. (b) liabilities. (c) expenses. (d) earnings and assets. 8) An important financial institution that underwrites the initial public offering (IPO) of securities in the primary market is the (a) commercial bank (b) mutual fund (c) investment bank (d) pension fund 9) Money market financial instruments _________ than capital market financial instruments. (a) are more risky (b) are less liquid (c) are more liquid (d) have a greater return 10) From the least liquid to the most liquid, we can rank some assets as ____________. (a) house, domestic currency, foreign exchange (b) foreign exchange, house, domestic currency (c) domestic currency, foreign exchange, house, (d) house, foreign exchange, domestic currency Short Answer (answer in a few sentences, 20 points): 11) Corporations only receive funds when their stock is sold in the primary market. Why do corporations pay attention to what is happening to their stock in the secondary market? Answer: First, value of the stocks of a company in the secondary market determines the total value of the company. If the company wants to sell more of its stock in the primary market, price that investment bank pays would be the price determined in the secondary market. Second, the fact that firm’s stock is traded in the secondary market makes them liquid. The firm’s stock can be sold in the primary market only if it can be resold in the secondary market. So trade volume of a stock in secondary market is important.