Report English Translation

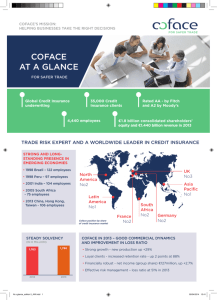

advertisement