Fall 2008

advertisement

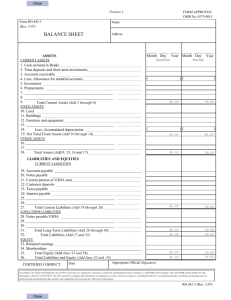

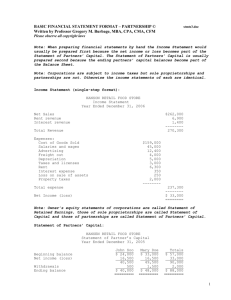

ACCT 1080 Fall 2008 Chapter 11 Notes CURRENT LIABILITIES AND PAYROLL Quick Review from Chapter 4: Liabilities Current Liabilities Current liabilities must be paid with cash or with goods and services within one year or within the entity’s operating cycle, if the cycle is longer than a year. Current liabilities include, but are not limited to ▪ Accounts Payable ▪ Notes Payable due within one year ▪ Salary Payable ▪ Interest Payable ▪ Unearned Revenue Long-Term Liabilities Long-term liabilities are all liabilities not classified as current. (In other words, they are liabilities that are not due for at least 12 months.) Long-term liabilities include, but are not limited to ▪ Notes Payable Remember that if a portion of that note payable is due within one year, that portion is considered current and the remaining portion is considered long-term. CURRENT LIABILITIES OF A KNOWN AMOUNT Accounts Payable Consists of amounts owed for products or services purchased on account Short-Term Notes Payable Short-term notes payable are promissory notes that must be paid within one year Sales Tax Payable Most states levy sales tax on retail sales. Retailers collect the sales tax in addition to the price of the item sold. The sales tax collected must be booked to the account Sales Tax Payable as the retailer owes the government this money. Background and entry: ▪ Suppose a retailer sells $10,000 of merchandise ▪ The state has a 5% sales tax ▪ Debit Cash………………...……………………………10,500 Credit Sales Revenue…………..………..…..………………10,000 Credit Sales Tax Payable……………………………………….500 D:\106757604.doc Current Portion of Long-Term Notes Payable Some long-term notes payable are paid in installments. The current portion of notes payable is the principal amount payable within one year. The remaining is long-term. Entry to reclass the current portion of notes payable ▪ Debit Long-Term Notes Payable.……………………………10,000 Credit Current Portion of Note Payable...…..……………………10,000 Accrued Expenses (Accrued Liabilities) An accrued expense is an expense that has not yet been paid. Typically occur with the passage of time, such as interest on a note payable or payroll. Refresher from Chapter 8: Computing Interest on a Note Formula ▪ Amount of Interest = Principal * Interest Rate * Time ▪ Example: Principal = $1,000 Interest Rate = 9.0% Time = 1 year Note was taken out on October 1, 2007 ▪ What is the total interest amount? ▪ What is the interest expense and accrued interest at December 31, 2007? ▪ What is the interest expense that is recorded in 2008? ▪ What is the journal entry on September 30, 2008? Unearned Revenues When the business receives cash in advance for a product or service, but has not earned the revenue yet by giving the product to the customer or performing a service to the customer. CURRENT LIABILITIES THAT MUST BE ESTIMATED A business may know that a liability exists but not know the exact amount. As the business cannot ignore the liability, it must be estimated. Estimated Warranty Payable Many companies guarantee their products against defects under warranty agreements. The matching principle says to record the warranty expense in the same period that we record the revenue. As such, the warranty expense should be recorded when the business records the revenue. At this time, the company does not know that exact warranty expense. Background and entry: ▪ An appliance manufacturer made sales of $200,000 during the period that are subject to warranties. ▪ The company estimates that 3% of its products will require warranty payments. ▪ Debit Accounts Receivable...……………………………200,000 D:\106757604.doc ▪ ▪ ▪ Credit Sales Revenue…………………....…..…………………200,000 Debit Warranty Expense……..…………………………….6,000 Credit Estimated Warranty Expense…...…..……………………..6,000 Assume that Whirlpool’s warranty payments totaled $5,800 during the period. (Reclass from Debit Estimated Warranty Expense ……..…………………5,800 Credit Cash…………………..…...…..…………………………..5,800 Contingent Liabilities A contingent liability is not an actual liability. It is a potential liability that depends on a future event. Usually related to lawsuits ACCOUNTING FOR PAYROLL Gross Pay and Net (Take-Home Pay) Two pay amounts are important for accounting purposes: ▪ Gross Pay – The total amount of salary, wages, commission, and bonus earned by the employee during a pay period ▪ Net Pay – The amount the employee gets to keep. It equals gross pay minus all deductions. Payroll Withholding Deductions Payroll withholding deductions are what constitute the difference between gross pay and net pay. Fall into two categories: ▪ Required deductions – Such as the employee income tax and social security tax ▪ Optional deduction – Such as insurance premiums, charitable contributions, etc… After these are withheld, payroll deductions become a liability of the employer, who then pays them to the outside party. Required Withholding for Employee Income Tax U.S. law requires companies to withhold income tax from employee paychecks. Required Withholding for Employee Social Security (FICA) Tax The Federal Insurance Contributions Act (FICA), also known as the Social Security Act, created this tax. This program provides retirement, disability, and medical benefits. U.S. law requires companies to withhold FICA tax from employee paychecks. Optional Withholding Deductions As a convenience to employees, companies withhold payroll deductions and then pay designated organization according to employee instructions Example - 401k or charitable contributions Summary of Gross Pay, Withholding Deductions, and Net Pay Example of a pay period for one employee: D:\106757604.doc Gross p ay Withholding Deductions: Employee Income Tax Employee FICA Tax Employee co-pay for health insurance Employee contribution to United Way Total Withholdings Net pay 10,000 2,000 400 180 20 2,600 7,400 Employer Payroll Taxes In addition to the income tax and FICA tax that are withheld from employee paychecks, employers must also pay at least three payroll taxes: ▪ Employer Social Security (FICA) tax ▪ State unemployment compensation tax ▪ Federal unemployment compensation tax Employer FICA Tax In addition to the employee’s FICA or Social Security tax, the employer must pay an equal amount into the program. Only taxed on up to $90,000 of gross pay State and Federal Unemployment Compensation Taxes These taxes finance workers’ compensation for people laid off of work. Most recently, employers have paid a combined tax of 6.2% (Federal at .8% and State at 5.4%) on the first $7,000 of each employee’s annual earnings. For this payroll tax, the employer uses two liability accounts: ▪ Federal Unemployment Tax Payable ▪ State Unemployment Tax Payable Payroll Accounting See exhibit 11-5 on page 562 of your text for an example of the entries related to payroll. Complete Summary Problem 2 on page 570 of your text D:\106757604.doc