Reporting Hobby Income - College Planning Virginia

advertisement

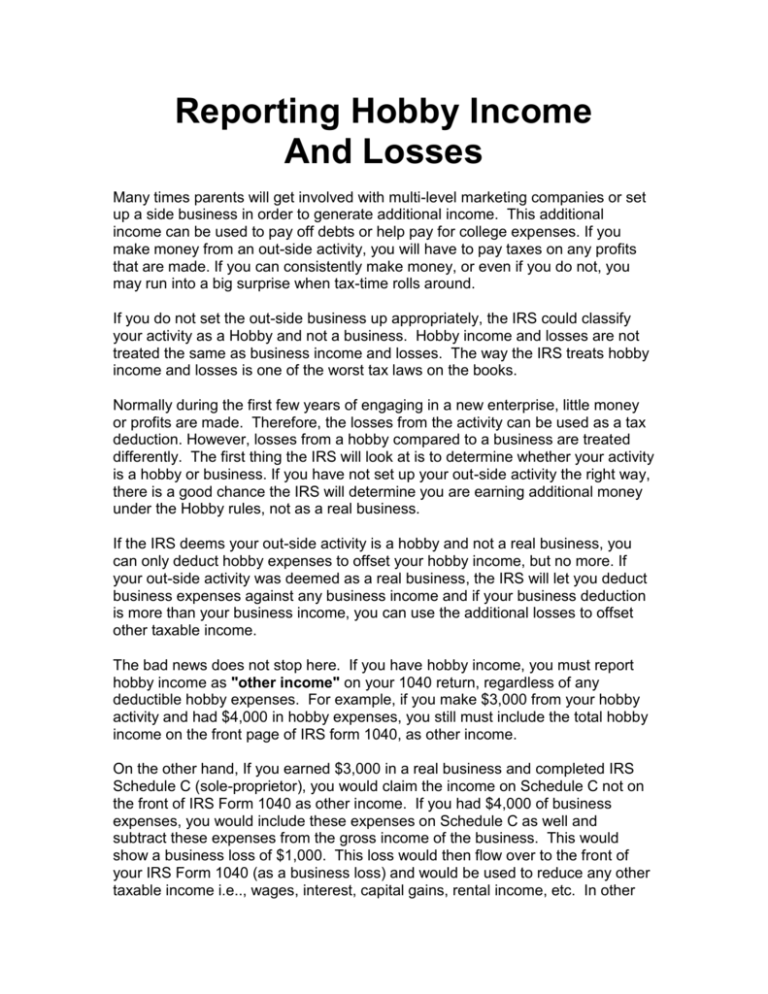

Reporting Hobby Income And Losses Many times parents will get involved with multi-level marketing companies or set up a side business in order to generate additional income. This additional income can be used to pay off debts or help pay for college expenses. If you make money from an out-side activity, you will have to pay taxes on any profits that are made. If you can consistently make money, or even if you do not, you may run into a big surprise when tax-time rolls around. If you do not set the out-side business up appropriately, the IRS could classify your activity as a Hobby and not a business. Hobby income and losses are not treated the same as business income and losses. The way the IRS treats hobby income and losses is one of the worst tax laws on the books. Normally during the first few years of engaging in a new enterprise, little money or profits are made. Therefore, the losses from the activity can be used as a tax deduction. However, losses from a hobby compared to a business are treated differently. The first thing the IRS will look at is to determine whether your activity is a hobby or business. If you have not set up your out-side activity the right way, there is a good chance the IRS will determine you are earning additional money under the Hobby rules, not as a real business. If the IRS deems your out-side activity is a hobby and not a real business, you can only deduct hobby expenses to offset your hobby income, but no more. If your out-side activity was deemed as a real business, the IRS will let you deduct business expenses against any business income and if your business deduction is more than your business income, you can use the additional losses to offset other taxable income. The bad news does not stop here. If you have hobby income, you must report hobby income as "other income" on your 1040 return, regardless of any deductible hobby expenses. For example, if you make $3,000 from your hobby activity and had $4,000 in hobby expenses, you still must include the total hobby income on the front page of IRS form 1040, as other income. On the other hand, If you earned $3,000 in a real business and completed IRS Schedule C (sole-proprietor), you would claim the income on Schedule C not on the front of IRS Form 1040 as other income. If you had $4,000 of business expenses, you would include these expenses on Schedule C as well and subtract these expenses from the gross income of the business. This would show a business loss of $1,000. This loss would then flow over to the front of your IRS Form 1040 (as a business loss) and would be used to reduce any other taxable income i.e.., wages, interest, capital gains, rental income, etc. In other words if you had $60,000 of taxable income, the $1,000 of business losses would reduce your taxable income down to $59,000, ($60,000 - $1,000 = $59,000). Hobby losses are treated differently than business losses. Not only do you have to claim the hobby income as other income on IRS Form 1040, you can ONLY deduct your hobby losses if you itemize your deduction on IRS Schedule A. Itemized deduction are things like home mortgage interest and taxes, charitable contributions, State income taxes paid, i.e. If you can itemize your deductions, you would deduct your hobby losses as a Miscellaneous Itemized Deduction. Under IRS rules, miscellaneous itemized deductions are limited. In order to deduct hobby losses as a miscellaneous itemized deduction, the losses must be more than 2% of your adjusted gross income. For example, if your adjusted gross income was $83,000 (which includes your $3,000 of hobby income), you could only deduct $2,340 of hobby losses, not the full $4,000,($83,000 X 2% = $1,660 - $4,000 hobby losses = $2,340 deduction). Under this example, even though you DID NOT make a profit ($3,000 of income minus $4,000 of losses or expenses), you will have to pay taxes on $660 of your hobby income, ($3,000 - $2,340 losses = $660 taxable income.) If you do not have enough itemized deduction to complete IRS Schedule A. You CANNOT deduct hobby losses and must pay taxes on all of your hobby income. Earning money as a hobby does have a benefit over earning money under a business structure. The benefit is, earnings from a hobby is NOT subject to SelfEmployment Taxes. Self-Employment taxes is the same as Social Security Taxes paid by W-2 earners. If you run a hobby activity collect stamps, coins, etc., for recreation and pleasure and you sell any of the hobby collection items, your gain or profit is taxable as a capital gain on your tax return, NOT as other income. However, if you sell items from your hobby collection at a loss, you CANNOT deduct a net loss on your tax return. For more information about deducting hobby expenses, check out IRS Publication 535. If you are a subscriber to our website, we have an e-book on showing you have to pay for the cost of a college education and reducing debt by setting up a small home-based business. Understanding how to pay for college could save your family thousands of dollars. If you are interested in learning more, go to our website www.collegeliteracyacademy.com or www.gearuped.com and become an annual subscriber or send us an e-mail (tuition2@insightbb.com) for more information.