valuing a forward contract

advertisement

Options et Marchés Spéculatifs

Class note 2- 1

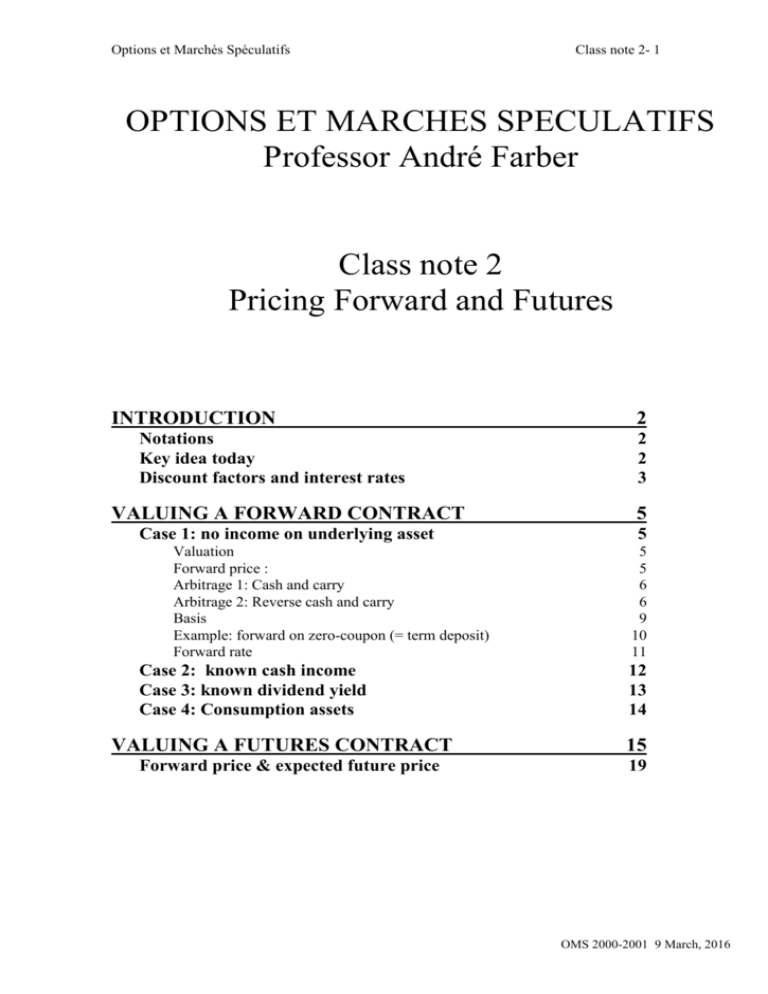

OPTIONS ET MARCHES SPECULATIFS

Professor André Farber

Class note 2

Pricing Forward and Futures

INTRODUCTION

Notations

Key idea today

Discount factors and interest rates

2

2

2

3

VALUING A FORWARD CONTRACT

5

Case 1: no income on underlying asset

5

Valuation

Forward price :

Arbitrage 1: Cash and carry

Arbitrage 2: Reverse cash and carry

Basis

Example: forward on zero-coupon (= term deposit)

Forward rate

Case 2: known cash income

Case 3: known dividend yield

Case 4: Consumption assets

VALUING A FUTURES CONTRACT

Forward price & expected future price

5

5

6

6

9

10

11

12

13

14

15

19

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 2

INTRODUCTION

Notations

F0 :

Forward price set at time 0

f :

Value of forward contract at time 0

K :

Delivery price

T :

Maturiy

(Reminder: When contract initiated : K = F0 f = 0)

Key idea today

1. DECOMPOSITION OF A FORWARD CONTRACT:

Two different ways to own a unit of the underlying asset at

maturity:

1.Buy spot (spot price: S0) and borrow

2. Buy forward (AT FORWARD PRICE Ft)

2. VALUATION PRINCIPLE:

NO ARBITRAGE : in perfect markets, no free lunch.

The 2 methods should cost the same.

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 3

Discount factors and interest rates

d(T) discount factor = present value at time 0 of 1 unit of currency

at time T

Note: 1/d(T) is the future value at time T of 1 unit of currency invested at time t

rs(T) simple interest rate over period 0,T

d (T )

1

1 rs (T ) T

ra(T) annually compounded interest rate over period 0,T

d (T )

1

(1 ra (T ))T

rn(T) interest rate with compounding n times per annum

d (T )

1

r (T ) nT

(1 n

)

n

r(T) continuously compounded interest rate over period 0,T

d (t , T )

1

e r (T ) T

e r (T )T

exp r (T )T

To shift from continuous compounding (rate r) to compounding n times per annum

(rate rn) , use the following formulas

er (1

rn n

)

n

Hence:

rn n

r

) n ln( 1 n )

n

n

rn n(e r / n 1)

r ln( 1

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 4

Numerical illustrations:

Present and future value calculations

One discount factor, several underlying interest rate...

Maturity

Discount factor

Simple (6m)

Annual

Continuous

6 months (0.5 year)

0.9804

4%

4.04%

3.96%

From Simple

To

Simple

0.9804 = 1/[1+(4%)(0.5)]

0.9804 = 1/[1+(4.05%)0.5]

0.9804 = 1/[1+(4%)(0.5)]

Annual

4%

Continuous

4%=

.5

Annual

4.04% =

[(1.0404) -1]

{exp[(3.96%)(.5)]-1}-1

4.04%

4.04% =

[1+(.04)(.5)]²-1

Continuous

4%=

exp(3.96%)-1

3.96%=

3.96%=

ln[1+(.04)(.5)]/(0.5)

ln(1.0404)

3.96%

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 5

VALUING A FORWARD CONTRACT

Case 1: no income on underlying asset

Valuation

No arbitrage opportunity

Consequence : in a perfect capital market, V

value of forward contract = value of synthetic forward contract

f =S0 - PV(K) = S0 – K d(T)

With continuously compounded interest rate:

f = S0 - K e-rT

Forward price :

Delivery price such that f = 0

F0 = S0/d(T) = FV(S0)

With continuously compounded interest rate:

F0 = S0 erT

NOTE :

f ( F0 K )e rT

f>0

F0>K

f=0

F0=K

f<0

F0<K

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 6

Arbitrage 1: Cash and carry

If forward price quoted on the market (K) is greater than its

theoretical value (F0), the “true value” of the contract is negative.

(As: f = (F0-K) d(T), f < 0)

But the market price for the contract is 0.

Hence, the contract is overvalued by the market.

cash-and-carry arbitrage :

Sell overvalued forward:

sell forward

Buy synthetic forward:

buy spot and borrow

Arbitrage 2: Reverse cash and carry

If forward price quoted on the market (K) is less than its

theoretical value (F0), the “true value” of the contract is positive.

(As: f = (F0-K) d(T), f > 0)

But the market price for the contract is 0.

Hence, the contract is undervalued by the market.

reverse cash-and-carry arbitrage :

Buy undervalued forward (futures):

Buy forward

Sell synthetic forward (futures):

Short asset and borrow

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 7

Numerical illustration

Cash and carry arbitrage

Underlying asset : Gold

No income

Spot price : 250 $/oz

Maturity: 6 months

Interest rate (simple) : 4% (or 3.96% with cont.comp)

Equilibrium forward price : 250 [1+(.04)(.5)] = 255

Quoted forward (futures) price : 260

Arbitrage table

Buy spot

Borrow

Sell forward

@ 260

Total

Current date

- 250

+ 250

0

0

Delivery date

+ST

- 255 =

250[1+(.04)(.5)]

260 – ST

+5

(=260-255)

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 8

Numerical illustration

Reverse cash and carry arbitrage

Underlying asset : Gold

No income

Spot price : 250 $/oz

Maturity: 6 months

Interest rate (simple) : 4%

Equilibrium forward price : 250 [1+(.04)(.5)] = 255

Quoted forward (futures) price : 250

Arbitrage table

Short

Current date

+ 250

Delivery date

-ST

- 250

+ 255 =

250[1+(.04)(.5)]

ST –250

(borrow + sell spot)

Invest

Buy forward

@ 250

Total

0

0

+5

=255 – 250

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 9

Basis

DEFINITION : SPOT PRICE - FUTURES PRICE

bt = St - Ft

Futures price

Spot price

F =S

T

T

T

time

Depends on:

- level of interest rate

- time to maturity ( as maturity )

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 10

Example: forward on zero-coupon (= term deposit)

A

0

T

T*

F0

Spot interest rates - notations:

r(T) = r

r(T*) = r*

Value of underlying asset :

S0 A e

r *T *

Forward price

F0 S0 e rT

A e rT r T

* *

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 11

Forward rate

Rate R set at time 0 for a transaction from T to T*

r*

0

T*

T

r

R

e

r *T *

e e

rT

R (T * T )

=> Continuously compounded forward rate

r *T * rT

R

T* T

Forward price of zero coupon:

F0 A e

R (T * T )

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 12

Case 2: known cash income

Ex: forward contract to purchase a coupon-bearing bond

C

0

t

T

Let I = Present value of C = PV(C)

Valuation:

f = (S0-I) - PV(K)

f S 0 I Ke T

Forward price : f = 0

F0 ( S 0 I )e rT

Note : as before

f ( F0 K )e rT

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 13

Case 3: known dividend yield

q : dividend yield p.a. paid continuously

Examples:

Forward contract on a Stock Index

q = dividend yield

Foreign exchange forward contract:

q = foreign interest rate (continuously compounded)

Valuation:

f S 0 e qT Ke rT

Forward price:

F0 S0e

( r q )T

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 14

Case 4: Consumption assets

1. No income

Take cost of storage into account

I = - PV of storage cost (negative income)

q = - storage cost u per annum as a proportion of commodity

price

The cost of carry:

Interest costs + Storage cost – income earned c=r-q

For consumption assets, short sales problematic. So:

F0 S0e( r u )T

The convenience yield on a consumption asset y defined so that:

F0 S 0e (c y )T

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 15

VALUING A FUTURES CONTRACT

If the interest rate is non stochastic, futures prices and forward

prices are identical

NOT INTUITIVELY OBVIOUS:

Total gain or loss equal for forward and futures

but timing is different

Forward : at maturity

Futures : daily

PROOF:

S

F

G

r

spot price

futures price

forward price

daily interest rate

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

At time T:

Class note 2- 16

ST = GT = FT

AT T-1:

LONG 1 FWD

SHORT 1 FUTURE

TOTAL

T-1

0

0

T

ST - GT-1

-(FT - FT-1)

FT-1 - GT-1

FT-1 = GT-1

AT T-2:

LONG (1+r) FWD

SHORT 1 FUTURE

TOTAL

T-2

0

0

T-1

(1+r)[GT-1 -GT-2]/(1+r)

-(FT-1 - FT-2)

FT-2 - GT-2

FT-2 = GT-2

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 17

NUMERICAL EXAMPLE

Initial spot price : 100.00

Interest rate (simple compounding) : 10%

Number of days per year : 360

FORWARD CONTRACT

cf 2 = new forward contract each month

days

year

180

150

120

90

60

30

0

0.50

0.42

0.33

0.25

0.17

0.08

0

spot

price

100.00

106.88

109.22

108.88

111.31

105.45

114.76

forward

price

105.00 (1)

111.33

112.86

111.60

113.17

106.33

114.76

cash

flow

0

0

0

0

0

0

9.76

cf 2

6.08 (2)

1.48

-1.23

1.54

-6.78

8.43

(1) Ft = St (1+r )

105.00 = 100.00 * (1+0.10* 0.50)

(2) Sell forward at 111.33

Profit in 0.42 years : 111.33 - 105 = 6.33

Present value

6.33 / (1+0.10*0.42) = 6.08

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 18

FUTURES CONTRACTS

Let us reproduce the roll over strategy with futures :

NOTE : FOR SIMPLICITY, MONTHLY MARKING TO

MARKET

days year

180

150

120

90

60

30

0

0.50

0.42

0.33

0.25

0.17

0.08

0

spot

price

100.00

106.88

109.22

108.88

111.31

105.45

114.76

futures

price

105.00

111.33

112.86

111.60

113.17

106.33

114.76

cash

flow

0

6.33

1.53

-1.23

1.54

-6.78

8.43

nb

0.960

0.968

0.976

0.984

0.992

1.000

net

c.flow

6.08

1.48

-1.23

1.54

-6.78

8.43

OMS 2000-2001 9 March, 2016

Options et Marchés Spéculatifs

Class note 2- 19

Forward price & expected future price

Is F an unbiased estimate of E(ST) ?

F < E(ST)

Normal backwardation

F > E(ST)

Contango

To understant the relation between F and E(ST), consider the

following strategy :

t

- F e-r(T-t)

0

- F e-r(T-t)

Invest

Long forward

Total

T

+F

ST - F

ST

PV = - F e-r(T-t) + E(ST) e-k(T-t) = 0

F = E(ST) e(r-k) (T-t)

If k = r

F = E(ST)

If k > r

F < E(ST)

If k < r

F > E(ST)

OMS 2000-2001 9 March, 2016