CHAPTER 9F - Faculty.frostburg

advertisement

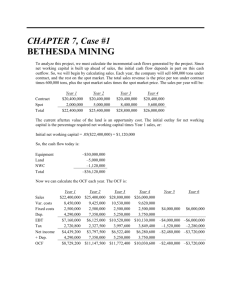

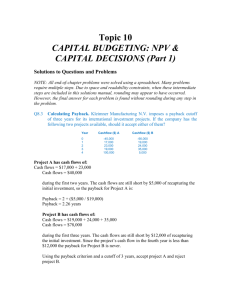

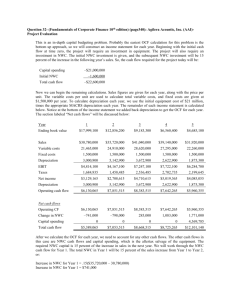

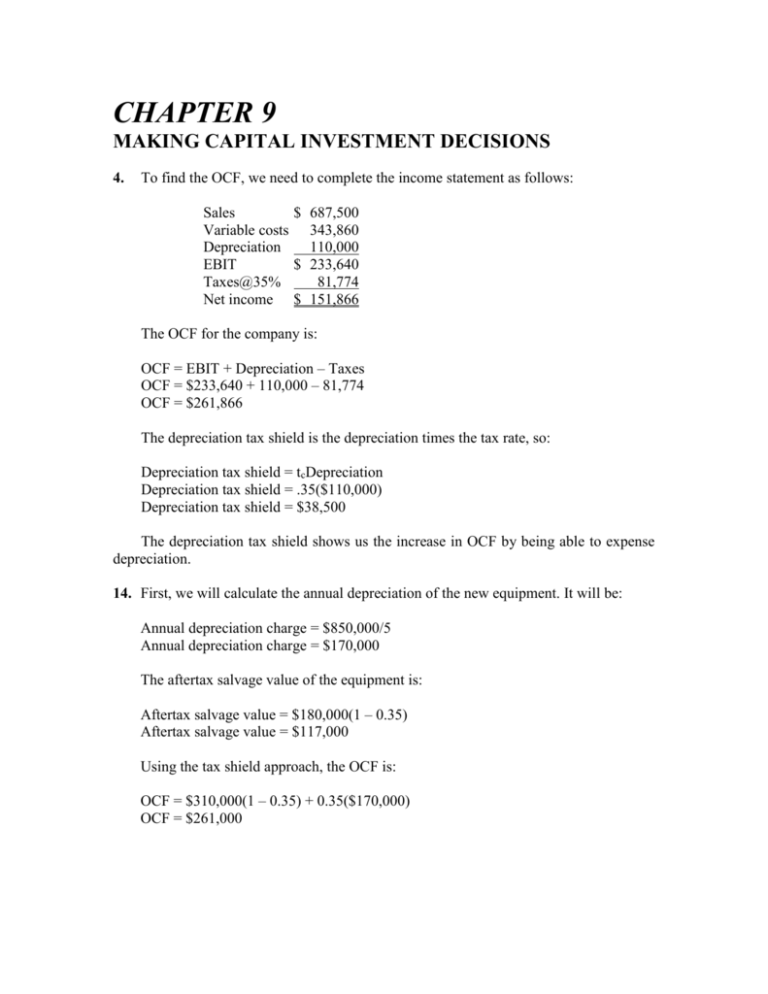

CHAPTER 9 MAKING CAPITAL INVESTMENT DECISIONS 4. To find the OCF, we need to complete the income statement as follows: Sales $ 687,500 Variable costs 343,860 Depreciation 110,000 EBIT $ 233,640 Taxes@35% 81,774 Net income $ 151,866 The OCF for the company is: OCF = EBIT + Depreciation – Taxes OCF = $233,640 + 110,000 – 81,774 OCF = $261,866 The depreciation tax shield is the depreciation times the tax rate, so: Depreciation tax shield = tcDepreciation Depreciation tax shield = .35($110,000) Depreciation tax shield = $38,500 The depreciation tax shield shows us the increase in OCF by being able to expense depreciation. 14. First, we will calculate the annual depreciation of the new equipment. It will be: Annual depreciation charge = $850,000/5 Annual depreciation charge = $170,000 The aftertax salvage value of the equipment is: Aftertax salvage value = $180,000(1 – 0.35) Aftertax salvage value = $117,000 Using the tax shield approach, the OCF is: OCF = $310,000(1 – 0.35) + 0.35($170,000) OCF = $261,000 Now we can find the project IRR. There is an unusual feature that is a part of this project. Accepting this project means that we will reduce NWC. This reduction in NWC is a cash inflow at Year 0. This reduction in NWC implies that when the project ends, we will have to increase NWC. So, at the end of the project, we will have a cash outflow to restore the NWC to its level before the project. We must also include the aftertax salvage value at the end of the project. The IRR of the project is: NPV = 0 = –$850,000 + 75,000 + $261,000(PVIFAIRR%,5) + [($117,000 – 75,000) / (1+IRR)5] IRR = 21.28% 21. First, we will calculate the depreciation each year, which will be: D1 = $480,000(0.2000) = $96,000 D2 = $480,000(0.3200) = $153,600 D3 = $480,000(0.1920) = $92,160 D4 = $480,000(0.1152) = $55,296 The book value of the equipment at the end of the project is: BV4 = $480,000 – ($96,000 + 153,600 + 92,160 + 55,296) BV4 = $82,944 The asset is sold at a loss to book value, so this creates a tax refund. After-tax salvage value = $55,000 + ($82,944 – 55,000)(0.34) After-tax salvage value = $64,500.96 Using the depreciation tax shield approach, the OCF for each year will be: OCF1 = $205,000(1 – 0.34) + 0.34($96,000) = $167,940 OCF2 = $205,000(1 – 0.34) + 0.34($153,600) = $187,524 OCF3 = $205,000(1 – 0.34) + 0.34($92,160) = $166,634 OCF4 = $205,000(1 – 0.34) + 0.34($55,296) = $154,101 Now, we have all the necessary information to calculate the project NPV. We need to be careful with the NWC in this project. Notice the project requires $21,000 of NWC at the beginning, and $3,000 more in NWC each successive year. We will subtract the $21,000 from the initial cash flow, and subtract $3,000 each year from the OCF to account for this spending. In Year 4, we will add back the total spent on NWC, which is $30,000. The $3,000 spent on NWC capital during Year 4 is irrelevant. Why? Well, during this year the project required an additional $3,000, but we would get the money back immediately. So, the net cash flow for additional NWC would be zero. With all this, the equation for the NPV of the project is: NPV = – $480,000 – 21,000 + ($167,940 – 3,000)/1.15 + ($187,524 – 3,000)/1.152 + ($166,634 – 3,000)/1.153 + ($154,101 + 30,000 + 64,500.96)/1.154 NPV = $31,683.79 24. The marketing study and the research and development are both sunk costs and should be ignored. The initial cost is the equipment plus the net working capital, so: Initial cost = $18,400,000 + 1,100,000 Initial cost = $19,500,000 Next, we will calculate the sales and variable costs. Since we will lose sales of the expensive clubs and gain sales of the cheap clubs, these must be accounted for as erosion. The total sales for the new project will be: Sales New clubs Exp. clubs Cheap clubs $650 60,000 = $39,000,000 $1,100 (–10,000) = –11,000,000 $300 15,000 = 4,500,000 $32,500,000 For the variable costs, we must include the units gained or lost from the existing clubs. Note that the variable costs of the expensive clubs are an inflow. If we are not producing the sets anymore, we will save these variable costs, which is an inflow. So: Var. costs New clubs Exp. clubs Cheap clubs $340 60,000 = $20,400,000 $550 (–10,000) = –5,500,000 $100 15,000 = 1,500,000 $16,400,000 The pro forma income statement will be: Sales Variable costs Costs Depreciation EBT Taxes Net income $32,500,00 0 16,400,000 9,000,000 2,628,571 4,471,429 1,788,571 $ 2,682,857 Using the bottom up OCF calculation, we get: OCF = NI + Depreciation OCF = $2,682,857 + 2,628,571 OCF = $5,311,429 So, the payback period is: Payback period = 3 + $3,565,713/$5,311,429 Payback period = 3.67 years The NPV is: NPV = –$18,400,000 – 1,100,000 + $5,311,429(PVIFA14%,7) + $1,100,000/1.147 NPV = $3,716,625.90 And the IRR is: 0 = –$18,400,000 – 1,100,000 + $5,311,429(PVIFAIRR%,7) + $1,100,000/IRR7 IRR = 19.91%