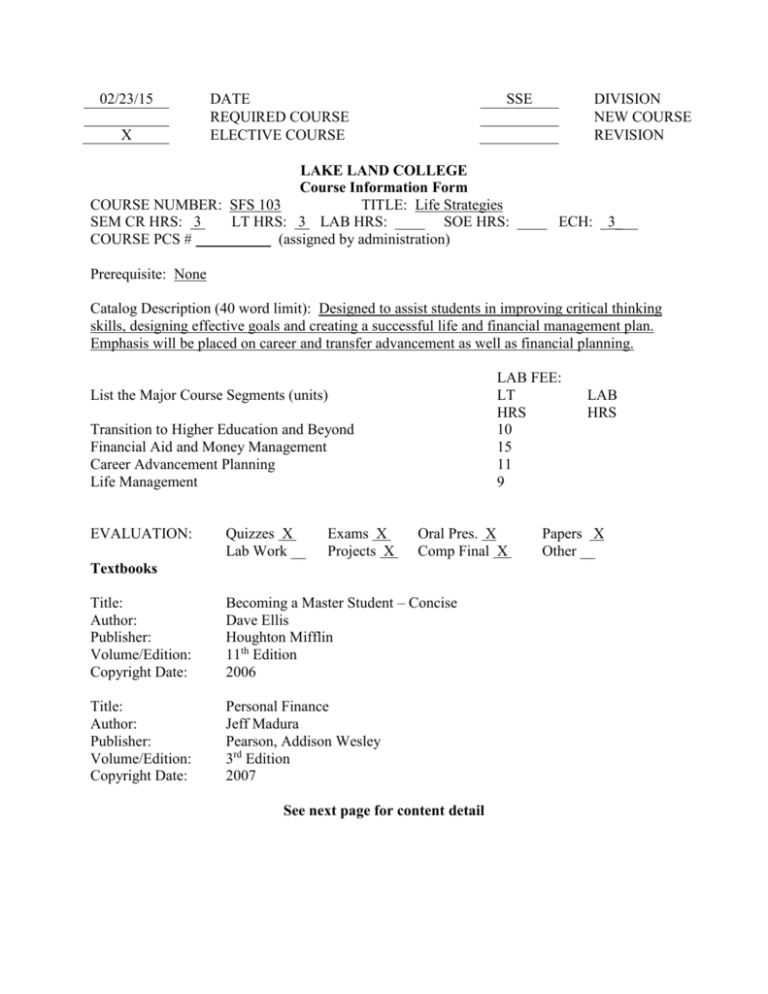

02/23/15

X

DATE

REQUIRED COURSE

ELECTIVE COURSE

SSE

DIVISION

NEW COURSE

REVISION

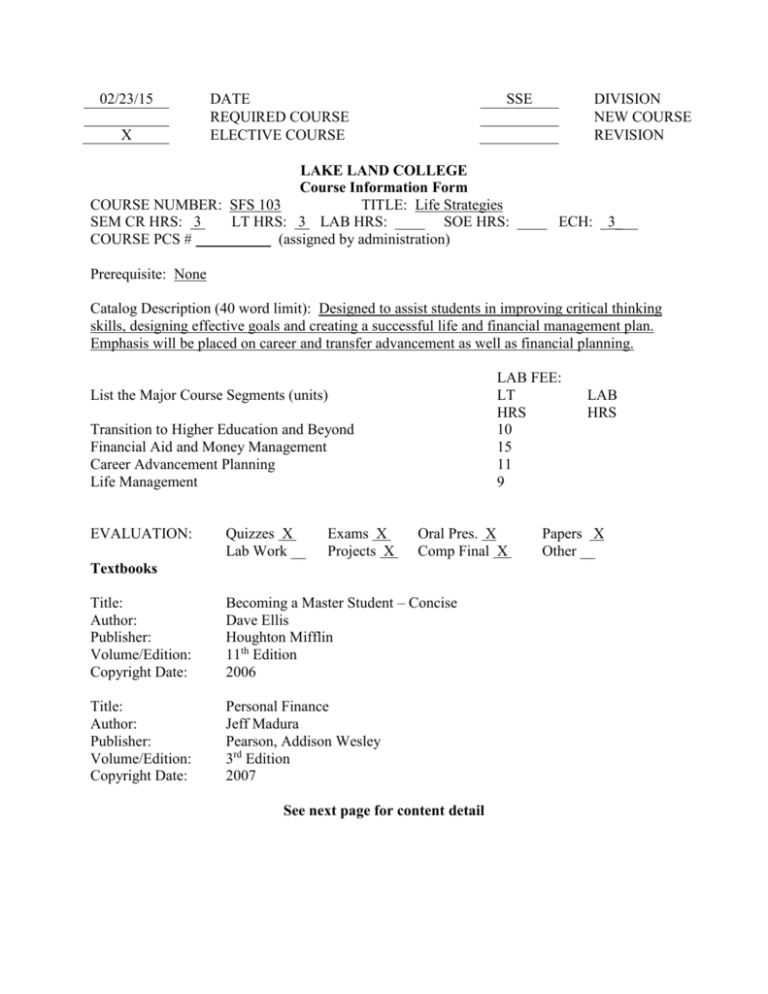

LAKE LAND COLLEGE

Course Information Form

COURSE NUMBER: SFS 103

TITLE: Life Strategies

SEM CR HRS: 3

LT HRS: 3 LAB HRS: ____ SOE HRS: ____ ECH: _3___

COURSE PCS #

(assigned by administration)

Prerequisite: None

Catalog Description (40 word limit): Designed to assist students in improving critical thinking

skills, designing effective goals and creating a successful life and financial management plan.

Emphasis will be placed on career and transfer advancement as well as financial planning.

LAB FEE:

LT

HRS

10

15

11

9

List the Major Course Segments (units)

Transition to Higher Education and Beyond

Financial Aid and Money Management

Career Advancement Planning

Life Management

EVALUATION:

Quizzes X

Lab Work __

Exams X

Projects X

Oral Pres. X

Comp Final X

Textbooks

Title:

Author:

Publisher:

Volume/Edition:

Copyright Date:

Becoming a Master Student – Concise

Dave Ellis

Houghton Mifflin

11th Edition

2006

Title:

Author:

Publisher:

Volume/Edition:

Copyright Date:

Personal Finance

Jeff Madura

Pearson, Addison Wesley

3rd Edition

2007

See next page for content detail

LAB

HRS

Papers X

Other __

Major Course Segment

I. Transition to Higher Education and

Beyond

A. The value of education

B. Higher education resources

C. Motivation, decision-making,

and goal-setting

Hours Learning Outcomes

10

The student will be able to:

1. use resources to think critically about

higher education and career goals

2. evaluate current positive and negative

behaviors for self awareness

3. utilize results of evaluation to enhance

and develop life goals

II. Financial Aid and Money

Management

A. Budget and bank account

basics

B. Identity theft and fraud

C. Debt reduction and loan

repayment

D. Short-term and long-term

savings and investing

15

The student will be able to:

1. identify and prioritize income and

expenditures, including zero-based

budgeting (paper, computer-based, and

online), and distinguish good and bad

debt

2. record and balance checks and debit

cards and interpret bank statements

3. understand basic principles of credit,

annual percentage rates, fees, and

penalties

4. apply strategies to detect, prevent and

recover from identity theft and fraud

5. construct strategies to eliminate debt

6. evaluate loan types and guidelines

(auto, home, college, high-interest, and

scam)

7. identify types of financial assistance

available for college and manage

tuition payments

8. construct, track and adjust growth in

savings plans, investment opportunities,

retirement accounts, and tax sheltered

accounts appropriate for different life

stages

III. Career Advancement Planning

A. Self-assessment (abilities,

aptitudes, interests) goalsetting

B. Career, academic, and life

planning

11

The student will be able to:

1. identify and evaluate abilities,

aptitudes, and interests and relate these

to specific majors and careers

2. identify and use career resources

3. develop personal career goals

IV. Life Management

A. Time management

B. Stress management for a

healthy lifestyle

C. Establishing rewarding

relationships

D. Putting it all together

9

The student will be able to:

1. use time management to take theories

into practice in meeting life objectives

2. develop a plan to integrate habits for

improved emotional and physical

health

3. develop interpersonal communication

skills

4. use ethical reasoning to examine their

impact on local and global communities

5. produce a final Life Portfolio, where

the student will describe one long-term

life goal, one long-term career, and a

financial plan.

Course Outcomes: At the successful completion of this course, students will be able

to:

Students will be able to identify the elements of a personal financial plan.

Students will be able to identify short-term, mid-term and long-term goals.

Students will be able to complete a personal life and financial plan including

strategies for working toward those goals