Qtel Delivers Nine Month Year-on

Qtel Delivers Nine Month Year-on-Year Revenue Growth of 14

Percent to QAR 20 Billion

Solid Performance in Key Operations Driving Growth; Consolidated Customer Numbers Grow 30.6

Percent Year-on-Year to 68.9 million

Doha, Qatar, 20 October 2010: Qatar T elecom Q.S.C. (“Qtel” or “The Qtel Group” or “The Group”) (Ticker:

QTEL.QA) today announced further strong revenue and profit growth for the nine month period ended 30 September

2010:

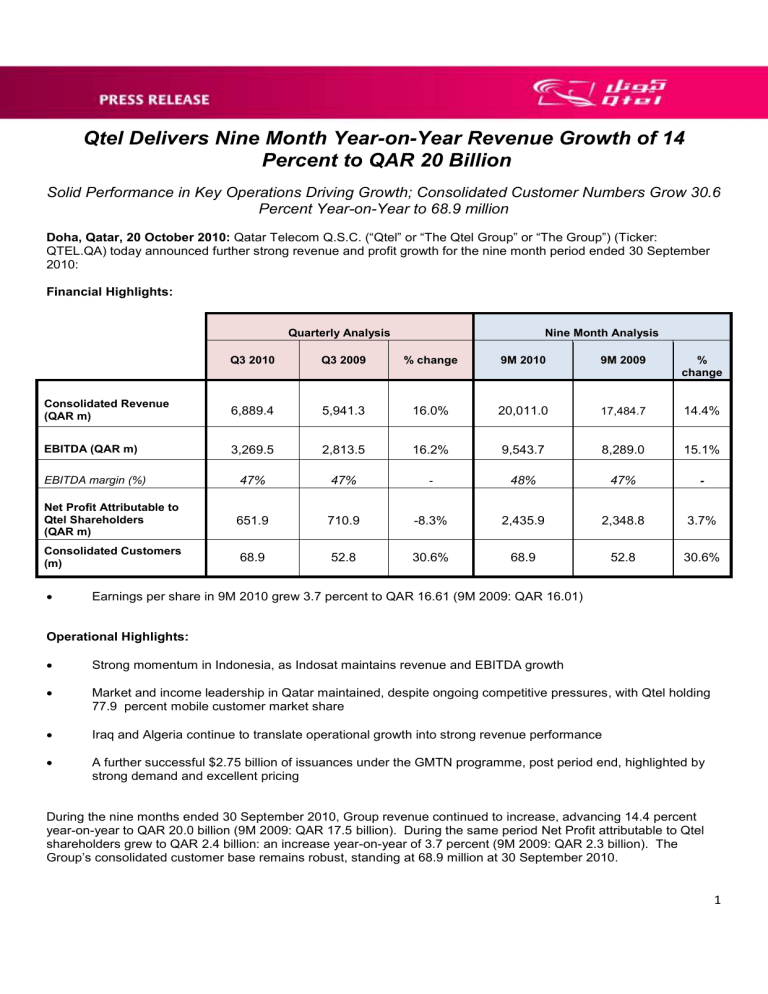

Financial Highlights:

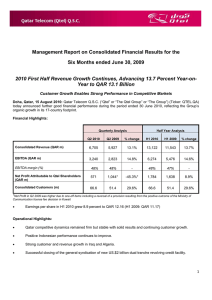

Quarterly Analysis Nine Month Analysis

Q3 2010 Q3 2009 % change 9M 2010 9M 2009 % change

Consolidated Revenue

(QAR m)

6,889.4

5,941.3

16.0% 20,011.0

17,484.7 14.4%

EBITDA (QAR m)

EBITDA margin (%)

Net Profit Attributable to

Qtel Shareholders

(QAR m)

Consolidated Customers

(m)

3,269.5

47%

651.9

68.9

2,813.5

47%

710.9

52.8

16.2%

-

-8.3%

30.6%

9,543.7

48%

2,435.9

68.9

8,289.0

47%

2,348.8

52.8

15.1%

-

3.7%

30.6%

Earnings per share in 9M 2010 grew 3.7 percent to QAR 16.61 (9M 2009: QAR 16.01)

Operational Highlights:

Strong momentum in Indonesia, as Indosat maintains revenue and EBITDA growth

Market and income leadership in Qatar maintained, despite ongoing competitive pressures, with Qtel holding

77.9 percent mobile customer market share

Iraq and Algeria continue to translate operational growth into strong revenue performance

A further successful $2.75 billion of issuances under the GMTN programme, post period end, highlighted by strong demand and excellent pricing

During the nine months ended 30 September 2010, Group revenue continued to increase, advancing 14.4 percent year-on-year to QAR 20.0 billion (9M 2009: QAR 17.5 billion). During the same period Net Profit attributable to Qtel shareholders grew to QAR 2.4 billion: an increase year-on-year of 3.7 percent (9M 2009: QAR 2.3 billion). The

Group’s consolidated customer base remains robust, standing at 68.9 million at 30 September 2010.

1

The Group’s EBITDA performance during the nine months ended 30 September 2010 also strengthened, increasing

15.1 percent year-on-year to stand at QAR 9.5 billion (9M 2009: QAR 8.3 billion). EBITDA margin has also improved, closing the period at 48 percent (9M 2009: 47 percent).

Commenting on the results His Excellency Sheikh Abdullah Bin Mohammed Bin Saud Al-Thani, Chairman of the Qtel

Group said:

“I am pleased with the consistent, positive progress we continue to make as a Group. This period’s performance illustrates our ability to overcome challenges, capitalise on opportunities, and deliver meaningful returns for our shareholders. I am also pleased to report solid growth for these first nine months of the year and an overwhelmingly positive response to our very successful bond issuances .”

Also commenting on the results Dr. Nasser Marafih, Chief Executive Officer of the Qtel Group said:

“Our broad portfolio of operations continues to perform well thanks to our focus on implementing the right strategy, at the right speed, in the right market. I am particularly pleased to see the changes in the Indosat management and the improvements in its network beginning to show through in its results.

”

Review of Operations

The Group’s operational performance can be summarized as follows:

Qtel – Qatar

Qtel maintained its market and income leadership in Qatar throughout the quarter. Total customer numbers were steady at 2.4 million at the period end (9M 2009: 2.4 million). Revenue stood at QAR 4.0 billion down marginally against the previous year (9M 2009: QAR 4.3 billion) while EBITDA stood at QAR 2.2 billion.

Qtel has continued to focus on its core strategy of maintaining its market leadership within the Qatar market, and enhancing its share of market value. The expansion of Qtel’s portfolio of new services and the successful completion of the first phase of a nationwide fibre-to-the-home programme have positioned Qtel to enjoy strong and sustainable returns moving forward.

Indosat – Indonesia

Indosat has successfully defended and strengthened its number two market position during the period, delivering steady ‘value subscriber’ growth in one of the world’s most dynamic communications markets. This growth – particularly in cellular – has taken Indosat’s consolidated customer base to 40.4 million at the period-end: a year-onyear increase of 40.8 percent. As a consequence, revenue for the nine months ended 30 September 2010 has increased, growing 27.8 percent to QAR 5.9 billion (9M 2009: QAR 4.6 billion). EBITDA has also continued to improve, trending 33.8 percent higher year-on-year to close the period at QAR 3.0 billion (9M 2009: QAR 2.2 billion).

Wataniya Telecom

Wataniya Telecom (“National Mobile Telecommunications Company K.S.C.”) encompasses the Qtel Group’s businesses in Kuwait, Tunisia, Algeria, Kingdom of Saudi Arabia, the Maldives and Palestine.

In Kuwait, Wataniya has continued to make good strategic progress and has maintained its strong market position despite ongoing competitive dynamics in the Kuwaiti marketplace. The lessons learned from success in Kuwait are also proving useful in Algeria where, operating under the Nedjma brand, Wataniya has extended its market share in spite of increased incountry competition. At a consolidated level, Wataniya Telecom’s customer base increased 29.7 percent year-on-year to end the period at 16.2 million (9M 2009: 12.5 million). Revenue also increased during the period, growing 13.9 percent year-on-year to QAR 5.1 billion (9M 2009: QAR 4.5 billion) with EBITDA also improving by 11.2 percent to QAR 2.0 billion (9M 2009: QAR 1.8 billion).

Nawras – Oman

2

Qtel ’s operations in Oman – under the “Nawras” brand – continued to show solid progress during the period. Nawras’ market position has remained strong, with customer numbers increasing to 2.0 million at the period end (9M 2009: 1.8 million). Revenue increased strongly to QAR 1.3 billion (9M 2009: QAR 1.2 billion): a year-on-year increase of 14.4 percent. This growth, coupled with further improvements in the cost base, led to further improvements in EBITDA which increased 38.9 percent year-on-year to QAR 727.5 million (9M 2009: QAR 523.4 million).

Asiacell – Iraq

Asiacell has progressed during the period in both revenue and profitability. At the same time, it has continued to successfully leverage its strong in-market brand equity and has benefitted from an increase in the level of outgoing voice traffic. In the nine months ended 30 September 2010, Asiacell delivered revenue of QAR 3.7 billion (9M 2009:

QAR 2.9 billion): a year-on-year growth rate of 28.9 percent. EBITDA also improved year-on-year by 32.7 percent to stand at QAR 2.1 billion (9M 2009: QAR 1.6 billion).

Qtel will publish its financial statement for the period ended 30 September 2010 on its website, accessible at: www.qtel.com.qa

- Ends -

About Qtel

Qatar Telecom (Qtel) Q.S.C. is a diversified telecommunications company with a presence in 17 countries, providing voice and data services to people and businesses, and bringing advanced technology to more than 66 million customers. Qtel is committed to expansion in the MENA region where it is the largest telecommunications company by number of operations, and South East Asia. Qtel’s vision is to be among the top 20 telecommunications companies in the world by 2020.

Qatar Telecom (Qtel) Q.S.C. cautions investors that certain statements contained in this document state management's intentions, hopes, beliefs, expectations, or predictions of the future and are thus forward-looking statements. Management wishes to caution the reader that forward-looking statements are not historical facts and are only estimates or predictions. Actual results may differ materially from those projected as a result of risks and uncertainties including, but not limited to: Qtel’s ability to manage domestic and international growth and maintain a high level of customer service; future sales growth; market acceptance of its product and service offerings; its ability to secure adequate financing or equity capital to fund its operations; network expansion; performance of its network and equipment; its ability to enter into strategic alliances or transactions; cooperation of incumbent local exchange carriers in provisioning lines and interconnecting our equipment; regulatory approval processes; changes in technology; price competition; other market conditions and associated risks.

Qtel undertakes no obligation to update publicly any forward-looking statements, whether as a result of future events, new information, or otherwise .

3