China's new labor regulations and government policies have begun

advertisement

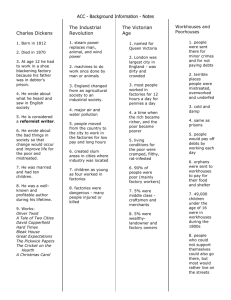

China Economic Update Economic Summary: 1.) Increase in cost of raw materials due to rising oil prices; especially petroleum based fabrics and chemicals. 2.) Increase in labor costs of between 15-20% compared to 2006. 3.) Property taxes have increased in China. 4.) Environmental taxes have increased in China. 5.) Power and Utilities costs have increased in China. 6.) Growing inflation in China causing rise in cost of living; demand for higher wages. 7.) Safety and Social Security costs have increased (Mandatory Pension Fund RMB minimum 300 per month per head). 8.) Exchange rate: Evaluation of RMB while weak US$ causing loss of RMB 0.14 per US dollar compared to 2006. 9.) Hikes of interest rates in China by 1.35% within 2007 10.) Competition for skilled labor; high demand versus low supply. 11.) Rise in socio-economic levels means less blue collar labor; increased competition for workers. 12.) Farming subsidies means less migrant workers; increased competition for workers. 13.) Pressure from China Gov’t to limit growth of low tech industries; focus is now on high tech, financial and service sectors. 14.) Increase in cost of transportation due to high gasoline prices. 15.) Mandatory housing fund scheme for laborers is currently in the works; further burden on employers’ overhead costs. China’s new socialistic labor regulations and government policies have begun to exert a huge amount of pressure on factories because such policies will dramatically increase production costs across the board. These effects are being felt immediately in the Pearl River Delta region. Everywhere you look within Guangzhou province, there should be a minimum increase in FOB prices of anywhere between 20-25% compared to 2007. However, this increase pales in comparison to the actual increases in operating costs for many factories that are tightening their belts to try and keep customers happy by absorbing a large proportion of this increase in costs. Other production areas located at, or near large city centers are also going to be slated with the same labor hikes and protection laws, as the China Government instigates its national policy of pushing manufacturing further and further away from all of its major cities. The overall plan is to increase economic activity in regions that are still relatively poor in comparison to all of the coastal cities which have been thriving over the past several decades. However, the further in-land we go, the more we have to contend with, such as increased logistics costs, longer travel times for raw materials to reach production sites, and of course, increased travel time for finished goods to reach the ports. However, despite these inconveniences, it seems that the China Government is bent on going forward with their plans. Everyone realizes that China has become a powerhouse of manufacturing mainly due to its large population of cheap labor. However, most if not all of its top manufacturing sites are located in coastal areas near sea ports. This makes a lot of sense when it comes to logistics but as with any developing country, these over developed areas soon become too expensive for the manufacture of low cost items due to the inflationary pressures of a booming economy. In today’s China labor market not only is it a fact that labor is no longer cheap but there is also a quickly shrinking number of willing and able workers. As the working class becomes wealthier and wealthier, their outlook on the future is no longer simply being able to find a job. They want jobs with higher pay, better benefits, and if possible white collar related occupations instead of blue collar factory work. The epitome of the economic boom in China throughout the 80’s and 90’s was spurred by a massive influx of foreign investment specifically in the manufacturing sector. This fostered a growing economy whereby the China government was relatively lax in enforcing labor regulations, let alone creating new ones. Factories were pretty much supported by the government and could do whatever they wanted to as long as workers were being hired to make goods that would then be exported for foreign currency. However, things are no longer the same, as the China government now focuses on bettering worker welfare and the environment as part of its evolution into becoming a 1st world country. Things are no longer the same in China and, as with all previous third world economies that have managed to transition into 2nd and 1st world countries China is walking along this very same path. Places like: Hong Kong, Taiwan, Korea, and Japan have all taken the very same road before and look at them now, each booming in the hi-tech, financial, and service sectors with very little low cost manufacturing still in existence if any are still to be found. As history has shown us before, as the working class becomes wealthier and wealthier, their offspring will undoubtedly become better educated and most likely be able to find better jobs outside of the manual labor field. Opportunities expand as the population’s socio-economic status progresses to higher and higher levels. When the entire world rushed to get into China, thousands upon hundreds of thousands of new factories popped up throughout the country all holding onto the belief that with a population of 1.3 billion people China had a never ending supply of cheap labor. This was a totally incorrect assumption! Although the population of China is the largest in the world, it does not mean that everyone within the status quo is able to work. One only needs to look at the true demographics of China’s population to realize that its labor supply is actually quite limited. One point to consider is that there are actually a very high percentage of old age people who cannot work at all, let alone work in factories. There are also a very high percentage of underage youths who have not reached working age either. Finally, there are a high percentage of invalids who are unable to work at all. After having screened out all of the able bodied workers, we are left with a much smaller figure than many had thought before. However, the creation of new factories has not only failed to slow down at all, but in fact has been on an exponential rise during the turn of the millennia. What we have ended up with is a scenario that is quite simple: there are way too many factories with not enough workers. This is a classic example of over demand with lack of supply. The under supply of workers has caused a massive increase in competition for workers with the highest bidder being able to attain the most workers. Not only is this creating a surge in wage rates, but it also has a detrimental effect on a factory’s capacity. In fact, workers have been known to leave in groups when a nearby factory offers higher wages, causing a sudden decrease in productivity at the current factory. This phenomenon has made it extremely difficult to effectively plan production as the fluctuations with worker numbers creates havoc with a factory’s output. Since the standard of living in China has increased, the shift in the socio-economic makeup of the general population has also caused an immediate reduction in the number of willing and able factory workers. This fact alone has caused a tremendous drain on the overall availability of new workers entering the labor force within the manufacturing sector. Not only are the youth of today’s China uninterested in working at factories, they really have no need to, especially if they have a higher education, the ability to comprehend foreign languages, and proficiency at using computers. Why on earth would they want to labor away at a factory as a career choice anyways? Just within this decade, about 50% of all high school graduates went on to receive a higher education annually. This change alone already extends the non occupational life of an able bodied person for an additional 3-5 years compared to the previous generation. Couple this with the fact that each family is basically allowed to have only one child, the best is afforded to raising that child which in many instances, means that the child will probably not have to work at a factory. The end result is that fewer and fewer people want or need to enter into the factory workforce. It is a matter of simple mathematics that we are finding a shortage in the number of new people entering into China’s (manual) labor force today. In other words, youths are entering into the work force much later than previous generations and, they are most likely unwilling to do manual labor or to work in factories due to better career opportunities available to them as a result of higher education. With less and less people entering into factory occupations, it will only mean fiercer competition amongst factories to hire enough workers in order to maintain output. Furthermore, the production lead times are going to have to be extended in order to compensate for the fluctuations that will occur due a shortage of factory workers. As for the China Government, they are well aware of the speed in which China has been growing and developing and hence, they see a need to ensure that the country will be able to be self-sustaining as far as food is concerned. This is why the China Government has passed new legislation to subsidize farming and the food industry. If we look back at the heyday of cheap labor in China, up to 99% of this workforce came from migrant workers who left their farms and villages with the hopes of finding a better life by working at a factory. This is no longer the case now that the new Government subsidies have allowed farmers to actually make quite a good living doing what they have always been doing. In other words, there has been a significant reduction in the number of migrant workers looking for jobs at factories because farmers can now remain as farmers and still make a living off of it. As the standard of living rises, so too do the demands of the workers. Strict socialistic labor laws have been devised by the China Government over the past few years which are for the sole benefit of the workers. A mandatory pension scheme is now in place which forces the employer to pay 75% of a certain amount towards a pension fund while the worker pays for the 25% balance. The monies that are paid towards this pension fund are in addition to the worker’s existing salary. However, this pension scheme also entails that a worker will not be able to acquire any of the money until after 15 years of continuous work, and that the worker must remain in the same province throughout the duration of this 15 year period. Many workers have already voiced that they do not want to contribute their 25% towards the pension fund since they do not feel that they would remain in the province for a minimum of 15 years. However, because the pension fund is mandatory, it will mean that the employer will now have to bear 100% of the cost of the pension fund that the China Government will ultimately seize when a worker leaves the province, and the worker essentially gets nothing. Also in the works is a mandatory housing scheme in which an employer will have to pay 80% of a specific amount towards a housing fund, while the worker is responsible for the remaining 20%. In theory the worker can use such monies towards the purchase of their own home which sounds good and dandy. But again, there are many limitations to this program that will prevent the workers from actually getting any of this money. On the outside, it looks as though China is trying to enhance the welfare of its people but in reality, everything being instigated thus far seems to solely benefit the Gov’t in the end. Yes, you may agree that all of these changes sound good and seem to be fair and just towards workers but on the other hand, it also means that the overhead of every single factory will be burdened by these extra costs. Unless foreign buyers are willing to pay more for made in China products, there is no way for such factories to survive, let alone be profitable under of these new regulations. Yet the same tone resonates throughout the buyer world…always wanting lower and lower prices despite the fact that this is just not economically viable anymore. Furthermore, the pressures from the US Govt’ for the appreciation of the Remenbi is also having a detrimental effect on the competitiveness of made in China goods because it directly affects costs. With the Remenbi continuing its appreciation from last year, the exchange rate alone is really hurting Hong Kong based companies conducting business in US dollars. The Remenbi is now traded at around HK$110 for RMB100 and since the US dollar is pegged to the HK dollar at about US$1 to HK$7.78, it will take over US$14 for RMB100. A year ago, it only took US$9 for RMB100. With the advent of oil prices having increased consistently over the past year, we are faced with very real and immediate pressures in relation to material prices. As fabric suppliers try to survive by raising their prices whenever they like to, we as manufacturers on the other hand, are left out in the open without any way to counter such sudden fabric price increases. This means that we have being forced to absorb any and all increases without the ability to in turn, increase our product prices to our customers. We truly believe that business should be fair and that every party should end up winning. But in light of the current market situation and foreseeable trend we have had to re-assess our business practices. It has really been a tough year for us especially since we have been hit pretty hard with material price hikes that have happened out of the blue. Every time a supplier increases material prices on us, we have to incur the loss that results because we have already agreed on pricing with our customers. In addition to fabric suppliers having to increase their prices because of high oil prices, the cost of transportation of fabrics and materials has also risen considerably. This is a hidden cost that we have had to absorb without any help from our customers and it is really beginning to hurt us as well. When fabric and material prices rise, it equates to an increase in our product cost as well because we have no ultimate control over how mills set their prices. Therefore, when it comes to pricing for our customers we have more often than not, had to absorb the increases in fabric prices simply because we had already quoted prices to our customers. With the way the market is moving, we really have no alternative other than to instigate set time limits on all of our pricing. Unless orders are placed within a certain time limit, we will have to revise our quotations in order to reflect any changes in material costs. We simply cannot maintain a single price for extended periods of time because of the volatility of the fabric market. Why should it be that material suppliers can increase prices whenever their costs area affected and we cannot? In fact, we have had to manage on our own, any and all sudden fabric price increases that have occurred thus far, without any prior warning from suppliers and this directly eats away our at margins. As with any organization, we have been forced to evolve along with the times in order to ensure our survivability and this translates into not only having to increase our prices, but also that our quotations can only remain valid for a specific amount of time. However, the truth of the matter is that we can no longer afford to just keep on absorbing material price increases forever. This is why we are asking all of our valued business partners to empathize with our situation and hope that they can understand that our price increases are but only a small fraction of what the actual increase in costs are, that we have to bear. So what is the bottom line amidst all of these changes? The pressures of inflation, high oil prices, high wages, lack of workers, appreciation of the RMB and new labor laws has resulted in the inevitable; Increased prices for made in China goods and longer production lead times. The following is an article from Footwear News Magazine about the price pressures being felt in China. The Cost Crisis WAYNE NIEMI April 21, 2008 LOS ANGELES — The footwear industry is facing a new pricing paradigm, with vendors struggling to absorb higher costs at all stops along the supply chain. Many firms are bracing for steep increases in the costs of raw materials, labor, ocean freight and transportation. Skyrocketing petroleum prices, the weak dollar, new labor policies in China and increased competition for workers in the Guangdong region are all pinching the bottom lines of many companies. And some say the end result for consumers could be price increases of 5 percent to 20 percent at retail. While most experts said the impact of pricing pressures wouldn’t fully hit home until the spring ’09 season, some are already feeling the sting. “It’s a reality going forward,” said Pat Devaney, chief of sustainable initiatives for Deckers Outdoor Corp. “I don’t see oil getting cheaper. Labor will not get cheaper in southern China.” Jim Issler, president and CEO of H.H. Brown, said the footwear industry is entering a new era, where cheaper labor will no longer be an alternative to raising wholesale prices. “It’s definitely a turning point in our industry and it’s not going to be solved easily,” he said. “We chased labor around the world. Now, we’re at the end of the maze and there is nowhere else to go.” Sterne, Agee & Leach analyst Sam Poser said these factors, combined with new labor enforcement initiatives by the Chinese government, are presenting footwear companies with a number of challenges. “This is about as bad as things can get,” he said. “What I’m hearing is that fixed costs in China are going up at least 10 percent [this year].” New taxes in China and the loss of incentives for shoe companies exporting abroad are also adding to the cost dilemma, according to Collective Brands CEO Matt Rubel. “A confluence of unprecedented events has led to a material shift in the cost of sourcing in China,” he said. Ted Gedra, president of Wolverine Footwear Group, a division of Wolverine World Wide, said that labor and component costs started to climb right after the first of the year and have continued to escalate. “It’s been substantial,” he said. “In general, there has been anywhere from a 7 to 10 percent increase in component costs.” For the time being, Gedra said, his division has been able to work with its manufacturing partners to absorb costs and keep them off the company’s balance sheet. Wolverine is also reexamining its sourcing strategy and looking for savings wherever possible. “Competitively, we constantly have to try to find ways to do things better because it’s very difficult to pass it along to the consumer,” he said. Still, price increases have been necessary. For fall, Gedra said his division raised wholesale prices 3 percent to 4 percent. He added that spring ’09 presented too many variables to guess what the company’s pricing structure might look like. “It’s very difficult to understand the ramifications going forward,” he said. Devaney, too, said he expected the company would increase its wholesale prices for spring, though he didn’t yet have an estimate as to how much they would rise. Skechers CEO Robert Greenberg said prices at Skechers could rise 3 percent to 8 percent. However, he won’t be looking for ways to substitute lower-cost materials. “We’re certainly not going to sacrifice our product just to make them cheaper,” he said. “[If the product is right] consumers will pay the prices and retailers will make more per pair.” Looking ahead, many observers said that as costs continue to rise in China, smaller companies will be more heavily impacted than larger firms such as Nike and Adidas, which have more advanced manufacturing capabilities and diversified production. During a March 5 earnings call with investors, Adidas AG CFO Robin Stalker said the company was well situated. “We believe we are extremely well positioned competitively, vis-à-vis our competitors, in terms of lean manufacturing and engineering of our product. Nevertheless, we do see some potential for negative pressures at the end of 2008.” Nike execs on a March 19 earnings call likewise said its efficiencies would mitigate cost increases. “Continued progress on gross margin initiatives and favorable selling currencies more than offset the impact of sourcing cost pressures such as higher oil prices, labor rates and stronger Asian currencies,” said VP and CFO Donald Blair. Still, some smaller vendors are optimistic they, too, can overcome pricing obstacles. K-Swiss President and CEO Steven Nichols said his company — which manufactures the vast majority of its product in China — could manage increases with a solid sourcing strategy, lessening the manufacturing cost difference between it and its larger competitors. “Obviously, we are a significantly smaller company than Nike, but we purchase our rubber, leather and labor in economic units that makes the difference between us and bigger companies not that much,” he said. While many footwear firms are tweaking sourcing plans for China, few plan to leave the country anytime soon. “Going farther north may be an interim approach, but the reality is that as we see economies changing in China, it’s what the future is going to be, and we’re going to have to adapt as an industry,” said Devaney. “Everybody has looked at India and talked about India, but there isn’t an infrastructure of support there to make it more cost effective. Yes, they make shoes and there are leather suppliers, but it’s not up to where it needs to be.” At H.H. Brown, Issler said the economics of relocating manufacturing to India and Vietnam wouldn’t likely yield any significant savings. “The problem is that even though the labor costs are less, they don’t have the same productivity,” he said. Greenberg agreed. “There is no moving to another country,” he said. “People talk about India, but that is light years away. There’s nowhere to hide anymore.” It’s clear that pricing pressures aren’t going away, and the end result may be higher costs for everyone. “The consumer is going to have to learn to pay for things, and companies are going to have to learn to adjust,” said Poser. Greenberg, however, was unfazed by current cost increases, noting that strong businesses will continue to find ways to thrive in even the most difficult times. “We’re going to be fine,” he said. “It’s about adjusting to new ways of doing business.”