Chapter 9 Lecture-1

advertisement

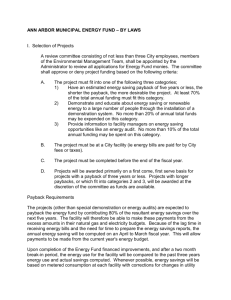

CHAPTER 9 LECTURE CAPITAL BUDGETING Capital Budgeting refers to the process of investing a corporation’s long-term sources of funds (capital) to maximize shareholder wealth. Theoretically, there are an infinite number of investments (projects) in which a corporation can invest. For example, a corporation could invest all of its funds in U.S. Treasury bills. This strategy would probably not maximize shareholder wealth since the return on Treasury bills would very likely be less than it cost to raise the funds (through borrowing and equity offerings) in the first place. So clearly, this strategy would not serve to maximize shareholder wealth. The purpose of capital budgeting is to select that small set of projects, out of all possible projects, that will maximize shareholder wealth. Toward that end several capital budgeting techniques can be used to screen projects for their ability to maximize wealth. Before proceeding further, it’s important to distinguish between two types of projects: independent projects and mutually exclusive projects. Two (or more) projects are independent if the cash flows of one project do not affect the cash flows of the other projects. For example, in the 1980s United States Steel began to diversify out of the steel business by buying petroleum companies (Marathon Oil in 1982 and Texas Oil and Gas in 1986). The cash flows generated by these oil companies could not possibly have any effect on the cash flows of U.S. Steel which is probably why U. S. Steel purchased them (I disagree with this justification – it would have been preferable to stick with its core competency and improve their steel operations). Consider an alternative example. In the 1960’s Coca Cola introduced a new carbonated diet drink called Tab. Clearly consumers that might formerly have purchased a Coke might now purchase a Tab instead. The cash flows of the Tab project would come at the expense of the cash flows of the Coke project. The Tab and Coke projects are dependent rather than independent. Projects might also be mutually exclusive. Two (or more) projects are mutually exclusive if only one of them can possibly be chosen. For example, suppose you own a quarter acre of land adjacent to JSU. You might undertake a project to build affordable student apartments on that land. Alternatively, you could build a fast-food restaurant on the land. You can choose to invest in one or the other, but you can’t invest in both at once. Capital Budgeting Techniques The capital budgeting techniques we will discuss include: 1. 2. 3. 4. Payback period Profitability index Net present value Internal rate of return. Chapter 9 Lecture Part I Chapter 9 Lecture Part II The first step in the capital budgeting process is to estimate the cash flows the project is expected to generate. Suppose the JSU Corporation is considering two projects A and B whose cash flows are shown below: Project A Time 0 -$600,000 Cash Flow 1 $500,000 2 $400,000 3 $300,000 4 $200,000 5 $100,000 Project B Time 0 -$800,000 1 2 3 $50,000 $100,000 $200,000 4 $300,000 5 $500,000 Cash Flow Notice the initial investment ($800,000) for project B is higher than that of A ($600,000). Also notice the larger cash flows come in earlier for A and later for B. Payback Period The payback period of a project measures how many years it takes for a project to recover its initial investment. To find a project’s payback period, simply net the cash inflows to the initial (time zero) investment until you reach zero. For example, project A’s payback period would be computed as follows: -$600,000 +$500,000 1 -$100,000 Notice after the first year, only $100,000 of the initial investment remains to be repaid. The year two cash flow expected from the project is $400,000 which is more than is needed to repay the remaining $100,000. So we don’t need the entire year 2 cash flow to repay the project. At this point, we ask “what fraction of year 2’s cash flow do we need to repay the project?” To get the answer, simply divide the $100,000 by year 2’s cash flow: $100,000/$400,000 = .25 We need all of year 1’s cash flow and .25 of year 2’s cash flow so the payback period for project A will be: 1 + .25 = 1.25 years. Project B’s payback period is: -$800,000 + $50,000 -$750,000 +$100,000 -$650,000 +$200,000 -$450,000 +$300,000 -$150,000 1 2 3 4 $150,000/$500,000 = .30 Project B payback period = 4.3 years It’s one thing to know what the payback for a project is. It’s another to know what to do with this information. We need a decision rule to guide us. The payback decision rule is: Accept all independent projects with payback periods less than management’s maximum allowable payback period. If the projects are mutually exclusive, accept the project with the lowest payback period as long as it is less than managements maximum allowable payback period. For this decision rule to work, management must specify the maximum amount of time it is willing to wait for a project to repay itself. Suppose managements maximum allowable payback period is 3 years. The firm would then accept project A (since its payback period of 1.5 years is less than 3 years) and reject project B because its payback period (4.3 years) is greater than 3. While easy to compute and to interpret, the payback period method of capital budgeting has some serious flaws. First, it does not consider the time value of money. Second, it does not consider cash flows received after the payback period. However, it does provide a simplistic estimate of the project’s liquidity. Profitability Index The profitability index (PI) of a project is a kind of cost-benefit analysis for a project. It is computed by dividing the present value of the project’s cash inflows by its initial investment. The formula for PI is: PI = CF1 (1 + K)1 + CF2 + CF3 + . . . + CFN (1 + K)2 (1 + K)3 (1 + K)N INITIAL INVESTMENT Where: CF = Cash flow K = Required Return Finding the present value of the cash inflows is easy. Simply use the Cash Flow worksheet on your calculator. For example assume project A has a required return of 10% to compensate shareholders for its risk. To find the PI for project A hit the following buttons on the calculator: CF 2ND CLR WRK C01 = 500,000 ENTER C02 = 400,000 ENTER C03 = 300,000 ENTER C04 = 200,000 ENTER C05 = 100,000 ENTER NPV I = 10 ENTER CPT The present value of project A’s cash flows is $1,209,213.23. To find the profitability index for project A divide this present value by A’s initial investment of $600,000. PIA = $1,209,213.23 = 2.02 $600,000 This tells us the present value of A’s cash inflows is a little over twice its initial investment. In other words, its “benefit” is more than twice its cost. Using the same technique, and again assuming a required return of 10%, we can compute the PI of project B: PIB = $793, 726.83 = .99 $800,000 This tells us the present value of B’s “benefit” is nearly equal to its initial investment. Investing in B would ever so slightly reduce shareholder wealth. The decision rule for the profitability index is as follows: Accept all independent projects with PI > 1. If the projects are mutually exclusive, accept the project with the highest PI as long as it is > 1. Clearly, under either scenario, we would invest in project A, but not project B. Problem with PI: Although PI considers all of a project’s cash flows and considers the time value of money it is, in effect, a percentage. As such PI presents us with a scale problem. For example: Suppose I offer you two mutually exclusive investment opportunities: Deal A: You give me $1 now and I immediately give you $1.10. PI = $1.10/$1.00 = 1.10 Deal B: You give me $1,000 now and I immediately give you $1,050. PI = $1,050/$1,000 = 1.05 According to the PI decision rule, you should select Deal A. However, deal A only results in a profit of $.10 while Deal B provides a profit of $50. Clearly you would prefer Deal B but this is difficult to see if all you examine are the deals’ PIs.