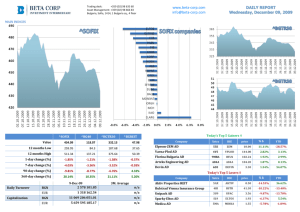

Example financial statements

advertisement