Reading Assignment 1 - Department of Agricultural Economics

advertisement

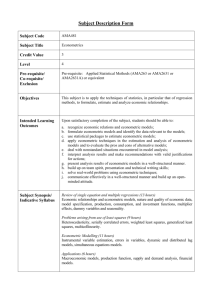

1 Introduction to Econometrics What is econometrics? Econometrics means different things to different people. Most economists, however, would agree econometrics is the application of statistical and mathematical methods to economic problems. Problems addressed using econometrics are almost endless. As such, econometrics has become the basis for economic and business analysis and forecasting. Students with a working knowledge of econometrics are a step ahead of other students in the job market. After college, knowledge of econometric techniques may help in job advancement. Beginning classes in econometrics are inevitably a source of frustration and concern for students. Very few students pick up the concepts without putting a sizable productive effort into the class. Why is econometrics a source of frustration and concern? From experience, it appears several reasons contribute to this source of frustration. First, econometrics is usually the first class most students take that integrates components and theory from various disciplines, namely, mathematics, statistics, and economics, along with minor components from other disciplines. Second, econometrics is usually taught assuming a basic knowledge of prerequisites. Although, the prerequisite knowledge necessary is small, students tend to focus on the need to remember prerequisite material from classes taken several semesters earlier. Experience has suggested by focusing attention on prerequisites, students have highly over estimated the prerequisite material necessary to understand econometric techniques. Comments such as “we needed to understand high level economic theory and calculus that we do not have” are common. When the truth is the high-level, economic theory the student was referring to is “demand curves slope downward.” Calculus required at the time of this comment was taking the derivative of a squared term. Only basic concepts are used in beginning econometrics. An unnecessary mental block is created even before the student is introduced to the material. Students who are not able to overcome this mental block perform poorly in econometric classes. Students want to place the blame on their lack understanding the prerequisites rather than on themselves for the lack of trying. Third, econometrics notation is different than notation used in previous classes. Learn the nomenclature, but do not use the new notation as an excuse for lack of understanding. Fourth, students do not put forth the effort at the beginning of the class to understand the initial problem setup. Failure to put forth this effort at the beginning of the class has consequences later in the class. Econometrics is a subject, there is no substitute for keeping current with the material and lectures. Students cannot comprehend the material by cramming the night before a test or doing their homework at the last minute. Fifth, econometrics lectures are not entertainment. A common paradigm arising in education is students must be entertained to learn. In reality, learning is hard work. Finally, giving the above reasons, students tend to fight the material and notation. To quote George Davis of the Department of Agricultural Economics at Texas A&M University, “Don’t fight it.” Don’t fall into the traps listed above. You will only get out of a beginning econometrics class what you put into it. Not surprisingly, the best advice to learning econometrics is to work hard, remain current on the lectures and homework, and ask questions. 2 Econometric Analysis Econometric analysis is an extremely powerful and versatile tool. However, like all methodological techniques, it is subject to proper use, along with abuse and misuse. One objective of this class is to introduce the statistical technique, ordinary least squares, and provide the basis for it proper application. Presented in table 1 (please note - for ease, most figures and tables are at the end of the reading assignments), is data on gross state product and per capita income level for 1997. As an economist, you are interested if there is a relationship between the gross state product and per capita income level. That is, does increasing gross state product lead to an increase in per capita income. If such a relationship exists, describing the relationship mathematically and statistically, along with making inferences from the relationship, is usually the next step. Data on per capita income and gross state product are graphed in figure 1. It appears that as gross state product increases, per capita income increases, although the relationship is far from perfect. Two questions are apparent. First, is the apparent relationship real or is it just a chance occurrence? Second, if it is a “true” relationship, can a relationship be found that represents the relationship between income and gross state product? The first question is usually answered using theory, that is, what does theory suggest about any relationships between per capita income and gross state product? Should one even be interested in this relationship? Econometric techniques can be used to provide inference or statistical tests of the existence of a relationship. Statistical tests although powerful cannot prove relationships exist. Instead, statistical tests indicate within an acceptable probability of an error, a relationship exists. Econometric techniques can be used to estimate the mathematical relationship, along with providing a foundation for statistical tests on the existence of a relationship between income and gross state product. As will be shown throughout this class, econometrics is used to turn observations on data points, such as in table 1 and figure 1, into specific mathematical equations. These equations are then used in economic modeling and forecasting. In addition, to obtaining specific equations, econometrics allows for statistical testing and inference. Components of an Econometric Analysis In figure 2, linkages and interactions between the different components that comprise an econometric analysis are illustrated. As illustrated, most of the linkages are two-way street. That is the flow of information is not one directional, but rather feedbacks exist. Each component is briefly described separately, but keep in mind the importance of the two-way linkages. Problem Identification. Before conducting an econometric analysis, a specific problem must be identified. As noted earlier, a wide range of problems can be addressed using econometrics. Examples of the types of problems econometrics can address include estimating and using price elasticities to determine how a price change may impact quantity sold, to forecasting product sales for next several years. In this class, it will be generally assumed the problem has been identified. Once a specific problem has been identified, analysis is undertaken. This class concentrates on the analysis and not identifying the problem. 3 Starting Point for the Analysis. The starting point for any econometric analysis is theory, economic theory or theory from other disciplines. For example, if you are interested in a demand relationship, economic theory indicates which variables are important in the demand function. Variables of interest would include own price, prices of substitutes and complements, income, and taste and preferences. If you are interesting in obtaining a production function for corn, agronomic theory provides information on important variables and how they might influence corn yields. Integration of theory is an important component. A priori knowledge, previous studies, and intuition are also important in conducting an econometric analysis. The role of these three components is often overlooked in teaching econometrics, but their role in applied studies is tremendous. Their role keeps analysts from reinventing the wheel. But, there is no substitute for the role of theory plays in economic analysis. The role of theory, however, cannot be over stressed. Data Collection. As noted earlier, econometrics turns data observations into specific mathematical equations for use in economic models and for statistical testing and inference. From this statement, it is clear; observations of the kind illustrated in table 1 and figure 1 are necessary for econometric analysis. Theory is the main source of information on data collection that is what economic variables should be collected. Next, a prior knowledge, experience, and prior studies contribute to determining which variables to collect. Finally, and unfortunately, availability of data ultimately determines which variables will be collected. Although an important component, data collection is not the main subject area for this course. Model Specification. Model specification involves which economic variables to include in the model and how they should be included. Obviously, the variables included in the model are related to the previous sections, staring point and data collection. The second issue how should the variable be included in the model will be covered in some detail in this class. This issue is often referred to as determining the functional form. Should the model be a linear equation? Or, should the model feature curvature, such as being a quadratic equation? To illustrate the importance of functional form, consider the following examples. Suppose you decide to estimate a demand equation. If you estimate a linear demand equation, the price elasticity of demand changes from elastic to inelastic as the quantity demanded increases. One could estimate a Cobb-Douglas type demand equation. Price elasticity of demand is constant over the entire range of the Cobb-Douglas demand equation. Conclusions drawn from these two different demand equations may be quite different. As a second example, consider estimating a production function. If a linear production function is estimated, the calculated marginal product is a constant. A constant marginal product indicates each additional unit of input provides the same amount of output. This contradicts economic theory of the “law of diminishing marginal returns.” One may be better off estimating a quadratic production function, which can provide diminishing marginal returns to the inputs. However, a quadratic production function introduces other problems. Trade-offs exist between the different functional forms. 4 These two examples illustrate the importance of determining the functional form. Further, the examples illustrate the interaction between the different components of an econometric analysis. As illustrated in the above examples, theory is important in helping determine the functional form. Another important determinate of the functional form is the use of the estimated model. Unfortunately, there is no silver bullet when it comes to the “proper” functional form. The reality is we do not know the proper functional form. Further, each functional form has pros and cons. This class examines some functional form issues. Estimation Procedures. At this point, you have identified a problem, collected data, and specified a functional form. This issue becomes how do you covert the data collected into a mathematical equation using all the data collected. That is, you do not want to throw away information contained in the data. In this class, considerable amount of time is devoted to deriving and using one econometric / statistical procedure, ordinary least squares (OLS), which converts data into a mathematical relationship. OLS is one of the most powerful and widely used econometric techniques. In deriving the OLS estimator, necessary assumptions and statistical properties are discussed. One often asked question is “because ‘canned’ programs exit that easily perform OLS, why should students learn how to derive the OLS estimator?” The most important response to this question is that because of the power and ease of using OLS it is often misused. Without knowing the background of OLS it is easy to violate the assumptions necessary to derive the estimator and its statistical properties. Inference derived from equations / data which violate the assumptions are suspect or possibly outright wrong. Do you want to make business decisions on wrong inference? Do you want your employment to hinge on such estimations? Further, by understanding the assumptions and possible violations, the student is making a large step forward to correction the problems by using advanced statistical techniques. Advanced techniques are beyond the scope of this class, but the basis is provided to understand these procedures. Along these lines, a statement often made by students is “I don’t need to know where it came from, just how to perform the estimation.” University’s are in the business of education and not vocational training. If a student only wants to learn how to do something, they should enroll in vocational school. Education involves much more than just doing, but also understanding where procedures come from and how to extend the procedures. Model Inference and Use. The main purpose for estimating an econometric model is to provide information concerning the original problem. Econometric models range from a single equation with a single variable for simple forecasting to very large policy models with tens of equations and hundreds of variables. Any student who has taken beginning economics has experienced economic model use and inference. Several simple examples are discussed. In your introductory economics classes, supply and demand equations were graphed. Did you ever wonder where the supply and demand equations came from? Econometric methods are used to estimate these equations. Once estimated, inference such as downward or upward supply equations can be made. Further use of the models was to find equilibrium price and quantity. Another use of such equations is to estimate price and income elasticities. Policy analysis can also be under taken to provide information on how changing some policy will impact the 5 equilibrium price and quantity. Most introductory classes also provide a discussion of production relationships. Econometric methods are used to estimate production functions. From the estimated functions, marginal product, average product, elasticities, etc. can be determined. The key here is econometrics provides the link from general theoretical concepts (i.e. just drawing a supply and demand graph) to specific mathematical equations that can be used in both academics and the business world. Statistics also plays an important role in the use and inference made from econometric models. Although statistics cannot prove any statement (recall there is always the chance of a type I or type II error), statistics are used to provide information concerning the fit of the estimated model to the data and provide inference on the estimated coefficients. Statistical inference will receive considerable attention in this class; as such it is not discussed further here. Statistical inference is highly interconnected to the estimation procedure. Discussion on inference and estimation is intermixed in this class. Conclusions The goal of this introduction was to introduce the idea of econometrics and provide motivation for understanding econometric basics. Econometrics provides one link from the general theoretical aspects discussed in introductory classes to applying the theory in business and economic settings. Three key aspects were discussed as they related to students in introductory econometric classes 1) econometric classes are different from other classes, 2) econometric classes are inherently tough, and 3) students must apply themselves and stay current with the material in order to understand the basics. There is no substitute for hard work. Several frequently encountered questions from students were answered. Important Terms / Concepts Econometrics Inference Estimation Why learn econometric basics? What is contained in each steps of an econometric analysis? What are some of the key concerns of beginning econometric students? Econometrics combines subject material from what subjects? Econometrics provides the link between what areas? 6 Table 1. State-Level Data on Gross State Product and per Capita Income for 1997. Gross State Per Capita Gross State Per Capita State Product Income State Product Income Alabama 104213 20899 Missouri 155811 23926 Alaska 26575 26898 Montana 18907 19920 Arizona 122273 21892 Nebraska 49275 24148 Arkansas 59141 19628 Nevada 59248 26789 California 1045254 26521 New Hampshire 37470 27238 Colorado 129575 27067 New Jersey 299986 31720 Connecticut 134968 34759 New Mexico 47829 19641 Delaware 31263 26807 New York 663377 29670 Florida 389473 24869 North Carolina 221629 23468 Georgia 235733 23911 North Dakota 15910 20520 Hawaii 38537 25765 Ohio 326451 24772 Idaho 29388 20534 Oklahoma 79423 20739 Illinois 400327 27950 Oregon 97510 24385 Indiana 162953 23418 Pennsylvania 347306 25635 Iowa 81695 23499 Rhode Island 29409 25643 Kansas 72998 24182 South Carolina 95447 20998 Kentucky 101535 20979 South Dakota 19767 21885 Louisiana 123549 20874 Tennessee 151738 22814 Maine 30409 22134 Texas 608622 23756 Maryland 154646 28857 Utah 55070 20613 Massachusetts 223571 30773 Vermont 15510 23026 Michigan 279503 25509 Virginia 212105 26385 Minnesota 152334 27086 Washington 175242 26469 Mississippi 58743 18580 West Virginia 38281 19351 Source: U.S. Department of Commerce. Bureau of Economic Analysis. http://www.bea.doc.gov/bea/regional/data.htm 7 Per Capita Income (in dollars) 40000 35000 30000 25000 20000 15000 0 200000 400000 600000 800000 1000000 1200000 Gross State Product (in 1000's dollars) Figure 1. Gross State Product and Per Capita Income for 1997 8 Theory, a priori knowledge, previous studies Data Collection Model Specification Problem Formulation Model Use and Inference Model Estimation Figure 2. A More Complicated Schematic of Econometric Analysis Showing Various Directions and Information Flows.