Exercise - CA Sri Lanka

advertisement

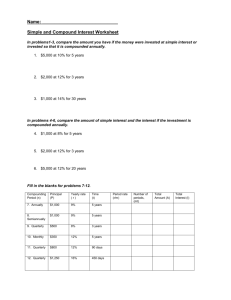

The Institute of Chartered Accountants of Sri Lanka Executive Diploma in Business and Accounting Tutorial 03: Financial Mathematics Financial Mathematics deals with problems of investing Money, or Capital. If the investor (an individual investor or company) puts some capital to an investment, a financial return will be expected. Investors may wish to know how much return will be obtained by investing money now for a given period or how much return will be obtained in n years time by investing some money every year for n years. The two major techniques of financial mathematics are compounding and discounting. These techniques are very closely related to each other. 2.1 .1 Simple Interest Simple interest is interest calculated on the principal only and which is a given proportion of original investment and duration. I prn Where I = Interest per period r = Interest rate n = the duration (normally years) P = Original sum invested Example : How much will an investor have after five years if he invests Rs.1,200 at 10% simple interest per annum?. Nishantha Palihawadana Page 1 2.1.2 Compound Interest The process of accumulating interest on interest on the investment over time. That is if a sum of money, the principal, is invested at a fixed rate of interest such that the interest is added to the principal and no withdrawals are made, then the amount invested will grow by an increasing in each successive time period, since interest earned in earlier periods will itself earn interest in later periods. A p(1 r )n Where A: The Sum invested after n periods p : the original sum invested n : the number of periods r : the annual interest rate if compounding has taken place several times per year: A p (1 r nm ) m where m is the number of times compound per year. 2.2 Continuous compounding If your number of compounding periods per year becomes infinite, then interest is compounded continuously. A pern 2.3 Discounting (present value) Discounting is the reverse of compounding. Its major application in business is in the evaluation of capital expenditure projects, to decide whether they offer satisfactory return to the investor. r nm ) m r Fv Pv (1 ) nm m Fv Pv r (1 ) nm m A P (1 Page 2 of 5 2.4 Net Present value The net present value (NPV) method works out the present values of all items of income and expenditure related to an investment at a given rate of return, and then works out a net total. If it is positive, the investment is considered to be acceptable. If it is negative, the investment is considered to be unacceptable. 2.5 Annuity An annuity is a finite set of sequential cash flows, all with the same values. Value of the ordinary annuity Ordinary annuity has the first cash flow that occurs at the end of the first period Va P (1 r / m) nm 1 r/m where p: annuity amount n: duration (Years) r: the interest rate m: number of compound per year Value of the annuity due Annuity due has a first cash flow that is paid immediately Va P (1 r / m)nm 1 r/m (1 r / m) Present value of the ordinary annuity p 1 (1 r / m) nm Pva r/m Present value of the annuity due p 1 (1 r / m) nm Pva (1 r / m) r/m Page 3 of 5 Depreciation Depreciation on reducing balance method can be calculated as follows: Nv Cost (1 r )n Where Nv = Net value of the asset r: Depreciation percentage Exercise: 1. A person is interested to invest Rs. 12,000 at a simple interest rate of 12% per annum. Calculate the interest he would have earned at the end of five years. 2. A person has borrowed Rs. 16,800 at a simple interest rate of 10% per annum from a company and settled after three years and six months. Find the amount he would have paid as interest at the end of this period. 3. A person gave a loan of Rs. 80, 000 at 10% simple interest rate to a friend. How long he has to wait to receive a total amount of Rs 200,000? 4. Mr. Fenando received Rs.27,200 after three years of depositing a sum of money in a bank which provides 12% simple interest. How much is the amount deposited originally. 5. A sum of Rs. 400,000 is invested on Simple interest, partly at 10% p.a. and partly at 12% p.a. if the total income is Rs. 42,000 per annum; find the amount invested at 10% p.a. 6. A client invests Rs. 500,000 in a bond fund projected to earn 7% compounded annually. Estimate the value of her investment after 10 years. 7. A person has deposited Rs. 14,600 in a financial Institute at a annual compound interest rate of 8% for three years. What would be the total value and interest after this period. 8. A client has a Rs. 5 million portfolio and invests 5% of it in a money market fund projected to earn 3% compounded annually. Estimate the value of this portion of his portfolio after seven years. 9. Find the interest rate necessary for Rs. 20,000 to occur to Rs.50,000 in 12 years under compound interest. 10. The finance manager has invested some money in a money market project. The amount will be doubled after 8 years. Compute the interest rate. Page 4 of 5 11. A financial institute provides 8% compound interest rate per year. How many years will it require to double the invested money. 12. Rs.125,000 was invested in a bank where annual interest rate is 18%. If the bank compound interest monthly what would be the total value after 3 yeas and nine months. 13. A company wishers to borrow money from a bank. Three banks have quoted different interest rates. Bank A will lend the money at 18.2% per year compounded quarterly. Bank B will lend at 18.4% per year compounded semi-annually. Bank C will lend money at 19% compounded annually. From which bank should the company borrow the money? 14. A person wants to deposit Rs.400, 000 for three years in order to earn some interest income. He can deposit in bank A at 12% per annum on simple interest and in bank B at 10% p.a. on compound interest. Advice him with necessary calculations, including which is more beneficial to him. 15. For liquidity purposes, a client keeps Rs. 100,000 in a bank account. The bank quotes a stated annual interest rate of 12 percent. The bank’s service representative explains that the stated rate is the rate one would earn if one were to cash out rather than invest the interest payments. i) With quarterly compounding, how much will your client have in his account at the end of one year, assuming no additions or withdrawals? ii) With monthly compounding, how much he have in his account at the end of one year, assuming no additions or withdrawals? iii) With continuous compounding, how much will he have in his account at the end of one year, assuming no additions or withdrawals? 16. A bank quotes a rate of 5.89 percent with an effective annual rate of 6.05 percent. Does the bank work with annual, quarterly, or monthly compounding? 17. A company invest Rs.100,000 and earned Rs.40,000 in the year 1 and Rs.50 000 in the year 2 and Rs. 20,000 in year 3. If the cost of capital of the company is 12%. Calculate the net present value. Page 5 of 5