English

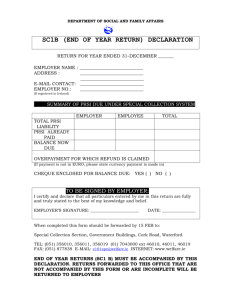

advertisement