Firm - AIB Midwest

advertisement

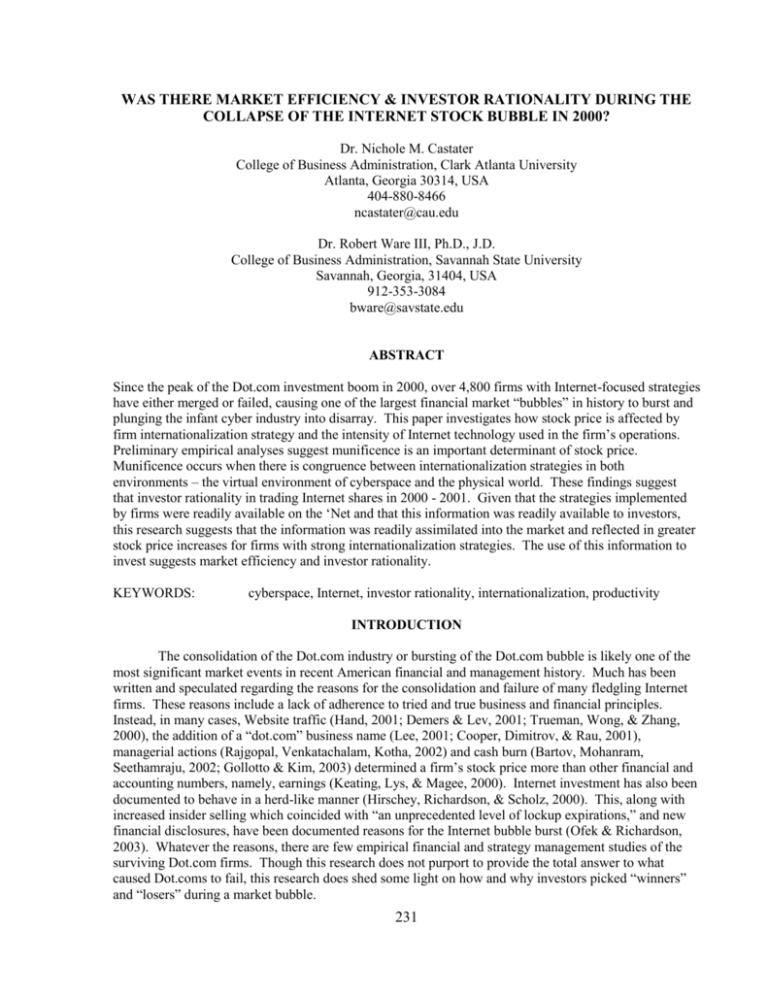

WAS THERE MARKET EFFICIENCY & INVESTOR RATIONALITY DURING THE COLLAPSE OF THE INTERNET STOCK BUBBLE IN 2000? Dr. Nichole M. Castater College of Business Administration, Clark Atlanta University Atlanta, Georgia 30314, USA 404-880-8466 ncastater@cau.edu Dr. Robert Ware III, Ph.D., J.D. College of Business Administration, Savannah State University Savannah, Georgia, 31404, USA 912-353-3084 bware@savstate.edu ABSTRACT Since the peak of the Dot.com investment boom in 2000, over 4,800 firms with Internet-focused strategies have either merged or failed, causing one of the largest financial market “bubbles” in history to burst and plunging the infant cyber industry into disarray. This paper investigates how stock price is affected by firm internationalization strategy and the intensity of Internet technology used in the firm’s operations. Preliminary empirical analyses suggest munificence is an important determinant of stock price. Munificence occurs when there is congruence between internationalization strategies in both environments – the virtual environment of cyberspace and the physical world. These findings suggest that investor rationality in trading Internet shares in 2000 - 2001. Given that the strategies implemented by firms were readily available on the ‘Net and that this information was readily available to investors, this research suggests that the information was readily assimilated into the market and reflected in greater stock price increases for firms with strong internationalization strategies. The use of this information to invest suggests market efficiency and investor rationality. KEYWORDS: cyberspace, Internet, investor rationality, internationalization, productivity INTRODUCTION The consolidation of the Dot.com industry or bursting of the Dot.com bubble is likely one of the most significant market events in recent American financial and management history. Much has been written and speculated regarding the reasons for the consolidation and failure of many fledgling Internet firms. These reasons include a lack of adherence to tried and true business and financial principles. Instead, in many cases, Website traffic (Hand, 2001; Demers & Lev, 2001; Trueman, Wong, & Zhang, 2000), the addition of a “dot.com” business name (Lee, 2001; Cooper, Dimitrov, & Rau, 2001), managerial actions (Rajgopal, Venkatachalam, Kotha, 2002) and cash burn (Bartov, Mohanram, Seethamraju, 2002; Gollotto & Kim, 2003) determined a firm’s stock price more than other financial and accounting numbers, namely, earnings (Keating, Lys, & Magee, 2000). Internet investment has also been documented to behave in a herd-like manner (Hirschey, Richardson, & Scholz, 2000). This, along with increased insider selling which coincided with “an unprecedented level of lockup expirations,” and new financial disclosures, have been documented reasons for the Internet bubble burst (Ofek & Richardson, 2003). Whatever the reasons, there are few empirical financial and strategy management studies of the surviving Dot.com firms. Though this research does not purport to provide the total answer to what caused Dot.coms to fail, this research does shed some light on how and why investors picked “winners” and “losers” during a market bubble. 231 Rajopal, et.al in their 2002 paper, found that managerial actions are determinants of stock price. In much this same way, this research seeks to determine whether internationalization decisions, either in the virtual or physical environments, affect stock price in the same manner. In previous research by Ware (2004), the researcher finds that virtual and international strategies actually diminish productivity. Ware (2004) found that the more domestic and focused the strategy, the higher the level of productivity achieved. This research seeks to determine whether the virtual and international strategies that cause productivity to increase, will also cause stock prices to increase. The question presented in this research is whether different internationalization strategies in the physical environment and cyberspace are associated with increased stock price. In order to explore the relationship between stock price and the virtual environment of cyberspace, a sample of one hundred firms with Internet-focused strategies were analyzed. To this end, a literature review, propositions, model presentation, and discussion of research results and implications follows. LITERATURE REVIEW This paper combines several areas of business research in an attempt to understand what existing research contributes to the understanding of stock price changes based in technology-based internationalization in unregulated international environments. The following sections cover the literature on the environment, strategy, finance and accounting performance that is pertinent to the investigation of Internet-focused firms. Each area of research literature will be discussed in turn. The Environment Virtual firms exist and operate in two environments – the physical and the virtual environment of cyberspace. By functioning in two environments, Internet firms face new challenges and opportunities, which affect their respective strategies. A firm’s environment has been conceptualized to be a principle construct for understanding the relationship between firm behavior and performance (Hofer & Schendel, 1978). The structure-conduct-performance paradigm has been the basic model used in industrial organizational economics (Prescott, 1986). According to the paradigm, firm performance is dependent on firm conduct, such as investment policies and pricing. Conduct depends on the structure of the industry (Scherer, 1980). An industry’s structure is defined by its concentration, level of product differentiation, barriers to entry, growth rate, and other factors. Studies by Bain (1959) and Scherer (1980) suggests that industry structure affects both conduct and performance. Strategic management scholars use the term “environment” as a surrogate for industry structure (Prescott, 1986). Likewise, conduct is called “strategy”. It is common in the strategic management literature to define strategy as a pattern of firm behavior (Smith & Grimm, 1987; Hambrick, 1983). Porter (1980) collected a comprehensive catalogue of how firm strategies and performance are affected by environment. These early studies suggested that different perceived and objective environments will have a moderating effect on the relationship between a firm’s strategy and its performance (Prescott, 1986). Strategic management considers the relationships of four constructs, namely: strategy, environment, organization, and performance (Summer, et al., 1990). Each of these constructs is multidimentional (Ketchen & Shook, 1996). Thompson (1997) suggests that environments can be divided into task and general elements. Hence, there is precedent in the strategy management literature for considering the internationalization environment as being comprised of two dimensions – the virtual and physical. The strategic management literature has investigated the effects of regulated environments on firm performance. Wyckoff (1976) found that regulated environments decreased organizational flexibility, innovation, and adaptiveness. Mahon & Murray (1981) suggested that focused strategies will be less important to firm performance in regulated markets than in unregulated markets. Smith & Grimm (1987) validated this assessment. In a study of the highly regulated U.S. railroad industry, Smith & Grimm (1987) found that few firms implemented focused strategies. The researchers suggested regulation reduced the benefits of implementing a focused strategy, and curtailed incentives to implement strategies most aligned with the regulated environment. 232 Internationalization Theory As well as being a virtual environment, cyberspace is international by its very nature. The international nature of cyberspace suggests the literature about internationalization may provide insights on firms with Internet-focused strategies. Internationalization process models are the focus of the literature. Internationalization process models define the stages and identify the determinants of firm internationalization. Moen (2002) proposes classifying internationalization literature into two, highly related groups – innovation process models and developmental process models, like the Uppsula model. In innovation process models, internationalization is considered an innovation of the firm. Developmental process models focus on the different stages of knowledge and commitment firms experience during their international development. In the Uppsala model, firms use acquisition, integration, and knowledge about a foreign environment in formulating and implementing internationalization strategies. The level of knowledge about a foreign environment suggests a level of market commitment equal to the level of knowledge. As the level of knowledge increases in the firm, the level of commitment increases. Firm knowledge is acquired through firm internationalization (Johanson & Vahlne, 1990; Yeoh, 2000), the experience of firm management (Harveston, Kedia & Davis, 2000), management’s mindset (Harveston, et. al, 2000), networking (Yeoh, 2000), and Internet usage (Yeoh, 2000). Empirical evidence supports the basic tenets of the Uppsala model. Researchers have validated the models basic premises over twenty years and in the context of many countries. Carlsson (1966) first suggested elements of the Uppsala model using a sample of Swedish firms. American researchers investigating Wisconsin manufacturing firms found support for the model (Bilkey & Tesar, 1977; Bilkey, 1978). Hawaiian exporters (Hook & Czinkota, 1988), Turkish exporters (Karafakioglu, 1986), and a study of Australian firms (Barrett, 1986) all found support for the basic tenets of the Uppsala model. Degree of Internationalization The investigation of internationalization has given rise to the study of quantifying the degree of internationalization (DOI) of the firm. Common measures of DOI include: foreign sales as a percentage of total sales (Daniels & Bracker, 1989; Geringer, Beamish & daCosta, 1989), the intensity of research and development (Caves, 1982), advertising intensity (Caves, 1982; Capon, Farley & Hoeing, 1990), export as a percentage of total sales (Sullivan & Bauerschmidt, 1989), foreign assets as a percentage of total assets (Daniels & Bracker, 1989), the number of foreign subsidiaries (Stopford & Wells, 1972), and lastly, foreign profits as a percentage of total profits (Eppink & Van Rhijin, 1988). DOI measures are typically investigated using the following financial performance variables – return on assets, beta, riskadjusted returns, sales growth, return on sales, return on equity, net profits, total risk, and leverage. Though the results of these studies have been varied (Sullivan, 1994), in general they support the hypotheses that the greater the degree of internationalization, the better the financial performance of the firm. To date, no studies have investigated the degree of internationalization and financial performance of firms with Internet-focused strategies. Another stream of research has investigated the factors that encourage firms with Internet-focused strategies to internationalize. Kotha, Rindova & Rothaemel (2001) found a mix of virtual and physical factors significantly determined the frequency of Website internationalization. The determinants that significantly predict the frequency of Website internationalization included intangible assets, such as Website traffic and reputation, and tangible assets, like cooperation and competitiveness (Kotha, et al., 2001). Harveston, et al. (2000) managers of born global firms tend to have a geocentric mindset and previous international experience. Neither study considered the dual environments in which firms with Internet-focused strategies operate nor did the analyses consider firm performance. Kotha, et al. (2001), Harveston, et al. (2000) and most of the born global literature examine firm formation with the aim of identifying the predictors and determinants of internationalization. The literature has yet to examine the link between firm performance and the dual environments in which firms with Internet-focused strategic compete. 233 Stock Price Performance Does the instant accessibility of global linkages equate to higher stock prices for Internet firms? This is one question the Internet technologies (IT) literature addresses by investigating the effects of implementing Internet-focused strategies on stock price. Two stunning determinants of Internet firm stock prices appear to be web traffic and “cash burn.” Hand (2001), Demers and Lev (2001), Trueman, Wong and Zhang (2000) found that the higher the level of web traffic, the more positive the effect on stock price. Cash burn, or the propensity of Internet firms to spend money on multiple endeavors, appears also to have a positive effect on stock price. Trueman, et al. (2000), Bartov, et al. (2002), and Gollotto & Kim (2003) find this to be the case. Applied to this research, virtual and international strategies require more cash burn. Therefore, the more virtual and international an Internet firm, the more likely its stock price will increase. Another component to Internet firm stock prices appears to be the fact that the market knows they are virtual. Lee (2001) and Cooper, et al. (2001) find that when a firm’s name changes to a “.com” name, stock price increases. It appears, according to these studies, that even the least virtual of the “.com” firms experiences positive and significant stock price movement after a name change. These findings seem to support the previously stated sentiment that the more virtual an Internet firm, the more likely its stock price will increase. Investor rationality in purchasing Internet stocks appears to be linked to the availability of firm information. (Keating, et al., 2000) Hirschey, et al. (2000) and Ofek, et al. (2002) found that investors were irrational as investors did not used publicly available information in deciding which Internet stocks to purchase. However, Hand (2001) found investors rationally used firm information, when web traffic was “immaterial.” In a discussion of Hand (2001), Talmor (2001) concluded that the conclusion of market rationality cannot necessarily be made given the results, and that Hand’s results could be attributed to a “spillover effect.” Even the findings of Keating, et al. (2000) have been disputed by Lewellen (2000), which stated that even though Keating, et al. found the stock price decline in 2000 could be partly attributed to 1999 annual report data, the results are unlikely to repeat, and hence are not applicable to other firms or time periods. Given the set of assertions just presented, it appears that the literature on Internet firms and stock price is still undecided, at best, concerning the determinants of Internet firm stock price. This research will shed light on investor rationality by showing which strategies, whether domestic, international, virtual, or balances of all of these, are the strategies that lead to stock price growth. If munificence, or the congruence of strategies, actually leads to stock price growth, this will help confirm the presence of rationality in Internet firm investment. HYPOTHESES According to the literature, several quantifications of management strategy are expected to increase firm performance. The quantifications of management include munificence, internationalization, and focus. Rational investors will seek out and prefer to invest in firms with sound management strategies and these firms should experience greater share price gains than firms that do not implement management strategies known to be associated with increased firm performance. H1a: Munificence increases firm performance and hence firm stock price performance. [from SM literature] H1b: Internationalization increases firm performance and hence firm stock price performance. [from DOI and IB literature] H1c: Focus increases firm performance and hence firm stock price performance. [from SM literature] A central tenet of strategic management is that firms must maintain a proper alignment with their environments. Specifically, the strategic focus of firms must align with the environment or environments in which the firms operate. Mahon & Murray (1980) argue that in chaotic environments, firms must play 234 particular attention to focus resources and strategies on specific strategic areas for optimum performance. Alignment is important for two reasons – (1) because firms are dependent upon their environments for resources (Pfeffer & Salancik, 1978); and (2) firms can manage this dependency by developing, implementing, and maintaining strategies that fit the environments in which they must operate (Hofer & Schendel, 1978). H2: Firms that utilize higher levels of Internet technology in their business operations and strategies will have higher changes in stock price than firms that utilize lower levels of Internet technologies. The exponential growth the Internet experienced during the late 1990’s can be argued to be a chaotic and unregulated environment. International theory suggests that internationalization positively impacts firm performance. It is expected that firms with Internet-focused strategies that implement internationalization strategies in tandem and that are focused on internationalizing in cyberspace and in the physical environment will be more productive than firms with unfocused, domestic strategies. SAMPLE The sample is comprised of one hundred firms representing 977 internationalizations to forty-four countries. 267 of the internationalizations occurred in cyberspace. Of the one hundred firms, stock price changes were available for eighty-six of the firms in the original sample. Two published indices of Internet firms were used to define the sample of this research. From 1998-2002, USA Today published an index of Internet firms listed on the NYSE and NASDAQ. To supplement this listing, an index of fortysix Internet firms was obtained from AMEX (the American Stock Exchange). In total, 171 Internet firms were identified through these lists. The resulting catalog of firms was reviewed to remove overlap, as over thirty firms were listed in both indices. Three firms were removed from consideration because they were not American. Removal of redundant and non-American firms reduced the total sample to one hundred and one firms. All data in the study were as of 2001. Data sources included SEC 10-K Forms, company annual reports, Yahoo! Finance1, REUTERS2, company Websites, Mergent’s Industrial Manual (2003), and Mergent’s OTC Industrial Manual (2003, 2002). Given the speculative nature of the Dot.com bubble and the short life span of many Internet start-ups, the use of firms whose shares traded on major exchanges increases the reliability of the financial and other data used in this analysis. All stock price data is adjusted for outstanding shares and for the annual increase of the respective stock markets on which the shares were traded. Since the 2001, the year for which all data was collected, only one company, Checkpoint Systems, of the one hundred and one firms in the sample were either bought, shutdown, or merged. The acquiring firm is a member of this research’s sample. VARIABLES The dependent variable in this study is stock price defined as the change annual change in share price from 2000 to 2001 adjusted for stock splits, warrants, and new share issues (STKPRC). STKPRC was calculated by dividing the firm’s 2000 average stock price by 2001 stock price. The independent variables in this research are a count of Website internationalizations (NUMWEB), a count of foreign direct investments made by the firm (NUMFDI), VIRTUAL, STRAT, MUNIFN, PROEMP, and DOTCOM. NUMFDI and NUMWEB are counts of the number of internationalizations in two environments. NUMFDI and NUMWEB represent firm internationalization 1 2 www.yahoo.finance.com www.reuters.com 235 performance. Cluster analysis was applied to NUMFDI and NUMWEB to identify the type of internationalization strategy implemented by the firm. Table 1: Research Variables, their Definition, and Sources Measures Host Country Web Pages Host Country FDI’s Variables NUMWEB NUMFDI Firm X Country Number of Employees Revenues LOGEMP Firm LOGREV Firm Employee Productivity Environment PROEMP Firm VIRTUAL Firm Firm Strategic Posture Munificence STRAT Firm MUNIFN Firm Change in Stock Price STKPRC Firm 10. Company Founding FOUND Firm 11. 12. Industry Firm Name INDUS DOTCOM Firm Firm 1. 2. 3. 4. 5. 6. 7. 8. 9. Dimension(s) Firm X Country Collection Criteria To qualify, the Web page had to be in local language with local links and content Physical location or FDI in Country; from Form 10-K Reports, Annual Reports, Websites Count of employees reported by firm annual reports, Yahoo! Finance, REUTERS Revenues for 2001 fiscal year reported by annual reports, Mergent’s Industrial Manual (2003) and OTC Industrial Manual (2003, 2002) LOGREV ÷ LOGEMP Degree of adoption of Internet technologies in firm’s business operations Groups of strategic posture identified using cluster analysis. Harmony between Website and FDI strategies Annual change in stock price adjusted for new issues and for the relative annual change in the stock market on which each respective share traded. Year firm was started; from Form 10-K Reports, Annual Reports or company Websites Service v. Manufacturing v. Finance Whether “.com” is used in the firm name. The table above provides sourcing and other details of the data used for the variables in this research. The environment variable, VIRTUAL, measured the extent of Internet dependence of the firm. Assessing the exact level of a firm’s Internet use was difficult to quantify with public archival data – the only source available for this study. Firms with Internet-focused strategies cover the spectrum of Internet dependence from being pure Internet plays, such as Yahoo!, to firms that conducted only some aspect of their affairs via the Internet, Barnesandnoble.com for example. VIRTUAL, was scored on a four-point scale. The firms in the sample were rated on whether the Internet was used for advertising or marketing, sales, customer service, and distribution. Firms were given a “0” representing an advertising or marketing presence. Since all firms in the sample had Websites, all firms rated at least a “0”. A “1” rating was given if the firm also sold products via the Internet. “2” represented firms that provided customer service, and “3” represented distributed products via the Internet. Two strategy variables were used in the analysis. The first strategy variable was STRAT; the firm’s internationalization strategy. STRAT represented the strategy used by the firm to internationalize in cyberspace and in the physical environment. The cluster groups that comprise STRAT were labeled and coded “1” for Cluster 1; “2” for Cluster 2; “3” for Cluster 3; “4” for Cluster 4; “5” for Cluster 5; “6” for Cluster 6; and “7” for Cluster 7. 236 Munificence (MUNIFN) was the second strategy variable included in the regression. MUNIFN, a Boolean variable, measured the munificence between cyberspace and physical world internationalization strategies. Munificence is the agreement of the two strategies in the two environments. Firms that implemented focused strategies in both cyberspace and in the physical environment were coded “1”. Mixed strategies, where the firm pursued a domestic strategy in one environment and an international strategy in the other environment, were not concordant and, thus, were coded “0”. Three control variables were used and accounted for the type of industry, firm size, and the firm’s age. Since, the sample is a mix of manufacturers, finance, and service firms, the Boolean control variable Industry (INDUS) was used to distinguish between the three types. INDUS was coded “0” for service firms, “1” for manufacturers, and “2” for financial firms. The firm’s founding year (FOUND) was seen to be important given the Internet’s relative newness. FOUND was used to normalize differences in opportunity time between firms of different ages. Firm size (LOGREV) was controlled by using the log of each firm’s 2001 revenues. DOTCOM was a variable inspired by Cooper, et al. (2001). DOTCOM was a Boolean variable coded “0” for firm names that did not include a “.com” suffix and “1” for those that did. PROEMP was calculated by taking the log of the firm’s 2001 revenue divided by the log of a count of the firm’s 2001 employees. ANALYSIS The objectives of this analysis are to identify strategies firms use to internationalize in two environments, and to determine if the strategic posture of firms with Internet-focused strategies is related to change in stock price. Collapsing internationalizations in two environments into one dimension will provide a measure of firm internationalization that more accurately reflects today’s business environment. Given the mutlidimensionality presented by considering internationalizing in two environments, cluster analysis is an appropriate method for distinguishing common profiles with distinct characteristics among distinct variables (Ketchen & Shook, 1996). The purpose of cluster analysis is to group observations such that each cluster is as homogeneous as possible with respect to the clustering variables, but is also significantly different from other cluster groupings. According to Ketchen & Shook (1996), “cluster analysis permits the inclusion of multiple variables as sources of configuration definition…” and “that [the] configurations represent a way to meaningfully capture the complexity of organizational reality.” Today’s business reality is that firms can internationalize in either cyberspace, via FDI, or both. In this study, cluster analysis was used to identify joint physical world and cyberspace internationalization strategies, derived from combinations of NUMFDI and NUMWEB. Cluster analysis is a heuristic technique and, therefore, requires establishing the reliability and external validity of the cluster solution. Ketchen & Shook (1996) recommends application of deductive reasoning in selecting variables with solid theoretical foundations. A count of internationalizations is a long established measure of internationalization performance. Kotha, et al. (2001) used a count of Website internationalizations to define some determinants of cyberspace internationalization. Moen & Servais (1997) used counts of countries to argue that some so called “born global” firms may actually internationalize gradually. The international business literature has measured DOI using non-financial measures such as firm growth quantified as counts of countries, offices, products sold, personnel or other quantifiable physical assets. Davidson (1980) used counts to illustrate the FDI patterns of American firms. Given the strong theoretical and empirical foundation of count variables in internationalization studies, NUMFDI and NUMWEB meet Ketchen & Shook’s (1996) standard. Ketchen & Shook (1996) recommends splitting the sample in two and reserving one subs-sample for reliability testing. This cross-validation procedure is also recommended by McIntyre & Blashfield (1980) for establishing cluster solution reliability. In this study, the sample of one hundred and one firms was split into sub-samples of fifty and fifty-one firms. Assignment to the two sub-samples was purely random, except that care was taken to have equal representation, by industry, in each sample. 237 One sub-sample was selected and subjected to cluster analysis. Several clustering techniques and cluster iterations were used to show reliability of the cluster memberships (Ketchen & Shook, 1996). To this end, several hierarchal clustering linkage methods were used, including average, single, complete, centroid, Ward’s, and McQuitty’s. Different distance measures were used in conjunction with the six linkage methods, and included Euclidean, Pearson, and Manhattan measures of distance. Hierarchical clustering methods do not require a priori knowledge of the number of clusters. Since the various hierarchical methods differ in how intercluster distances are calculated, multiple methods are used to determine if a common pattern of cluster solutions exists across the methods. With the strategy clusters identified, labeled, and tested for reliability and validity, a hierarchical moderated regression was used to test for the main effects between environment which is cyberspace in this research, strategy, the firm’s cluster membership, and firm internationalization performance. In hierarchical moderated regression, the predictor, independent, and control variables are initially specified (Cohen & Cohen, 1983). The following equation modeled and tested the relationships between firm stock price performance and firm internationalization strategy: YΔSP = F0 + F1X1 + F2X2 + F3X3 + F4X4 + F5X5 + C1 + C2 + C3 + EQ 1 Where YWEB is the count of Website internationalizations (NUMWEB) for each firm, F0 is the intercept, X1 is the firm’s internationalization strategy (STRAT) as defined by its cluster membership, X 2 measures the munificence (MUNIFN) between cyberspace and physical world internationalization strategies, X3 represents the degree to which the firm uses Internet dependent strategies in its operations (VIRTUAL), X4 represents whether firm stock price was affected by branding (DOTCOM), and X 5 represents the firm’s employee productivity level (PROEMP). C1 represented the type of industry (INDUS) in which the firm operates. INDUS was coded “0” for service firms, “1” for manufacturers, and “2” for financial organizations. C3 is the founding date (FOUND) of the firm. C3 is the log of firm 2001 revenues, (LOGREV). The regression results were then explored on a cluster-by-cluster basis to determine which internationalization strategies were the most productive. This was accomplished by using difference of means tests to determine whether internationalization via cyberspace increased firm stock price. Onetailed tests were used because all comparisons were testing for deviations in a particular direction from μ. One-sided tests are best in cases where the alternative hypothesis is not testing for equality, but for a difference. All difference of means tests in this study checked for differences in one direction, the purpose of which is to determine if the internationalization or the virtual intensity of the firm are associated with greater than or lesser than a mean value. RESULTS A correlation matrix for the dataset is provided in Table 3, and includes Pearson correlations and -values. Multicollinearity (Ketchen & Shook, 1996) was nonexistent in the cluster analysis given the low correlation between NUMWEB and NUMFDI (σ = 0.272). Graphs of RS, RMSSTD, SPR, for the various clustering techniques, and a scree plot of the eigenvalues of the factors used in this study, suggested a five, six or seven cluster solution. After evaluating the cluster solutions of the average, single, complete, centroid, Ward’s, and McQuitty’s techniques, Ward’s method was preferred because its clustering solutions were found to be more reliable and valid. With the clustering technique chosen, the number of cluster groupings was decided. The Ward’s method cluster solutions for five, six and seven clusters were examined. The modified Perlmutter schema suggests a cluster solution of five or greater. The highest sum-of-squares for each cluster solution ranged from 1,268 to 665 to 278, for five, six and seven cluster solutions, respectively. Given the aim of cluster 238 analysis is minimize within-cluster sums of squares and maximize between-cluster sums of squares, the increased homogeneity of the six and seven cluster solutions was of interest. The hierarchical analysis is therefore validated. With the hierarchical analysis validated, the clusters were named Cluster 1 – Domestic; Cluster 2 – Multinational; Cluster 3 – International; Cluster 4 – Global; Cluster 5 – Balanced; Cluster 6 – Virtual; and Cluster 7 – PreVirtual. Table 2: Correlation Matrix LOGREV PROEMP FOUND NUMWEB NUMFDI INDUS VIRTUAL MUNIFN ClusW7M PROEMP -0.120 0.231 FOUND -0.246 0.013 0.308 0.002 NUMWEB 0.124 0.215 -0.092 0.361 -0.172 0.086 NUMFDI 0.186 0.063 -0.298 0.002 -0.341 0.000 0.272 0.006 INDUS 0.076 0.452 0.097 0.335 -0.262 0.008 -0.082 0.412 0.314 0.001 VIRTUAL -0.085 0.397 -0.086 0.393 0.121 0.228 0.276 0.005 -0.161 0.109 -0.450 0.000 MUNIFN 0.020 0.844 0.126 0.210 0.092 0.360 0.253 0.011 -0.252 0.011 -0.219 0.028 0.333 0.001 ClusW7M 0.122 0.223 -0.300 0.002 -0.352 0.000 0.078 0.437 0.680 0.000 0.333 0.001 -0.294 0.003 MODW7M -0.026 0.800 -0.179 0.073 -0.135 0.179 0.390 0.000 0.286 0.004 -0.182 0.068 0.710 0.000 -0.494 0.000 0.076 0.449 0.279 0.005 With the strategic clusters identified, strategic posture was regressed against internationalization performance. The correlations between the predictor and criterion variables were low. Thus, moderating effects were not adversely affected by mutlicollinearity. If there was a high correlation between two measures, then it would be inappropriate to include both variables in the same liner equation as multicollinearity would surpass the acceptable threshold for variance inflation factors (VIF > 10.0) and violate the assumptions of the general linear model (Lomax, 1992). The Variable inflation Factors (VIFs) for the regressions were well below the threshold heuristic of 10.0, evidence that multicolinearity was not a problem in the regression analyses. Anderson-Darling normality, skewness, and kurtosis tests were also performed. These descriptive measures were found to be within acceptable norms. Hypothesis 1a was supported. Regression Model 1 demonstrates that munificence of firm strategy (MUNIFN) has significant power in predicting firm stock price movement. The predictor variable, MUNIFN, was found to be a significant factor in predicting STKPRC with ρ = 0.010. Agreement between firm strategy in both physical and virtual environments positively influenced stock price. All other predictor variables and control variables were not found to be significant in predicting STKPRC. 239 Hypothesis 1b was supported. Difference of means tests showed significant differences in the average change of firm stock price between firms that implemented highly international strategies versus firms with purely domestic strategies (Multinational > Balanced and Balanced > Virtual, both with a 99% CI). This finding suggests that investors had a preference for firms with physical internationalizations (FDI’s) and discounted firms that internationalized via cyberspace. Hypothesis 1c was supported. Internationalization can be viewed as a strategic focus and hence internationalizing on the Web could be seen as a continuation of internationalization strategy. Difference of means tests between firm strategies showed that investors significantly favored physically internationalized firms over domestically focused firms (Multinational > Balanced with a 99% CI). Hypothesis 2 was not supported. The regression showed no significant relation between VIRTUAL and STKPRC. VIRTUAL was not found to be a significant factor in predicting STKPRC with ρ = 0.183. Table 3: Hierarchical Moderated Regression Analysisfor Internationalization Performance Model 1 Dependent Variable: STKPRC Constant 18.36 Model 2 Model 3 Model 4 38.77 47.38 78.78 -0.185 -0.190 -0.141 VIRTUAL 0.255 0.267 0.261 MUNIFN -1.178 Strategy Variables: STRAT Literature Variables: DOTCOM ** -1.223 0.389 PROEMP -1.247 ** -0.496 0.714 Control Variables: INDUS FOUND LOGREV Statistics: Adjusted R2 R2 F Df One-tailed test with: ** ** *** -0.006 -0.407 -0.142 -0.017 -0.307 -0.040 -0.021 -0.308 -0.005 -0.038 -0.183 -0.176 0.0% --0.78 86 0.015 0.001 3.9% + 0.79 1.57 86 3.2% - 0.7 1.41 86 4.7% + 1.5 1.52 86 Changes in stock price varied significantly across the seven strategic clusters. In general, firms with Internet-focused strategies that internationalized realized significantly greater increases in stock price than firms with Domestic strategies. When firms internationalized in roughly equal measure in both environments, i.e., implemented a Balanced internationalization strategy, the changes in stock price of these firms were significantly greater than firms with Domestic strategies. Lastly, changes in stock price appear to favor firms with strong FDI performance as opposed to cyberspace internationalizations. 240 DISCUSSION The primary finding of this research is that the change in stock price, of firms with Internetfocused strategies, rose as the degree of internationalization increased. This research reinforces previous research in this area on cash burn. (Bartov, et al. 2002) A higher degree of internationalization corresponds with higher investment, and hence higher stock price. A second finding of this study hints at a form of market rationality by the Internet firm investor. Since the Internet is an international medium, investors could have perceived that firms with highly international strategies and operations could take the most advantage of the Internet. The results confirm this, because firms with high degrees of international physical operations, no matter how extensive their virtual presence, experienced the highest changes in stock price in response to virtual strategies. This corresponds with the literature mentioned earlier concerning Dot.com name changes. However, market irrationality can be argued in that stock price should rise with the more productive firms. Domestic firms, which have more focused strategies, were found to be more productive in Ware (2004), but it was these very same companies whose stock prices changed the least. This corresponds with other literature which finds that earnings and its components are not used to determine stock price in virtual firms. (Rajopal, et al., 2002) And in the case where these financial variables are compared with other non-financial variables, the non-financial variables have more influence over stock price. The third finding is that the degree to which IT strategies are implemented is not significantly related to changes in firm stock price. This research suggests that Internet technology intensity was less highly valued by investors than internationalization performance in the physical environment. The functional nature of the Internet may be a factor in affecting the relationship between change in stock price and internationalization performance of firms with Internet-focused strategies. The factor to be considered is the incidental viewing issue identified in Kobrin (2001) and in the landmark case, Zippo Manufacturing Corp. v. Zippo Dot Com, Inc., 952 F. Supp. 1119, (W.D.Pa.1997). Zippo was an Internet domain name dispute between the manufacturer of “Zippo” lighters and a California-based Internet news service, Zippo Dot Com. In its decision, the court observed that the very nature of the Internet allowed nearly any user anywhere to view any posted Webpage irrespective of whether the Webpage in question is specifically directed toward specific users. This effect, called “incidental viewing” may decrease the need to and the benefits of internationalizing Webpages. Firms with Internetfocused strategies must realize their pages can be viewed by all Internet users, thus making any page internationally available. This leaves the firm with the option of internationalizing Webpages, at a cost, including a loss in productivity (Ware, 2004) or adopting a less aggressive internationalization strategy by simply posting firm, product or service information on a “domestic” Website. Though the Website appears to be domestic in its intent, contents, and focus, the fact is that the Website to posted in an international environment. In effect, the Website is an international billboard, with the potential intent of the firm to passively internationalize by posting information in an international environment. Once the information is posted, it is up to firm to decide whether to honor international sales. Incidental viewing may decrease the relative importance of internationalizing via cyberspace and may further cloud the relation between productivity and internationalization. Incidental viewing also clouds the differences of what is meant by internationalizing in cyberspace. Is internationalizing in cyberspace simply having a presence on the WWW? Or does cyberspace internationalization mean increasing the internationality of the Website through host country customization in terms of language, format, look and feel, contents, functionality, and compliance with host country laws and customs? Are so called international “top-level” domains, such as, ‘.org’, ‘.com’, ‘.net’, ‘.gov’, and ‘.edu’, more international than country-level domains, such as ‘.us’, ‘.kz’, ‘.be’, or ‘.jp’? If there is a quantitative difference between domains, then should evaluation of internationalization performance consider the strategic choice of internationalizing via top-level versus country-level domains? Finally, it is possible that domain types are relatively less important than a quantitative appraisal of Website performance. Some measures commonly available are Website traffic and sales. 241 The inclusion of Website traffic could provide another measurement of cyberspace internationalization intensity. The sample and the cluster centroids of the groups support this supposition. The Domestic cluster averaged less than one Website and less than three FDI’s. Domestic firms use only one Website in their Internet strategy. This single presence is likely more significant to the firm’s international development than its initial FDI’s. The data supports these assertions. Graph #1 shows a productivity benefit to having a Website. The Website productivity gain is quickly lost as the firm continues to internationalize in cyberspace. Productivity starts to increase sharply after the third or fourth internationalization, peaks around ten internationalizations, and then steadily declines. Incidental viewing is one explanation of the initial benefit of having a presence on the WWW. Incidental viewing allows the Website to be viewed all Internet users, making the page instantly international. Firms with Domestic strategies may perceive the returns to internationalizing their Website as being low, either due to perceive or actual increased IT costs or due to perceived lower rates of attracting Internet users through customization. CONCLUSION The Internet is an environment separate and unique from the physical environment most familiar to firms. Likely the biggest difference between the cyberspace and the physical environment is not the fact that the Internet is a virtual environment, it is the fact that the Internet is an international environment. In the physical world, firms have the ability to choose which host country jurisdictions they will avail themselves. Firms can choose, to an extent, the degree to which they are exposed to the physical international environment. As a result, firms in the physical world can harness domestic strategies perfectly suited for and limited to the domestic physical environment in which the asset is geographically located. Unfortunately, it appears firms have fewer choices in the virtual environment of the Internet. Once a presence is established on the Internet, a firm is operating in an international environment, whether its strategy is internationally focused or not. If a firm does opt for an international strategy, the costs and benefits to the firm are linked to the environment in which the firm internationalizes. Internationalizations in the physical environment, i.e., FDIs, appear to have a positive effect on firm stock price. Financial markets may recognize the benefits of internationalization enjoyed by firms with Internet-focused strategies. On 21 December 2003, eBay announced it was opening a Chinese language auction site targeted at the Hong Kong market with prices in Hong Kong dollars.3 This initiative was a major international expansion for eBay. The day eBay announced the opening of this new Website internationalization, the stock increased 2.2%4 compared to an increase in the NASDQ index of 0.3%5. This research is based on the survivors of the Dot.com consolidation. A major concern is survivorship bias. (Agarwal & Naik, 2000; Elton, Gruber, & Blake, 1996) Survivorship bias results in an overestimation of past returns and leads investors to be overly optimistic in predictions of future returns. From 1999 through 2002, the worldwide Internet industry has faced sharp contraction and consolidation. Actual numbers reflecting the overall level of consolidation are most difficult to find, however, the information available in the United States, the country with the largest Internet industry and the country that has suffered the most industrial change, is telling. At least three American Websites are devoted to tracking structural changes in the Dot.com industry – Webmergers.com, Dot-Comdeathwatch.com, and Downside.com. 3 http://investor.ebay.com/releases.cfm?year=2003. Yahoo! Finance, http://finance.yahoo.com. 5 Ibid. 4 242 Table 4: Worldwide Internet Mergers, Acquisitions and Shutdowns6 Internet-related Mergers Number of Mergers Internet Failures 1998 1999 2000 2001 2002 137 465 910 1,289 1,085 224 537 170 9317 Internet companies have closed since January 2000 with over 58%8 of the closings occurring in 2001. The rate of industry consolidation, as reflected in the merger and acquisition activities, has increased. The United States accounted for 92% and 96% of all merger activity in 1998 and 1999, respectively.9 The sample is comprised of Dot.com survivors. Therefore no inferences can be made between this sample and non-survivors. It is possible that surviving and non-surviving firms implemented different internationalization strategies and realized different productivity levels. It is also possible the firms in the sample survived the Dot.com bubble is because they implemented international strategies. Future studies should investigate the differences among these two groups. This research did not investigate how or why some firm’s with Internet-focused achieve success when limiting their operations to domestic strategies. Future studies should investigate under what conditions firm’s with Internet-focused strategies identify, exploit, and protect business domestic Internet strategies. Several factors, such as the geographic concentration of the Internet community to which the firms services, economics, financial constraints, available resources, and trade barriers, may constrain or encourage the firm to the self-limit its horizons. The legal concept of jurisdiction is one barrier that is well documented and understood to significantly impact operating environment of firm’s conducting business on the Internet. Yet, the legal aspect of cyberspace has not been studied in the strategy management literature. During the Internet bubble, pundits claimed that cyberspace was the wave of future.10 This was true even though the manner in which firms with Internet-focused strategies would earn a profit or be financially viable long-term.11 A strict interpretation of the result of this analysis is that employee productivity increases as the virtual nature of the firm and the degree of internationalization of the firm increases. This paper suggests that, in general, firms with Internet-focused strategies will benefit from improved financial performances by internationalizing their virtual resources. REFERENCES Agarwal, V.& Naik, N.Y. (2000), Multi-Period Performance Persistence Analysis of Hedge Funds, Journal of Financial and Quantitative Analysis, Vol. 35, Iss. 3; p. 327-343. Agarwal, S. & Ramaswami, S.N. (1992), Choice of Foreign Market Entry Mode: Impact of Ownership,Llocation, and Internationalization Factors, Journal of International Business Strategy, 23(1), pp. 1-27. Bain, J.S. (1959) Industrial Organizations, New York: John Wiley & Sons. Barrett, N.J. (1986), A Study of the Internationalization of Australian Firms, doctoral dissertation, University of New South Wales. 6 Webmergers.com. InterActive Week Online, November 2001. 8 Ibid. 9 Webmergers.com 10 Tim Russert, Meet the Press, 11 Jan ’04. 11 Ibid. 7 243 Bartov, E., Mohanram, P., Seethamraju, C., and Berger,P.G. (2002) Valuation of Internet Stocks--An IPO Perspective / Discussion, Journal of Accounting Research, Vol. 40, Iss. 2; p. 321-347. Bilkey, W.J. (1978), An Attempted Integration of the Literature on the Export Behavior of Firms, Journal of International Business Studies, No. 9, pp. 33-46. Bilkey, W.J. & Tesar, G. (1978), The Export Behavior of Smaller-Sized Wisconsin Manufacturing Firms, Journal of International Business Studies, No. 8, pp. 93-96. Capon, Noel, Farley, John U., Hoenig, Scott (1990), Determinants of Financial Performance: A Meta-Analysis, Management Science, Vol. 36, Iss. 10, p. 1143-1160. Carlsson, S. (1966), Investment in Knowledge and the Cost of Information, Acta Academiae Regiae Scientiarum Upsaliensis. Caves, Richard (1982), Intra-industry Trade and Market Structure in the Industrial Countries, Oxford Economic Papers, Vol. 33, Iss. 2, p. 203-224. Cohen, J. & Cohen, P. (1983), Applied Multiple Regression/Correlation Analysis for the Behavioral Sciences, Hillsdale, NJ: Lawrence Erlbaum Associates. Cooper, Michael J., Orlin Dimitrov, P Raghavendra Rau (2001), A Rose.Com by Any Other Name, The Journal of Finance, Vol. 56, Iss. 6, p. 2371. Daniels, John D. & Bracker, Jeffrey (1989), Profit Performance: Do Foreign Operations Make a Difference?, Management International Review, Vol. 29, Iss. 1, p. 46-57. Davidson, W.H. (1980), The Location of Foreign Direct Investment Activity: Country Characteristics and Experience Effects, Journal of International Business Studies, Vol. 11, No. 2., pp. 9-22. Demers, Elizabeth & Lev, Baruch (2001), A Rude Awakening: Internet Shakeout in 2000, Review of Accounting Studies, Vol. 6, Iss. 2-3, p. 331. Elmuti, Dean (2003), Impact of Internet Aided Self-Managed Teams on Quality of Work-Life and Performance, Journal of Business Strategies, Vol. 20, Iss. 2, p. 119. Elton, E.J., Gruber, M.J., Blake, C.R.(1996), Survivorship Bias and Mutual Fund Performance The Review of Financial Studies, Vol. 9, Iss. 4; p. 1097-1121. Eppink, D. Jan, Van Rhijn, Bas M. (1988), The Internationalization of Dutch Insurance Companies, Long Range Planning, Vol. 21, Iss. 5, p. 54-61. Geringer, J. Michael, Beamish, Paul W., daCosta, Richard C. (1989), Diversification Strategy and Internationalization: Implications for MNE Performance, Strategic Management Journal, Vol. 10, Iss. 2, p. 109-120. Gollotto, Jamie C, Sungsoo Kim (2003), Patrington Market Valuation of Dot Com Companies: R&D Versus Hype, Managerial Finance, Vol. 29, Iss. 11, p. 61. Hambrick, Donald C. (1983), Some Tests of the Effectiveness and Functional Attributes of Miles and Snow's Strategic Types, Academy of Management Journal, Vol. 26, Iss. 1, p. 5. Hand, John R. M., (2001) The Role of Book Income, Web Traffic, and Supply and Demand in the Pricing of U.S. Internet Stocks, European Finance Review, Vol. 5, Iss. 3, p. 295. Harveston, Paula D., Ben L. Kedia, Peter S. Davis (2000), Internationalization of Born Global and Gradual Globalizing Firms: The Impact of the Manager, Advances in Competitiveness Research, Vol. 8, Iss. 1, p. 92. Hirschey, M., Richardson, V.J., Scholz, S. (2000), How "Foolish" Are Internet Investors?, Financial Analysts Journal, Vol. 56, Iss. 1; p. 62-70. Hofer, C.W. & Schendel, D. (1978), Strategy Formulation: Analytical Concepts, New York: West Publishing Company. Hook, R.C. Jr. & Czinkota, M. (1988), Export Activities and Prospects of Hawaiian Firms, International Marketing Review, Vol. 5, No. 4, pp. 51-57. Johanson, J. & Vahlne, J-E. (1977), The Internationalization Process of the Firm: A Model of Knowledge Development and Increasing Foreign Market Commitments, Journal of International Business Studies, Vol. 8, Spring-Summer Issue, pp. 23-32. Johanson, J. & Vahlne, J-E. (1990), The Mechanism of Internationalization, International Marketing Review, Vol. 7, No. 4. Karafakioglu, M. (1986) Export Activities of Turkish Manufacturers, International Marketing Review, Vol. 3, No. 4, pp. 34-43. Keating, E.K., Lys, T.Z., Magee, R.P. (2000), Internet Downturn: Finding Valuation Factors in Spring 2000, Journal of Accounting & Economics, Vol. 34, Iss. 1-3; p. 189. Ketchen, David J. & Shook, Christopher L. (1996), The Application of Cluster Analysis in Strategic Management Research: An Analysis and Critique, Strategic Management Journal, Vol. 17, Iss. 6, pp. 441-459. 244 Kobrin, S. (2001), Territoriality and the Governance of Cyberspace, Journal of International Business Studies, Vol. 32, No. 4, pp. 687-704. Kotha, Suresh, Rindova, V. P., Rothaermel F. T. (2001), Assets and Actions: Firm-Specific Factors in the Internationalization of U.S. Internet Firms, Journal of International Business Studies, Vol. 32, Iss. 4, p. 769792. Lee, Peggy (2001), What's In A Name.Com? The Effects of '.Com' Name Changes on Stock Prices and Trading Activity, Strategic Management Journal, Vol. 22, Iss. 8; p. 793. Lewellen, J. (2003), Discussion of "The Internet Downturn: Finding Valuation Factors in Spring 2000", Journal of Accounting & Economics, Vol. 34, Iss. 1-3; p. 237. Lomax, R.G. (1992), Statistical Concepts: A Second Course for Education and the Behavioral Sciences, White Plains, NY: Longman. Mahon, John F., Murray, Edwin A., Jr. (1981), Strategic Planning for Regulated Companies, Strategic Management Journal, Vol. 2, Iss. 3, p. 251. McIntyre, R.M. & Blashfield, R.K. (1980), A Nearest-Centroid Technique for Evaluating the Minimum-Variance Clustering Procedure, Multivariate Behavioral Research, Vol. 15, pp. 225-238. Moen, Oystein (2002), The Born Globals: A New Generation of Small European Exporters, International Marketing Review, Vol. 19, Iss. 2/3, p. 156. Moen, Oystein & Per Servais (2002), Born global or gradual global? Examining the export behavior of small and medium-sized enterprises. Journal of International Marketing, Vol. 10, Iss. 3, p. 49. Ofek, E., Richardson, M. (2003), DotCom mania: The Rise and Fall of Internet Stock Prices, The Journal of Finance, Vol. 58, Iss. 3; p. 1113-1138. Pfeffer, Jeffrey & Salancik, G. R. (1978), Organizational Context and the Characteristics and Tenure of Hospital Administrators, Academy of Management Journal, Vol. 20, Iss.1, p. 74-89. Porter, M.E. (1980) Competitive Strategy: Techniques for Analyzing Industries and Competitors, New York, NY: The Free Press. Prescott, J.E. (1986), Environments as Moderators of the Relationship Between Strategy and Performance, Academy of Management Journal, 29(2) pp. 329-346. Rajgopal, S., Venkatachalam, M., Kotha, S., Erickson, M. (2002), Managerial Actions, Stock Returns, and Earnings: The Case of Business-to-Business Internet firms, Journal of Accounting Research, Vol. 40, Iss. 2; p. 529. Scherer, F.M. (1980) Industrial Market Structure and Economic Performance, Chicago: Rand McNally & Company. Smith, Ken G., Grimm, Curtis M. (1987), Environmental Variation, Strategic Change and Firm Performance: A Study of Railroad Deregulation, Strategic Management Journal, Vol. 8, Iss. 4; p. 363. Thompson, J.A. (1997) The Contingent Workforce: The Solution to the Paradoxes of the New Economy, Strategy & Leadership, Vol. 25, Iss. 6; p. 44-46. Stopford, J.M. & Wells, L.T. (1972), Managing the Multinational Enterprise: Organization of the Firm and Ownership of the Subsidiaries, New York: Basic Books. Sullivan, Daniel (1994), Measuring the Degree of Internationalization of a Firm, Journal of International Business Studies, Vol. 25, Iss. 2, p. 325. Sullivan, Daniel & Bauerschmidt, Alan (1989), Common Factors Underlying Barriers to Export: A Comparative, Management International Review, Vol. 29, Iss. 2, p. 17-33. Summer, Charles E., Bettis, Richard A., Duhaime, Irene H., Grant, John H., et al. (1990), Doctoral Education in the Field of Business Policy and Strategy, Journal of Management, Vol. 16, Iss. 2, p. 361. Talmor, Eli (2001), Comment on “The Role of Book Income, Web Traffic, and Supply and Demand in the Pricing of U.S. Internet Stocks”, European Finance Review, Vol. 5, Iss. 3, p. 315. Trueman, Brett, M H Franco Wong, Xiao-Jun Zhang (2000), The Eyeballs Have It: Searching for the Value in Internet Stocks, Journal of Accounting Research, Vol. 38; p. 137. Vahlne, J-E. & Wiedershien-Paul, F. (1973), Psychic Distance – An Inhibiting Factor in International Trade, Working Paper, Center for International Business Studies, Department of Business Administration, University of Uppsala, Sweden. Venkatraman, N. & Ramanujam, V. (1986) Measurement of Business Performance in Strategy Research: A Comparison of Approaches, Academy of Management Review, 11, pp. 71-87. Yeoh, Poh-Lin (2000), Information Acquisition Activities: A Study of Global Start-Up Exporting Companies, Journal of International Marketing, Vol. 8, Iss. 3, p. 36. Ware, Robert (2004), Virtuality, Internationalization, and Firm Productivity, Working Paper. 245