PERK Session Request Form

advertisement

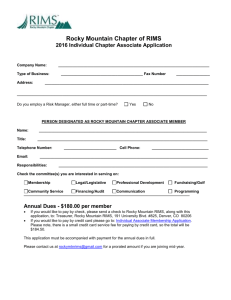

2014 PERK Request Form Please review the list of sessions below and select a PERK session. Sessions are alphabetized by partner. Send completed request form to PERK@rims.org or by fax at 212-655-7425. Submit one form per session request. Chapter: Contact Name: Email: Phone Number: Program Request Date: Time: Session Title: PERK Partner: PERK Session Request Form 2014 PERK Sessions Weighing in On Obesity: Steps for Risk Managers to Tackle Rising Costs (Presented by: Adelson, Testan, Brundo, Novell & Jimenez (ATB)) By latest estimates, some two-thirds of American adults are overweight or obese. The American Medical Association recently classified obesity as a disease, which might subject workplace practices to further scrutiny by plaintiff's attorneys and advocacy groups. Risk managers and their employers recognize that employee obesity drives up workers' comp expenses, employee healthcare and disability costs, and hurts productivity. With an imperative to manage costs, they need answers. This session examines obesity in the workplace and outlines proactive measures for risk managers to manage these rising costs. The discussion looks at the potential fallout from AMA's classification of obesity as a disease and outlines steps for risk managers to tackle this exposure, including: more effective management of workers' comp claims involving obesity as a comorbidity; teaming with HR on wellness initiatives; more effective benchmarking techniques; taking advantage of incentives under Obamacare; obesity data collection, and using tools such as CDC's obesity calculator to analyze obesity's impact on costs and establish baselines for determining ROI on wellness and related workplace obesity initiatives. (This program will be available to RIMS chapters throughout the U.S.) Sessions available to All RIMS US Chapters in the 48 contiguous states Risk Manager's Guide to Navigating California's SB 863 (Presented by: Adelson, Testan, Brundo, Novell & Jimenez (ATB)) California's latest attempt at workers' comp reform focuses on bringing greater efficiency to the state's system. However, employers with operations in the state need to understand the changes under SB863 in order to effectively manage their comp programs. This session examines three elements of SB863 with the widest potential implications for employers – medical treatment, indemnity, and medical liens. Focusing on these areas may mean the difference between cost savings or increases in an employer’s risk program. Notably, SB 863 aims to provide cost containment and savings by utilizing medical provider networks and independent medical review boards, changing statute of limitations for liens, and adjusting bill review procedures. Yet, lack of implementation, inadequate understanding of SB863’s cost containment measures, and mandated increased permanent disability benefits ultimately may drive employer risk costs up rather than down. (This program will be available to RIMS chapters throughout the U.S.) Sessions available to All RIMS US Chapters in the 48 contiguous states IMPROVING YOUR GAME PLAN FOR MANAGING LITIGATION COSTS IN WORKERS’ COMPENSATION (Presented by: Adelson, Testan, Brundo, Novell & Jimenez (ATB)) Litigation represents one of the largest cost components of any workers’ compensation program, as well as one of the most difficult to manage. The silver lining is that reducing these costs can have a profound effect on the overall costs of any organization’s workers’ compensation program. This session takes a close look at the key challenges risk executives face in controlling litigation costs and provides a checklist of proven strategies and tactics for employers to achieve exceptional results. The session examines key considerations in bringing legacy and complex cases to closure, as well as tools 2 PERK Session Request Form to measure performance of law firms and individual attorneys. Learn how law firms are typically structured to handle workers’ compensation assignments so you can provide more effective direction and drive results. While sharing information with your providers can help speed success, learn what types of data you should share, with whom and the best ways for doing it. The discussion will account for differences in resources, needs and challenges for various types of employers, including organizations with substantial operations across multiple states and those with more consolidated geographical footprint. As a result, everyone will come away with the insights they need to develop or refine their game plan for reducing litigation costs. Sessions available to All RIMS US Chapters in the 48 contiguous states Increasing the Impact of Risk Management with your Organization (Presented by: Advisen Ltd.) Leading risk managers are delivering compelling insight to executives and board members regarding their organizations’ risk portfolio and the financial implications of their combined risk transfer, risk retention and risk mitigation program. Attend this session to learn how the nation’s top risk managers deliver compelling Executive Management information. Session available in the NYC-Metro area (NY, NJ, CT) Managing Property Valuation Issues in Today's Insurance Market (Presented by: American Appraisal) This session will discuss a best practice property appraisal process from review of current values to the commissioning and receipt of the valuation consulting report. You will learn about the insurance market forces that are driving the demand for supportable values; how to conduct your own initial diagnostic review of your current property values; and the use of appropriate selection criteria for valuation consultants. The session will also highlight the optional levels of service appropriate for valuing properties in both public and private entities, and the structuring of an affordable appraisal program over a numbers of years. (Note that the session would be customized to address construction and equipment cost trends specific to the particular chapter, and all data would be updated to the most current available.) Sessions available to All RIMS US Chapters in the 48 contiguous states as well as Canada. NEW! Everything a Risk Manager Needs to Know About D&O Liability and Insurance (Presented by: Anderson Kill) While D&O insurance provides essential liability protection to directors, officers and companies, the claims process is a minefield for policyholders. A risk manager needs to know which policy provisions to insist on and which to avoid as well as how countering typical insurance company defenses once a claim is filed, and how to keep an insurance company on board while settling a suit. This session will cover these essentials. Key policy language issues include “severability” of coverage for insurers not implicated in wrongdoing; priority of payment provisions when multiple parties are all seeking coverage; and the scope of “bad acts” exclusions. Settlement issues include satisfying the insurer’s desire for information and right to “participate” in a settlement, as well as whether settling with the primary insurance company can arguably endanger excess coverage. NEW! What Every Insurance Professional Should Know About Insurance Coverage (Presented by: Anderson Kill) Most insurance professionals know in some detail the types of coverage their companies or clients need and various formulae for determining how much coverage to buy. What's all too often not so widely recognized are the types of policy provisions that often spell the difference between coverage and no coverage; the kind of persistence required to get a claim processed and paid in full; and the lengths an insurance company will typically go to wear a policyholder down and force it to accept either half-a-loaf or no bread. This session will walk a risk manager and broker through the minefield, detailing key issues of policy language and effective claims 3 PERK Session Request Form handling techniques from loss valuation to short-circuiting insurance company delays to insisting on partial payment when the loss amount is in dispute. What Every Risk Manager Needs to Know About Data Security (Presented by: Anderson Kill) Data security breaches continue to dominate the headlines, with more and more businesses, governmental authorities and other organizations falling victim. Now news comes that data breaches are actually under-reported. Thus, the problem is even worse than currently thought. To equip risk management professionals for this ever-growing threat, this session will examine key measures that businesses must take to protect themselves and comply with the law, including how risk managers can better work with their IT departments and in-house counsel, how best to deal with a data breach, and providing an overview of the types of losses that a serious breach will entail so that risk managers can make more informed assessments of this peril and adjust their risk management strategies and insurance purchases accordingly. Business Interruption Boundaries (Presented by: Aon Global Risk Consultants) What are the limitations of the business interruption contract, and how can you maximize opportunities for recovery within the four corners of the policy? This program can be tailored to the level of experience expected in the audience. A team of Dempsey Partners Experienced claims preparations experts will focus on either the basics of the business interruption contract, or on more complex ideas and recent examples…or both. • Circumstance and cause limitations --‐ what triggers business interruption cover? • Understanding the measurement formulas in the policy. • Opportunities and limitations of the various business interruption coverage extensions. • Grey areas to negotiate--‐recent examples of disputes, and how they were successfully resolved, including: o The Attraction Properties clause o Calculation and negotiation of a 3 day waiting period or 3% deductible o Residual value –getting to a fair resolution Sessions available to all RIMS Chapter (including Mexico & Canada). This session is available in Spanish. Crime Pays: Recovering Employee Dishonesty Claims (Presented by: Aon Global Risk Consultants) An organized crime investigator and a forensic accountant discuss strategies to maximize recovery of employee dishonesty claims, including: Tips for a productive investigation, coverage and legal pitfalls to be avoided. properly documenting liability and damages, working with law enforcement and negotiating a successful settlement with your bond carrier Property Insurance Program Potholes (Presented by: Aon Global Risk Consultants) Property insurance policies are very complex documents. When putting together programs and policies to cover an organization’s physical assets and resulting time element losses, there are common “potholes” in these contracts that risk managers need to be aware of. Many of these can be eliminated with thorough negotiation, communication and documentation of the coverage terms and conditions. This program will help risk managers identify, avoid and fix the common potholes and minimize surprises in the event of a loss. 4 PERK Session Request Form Determining Injury Causation: Biomechanical Engineering for the Risk Manager (Presented by: ARCCA) Risk Professionals deal with bodily injury claims every day resulting from vehicle collisions, slips & falls, product use and industrial accidents. In some cases, the description of loss does not account for the claimed injuries. This session takes a biomechanical analysis of events and injuries to determine whether there was an injury mechanism present that could have caused the claimed injuries. NEW! Increasing Vendor Insurance Compliance- The Effect of Best Practices People and Process (Presented by: CertFocus) Not only does vendor insurance compliance require administrative personnel to handle the daily clerical to-do’s and follow up activities that proper risk transfer demands, but it also takes the Risk Manager’s focus away from the strategic initiatives and other critical risk management functions that demand and deserve his or her full attention. How can Risk Managers still make risk transfer a priority, get it done right, increase vendor compliance, but still keep up with the work load. Today’s corporate environment requires total compliance in regard to assuring risk transfer To garner the highest level of vendor compliance possible, it takes a strategic approach As an indication of just how important risk transfer is, brokers are now spending millions of dollars in additional services (aside from insurance marketing) to their clients in order to further protect their clients’ interests On the corporate side, Risk Managers are spread so thin but yet realize that most claims could have been mitigated if the vendor insurance review was managed more effectively The presentation/think tank, will focus on strategies and tactics focused on improving vendor insurance compliance... as opposed to the rote skill of simply tracking certificates. What does this mean What are best practices How to get the highest compliance levels, with the least amount of time spent Business Continuity Management for Risk Managers (Presented by: DRI International) This program provides risk managers and professionals with a better understanding of the issues surrounding Business Continuity Management (BCM) and a starting point for understanding how BCM relates to Risk Management in general. The regulatory landscape, the business continuity continuum and context with enterprise risk management are highlighted and evaluated using real world examples. Sessions available to all RIMS Chapters (including Mexico & Canada). This session is available in Spanish. Disaster Preparation and Business Recovery (Presented by: Ernst & Young) Recent catastrophic events around the world have highlighted the critical nature of planning for and executing after catastrophic events. Companies that prepare and react effectively during times of crisis to protect key resources, restore operations and recover financially will have an advantage over their peers. This session combines the experience of professionals dedicated to assisting companies with disaster recovery and claims along with results from E&Y’s 2011 Catastrophic Claims Survey to provide practical insight into how companies around the world are preparing for and responding to catastrophic loss. Sessions available to all RIMS Chapters in the 48 contingent states. Business Continuity and Catastrophic Event: What Your Peers are Saying (Presented by: Ernst & Young) Recent catastrophic events around the world have highlighted the critical nature of planning for and executing after catastrophic events. Companies that prepare and react effectively during times of crisis to protect key resources, restore operations and recover financially will have an advantage over their peers. This session combines the experience of professionals dedicated to assisting companies with disaster recovery and claims along with results from E&Y’s Catastrophic Claims Survey to provide 5 PERK Session Request Form practical insight into how companies around the world are preparing for and responding to catastrophic loss. Sessions available to all RIMS Chapters in the 48 contingent states. Supply Chain Risk and the World Economy (Presented by: Ernst & Young) As companies grow, acquire and move toward more complex, global supply chains, the risk that they acquire or create grows and changes as well. Without proper identification of supply chain complexities, companies could improperly identify and measure their risk and either overpay premiums or, worse, underinsure the risks they face. Learn to identify risk factors, contingencies and interdependencies and measure those risks. Recent global shed a spotlight on the risk that a global economy and global supply chain can have on business and the insurance industry. Sessions available to all RIMS Chapters in the 48 contingent states. What is Subrogation and Why is it Important? (Presented by: Gitter & Associates) This presentation is designed to draw attention to the importance of pursuing subrogation recoveries on Workers’ Compensation claims. This session also provides attendees detailed information about what attendees need to know about how to pursue subrogation recoveries. Sessions available to All RIMS US Chapters (including Hawaii & Alaska). Workers’ Compensation Large Loss and Catastrophic Claims Settlement (Presented by: Gitter & Associates) This presentation focuses on the components, valuation and negotiation techniques that can be employed to bring resolution to workers’ compensation cases. The discussion includes the various aspects of a case including indemnity, medical, non-medical items as well as a brief discussion and history of Medicare Set-Asides. Various strategies are outlined and approaches/methodologies for resolving ongoing high exposure claims. Sessions available to All RIMS US Chapters (including Hawaii & Alaska). *However, it is not recommended for Minnesota, New Hampshire, Nevada, Washington (state), Montana, Oregon, Texas or South Dakota as they do not allow for the settlement of future medical claims. Natural Catastrophe Management Lessons from Recent Hurricanes and Earthquakes (Presented by: Global Risk Consultants) First hand lessons learned from recent disasters that caused significant property and business interruption loss to businesses and industries, including earthquakes in Italy, Japan, China, Mexico and Chile, and hurricanes along the Gulf Coast of the United States. In addition, a proactive approach to catastrophe risk management, related successes and failures, and natural hazards software applications and limitations will be discussed. Sessions available to all RIMS chapters including Mexico and Canada. NEW! Vendors and Security (Presented by: Identity Theft 911) Your technology service providers are an important part of your information security program. Learn the most critical aspects of vetting and engaging those vendors that access, store or transfer your protected, sensitive or confidential information. NEW! Protecting the Crown Jewels-A Risk Manager's Guide to Cybersecurity Strategy (Presented by PricewaterhouseCoopers) Is your organization's cybersecurity strategy protecting the information that is most valuable to your business? Can you explain your organization's cybersecurity strategy to others, including internal stakeholders and potential insurance partners? In today's interconnected environment, vendors, partners, and suppliers have all become a potential source of compromise. But safeguarding all data at the highest level is just not realistic or possible. Rather than treating everything equally, companies must now identify and protect the "crown jewels'; 6 PERK Session Request Form those business assets that are critical to future cash flow. This session will describe an approach that focuses on prioritizing and protecting assets according to their value to the enterprise. Sessions available to all RIMS Chapters (including Mexico & Canada). NEW! Turning Risk Into Profit (Presented by: ReedSmith) This program will discuss how Risk Managers can work with Legal Departments to identify areas in which the corporation can pursue claims that it has against outside entities. In addition to insurance and indemnity, we will discuss claims arising from intellectual property, commercial contracts, and acquisitions and beyond. NEW! Don’t Sell Out Your Directors and Officers If You Sell Your Company: The Role of Risk Management in Corporate Transactions (Presented by: ReedSmith) If your company is acquired, there is a very great likelihood your directors and officers will be subject to litigation for their actions before and during the transaction (and even potentially after the transaction). It is critical that the company and its directors and officers have the right insurance coverage to protect their assets when faced with such claims. Almost all purchase agreements will require one of the parties to the transaction to obtain “run off” or “tail” insurance for the directors and officers of the company being sold, yet many insurers do not even have standard forms for this coverage, and this coverage may be negotiable. This program will help guide risk management professionals through these issues: (1) what questions can risk expect to be asked when a corporate transaction (acquiring or selling) is on the horizon? (2) what is the role of risk management during the transaction? (3) what are best practices in negotiating “run off” coverage? (4) what can risk management do at policy renewal time to put the company and its directors and officers in the best position if the company is acquired? This program will be of great interest to any risk manager working for a company with the potential to be acquired or for a company that is acquisitive. In addition, this guidance is equally important in the event the company becomes insolvent. NEW! Bad Faith in Insurance Disputes- the Line between Sharp Practices and Bad Faith (Presented by: ReedSmith) The program examines what courts consider bad faith, in three contexts: (1) third-party liability claims; (2) first-party property claims and (3) insurance litigation. The focus of the program is on what actions by both insurers and policyholders courts will consider bad faith and what actions are allowed. It will also examine the repercussions to insurers and policyholders for acting in bad faith. NEW! Representations and Warranties Insurance (Presented by: ReedSmith) Not so long ago, many risk professionals’ dubbed Reps & Warranties insurance an urban legend: you heard about it frequently, but never actually knew anyone who purchased or placed it. There is a new breed of Reps & Warranties insurance, however, and we have negotiated two policies that were instrumental in completing acquisitions. The new products get rid of (or minimize) some of the old complaints about Reps & Warranties insurance: it slowed down due diligence, the premium was too high and the coverage was too narrow. This coverage is of interest to private equity firms and others in the mergers and acquisitions arena. A Risk Management Tool for Risk Managers (Presented by: Risk and Insurance Management Society) One of RIMS most exciting new initiatives for 2011 is the creation of RISK PAC, a political action committee created for the purpose of advancing the discipline of risk management through public policy. This session will provide information on political action committees in general, the purpose and necessity of having an effective political action committee, and background on RIMS decision to create RISK PAC. Members will also learn about the structure of RISK PAC and how the PAC fits into RIMS goals going forward. This session is available only to Chapters within the 48 contiguous states. 7 PERK Session Request Form NEW! Terrorism Risk Insurance Act (TRIA): Why Risk Managers Need to Get Involved Now (Presented by: Risk and Insurance Management Society) The Boston Marathon bombing. The Kenyan mall massacre. The U.S. consulate attack in Benghazi. The threat of terrorism is still very much a reality, both in large metro areas and smaller cities and towns. In the aftermath of September 11, the U.S. Congress created the Terrorism Risk Insurance Act (TRIA) with the purpose of providing certainty to the terrorism insurance marketplace. While TRIA is set to expire at the end of 2014, it is critical that you understand its importance. Review how the TRIA program works; why it was created; how it has changed over time; and the impact of its potential expiration. Discuss why terrorism risks are unlike other catastrophic risks and the politics surrounding TRIA. This session is hosted by RIMS External Affairs Committee. Learning Objectives • Gain an understanding of why the TRIA program was created and how it works. • Appreciate the program's importance to risk professionals, the industry and the economy as a whole. • Determine ways you can get involved in advocating for a long-term extension of the program. This session is available only to Chapters within the 48 contiguous states. This session will not be available from May 15-June 15th. (available by Webinar) Delivering Value through RIMS Risk Maturity Model for Enterprise Risk Management (Presented by: Risk and Insurance Management Society) If Enterprise Risk Management is the weapon for advancing your organization’s odds of success, make the RIMS Risk Maturity Model (RMM) part of your plan of attack. RIMS RMM applies to all types of organizations and industries across the risk spectrum. For both veteran risk professionals and novices, RIMS RMM is an indispensable tool that can provide a game plan for program development and enhancement. This presentation provides an introduction to the RMM and how your organization can use it once completed. Presenters are: Carol Fox, ARM, is director of strategic and enterprise risk practice for RIMS Steve Minsky, MBA, MA, developed the RIMS RMM and is CEO of Logic Manager, Inc. a leading provider of ERM infrastructure solutions. Work Smarter, Not Harder: Risk Management, Safety Workflow and Business Rules (Presented by: Riskonnect) In this presentation we will discuss and demonstrate specific, real-world examples of how risk management executives of global, brand name organizations are implementing new and innovative methods of managing losses and controlling costs. Participants will observe technology and functionality that risk managers are using to impact costs through risk transfer, claims management and risk financing. Sessions available to all RIMS Chapters (including Mexico & Canada). 8 PERK Session Request Form NEW! Managing Your Supply Chain: Is the biggest risk to your organization coming from outside your direct control? (Presented by: Riskonnect) Surveys and studies over recent years have consistently identified that one of the top 5 risks for most organizations is interruption to or destruction of your supply chain. Anything from storms, earthquakes, health events, etc. can seriously disrupt or even destroy the organizations on which you depend for products or services. This session is intended to help attendees understand the scope of their supply chain (Is it your tier 1 vendors that could cause problems or is it really the tier 2,3 or 4 vendors that could have a much wider and catastrophic impact). Details of your supply chain are available but then what? How much do you depend on them? What Products or Processes need these vendors? How well will a vendor be expected to react when an event occurs? How quickly can you take action to replace a vendor in trouble? NEW! Rockin’ Your Renewals (Presented by: Riskonnect) Are you maximizing the potential of a policy management solution? Are you able to compare your loss experience to the total premium spend on a policy? Are you struggling to keep policies up-to-date across renewal periods? Join us, as we expound upon some potential renewal process fixes and best practices that will make renewals a breeze! NEW! Integrated Incident Reporting Solutions and Best Practices (Presented by: Riskonnect) Many organizations are seeing significant improvements in incident reporting and incident management practices, thanks to advanced risk management techniques and technology. However, the incident management requirements of many organizations are so unique that a onesize-fits-all approach no longer yields adequate loss control and safety management. In this presentation, Riskonnect, Inc., will help you gain an understanding of incident reporting best practices and provide illustrations of recent advances in incident management technology. This presentation will give risk managers a better understanding of how enterprise-class risk management technology and service can deliver more timely and accurate information, yielding actionable business intelligence and driving tangible results for key stakeholders. How Surety Fits into Your ERM Strategy (Presented by: Rosenberg & Parker) Learn how to make ERM seamless in your organization and discover the tools other organizations are using to implement ERM and uncover the new trends. Sessions available to all RIMS Chapters (including Mexico & Canada). Surety, Wine & Cheese (Presented by: Rosenberg & Parker) What do surety, wine & cheese have in common? Rosenberg & Parker! Rosenberg & Parker will provide your RIMS chapter with a wine & cheese tasting as well as a fun educational class on cheese. A great session for a chapter’s holiday party or for special events, Surety, Wine & Cheese can be offered on its own, or paired either with one of our other surety bond presentations or on a surety topic specifically tailored to your chapter’s needs. Chapters are responsible for the cost of the wine & cheese. Sessions available to all RIMS Chapters (including Mexico & Canada). Business Interruption Values & Exposures: Quantifying and Communicating your BI Risk (Presented by: RWH Myers) This session reviews the basics of BI worksheets, including what information they are meant to convey and why they may not accurately represent your organization's risk. We will also discuss the challenges in allocating BI values by physical location and compiling consistent and accurate reporting from different divisions / business units. Finally, this session will discuss the benefits to performing a study of BI exposures vs. the annual, consolidated value and highlight the concepts of and methodology of an exposure study. Sessions available to all RIMS Chapters in the 48 contingent states. Effective Construction Auditing for Property Damage Claims (Presented by: RWH Myers) 9 PERK Session Request Form The construction auditor bridges the considerable gap between construction and accounting functions by recognizing and preventing risks at every stage of the project, from inception to completion. Construction audits can mitigate the risk that billing issues excluded from an insurance recovery leave the risk manager with an uninsured cost of rebuilding damaged property. Sessions available to all RIMS Chapters in the 48 contingent states. NEW! Business Interruption Claims – Trends & Challenges (Presented by: RWH Myers) What you need to know before a loss to set expectations and navigate the risks to full and timely recovery. This session includes an update on issues encountered in recent years, as well as changes in a major carrier's policy form that will likely be duplicated throughout the industry. Sessions available to all RIMS Chapters in the 48 contingent states. NEW! WC Fraud: Liars, Cheaters and Thieves (Presented by: Chris Mandel of Sedgwick CMS) Millions of dollars is lost each year from fraud in the workers’ comp system. At a time when businesses are doing more with less, few can afford the strains posed by fraudulent actions. In addition to employee fraud, providers and employers who circumvent the rules can cause as much or more expense and are harder to detect. But organizations are fighting back with new tools such as social media and predictive modeling. Learn about the different types of fraud, the red flags to identify them, and strategies to stop fraud in its tracks. Sessions available to all RIMS Chapters (including Mexico & Canada). Topics covered include: 1. 2. 3. 4. Learn the types of fraud and how. Find out how fraud is impacting the workers’ comp system and your business. Discover a tool box of red flags to identify fraud. Develop strategies to combat and mitigate fraud. Presented by Chris Mandel, SVP at Sedgwick, Inc., former RIMS President and 2004 Risk Manager of the Year. NEW! Emerging Risks: You Can’t Afford to Ignore What You May Not Understand (Presented by: Chris Mandel of Sedgwick CMS) One of the bigger challenges for risk leaders is getting ahead of poorly understood or completely unforeseen risks. CEO’s want to know what they can’t anticipate that will impact stakeholder expectations. Sessions available to all RIMS Chapters (including Mexico & Canada). This session will explain how to get ahead of these concerns and will include: 1. 2. 3. 4. 5. Why try to manage the “Unmanageable?” Identifying emerging risks Best practice considerations Practitioner experiences Selected emerging risk Presented by Chris Mandel, SVP at Sedgwick, Inc., former RIMS President and 2004 Risk Manager of the Year. NEW! ERM: Not Just for “For Profit” Corporates (Presented by: Chris Mandel of Sedgwick CMS) While ERM has been getting traction in many sectors, some more quickly than others, nonprofits, private and public entities offer a unique opportunity to apply a true enterprise-wide approach to managing risk. These stakeholders can find greater assurance that risks to mission is managed effectively, even if only selective component parts of a full ERM strategy are deployed. The truth is that these entities often have a much more complex risk profile than many for profit corporations. As a result, it is that much more important that these risk managers move beyond hazard risks to address this wider array of risks as well as meet the expectations of a typically larger group of stakeholders with sometimes higher expectations than public for profits. This session will carve out and explain where the many unique applications of ERM are with organizations of these types and how 10 PERK Session Request Form their risk managers can move to the next level more effectively. Sessions available to all RIMS Chapters (including Mexico & Canada). Topics covered will help attendees: 1. Understand distinctions in risk profiles that increase the importance of a more comprehensive approach to risk management 2. Learn what areas of risk offer the most opportunity for risk managers to broaden their reach 3. Learn what process elements lead to successful deployment of an ERM strategy Presented by Chris Mandel, SVP at Sedgwick, Inc., former RIMS President and 2004 Risk Manager of the Year. NEW! Leveraging ISO31000 for ERM Success (Presented by: Chris Mandel of Sedgwick CMS) ERM has been guided by various frameworks and standards but has fallen short in many deployment attempts. While every approach has legitimacy since ERM should be customized to the needs of adopting firms, the ISO 31000 approach provides the flexibility and emphases to improve the users chance of success. This session will review the aspects of risk frameworks that help drive ERM success and focus specifically on the ISO 31000 “standard” gaining traction with practitioners around the world. Sessions available to all RIMS Chapters (including Mexico & Canada). Topics covered will include: 1. 2. 3. 4. 5. How ISO 31000 Aligns with ERM Priorities Strategy as the core competency of high performing ERM Where does Strategic Risk Management (SRM) fit in? How ISO 31000 can facilitate success in ERM What is the next level for progressive ERM? Presented by Chris Mandel, SVP at Sedgwick, Inc., former RIMS President and 2004 Risk Manager of the Year. NEW! Navigating the Shark Infested Waters of Catastrophic Claims (Presented by USLAW Network) Cue the Jaws music. Catastrophic claims are almost never anticipated and can occur at any time and in any venue. Therefore, we must devise a repellant strategy to deal with them. Our team of experts will lead a discussion centering on the creation of a rapid response team that is ready to dive in when crisis strikes along with a discussion of best practices: during the crisis, the post incident investigation, dealing with the media, brand impact, consideration of the effect venue will have on the case, retention of appropriate experts, and strategies for minimizing vulnerability to punitive damages claims. Our analysis will also focus on utopia vs. reality in crisis management. Lessons learned during prior successful/failed catastrophic damages claims will also be discussed. Da dum, da dum …. This session will be offered to any chapter. All PERK Sessions should be requested at least four weeks before the meeting is scheduled to take place. For special arrangements please email PERK@RIMS.org. 11