BOOM-XI C10

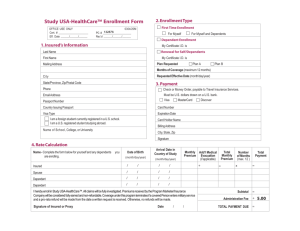

advertisement

Chapter-10 LIFE INSURANCE Meaning: Life is a very risky, no body knows what could happen in near future. To reduce the uncertainties of the life, Life insurance is most important and is very popular type of insurance. It had special position among various types of insurances. It is not a contract of indemnity because life of a person cannot be measured in term of money but it is a contract between insurer and insured in which insured agree to pay certain amount of premium to the insurer at a fixed internal of time and same as insurer agree to pay insured amount on the happening of the event. The event may be death of insured or expiry of certain number of years. In life insurance, loss of life cannot be compensated. Actually only the specified sum of money is paid to the insured or his dependent after his death. It gives financial protection to the insured in old age or his family after his death. Definition: According to John H. Magee, “The life insurance contract, embodies an agreement in which, broadly stated the insurer undertakes to pay a stipulated sum upon the death of the insured or at some designated time to a designated beneficially”. According to N N. Mishra, “Life insurance contract may be defined as the contract where by the insurer in consideration of premium undertakes to pay a certain sum of money either on the death of insured or the expiry of a fixed period”. From the above definition it can be concluded that life insurance is a contract under which insured agrees to pay sum of money as premium and insurer agrees to pay insured amount on the happening of insured event or maturity of the policy. It includes the element of protection and investment. If the insured dies before the maturity, then it provide financial protection of the dependent of nominee of the insured otherwise if insured will survive till the maturity then, it become investment during the old age period of the insured. Life insurance policy: Life insurance policy is a written document which contains name, address, age of the insured, period of the insurance, amount of premium, date of payment, insured amount, mode of payment and condition of insurance for insuring the life of a person, insurance company introduce different types of life insurance polices. They are classified into different categories. A. On the basis of duration of policy: 1. Whole life policy: i. Ordinary whole life policy ii. Limited payment whole life policy iii. Convertible whole life policy 2. Endowment policy: i.Ordinary endowment policy ii. Pure endowment policy iii. Double endowment policy iv. Anticipated endowment policy v. 3. i. ii. iii. Deferred endowment policy Term policy: Single term policy Renewal term policy Convertible term policy 1. Whole life policy: In this policy the insured should pay the premium during the whole life time and insured amount is paid to the dependent of insured after his death and insured doesn’t receive any amount. i. Ordinary whole life policy: Under this policy insured has to pay premium whole life time and after the death of his insured the sum assured is payable to the dependent or nominee of him. The main motive of this policy is to provide financial security to the dependent after death. In practice under this policy an insured has to pay premium for 35 years or 80 years of age, which ever is more? ii. Limited payment whole life policy: In this policy insured will have to pay the premium for the limited number of years but the policy will mature after insured death. If the insured dies before the maturity then, insurance become completed and his dependent get the insured amount. iii. Convertible whole life policy: In this policy insured can convert his policy into any other form of policy, particularly endowment policy, after expiry of 5 years or 7 years. 2. Endowment policy: Endowment policy is issued for the fixed period of time i.e. 5 years, 20 years, 25 years so on. The premium will be paid during the years. Insured amount will be paid to the insured after the maturity on his dependent on the death of policy holder before the maturity. After the death of insured no premium will be paid by the dependent. It is very popular because it makes provision for the security of the family as well as livelihood in the old age. i. Ordinary endowment policy: This policy is issued for the fixed period of time like 5 years, 10 years, 15 years, etc. and premium will be paid for that period. Insured amount will be paid by the insurance company after the maturity or on the death of insured which ever is earlier. ii. Pure endowment policy: Under this policy if the insured survives till the endowment period then, insurance company will pay the insurance amount to the policy holder otherwise no money return to the members. It is suitable for those people who don’t want to have any property behind their death. iii. Double endowment policy: Under this policy, if the insured survive till the maturity period then, he will get double of the insured amount on the date maturity but if he dies then his dependent will get insured amount only. In this policy rate of premium will be high. iv. Anticipated endowment policy: In this policy a part of insured amount is paid to the insured after a fixed interval of time like 5 years, 10 years, 15 years, etc. but if insured dies before the maturity then his dependent will get the full insured amount even if the insured had received any amount. v. Deferred endowment policy: In this policy, insured amount is paid by the insurance company, to the insured at the date of maturity. Even if the insured dies before the maturity, insurance company will pay the insured amount after the maturity of the policy. 3. Term policy: This policy is issued for the short term like 3 months, 6 months, etc. The insured amount is payable if the insured dies during the period before the maturity. But if he survives then no amount will be paid by the insurance company: i. Single term policy: It is issued for various short periods of years. Generally installment is paid only once in the life time of policy. This type of one installment is called single premium. Insured is paid only if insured dies with in the term. ii. Renewal term policy: Under this policy system, a policy can be renewed after the expiry of time with out medical examination. iii. Convertible term policy: In this policy an insured can convert his policy into another policy with out going in for a fresh medical examination but rate of premium will be applicable according to new policy and contract. B. On the basis of payment of premium: On the basis of mode of payment of premium, there are following polices, which are as follows. 1. Single premium policy: Under this system premium amount will paid lump sum and only once at the time of policy taking. It is not favorable for an ordinary person because amount of premium is very high. 2. Regular premium policy: In this policy premium will be paid regularly and in equal installment. The installment may be monthly, Quarterly, half yearly or yearly. The installments are paid throughout the policy period. 3. Limited premium policy: In this policy the amount of premium will be paid for limited years but the policy will mature after the completion of policy period. 4. Easily Reduce premium policy: Under this policy, the premium amount is low at the beginning of the policy and after some years the premium amount becomes high. C. On the basis of participation in profit: These types of polices are categorized in to two form. 1. With profit: Under this policy an insured has right to take part in profit of insurance company. Profit can be received in the form of bonus. It is paid along with the insured sum. This is very popular policy and amount of premium is also very high. 2. With out profit: Under this policy an insured has no share in the profit of insurance company. Only inured amount will be paid by the insurance company to the insured. D. On the basis of lives covered: According to the member of live insured polices are as follows 1. Single life policy: When a single person insured his life individually then it is known as single life policy. The person whose life is financially secured is known as insured and who takes risk of security is known as insurer. 2. Joint or multiple life policy: When two or more than two person takes life insurance policy jointly, then it is known as joint life policy. In this policy system, if any person dies then, insured amount is paid to the survivor. This policy is popular in husband- wife or popular or partners of a firm. E. On the basis of payment of claim: On the basis of payment of claims the polices are as follows: 1. Lump sum policy: Under this policy system after the maturity or on the death of insured, the insured amount is paid by the insurer to the insured or his nominee in single lump sum. 2. Installment policy: Under this policy system after the maturity of the policy or on the death of insured, the amount is paid to insured or his nominee in equal installment. This type of policy is helpful in old age. Procedure of effecting life insurance: A person will have to follow the following procedure to get his life insured. 1. Proposal form 2. Medical examination report 3. Agent report 4. Certificate of age 5. Acceptance of proposal 6. Payment of first premium 7. Issue of policy/ bond 1. Proposal form : In order to obtain an insurance policy, first of all a proposal from is to be filled up. It is printed from and available from insurance office or insurance agent free of cost. Actually it is a small questionnaire, contains information about insured like i. Name, address, occupation of proposer ii. Date of birth and age of proposer iii. Family history and health of the proposer iv. Fact about the income, life and habit of proposer v. Mode of payment of premium 2. Medical examination report: For life insurance medical report of proposer is necessary. After filling the proposal from, insurance company arranges the doctor who examines the proposer and prepares a medical report, which is forwarded to insurance company. It is a very important report and also risk is evaluated on the basis of this report. 3. Agent report: The important report regarding the insurance contract is prepared by the agent of insurance company. This report is confidential report about the proposer and contains the information like proposer health, character, habit, wealth and the personal information. After preparing the report it must be attached to the proposal from. Insurance contract is also largely depend on the agent’s report. 4. Certificate of age: The proposer must submit, the certificate of his/ her actual age, because the premium amount is also depending on the age of the proposer. People of higher age are required to pay higher rate of provision. The birth certificate may be issued by the hospital, VDC, school, colleges or horoscope of the proposer. 5. Acceptance of proposal: If medical report, agent report and other information about proposer are right and also according to the rules of insurance company then proposal is accepted and first premium is demanded by the insurance company. 6. Payment of first premium: After receiving the acceptance letter, a proposer will have to deposit first insurance premium. After receiving the receipt of first insurance premium, the insurance contract become complete and insurance becomes liable for the loss from this date. 7. Issue of policy/ bond: After the payment of first premium, the process comes to end of its operation and the insurance policy is issued by the insurance company. This policy/ bond generally contains the policy holder name, occupation, age, date of birth, amount of insurance, amount of premium, nomination, transfers, claims, condition of insurance, etc. this policy must be prepared carefully and duly stamped and signed by the authorized officer. *******