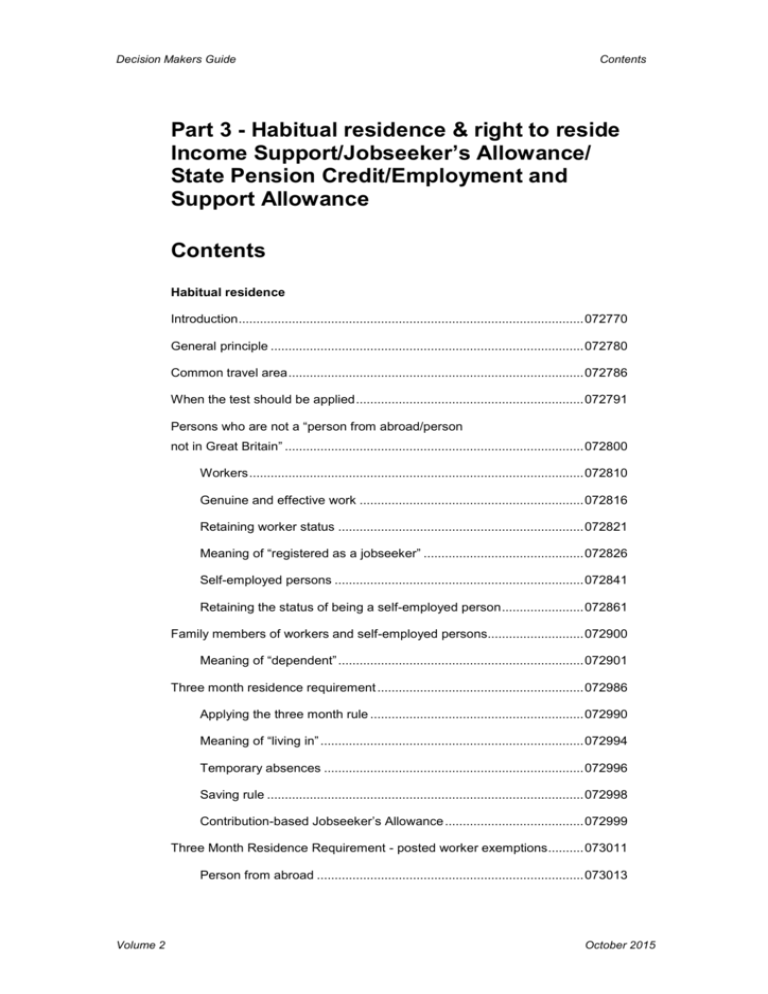

DMG Chapter 07 Part 3 - Habitual residence and right to reside IS

advertisement