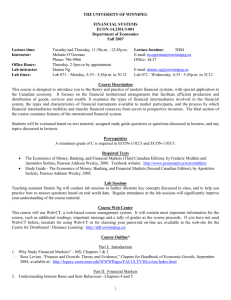

THE UNIVERSITY OF WINNIPEG

INTRODUCTION TO MONETARY ECONOMICS

ECON-14.2302/3-001

Department of Economics

Winter 2007

Lecture time:

Lecture location:

Instructor:

Tuesday and Thursday, 11:30a.m. - 12:45p.m.

4M47

Melanie O’Gorman

E-mail: m.ogorman@uwinnipeg.ca

Phone: 786-9966

Office: 6L37

Office Hours:

Lab instructor

Friday, 1-3pm or by appointment

Dennis Ng

E-mail: dennis.ng@uwinnipeg.ca

Lab 071 – Friday, 4 - 5:15p.m., in 3C12

Lab 072 - Wednesday, 4 - 5:15p.m., in 3C12

Lab times:

Course Description

This course will provide an introduction to monetary economics, by providing an overview of the main issues in

central banking, monetary theory and monetary policy. Particular emphasis will be placed on the recent

Canadian monetary policy experience and performance, but we will also discuss monetary developments in

countries other than Canada. We will analyze the role and functions of money in the economy, the formulation

of monetary policy, the demand and supply of money and issues related to inflation, the monetary transmission

mechanism and optimum currency areas. Term tests and the final exam will cover material from the textbook

as well as material discussed in the lectures and lab sessions.

Prerequisites

A minimum grade of C is required in ECON-1102/3 and ECON-1103/3.

Required Text

The Economics of Money, Banking, and Financial Markets (Second Canadian Edition), by Frederic Mishkin and

Apostolos Serletis, Pearson Addison Wesley, 2004. Textbook website: http://www.pearsoned.ca/text/mishkin/

Lab Sessions

Teaching assistant Dennis Ng will conduct lab sessions to further illustrate key concepts discussed in class, and to

help you practice how to answer questions based on real world data. Regular attendance at the lab sessions will

significantly improve your understanding of the course material.

Course Web Center

This course will use Web-CT, a web-based course management system. It will contain most important

information for the course, such as additional readings, important message and a tally of grades as the course

proceeds. If you have not used Web-CT before, tutorials for using Web-CT or for claiming your password online are available at the web-site for the Centre for Distributed / Distance Learning: http://ddl.uwinnipeg.ca/

Course Outline*

Week 1: What Is Money? (Chapter 3)

Week 2: Structure of Central Banks and the Bank of Canada (Chapter 14)

Week 3: Multiple Deposit Creation and the Money Supply Process (Chapter 15)

Week 4: Determinants of the Money Supply (Chapter 16)

Week 5: Tools of Monetary Policy (Chapter 17)

Term Test 1

Week 6: Conduct of Monetary Policy: Goals and Targets (Chapter 18)

Week 7: Monetary Policy Strategy: The International Experience (Chapter 21)

Week 8: The Demand for Money (Chapter 22)

Week 9: The Keynesian Framework and the ISLM Model (Chapter 23)

Term Test 2

Week 10: Monetary and Fiscal Policy in the ISLM Model (Chapter 24) and Aggregate Demand and Supply

Analysis (Chapter 25)

Week 11: Transmission Mechanisms of Monetary Policy: The Evidence (Chapter 26)

Week 12: Money and Inflation (Chapter 27) and Optimum Currency Areas (online notes)

*Tests will cover all material in assigned chapters, unless otherwise stated.

*Due to time constraints, all topics listed may not be covered

Evaluation

Term test 1 – February 1st, 2007, in class - 30%

Term test 2 – March 1st, 2007, in class - 30%

Final exam – April 13th, 2007, 9a.m. - 40%

Important Notices

Services for Students with Disabilities: Students with documented disabilities requiring academic

accommodations for tests/exams (e.g., private space) or during lectures/laboratories (e.g., access to

volunteer note-takers) are encouraged to contact Shannon Schaus, Coordinator of Disability Services (DS)

at 786-9178 or s.schaus@uwinnipeg.ca, to discuss appropriate options. Specific information about DS is

available on-line at http://www.uwinnipeg.ca/index/services-disability. All information about disability is

confidential.

Final grades are subject to University Senate review.

Students will not be permitted to write make-up tests or hand in assignments late, except for documented

medical or compassionate reasons. Students will lose 15% of the mark for each day after the due date for an

assignment. If a student misses a term test, an official document must be given to the instructor, justifying

the absence, and the weight of that test will be added to the final exam weight. If no documentation is

given, a grade of zero will be awarded.

During tests and final exam, only basic calculators will be permitted (i.e. calculators without any memory).

The last day to withdraw without academic penalty from this course is Friday March 2, 2007

Students should familiarize themselves with the University's policies on plagiarism, cheating, academic

misconduct and appeals – information on these policies is available in Section VII of the University of

Winnipeg General Calendar.

All tests will be closed book tests. Student identification cards may be requested during tests. Paper

dictionaries are permitted during tests for the purposes of translation but they must be examined by the

instructor prior to the test.