Healthcare Finance - Askew School of Public Administration and

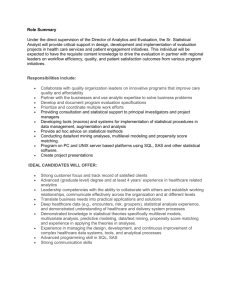

advertisement

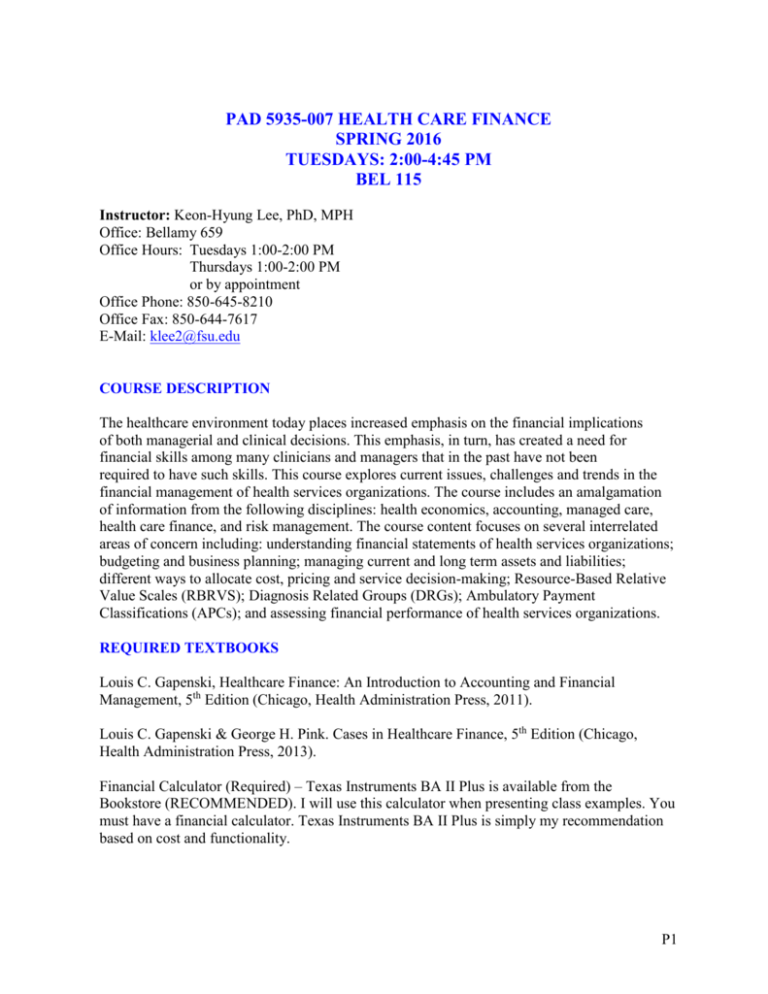

PAD 5935-007 HEALTH CARE FINANCE SPRING 2016 TUESDAYS: 2:00-4:45 PM BEL 115 Instructor: Keon-Hyung Lee, PhD, MPH Office: Bellamy 659 Office Hours: Tuesdays 1:00-2:00 PM Thursdays 1:00-2:00 PM or by appointment Office Phone: 850-645-8210 Office Fax: 850-644-7617 E-Mail: klee2@fsu.edu COURSE DESCRIPTION The healthcare environment today places increased emphasis on the financial implications of both managerial and clinical decisions. This emphasis, in turn, has created a need for financial skills among many clinicians and managers that in the past have not been required to have such skills. This course explores current issues, challenges and trends in the financial management of health services organizations. The course includes an amalgamation of information from the following disciplines: health economics, accounting, managed care, health care finance, and risk management. The course content focuses on several interrelated areas of concern including: understanding financial statements of health services organizations; budgeting and business planning; managing current and long term assets and liabilities; different ways to allocate cost, pricing and service decision-making; Resource-Based Relative Value Scales (RBRVS); Diagnosis Related Groups (DRGs); Ambulatory Payment Classifications (APCs); and assessing financial performance of health services organizations. REQUIRED TEXTBOOKS Louis C. Gapenski, Healthcare Finance: An Introduction to Accounting and Financial Management, 5th Edition (Chicago, Health Administration Press, 2011). Louis C. Gapenski & George H. Pink. Cases in Healthcare Finance, 5th Edition (Chicago, Health Administration Press, 2013). Financial Calculator (Required) – Texas Instruments BA II Plus is available from the Bookstore (RECOMMENDED). I will use this calculator when presenting class examples. You must have a financial calculator. Texas Instruments BA II Plus is simply my recommendation based on cost and functionality. P1 COURSE LEARNING OBJECTIVES Upon completion of this course, a competent student shall demonstrate an expanded understanding of the applications of financial management of health services organizations. This shall include an ability to read, understand, and interpret the financial statement of a healthcare organization and the ability to prepare and defend an analysis of an issue affecting one or more health services organizations. More specifically, each student should be able to: 1. Analyze the financial statements of a healthcare organization, draw definitive conclusions as to its condition, and articulate the findings. 2. Explain the basic analytical and decision-making principles of healthcare financial management 3. Explain the financial management process as it applies to for profit and not for profit organizations. 4. Explain revenue and expense budgeting, capital expense budgeting, and cash budgeting as well as the relationships existing between planning, directing, budgeting, and establishing financial controls. 5. Utilize financial ratios as tools for the analysis of financial performance. 6. Articulate ethical practices & their significance in establishing a viable financial management strategy. 7. Examine sources of revenue for healthcare services and the reimbursement mechanisms for those services (FFS, DFFS, DRGs, RBRVS & APCs) and their critical role in financing health care organizations. 8. Explain how to perform a cost analysis of services rendered. 9. Present computer modeling skills 10. Effectively communicate using financial information COURSE REQUIREMENTS AND GRADING Case Presentations (two (2) cases) Midterm Exam (open book) Comprehensive Final Exam (open book) Class Participation and Case Summaries 30% 25% 35% 10% Letter grades will be assigned according to the following point totals: A=93 or higher; A-=9092.99; B+=87-89.99; B=83-86.99; B-=80-82.99; C+=77-79.99; C=73-76.99; C-=70-72.99; D+=67-69.99; D=63-66.99; D-=60-62.99; F= less than 60. MAKEUP WORK AND EXAMS Late case analysis is NOT accepted without an academically valid and approved FSU excuse. The instructor will NOT give make-up exams. P2 ATTENDANCE POLICY Regular attendance is considered essential to achieving a successful course outcome. If you miss a class, it is your responsibility to obtain complete information on that class from another student in the course. Excused absences include documented illnesses, deaths in the immediate family and other documented crises, call to active military or jury duty, religious holy days, and official University activities. Accommodations for these excused absences will be made and will do so in a way that does not penalize students who have a valid excuse. Consideration will also be given to students whose dependent children experience serious illness. ACADEMIC HONOR CODE The Florida State University Academic Honor Policy outlines the University’s expectations for the integrity of students academic work, the procedures for resolving alleged violations of those expectations, and the rights and responsibilities of students and faculty members throughout the process. Students are responsible for reading the Academic Honor Policy and for living up to their pledge to ….. be honest and truthful and . . . [to] strive for personal and institutional integrity at Florida State University. (Florida State University Academic Honor Policy, found at http://dof.fsu.edu/honorpolicy.htm.) AMERICANS WITH DISABILITIES ACT Students with disabilities needing academic accommodation should: (1) register with and provide documentation to the Student Disability Resource Center; and (2) bring a letter to the instructor indicating the need for accommodation and what type. This should be done during the first week of class. P3 COURSE OUTLINE AND TENTATIVE SCHEDULE (based on the 5th edition textbook) Class 1 2 3 4 Date 1/12 Topics Course Introduction Healthcare Environment - What is healthcare finance? - Major players in the health industry? - Third-party payer system - Major trends in the healthcare sector 1/19 The Financial Environment - Forms of business organization - Tax - Organizational goals - Different forms of payments 1/26 Financial Accounting Basics Income Statement (IS) - What are the components of IS? - Why are financial accounting statements important? Balance Sheet (BS) - Purpose of BS? - What are the contents of the BS and how is it related to the IS? Statement of Cash Flow - Purpose of the statement of cash flow - What are the contents of the statement of cash flow? 2/2 Managerial Accounting Basics (Differences between financial and managerial accounting) - Cost behavior (How costs are classified according to their relationship with volume?) - Profit analysis (to analyze the impact of input value changes on both profitability and BEP; FFS vs. Capitation) Chapters/Cases Chapter 1 Chapter 2 Extra Readings Chapters 3, 4 Homework #1: 3.1 (p.104) 3.2 (p.104) 4.3 (p.140) 4.4 (p.140) Chapter 5 Case 6: Tulsa Memorial Hospital: Break-even Analysis Homework #2: 5.1 5.2 5.4 P4 5 2/9 Group Presentation (Case 6) Cost Allocation - Why proper cost allocation is important? - Define a cost driver and explain the characteristics of a good driver. - Primary cost allocation methods - Activity based costing (ABC) Chapter 6 cost allocation (extra handout) Case 4: Eagan Family Practice: Cost Allocation Methods Case 10: Dallas Health Network: ABC Analysis 6 2/16 Group Presentation (Case 4) Group Presentation (Case 10) Pricing and Service Decision - Providers as price setters vs. price takers - Difference among full, marginal, and direct cost pricing - How accounting and actuarial information are used to make pricing and service decisions? - Conduct basic analyses to set prices and determine services offerings under both FFS and capitation 7 2/23 Group Presentation (Case 9) Group Presentation (Case 32) Planning and Budgeting - Planning process and the key components of the financial plan - What are the formats and uses of budgets? - Static budget vs. flexible budget - How to create a simple operating budget? Homework #3: Cost Allocation (extra handout) Chapter 7 Case 9: Cambridge Transplant Center: Marginal Cost Pricing Analysis Case 32: Santa Fe Healthcare: Capitation and Risk Sharing Homework #4: 7.1 a, b, c 7.4 a, b Chapter 8 Case 7: Cascades Mental Health: Variance Analysis Case 8: Mt. Village Clinic: Cash Budgeting Homework #5: 8.1 8 3/1 Midterm Exam (covers Chapters 1 through 8) P5 9 10 3/8 Spring Break 3/15 Group Presentation (Case 7) Group Presentation (Case 8) Chapter 9 Case 12: Gulf Shore Surgery Centers: Time Value Analysis 11 12 Time Value Analysis - Why time value analysis is so important to healthcare financial management? - Find the present and future values for lump Homework #6: sums, annuities, and uneven cash flow 9.1 streams 9.2 a - Solve for interest rate and number of periods 9.6 - Measure the financial return on an investment in both $ and % terms - Create an amortization table 3/22 No Class – American Society for Public Administration National Conference 3/29 Group Presentation (Case 12) Chapter 10 Financial Risk and Required Return - The concept of financial risk - Stand-alone risk vs. portfolio risk - Corporate risk vs. market risk - Capital Asset Pricing Model (CAPM) 13 4/5 Group Presentation (Case 1) Group Presentation (Case 13) Capital Structure and the Cost of Capital - Capital Structure Basics & Theory - Identifying the Optimal Capital Structure in Practice - Cost of Capital Basics - Cost of Debt Capital - Cost of Equity Capital - An Economic Interpretation of the Corporate Cost of Capital Case 13: Mid-Atlantic Specialty, Inc.: Financial Risk Case 1: River Community Hospital (A): Assessing Hospital Performance Homework #7: 10.1 10.2 Chapter 13 Case 18: Southeastern Homecare: Cost of Capital Case 19: RN Temps, Inc.: Capital Structure Analysis Homework #8: 13.1 P6 14 4/12 Group Presentation (Case 18) Group Presentation (Case 19) Basics of Capital Budgeting - What is the role of financial analysis in health services capital budgeting decisions - What are key elements of cash flow estimation, breakeven analysis, and profitability analysis Chapter 14 Case 20: Coral Bay Hospital: Traditional Project Analysis Homework #9: 14.3 Chapter 18 Lease Financing - Lease vs. Purchase - Two primary types of leases - Conduct a basic lease analysis - Factors that create value in lease transactions 15 4/19 Group Presentation (Case 17) Group Presentation (Case 20) Financial Condition Analysis - What is the purpose of financial statement and operating analyses? - What are primary techniques used in financial statement and operating analyses? - Assessment of the financial condition of a business - What are the problems associated with financial statement and operating analyses - Market Value Added (MVA) vs. Economic Value Added (EVA) performance measures 4/26 Case 17: Seattle Cancer Center: Leasing Decisions Homework #10: 18.2 Chapter 17 Homework #11: 17.3 Comprehensive Final Exam (covers all lectures) P7 Guidelines for Case Presentations: Most cases require spreadsheet analysis. However, a starting model containing the base case is provided in the Cases in Health Care Finance text, and hence the cases will not require an inordinate amount of modeling time. Case analyses are intended to develop decision-making skills. Although computer analysis is an important element of this course, the primary emphasis should be on health care financial management decisions. You should form a 4-member group in this class and make two presentations. You should form a group by the end of the second session. If you cannot find any group members by the end of the second session, please let me know. Group work is an excellent experience for students because almost all decision making in businesses is done in a group environment, and people who cannot work in groups are doomed to failure. Case presentations should include the use of PowerPoint and all members of the groups are to be involved in the presentation. For those students who are presenting on a given night, a group should submit a 10page written report (double-spaced) on the assigned case and prepare appropriate handouts (e.g., powerpoint handouts) to the audiences. You should limit your presentation in 20 minutes and take questions for 5-10 minutes after the presentation. For those students who are not presenting on a given night, please submit a one-page (single-spaced) summary about the case including questions to the presenters. This is due in the beginning of the class that the case is presented. No email submission, please. Your role on those evenings is to serve as Board Members whom the presenters will be addressing. P8