Word doc - people - Boston University

advertisement

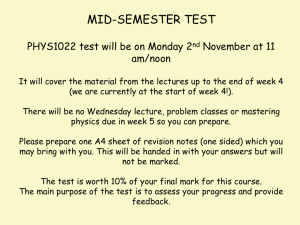

EC 501: Microeconomic Theory Fall 2010 Professor Pankaj Tandon 270 Bay State Road, Room 526 Phone: (617) 353-3089 email: ptandon@bu.edu Office Hours: M 9-10:30, W 8-9:30 Overview: This course is the Master’s level offering in microeconomics, in which we study the functioning of the economy by looking at the behavior of individual agents: consumers, producers and the government. The approach is mathematical. Prerequisites: You must have taken courses in intermediate microeconomics and multivariate calculus. A calculus review is provided in Chapter 2 of the textbook. Examinations and grades: Your grade will be determined as follows: 20% on required problem sets, 30% on an in-class mid-term exam (to be held on Monday, October 25), and 50% on a final exam (to be held on a date to be announced later). Examinations will be closed-book. Make-up examinations are offered only in the case of extreme and documented emergencies. No make-up final examinations will be given to accommodate travel plans that conflict with the assigned final exam date. Please make your travel plans EARLY. University policy also requires me to remind you that you are expected to be familiar with the CAS Academic Conduct Code, and that I am required to report all violations of this to the Dean’s office. Problem Sets: There will be regularly assigned problem sets (10 in all) which must be turned in on their due dates. Late problem sets will not be accepted; the solutions are handed out at the time when the assignments are turned in. You are encouraged to work together on the problem sets, by actively discussing approaches to solutions (not by copying one another’s work!). The purpose of the problem sets is to help you learn the material, not to test you. Textbook: The lectures will form the backbone of the course and your class notes constitute the most essential reading. The required textbook for the course is: Walter Nicholson: Microeconomic Theory: Basic Principles and Extensions, 10th edition, Thomson Southwestern, 2008. The book is available at the BU Bookstore. Also, the workbook to Nicholson’s book (out of print, but can be found second-hand on the internet), may be used for practice problems. Class discussion: Because the material covered in class is not fully covered in the assigned reading, it is important that you understand what is discussed in class. For this reason, it is vital that you ask questions in class to make sure you understand the material. 2 Contacting me: My office hours (posted above) are times when you can stop by my office without an appointment to ask questions or otherwise discuss issues that come up. This is the best way to be in touch with me. In addition, I check my email several times a day and generally respond promptly. You can use this method to ask questions, or to set up appointments. However, the best forum to ask substantive questions about the class (other than in class itself) is the Class Discussion Board. Class Discussion Board: All students should sign up for membership in the class discussion board, which is based on Yahoo! Groups. You must be a registered member of Yahoo! Groups to join (membership is free and easy). Register at http://groups.yahoo.com/ and, once you are registered, join the Discussion Board at http://groups.yahoo.com/group/bu-ec5012010/. Use this forum to ask questions about material discussed in class, about the problem sets, exams, or any other subject of relevance to the class. Posing your questions there allows others to see them and to see my answers as well. And of course other students can also respond or comment and get a discussion going. Teaching Assistant: The TA (name to be announced) will grade the problem sets, hold the discussion sections, and hold office hours. If you have any questions about the grading of your problem set, you should go to the TA for an explanation. Detailed Syllabus and Reading List (Readings marked with * are optional) Most of the hyperlinks to web-available articles require your BU login. We will be covering a lot of material and the pace of the class is fast. It is best therefore if you do the required reading before each class. You don’t have to understand everything, but just try to get a rough idea of the basic concepts. You can come to class with a clear idea of what you don’t understand and that will help me immensely to focus on the more difficult parts of the subject matter. That way, your doubts can be cleared up and your understanding can be deepened during class. Remember also that I do not follow the textbook closely, so be prepared that my class lectures will feel quite different from the book. Ultimately, you are responsible for the material I cover in class, not what is in the book, although there is considerable overlap. Mathematical Pre-requisites: Basic algebra. Functions and their properties, including exponential and logarithmic functions. Implicit functions and inverse functions. Differentiation of functions. Maximization and minimization of functions. Integrals, both indefinite and definite. Multivariate constrained optimization. The envelope theorem. Nicholson: Chapter 2. Knut Sydsaeter and Peter Hammond: Essential Mathematics for Economic Analysis, 2nd edition, Chapters 1-14. 3 1. Wednesday, September 8 Introduction and Theory of Consumer Behavior: Introduction to microeconomics. Basic demand and supply model. Theory of demand. Cardinal utility and the Marshallian theory of demand. Ordinal utility and the Hicksian theory of demand. Properties of utility functions. Indifference curves and indifference maps. The cases of perfect substitutes and perfect complements. The difference between the law of diminishing marginal utility and the convexity of indifference curves. Nicholson: Chapter 3. 2. Monday, September 13 Theory of Consumer Behavior (continued): The budget constraint. Complex cases: rationing, multiple constraints, non-linear prices. The consumer’s choice problem: utility maximization subject to the budget constraint. The demand function. Computation of the demand function in three specific cases: Cobb-Douglas, Leontief, and linear utility functions. Nicholson: Chapter 4. 3. Wednesday, September 15 The Law of Demand: Properties of demand functions. Comparative statics. The effect of changes in income on demand. Normal and inferior goods. The income elasticity of demand. The own-price effect. Substitution and income effects and the law of demand. Giffen goods. Other goods that violate the law of demand. Nicholson: Chapter 5, pp. 141-151. * Robert T. Jensen and Nolan Miller. "Giffen Behavior: Theory and Evidence." KSG Faculty Research Working Paper Series and NBER (RWP07-030 and w13243), July 2007. Available at: http://web.hks.harvard.edu/publications/workingpapers/citation.aspx?PubId=4876 * Harvey Leibenstein: “Bandwagon, Snob, and Veblen Effects in the Theory of Consumers’ Demand,” Quarterly Journal of Economics, May 1950, pp. 183-207. Available at: http://www.jstor.org.ezproxy.bu.edu/stable/1882692 4. Monday, September 20 The own-price effect (continued): Compensated demand functions and their relationship with ordinary demand functions. The Expenditure Function. The Slutsky equation. Nicholson: Chapter 5, pp. 151-165. 5. Wednesday, September 22 Applications of Demand Theory: Welfare Measurement and Price indices: Consumer’s surplus. The compensating and equivalent variations in income. The revealed preference approach to demand theory. Laspeyre and Paasche price indices. True price indices. Nicholson: Chapter 5, pp. 165-173. 4 * Hal Varian: Microeconomic Analysis, 3rd edition, Chapter 10. * Michael Boskin, et al, “Toward a more accurate measure of the cost of living,” Final report to the Senate Finance Committee from the Advisory Commission to Study the Consumer Price Index, December 4, 1996. Available at http://www.ssa.gov/history/reports/boskinrpt.html#cpi4 6. Monday, September 27 Cross-price effects: Net and gross substitutes and complements. The Slutsky equation for cross-price effects. Summary of the properties of demand functions and the relationships between related elasticities. Aggregation of individual demand to market demand. Further applications of the theory of consumer behavior. Nicholson: Chapter 6 (pp. 182-188 only) and Chapter 12 (pp. 391-395). 7. Wednesday, September 29 Theory of Producer Behavior: Production functions and their properties. Returns to scale. Elasticity of substitution. Cost functions in the short and long runs. Derivation of the cost function from the production function. Nicholson, Chapters 9 and 10. 8. Monday, October 4 Cost functions (continued): Cost functions for the Cobb-Douglas, Leontief and linear production functions. Average and marginal cost functions and their relationship to one another. Nicholson, Chapter 10. 9. Wednesday, October 6 Supply curves: The profit maximizing behavior of competitive firms. Derivation of the firm’s supply curve and the market supply curve in the short and long runs. Pecuniary and technological externalities. Nicholson, Chapter 11. Monday, October 11 Holiday, Columbus Day 10. Tuesday, October 12 (note Tuesday class, substituting for the Monday holiday) Partial equilibrium in a competitive market: The basic demand and supply model. Comparative statics in the short and long run. The significance of the long run equilibrium. Efficiency of perfect competition in partial equilibrium. Applications of the basic market model. Nicholson, Chapter 12 (pp. 391-423). 5 11. Wednesday, October 13 Further applications of the market model: Commodity taxes: specific and ad valorem taxes. Sales taxes and excise taxes. Tax incidence analysis. (Start on General Equilibrium topic if time allows … see next entry.) Nicholson, Chapter 12 (pp. 423-432). * Richard Layard and A.A. Walters: Microeconomic Theory, Chapter 3. 12. Monday, October 18 General equilibrium and welfare economics: The concept of Pareto efficiency. Pareto efficiency in the pure exchange model. The Edgeworth box and the contract curve. The utility possibilities frontier. Offer curves and the principles of international trade. Efficiency in production. The production possibilities frontier. Efficiency in product mix. The two optimality theorems of welfare economics. The theory of second best. Nicholson, Chapter 13. 13. Wednesday, October 20 Overflow and Review: Time allowed to catch up on remaining topics and to review for the mid-term. 14. Monday, October 25 MID-TERM EXAM (to cover through General Equilibrium) 15. Wednesday, October 27 Monopoly: Basic monopoly model. Multi-plant monopoly. Cartels. Price discrimination. Two-part pricing. Limit pricing. Contestable markets. The welfare cost of monopoly. Monopoly in general equilibrium. Monopoly and innovation. Nicholson, Chapter 12 (pp. 491-509). 16. Monday, November 1 Regulation of monopoly: Natural monopoly and the need for regulation. Marginal cost pricing. Average cost pricing. Two-part pricing. The multi-product case: Ramsey pricing. Rate of return regulation. The Averch-Johnson effect. Price cap regulation. Nicholson, Chapter 12 (pp. 510-513). 17. Wednesday, November 3 Imperfect Competition: The Cournot model. Reaction functions and Cournot-Nash equilibrium. Symmetric and asymmetric Cournot equilibria. Long run (free entry) Cournot equilibrium. The Stackelberg model. Nicholson, Chapter 15. 6 18. Monday, November 8 Imperfect Competition (continued): The price leadership model in the short and long run. The Bertrand model. Monopolistic competition and product differentiation. The excess capacity theorem. Nicholson, Chapter 15. 19. Wednesday, November 10 Theory of Games: Static games of complete information. Nash equilibrium in pure and mixed strategies. Repeated games. Dynamic games: normal and extensive forms. Subgame perfect equilibria. Nicholson, Chapter 8. * Eric Rasmusen: Games and Information, 4th edition, Blackwell, 2007. Some parts available at: http://www.rasmusen.org/GI/download.htm 20. Monday, November 15 Input Markets, Labor: The basic labor-leisure tradeoff and labor supply. Marginal productivity and labor demand. Monopsony in labor markets. Wage discrimination. The effect of unions in labor markets. Bilateral monopoly. Nicholson, Chapter 16. * Gary Becker: “A Theory of the Allocation of Time,” Economic Journal, September 1965, pp. 493-517. Available at: http://www.jstor.org.ezproxy.bu.edu/stable/2228949 21. Wednesday, November 17 Input Markets, Capital: The intertemporal consumption decision and the supply of capital. Saving and borrowing. The firm’s investment decision and the demand for capital. Intertemporal aggregation and the concept of present value. Discrete and continuous compounding. The price of natural resources. Nicholson, Chapter 17. 22. Monday, November 22 Decisions under Uncertainty: The choice problem under uncertainty. The St. Petersburg Paradox. The expected utility hypothesis. Cost of risk and maximum willingness to pay for insurance. Decision trees. Risk-pooling and risk-spreading. The problem of correlated risks. Critiques of the expected utility hypothesis. Nicholson, Chapter 7, pp. 202-213. * Wolfgang Pesendorfer: “Behavioral Economics comes of age: A review essay on Advances in Behavioral Economics,” Journal of Economic Literature, September 2006, pp. 712-721. Available at: http://www.jstor.org.ezproxy.bu.edu/stable/30032350 7 Wednesday, November 24 Holiday, Thanksgiving. 23. Monday, November 29 Imperfect Information: The problems of moral hazard and adverse selection. The statecontingent approach to decision-making under uncertainty. Solutions to the problem of asymmetric information: screening and signaling. Nicholson, Chapter 7, pp. 213-226. * George A. Akerlof: “The Market for “Lemons”: Quality Uncertainty and the Market Mechanism,” Quarterly Journal of Economics, August 1970, pp. 488-500. Available at: http://www.jstor.org.ezproxy.bu.edu/stable/1879431 * Michael Spence: “Job Market Signalling,” Quarterly Journal of Economics, August 1973, pp. 355-374. Available at: http://www.jstor.org.ezproxy.bu.edu/stable/1882010 24. Wednesday, December 1 Externalities: Positive and negative externalities. Allocative effects of externalities. Solutions to the problem of negative externalities: Pigouvian taxes and quantity restrictions. Effluent charges. The cap and trade option. The transactions cost approach to externalities. The Coase Theorem. Nicholson, Chapter 19, pp. 670-679. Pankaj Tandon: “An Integrated Approach to the Theory of Externalities: An Exposition,” unpublished draft, Boston University. Available at: http://pankajtandon.com/Externalities-An%20Exposition.pdf * Ronald Coase: “The Problem of Social Cost,” Journal of Law and Economics, October 1960, pp. 1-44. Available at: http://www.jstor.org.ezproxy.bu.edu/stable/724810 25. Monday, December 6 Externalities (continued) and Public Goods: The tragedy of the common and common property resources. Public goods. Efficient provision of public goods: partial equilibrium and general equilibrium approaches. The free rider problem. Nicholson, Chapter 19, pp. 679-687. 26. Wednesday, December 8 Social Choice, Justice and Wrap-up: Political solutions to the problem of public good provision. The median voter rule. The paradox of voting and Arrow’s impossibility theorem. Other concepts of efficient allocation: the Kaldor-Hicks Compensation Criterion, utilitarianism, and Rawls’s Theory of Justice. Social choice criteria as decisions under uncertainty. Final course wrap-up: What have we learned? Nicholson: Chapter 19, pp. 687-693. * John Rawls: A Theory of Justice, revised edition, 1999. 8 * John C. Harsanyi: “Cardinal Welfare, Individualistic Ethics, and Interpersonal Comparisons of Utility,” Journal of Political Economy, August 1955, pp. 309-321. Available at: http://www.jstor.org.ezproxy.bu.edu/stable/1827289 * William Vickrey: “Utility, Strategy, and Social Decision Rules,” Quarterly Journal of Economics, November 1960, pp. 507-535. Available at: http://www.jstor.org.ezproxy.bu.edu/stable/1884349