Must Create Test Item Bank

advertisement

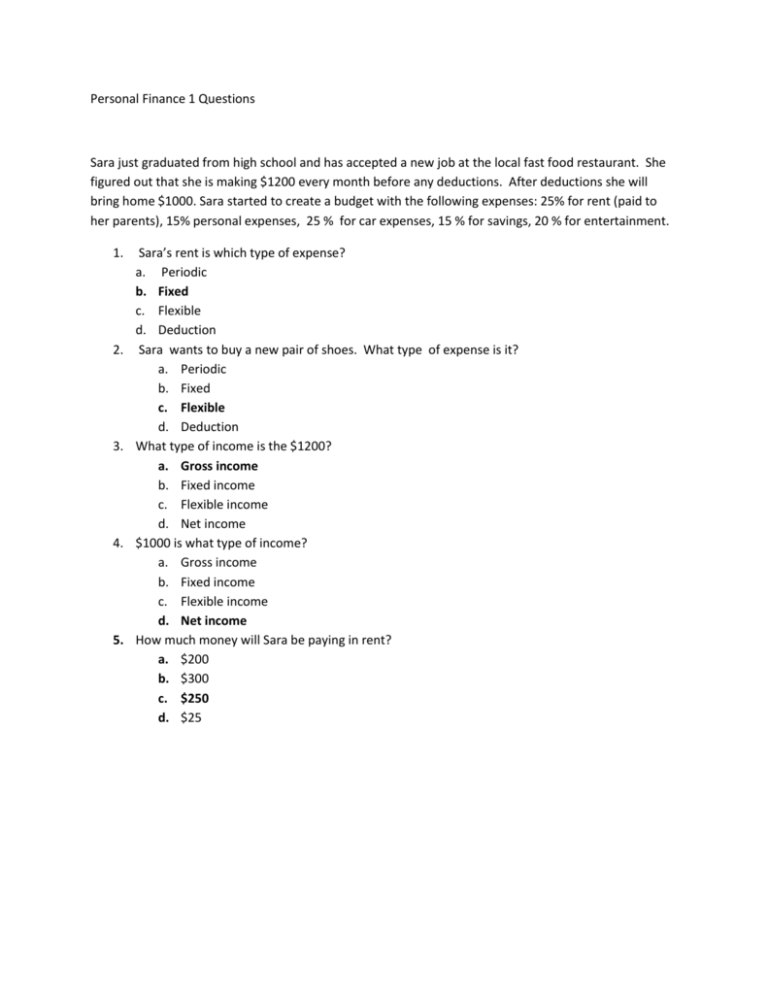

Personal Finance 1 Questions Sara just graduated from high school and has accepted a new job at the local fast food restaurant. She figured out that she is making $1200 every month before any deductions. After deductions she will bring home $1000. Sara started to create a budget with the following expenses: 25% for rent (paid to her parents), 15% personal expenses, 25 % for car expenses, 15 % for savings, 20 % for entertainment. 1. 2. 3. 4. 5. Sara’s rent is which type of expense? a. Periodic b. Fixed c. Flexible d. Deduction Sara wants to buy a new pair of shoes. What type of expense is it? a. Periodic b. Fixed c. Flexible d. Deduction What type of income is the $1200? a. Gross income b. Fixed income c. Flexible income d. Net income $1000 is what type of income? a. Gross income b. Fixed income c. Flexible income d. Net income How much money will Sara be paying in rent? a. $200 b. $300 c. $250 d. $25 Cammie wants to attend prom this year. Last year she could not afford to buy a dress, so she has decided to start saving $20 per week for the next 4 months (16 weeks). A local dress shop is having a sale right now. The perfect dress is on sale for $300. She could buy it now on her mom’s credit card which has 20% interest that her mom said she would have to pay. The store offers a layaway plan that would allow her to put down 10 % and make weekly payments of $17 until the dress is paid off. Another option is wait until she has saved all the money and find a dress then. 1. If Cammie waits to save all of her money how much money will she have to purchase a dress? a. $560 b. $240 c. $1000 d. $320 2. What is the financial disadvantage of using her mom’s credit card to buy the dress right now? a. The dress will cost more than if is waited to pay cash b. She can get the dress right now c. The dress will be cheaper than if she waited d. The dress may not fit in four months, or she may find a dress she likes even better Cammie figured up the actual cost of charging her $300 prom dress for the next 4 months by making the following chart: Month 1 Month 2 Month 3 Month 4 Cost of dress $300 $300 $240 $112 Monthly payment -$50 -$100 -$100 -$100 Subtotal $250 $200 $140 $12 Finance +$50 +$40 +28 +$2.40 Charge(20%APR) Balance $300 $240 $112 $14.40 1. What is the total cost of financing the prom dress for 4 months? a. $666.40 b. $120.40 c. $350.00 d. $962.00 2. What is the total cost of Cammie’s prom dress if she charged it and paid off according to her chart? a. $420.40 b. $666.40 c. $962.00 d. $300.00 3. Which of the following was NOT a reason for Cammie to increase her monthly payment after the first month? a. She realized she would not have it paid off on 4 months b. The interest was making the dress cost more money c. The sooner she could pay it off the more money she would have for other expenses d. Charging the dress will save her money 4. When talking about credit cards, what does the term “interest” refer to? a. Money earned for putting money in the bank b. Cost of paying your bill late c. Over the limit fee d. Cost of borrowing money When Sara received her first paycheck, she was shocked to see that her check was not $300 like she expected. The following things were taken out: Federal income tax, social security, Medicare, meal allowance, and uniform allowance. 1. Social security and Medicare represent: a. Federal taxes b. Deductions c. Expenses d. Budget 2. The meal allowance and uniform allowance represent: a. Federal taxes b. Deductions c. Expenses d. Budget 3. If Sara wants to receive more take home pay, which tax or deduction can she control? a. Social security b. Medicare c. Meal Allowance d. Uniform allowance Maria had her purse stolen at the grocery story today and is worried about becoming a victim of identity theft. 1. What information was in her purse that could increase the risk of identity theft? a. Store reward cards b. Social Security number c. Old Receipts d. Cash 2. What procedure will NOT help to prevent identity theft? a. Have a list of all the credit cards that she carried in her wallet/billfold b. Sign the back of her credit cards when she gets them c. Call credit card companies to report cards stolen d. Keep all the personal information together in her wallet/purse so she knows where it is 3. All the following are ways to steal identity information except: a. Stealing the mail b. Watching over your shoulder while you make ATM transactions c. Giving out your passwords to friends/family or over the phone d. Signing the back of the credit card Khia wants a large, flat screen TV. She has been doing some research on flat screen TVs so she could make an informed decision. She saw one advertised at Best Buy for $1000 that seemed to have all the features she wanted. When she got to the store the salesperson told her that one had already sold and tried to talk her into a higher cost model for $1600. When that did not work, the salesperson started pushing a model which had less features and was $800. Khia did not make the purchase at that time and decided to shop around. 1. The technique that the salesman was using is called: a. Fair advertising b. Bait and switch c. Phishing d. Spam 2. If Khia wanted to check to reliability of the TV. Which research tool would be the most helpful? a. Mom and Dad b. Craig’s List c. Consumer Report d. Better Business Bureau 3. If Khia wanted to check on the store’s reputation and business practices the best research tool would be: a. b. c. d. Angie’s List Craig’s List Consumer report Better Business Bureau 4. Khia decided to check out the rent to own store in her town. Why might this not be the best place to buy the TV? a. The total cost of the purchase of the TV will be a lot cheaper b. The interest rates of a rent to own type place are usually lower that other places c. Higher interests and for a longer period of time, also if you miss a payment they get the item back d. The product is yours even if you don’t pay the bill Jim and Sue are newlyweds and are struggling with a difficult decision. Jim is between jobs, and Sue is currently commuting 45 minutes to work with no public transportation available. They are trying to decide on whether or not to buy a new 55” television that Jim has wanted for several years. The TV costs $1000. Sue is driving a 1997 Nissan Sentra that has 150,000 miles on it and has recently spent over $500 on repairs for the car. What should their decision be as to how they should spend or save their money? - Buy the TV, the vehicle has lasted this long, of course it will last. - Don’t buy the TV, and use the money as a down payment towards a new car. - Put the money they would have spent on the TV into savings and wait until the car dies. - Buy a small TV, at less cost, and save some of the money. What tool could they use to help them make this decision? - Cash Flow Statement - Budget - Expense Report - Cost Analysis Sheet What additional resource(s) could they use to help them make this decision? - Bank or Credit Union - TV Salesperson - Wikipedia - Colleague What is an example of an Opportunity Cost in this scenario? - Jim isn’t working so they are living off of one income - If they save the money, they can put it towards a car. - Sue is the money maker, so she should get to decide. - If they buy the TV, they are not putting money towards a new car. If they decided to save the money and still buy the TV, the best option would be: - Get a cash advance - Credit card with low interest - Rent to own - Payday Lender Ajeet is 19 years old, a recent high school graduate and is not sure what he wants to do. He is landscaping as a seasonal job and may be going to college in the fall. He uses his money to pay for fuel and insurance on his car, cell phone – he pays for the data he uses, and seeing movies with his friends. When shopping recently, the low interest rate and immediate discount enticed him to sign up for a credit card. Which of Ajeet’s expenses are fixed? -Movies -Phone -Fuel for car -Monthly car insurance Ajeet wants to buy a pair of shoes that cost $279, but doesn’t have the cash to pay for them. What should he do? -Charge the shoes, only if he anticipates having the money to pay of his credit card at the end of the month. -Charge the shoes and pay the minimum amount each month until his balance is gone. -Bug his parents for the money, they’ve always been good for it. -Wait until the shoes go on sale. Regardless of him going to college, he someday hopes to buy a home. What type of goal would this be? -Short Term -Long Term -Immediate Goal -SMART GOAL After talking to his parents, Ajeet thinks that he will save 200 a month, for the next year to pay for his prerequisite courses at a community college. This is an example of what -Short Term -Long Term -Immediate Goal -SMART GOAL To help him achieve his goals, Ajeet wants a safe bet to protect his money in the short term, while making a little bit of interest. What would be a good choice? -Buy stock -Buy a 10 year bond -Open a savings account -Open a checking account The summer before her freshman year, Carmela just moved to a new school in the suburbs. Prior to moving, she occasionally babysat for her neighbors and is looking to find more families to sit for. She also runs cross country and plans on trying out for basketball. Her mother plans on taking her shopping for the upcoming school year. Besides clothing she has had her eye on a new purse she always sees her favorite TV star carrying. What type of advertising is this? -Bandwagon -Celebrity Testimonial -Peer Approval -Rewards Her mother said she would pay $50 for shoes but no more. Carmela knows the shoes all the other girls wear shoes that cost more than $50. If Carmela pays the difference and buys the more expensive shoes, what type of advertising would she be subject to? -Bandwagon -Celebrity Testimonial -Peer Approval -Rewards She needs new shoes for both sports, what should she do before making her decision? -Visit one store, and buy the shoes -Visit multiple stores (specialty and department) and compare prices -Go to a second hand store or resale shop -Buy them online After Carmela and her mother were done shopping, Carmela reflected on her purchases. What would be an indication she was being a smart consumer? -She checked labels, did her research, and went to multiple stores -She checked twitter to see what all her friends were talking about -She bought the first thing she saw at each store -She picked her favorite colors and styles regardless of price Since Carmela has been playing competitive sports for years, she is starting to have pain in her ankles after games. What would be most important when buying new shoes? -Shoes in her favorite color offer less support -Shoes that offer more support are a little more expensive, but don’t cause pain. -Her favorite brand’s new model got bad consumer reviews -Her current shoes are worn out and cause a lot of pain Satoshi is a single father with a daughter who is 3 years old. They are renting a small apartment, and paying monthly for internet so Satoshi can talk to his family back home. His daughter will be starting pre-school in a year, but until then, she attends Day Care. Satoshi works at a factory making $12 an hour, but gets health insurance. He is considering switching jobs and the other job would provide more income, but only partial insurance coverage. He has some minor health issues but his doctor recommended a restricted diet that is mostly plant based with little meat. He receives some government assistance but not enough to cover all of his expenses. When planning his weekly meals what should Satoshi do? - Shop at specialty stores, buying all his favorite items regardless of price - Shop bulk / big box stores, even if he doesn’t use all of the items - Pick up groceries at local convenience store in their neighborhood. - Check ads, make a list, and shop at discount as well as regular grocery stores For insurance purposes, if Satoshi needed help when taking care of his family’s needs he would need to contact: - Chamber of Commerce - Local Government Assistance Program - Health Department - Police Department Knowing that his daughter will be in preschool next year, Satoshi needs to find a place for her to attend. He heard there are several options close by, but wants to make sure he is financially able for her to start. - The district they live does not bus their students, and is on the other side of town. - The preschool in their neighborhood is an expensive, charter school. - Check the local library, ask around at work and do some more research. - Home school, when able to, and pay for a tutor. Which of the following taxes does Satoshi not pay? - School District - Property - Federal Tax - Local Tax Which of the following expenses would be a flexible / variable expense in Satoshi’s budget? - Groceries - Rent - Day Care - Internet The Rodriguez family has a small house in the city. The two children, Gabriella 15 and Esteban 17, are both in high school. Manuel works 3rd shift as a maintenance at the local university, and Marta worked most recently as a teacher’s aide, however, due to district cuts recently lost her job. The family own a used car and are in the 2nd year of a 3 year lease on another. Now that Esteban finally got his license, he is insistent that he be able to drive him and his sister to school. When driving home from work, Manuel got into an accident totaling their used car. The family needs another car, how should they acquire one? - Buy a new car from a dealership - Lease another car from a dealership - Buy another used car - Use public transportation and save up for another car. As a junior in high school, Esteban is beginning to consider college which of the following should he NOT allow to affect his choice when selecting his college. - Attending based on his favorite teams to follow - Attending based on student loan rate vs. affordability - Attending based on parental employee discount - Attending based on scholarships available for at need populations Gabriella wants some new clothes for school, so without asking, took her mother’s credit card and went to the mall. She charges $200 at a few stores and already removed all the tags. Her mother saw the bill, and knows Gabriella made the purchases. What should she do? - Blame her brother - Pick up more babysitting jobs and take that money to pay for the clothes - Return the clothes, get store credit, and buy something for her mom - Don’t do anything and hope her mother doesn’t say anything Marta received a letter noting that if she attended an adult education program she could become employed within 2 weeks after a 2 month training. It is in the evenings on the other side of town when Manuel is still at work. Should she take the classes? - No, she could find a part time job to help out - No, she could try and find another job as an aid next school year. - Yes, going through the training program would make more money in the long run - Yes, start the class, but if she doesn’t like it, just drop out. Financial Management I Megan is a single mom with two children ages one and three. Employed as an in-home health care provider, Megan works 25 hours per week at $9.50 per hour. Also a part-time student, she is working on becoming an RN. Felipe, the father of the children whom she lives with, works as a truck driver. Grandparents and relatives watch the children while the parents work and Megan attends school. 1. Which of the following would be considered expenses on Megan’s and Felipe’s spending plan/budget? a. b. c. d. $50.00 Birthday Present, Income Tax Refund, Gym Membership Cell Phone, Internet, Car Payment, Savings Government Assistance (food stamps/ SNAP), Wages Child Care Expenses, Rent, Utilities 2. Which of the following items would be considered income on Megan and Felipe’s spending plan? a. $50.00 Birthday Present, Income Tax Refund, Savings b. Cell Phone, Internet, Car Payment, Savings c. Government Assistance (food stamp/SNAP), Wages d. Child Care Expenses, Rent, Utilities, Lottery winnings 3. Megan and Felipe are looking to purchase a home in the next five years. They need to boost their credit score and save for a down payment. Which of the following will NOT improve their credit score? a. Pay bills on time b. Maintain employment stability by keeping the same job for several years c. Only pay credit card bills when you have extra money d. Using a credit card only for emergencies 4. Attitudes and behaviors can lead to financial satisfaction. Which behaviors will hinder Megan and Felipe’s meeting their financial goals. a. Having 3-6 months of wages saved for unexpected life emergencies b. Having a monthly budget that is followed c. Investing in yourself through taking classes or training d. Living each day for the moment no matter what the cost 5. How would you figure Megan’s gross pay? a. Number of hours worked multiplied by hourly wage b. Minimum wage divided by 40 hours c. Number of hours worked multiplied by hourly wage minus deductions d. Net pay multiplied by hours worked minus hourly wage Niequa graduated from high school this spring and is moving out on her own. She will be finding an apartment and has secured a full time position as a waitress. She needs to find a financial institution to meet her needs. She likes to use her Mom’s Debit card and the ATM, it is very convenient. Help her make some wise financial decisions. 1. What type of financial institution account does Niequa need in order to easily pay bills, access her money quickly, have a debit card, and have her check direct deposited? a. Savings account b. Money market account c. Checking account d. Certificate of deposit 2. Niequa wants to start saving to get a new car and would like to earn interest on her savings. The following are examples of interest earning accounts that she could chose except: a. Certificate of deposit b. Money market deposit account c. Credit card account d. Savings account 3. Niequa made a mistake in her checking account recordkeeping and spent $10 more than she had deposited in her account. As a result, she can expect to be charged a(n): a. ATM Fee b. Monthly Account Usage Fee c. Safe Deposit Fee d. Overdraft Fee 4. Niequa received an email from her depository institution describing a new service being offered where she can access her account, transfer funds, and pay bills from her smartphone or tablet. This new service is best described as: a. Contactless Banking b. Online Banking c. Mobile Banking d. ATM Banking Kareem has been a victim of identity theft! He made a purchase online from Amazon with his debit card. Shortly after the purchase he discovered that money had been taken out of his checking account on purchases that he had not made. Help Kareem become a savvy consumer that avoids the pitfalls of identity theft. 1. Which of the following is an act of identity theft? a. Receiving permission to use a parents’ credit card for school clothes b. Wrongfully acquiring and using someone’s personal identification c. Taking the identity of another individual as inspiration for a costume d. Having the same name as another person 2. Which of the following actions will not make an individual vulnerable to identity theft? a. Purchasing an item online with a credit card b. Responding to an e‐mail from your depository institution c. Paying cash for a movie ticket d. Throwing mail in the garbage 3. What is a safety tip for shopping safely online? a. Always be sure to give your social security number b. Shred sales receipts as soon as the item purchased has been received c. Use a credit card d. Use a debit card 4. Which is a general rule when dealing with credit reports to minimize identity theft? a. Check credit reports at least once per year b. Wait 60 days before disputing any wrong information found in the credit report c. Keep credit reports in an easily accessible location, so information can be accessed if identity theft does occur d. Report mistakes to only one credit reporting agency and they will inform the others 5. If a credit card is used fraudulently, what is the cardholder’s personal liability for the unauthorized charges? a. The cardholder has no liability for unauthorized charges if they are reported within 60 days b. The cardholder’s liability is limited to $50.00 for unauthorized charges if they are reported in writing within 60 days c. The cardholder’s liability will vary depending on the amount that was fraudulently chargedto the card d. The card holder is liable for all unauthorized charges to the card Brad and Amanda were married almost a year ago. Their goal is to put money aside from their paychecks so that they can have a down payment to purchase a home of their own. They are interested in learning about saving and discovering what savings tools will help them achieve their dream of home ownership. 1. Compounding interest is best defined as: a. Interest earned on the principal investment b. Any form of interest earned from saving or investing c. Earning interest on interest d. The effect interest has on the total return on investment 2. Brad and Amanda have heard their parents talk about the “pay yourself first” policy. What does this mean? a. An individual should save whatever money is left over after paying monthly bills. b. An individual should pay all fixed expenses before paying flexible expenses. c. An individual should set aside a predetermined amount of money for saving before using any of that money for spending. d. An individual should spend money on the items and activities enjoyed in life before paying any other expenses. 3. Brad and Amanda are worried about the security level of saving tools. Which of the following statements correctly describes the security level of savings tools? a. Savings tools are not secure because they have a high risk of losing money. b. Savings tools are secure because they are protected by the U.S. government against loss. c. Savings tools are very secure because there are no risks involved with saving or investing. d. It would be safer to keep the money at home in a shoe box. 4. Brad and Amanda’s goal is to save $350.00 a month towards their dream goal of home ownership. Giving up food from vending machines to achieve that goal is the: a. Opportunity cost b. Interest c. Specific part of the SMART goal d. Trade-off 5. When taking advantage of the time value of money, which of the following is most likely to result in the largest return? a. Invest a large principal amount of money and then make no additional investments. b. Invest as long as possible and at the highest interest rate possible. c. Invest a small amount of money for a short period of time at the highest interest rate possible. d. Invest at a high interest rate because interest is the only factor that affects return. 6. The function of the Federal Deposit Insurance Corporation is to _______________. a. Control the amount of money and credit available to the public b. Offer discount bonds for 50% of the face value c. Insure member depository institutions against loss d. Provide the system for cashing checks and electronic transactions Financial Management I Dominick wants to buy an iPod and has done research online and in local stores. He found the best price online. He has a part time job after school and has his own checking account with a debit card, as well as a PayPal account. He made his purchase using his debit card. However, when the package arrived, it was damaged and the iPod did not work. 1. What is the first step Dominick should take in resolving his problem? A) Contact the bank B) Contact the delivery service* C) Contact the online sight D) Purchase another iPod at a local business where he can verify that it works 2. In the future, to ensure more security in online purchases, it would be best to use... A) A check B) A money order C) A debit card D) A credit card* 3. When using PayPal for online purchases, which is NOT the advantage? A) Personal information more secure B) Credit card number is protected C) Fraudulent transactions are reimbursed D) PayPal will replace a damaged item* 4. By using his debit card to make on online purchase, Dominick will pay for his iPod... A) At the point of purchase* B) Next month C) When the item arrives D) After a 10-day grace period 5. A disadvantage of shopping online is A) Lower overhead B) Sales tax C) Additional shipping and handling costs* D) Convenience Levi just got hired as a highway patrolman. His parents tell him he needs to start saving for his retirement. Levi knows he should be diversified in his investment choices and strives to assure himself both financial growth and safety. He is aware that in order to enjoy retirement, he will need to do more than put money in a savings account. 1. Which type of investment provides the safest way for Levi to achieve financial growth? A) Certificate of deposit B) Mutual fund* C) Individual stock D) Store it under his mattress to avoid market risk 2. Being employed as a state highway patrolman, Levi has the opportunity to participate in a work-related ____ plan available only to public employees A) Roth IRA B) Simplified Employee Pension C) 403b* D) Keough 3. Levi learned through his research that he can invest small amounts of money from each paycheck while staying diversified when investing in A) Individual stocks B) Bonds C) Mutual funds* D) Options 4. By investing early in his career, Levi can take advantage of _____ to help his money grow. A) The time value of money* B) Indirect investing C) Inflation D) Liquidity 5. To stay ahead of inflation, Levi will need to strive for an average annual return of A) 3% B) 5% C) 8%* D) 10% Tiana has been receiving numerous credit card offers in the mail. She decided to create a chart so that she could better compare the card offers and make an informed decision that would best meet her individual needs. Her chart is as follows: Bank Card #1 Bank Card #2 Store Card Annual Percentage Rate 0.00% intro for 12 months, then 13.99% 0.00% intro for 18 months, then 9.99% 21.6% Balance Transfer 0% intro, then 13.99% 0% intro, then 9.99% N/A Cash Advance 25.24% - will vary with prime rate 19.24% - will vary with prime rate N/A Annual Fee None None None Grace Period 21 days 21 days 25 days Transaction Fee: Balance Transfer 4% with a minimum fee of $10 3% with a minimum fee of $5 N/A Transaction Fee: Cash Advances 3% with a minimum fee of $10 5% with a minimum fee of $15 N/A Late Payment Fee upto $35 upto $39 upto $25 International Transactions 3% of transaction in U.S. dollars None N/A 1. Tiana realizes that the use of credit can be very expensive and has decided to always pay off her balance at the end of each cycle. She is looking for an all-purpose card that she can use at various stores as well as transfer a balance from a previous card. Although she doesn’t carry a balance, she is looking for the best interest rate to protect herself from any hardships in the future. Which card offer is the best choice for Tiana? A) Bank Card #1 B) Bank Card #2* C) Store Card D) Either Bank Card #1 or Bank Card #2 2. Tyrone, Tiana’s older brother, wants to buy a new gaming system. The newest system sells for $599.00, not including sales tax. According to Tyrone’s budget, he can afford payments of $62.00 a month. Which of the three credit cards would be the best to make the purchase? A) Bank Card #1 - since it offers the cheapest rate for cash advance B) Bank Card #2 - since it offers the best rate for balance transfers C) Store Card - since it has the longer grace period D) Either Bank Card #1 or Bank Card #2 - since they offer 0% introductory rates* 3. In Personal Finance class, Tiana learned that the _____ is the time given between credit card payments where interest does not accrue on new purchases (providing you’ve paid your card balance in full the month before.) A) Annual Percentage Rate B) Cash Advance C) Grace Period* D) Late Payment Fee 4. Tiana’s credit card company can change the Annual Percentage Rate in her agreement at anytime providing she misses her car payment, overdrafts her checking account, or makes a late payment on another credit card. This practice is known as A) Credit Limit Overdraft B) Debt Loan Recovery C) Late Payment Fee D) Universal Default* 5. Felicia, a friend of Tiana’s would like to travel to Europe. She usually pays her balance in full, but occasionally makes the minimum payment. What two criteria should Tiana consider in helping her friend shop for credit? A) Annual Percentage Rate and Balance Transfer B) Annual Percentage Rate and International Transaction Fee* C) Grace Period and International Transaction Fee D) Grace Period and Late Payment Fee Financial Management Karl bought his first vehicle, a 2000 Ford 150 truck. The price of the truck was $5000. He worked hard and saved his money to pay cash for it, but Karl didn’t save enough to purchase full coverage insurance on it. He only purchased the state minimum coverage. He looked down and was changing the radio station when he lost control and crashed into a house. 1. What is the state minimum coverage? A. Collision B. Disability C. Liability D. Property Damage 2. What type of insurance would cover Karl’s accident? A. Homeowners B. Disability C. Renter’s D. Automobile 3. Who should be Karl’s first contact be? A. His mother B. Police C. Insurance Agent D. Insurance Company 4. What type of insurance covers the homeowner? A. Uninsured motorist B. Comprehensive C. Liability D. Collision What type of insurance should have Karl purchased if he had wanted to cover his own truck’s damage in the accident? A. Uninsured motorists B. Collision C. Comprehensive D. Bodily Injury Mary just graduated high school and is leaving for college in the fall. She has a savings account at her local bank. She has decided to take out $500.00 to open a checking account. Mary knows that she probably will write only 2 checks a month, but she knows she’ll use the debit card all of the time. Mary decides against the overdraft protection on her account, because she will never overdraw her account. 1. Why is it important to balance your checkbook every month? A. Automatic check readers can misread an amount you wrote on your check B. Banks calculate interest by hand, and sometimes they forget to do this step C. Mary is likely to spend more money than she has in her account D. The money for her debit card comes out of Mary’s savings account 2. Mary did overdraw her account and the bank charged her overdraft fees. She has decided that she needs to add this to her account. Which of the following statements best describes overdraft protection? A. Is always a free service provided by banks B. Is like a credit card you don’t use until your checking account gets below a zero balance C. Is always a waste of money because people don’t bounce checks anymore D. Should be bought by everyone, even if they always keep a significant amount of money in their account 3. Mary is going to balance her checkbook. Which is the best statement that describes what she will do? A. Subtract any checks in your check register that are not marked as cleared B. Subtract any deposits in your check register that have not been marked as cleared C. Add the interest paid and bank charges to the register balance D. Add any checks in your check register that are not marked as cleared 4. Mary misplaced her debit card so she has to write a check to purchase books at the bookstore. It’s been so long since she wrote a check that she needs to remember to: A. Always print your signature B. Sign on the line that says Pay to the order of C. Spell out the dollars and cents on the long line that ends in Dollars D. Spell out the dollars and cents in the short box next to the $ symbol 5. Mary wants to see if her check that she wrote to the bookstore has cleared her account. Which of the following statements would best describe a cleared check? A. Are available as online images for you to refer to or as reduced images sent with each monthly statement B. Are always sent to the account holder with each monthly statement C. Should be used to notify the people you wrote the check to, since they haven’t cashed the checks yet D. Are automatically re-deposited if the check image is lost Employee Name Employee Number 123-45-6789 Check # Pay TypeGross Pay Deductions #6789 Check Amount Employee Address Current Year to Date Fed Withholding State Withholding OASDI/Fed EE Social Security Fed MED/EE or Medicare Medical 401K Totals Pay Period: January 15th - February 11th Amanda Smith is employed as a clerk at Clothing For You, a local clothing store. She is paid every two weeks. Amanda makes $8.00 per hour. She works 40 hours each week. She also has medical benefits and a retirement package. Amanda’s person information is: Amanda Smith 123 Elm Street Columbus, Ohio 43222 Amanda’s paycheck deductions include: 6.2% Social Security, 1.45% Medicare, $66.14 Federal Withholding Tax, $10.60 State Withholding Tax, $40 Medical, and $60.40 for her 401K. Complete the paycheck above and answer the questions below. 1.) How much is Amanda’s gross pay? A.) $320 B.) $640* C.) $960 D.) $1180 2.) How much is Amanda’s Social Security deduction? A.) B.) C.) D.) $8.66 $18.84 $39.68* $66.14 3.) What is Amanda’s yearly contribution to her 401K.? A.) $74.50 B.) $894.00 C.) $1288.60 D.) $ 1570.40* 4.) What does Amanda’s social security payment cover? A.) Retirement* B.) Medical expenses C.) Homeland Security D.) Entertainment expenses 5.) How much is Amanda’s net pay? A.) $320 B.) $413.90* C.) $562.78 D.) $640.00 6.) If Amanda is paid bi-weekly, how many paychecks will she get in a year? A.) 6 B.) 12 C.) 24 D.) 26* 7.) What does Amanda’s Medicare deduction cover? A.) National health care programs* B.) Personal medical expenses C.) Emergency room visits D.) Regular Wellness visits to the doctor Answer sheet for deductions: Gross pay - $640 Federal withholding - $66.14 State withholding - $10.60 Social Security- $39.68 Medicare - $9.28 Medical - $40 401K - $60.40 Net pay - $413.90 Personal Finance I- Standard 3 and 5 High School FCS Pre and Post Assessment Questions Scenario As Carlos prepares to move out on his own he has been tracking his expenses to help him in creating a spending plan. Categories Wages Planned 1920.00/month Savings Rent 450.00 Car Payment 200.00 Insurance-Renters 75.00/year Food/Groceries 400.00 Gas 160.00 Phone/Cable/Internet Package 145.00 Insurance-Car 252.00/bi-annually Maintenance and Repair -Car 100.00 Utilities 100.00 1. Based on Carlos spending plan above which of the of the following is true: a. Expenses are less than income b. Income is greater than his expenses c. Income and expenses are equal d. Carlos has only fixed expenses 2. If Carlos pays his car insurance bi-annually how much must he save per month to plan for car insurance: a. $126.00 b. $ 42.00 c. $21.00 d. $84.00 3. Rent, Car payment and insurance would be examples of what? a. income b. variable expenses c. flexible expense d. fixed expenses 4. If Carlos is earning $1920.00 a month, excluding taxes, how much does he make per hour if he works 40 hours per week? a. $10.50 b. $12.00 c. $18.00 d. $48.00 5. If Carlos plans to put 15% of his wages each month in to a savings account he would save: a. $28.80 b. $72.00 c. $128.00 d. $288.00 Scenario Martina has just received her first paycheck and is trying to understand where all her money went. Please help her understand where all her money went. 1. Federal income tax, state income taxes, FICA and medical insurance are considered: a. fixed expenses b. deductions c. payroll withdrawals d. debt 2. If Martina earns $480.00 a week before taxes are taken out what would she bring home if she falls into the 25% tax bracket? a. $120.00 b. $240.00 c. $360.00 d. $380.00 3. If Martina is working 40 hours per week and her before tax pay is $480.00 before taxes what is her hourly wage? a. $9.20 b. $10.00 c.$12.00 d.$19.20 4. Which of the following are common expenses related to have a job that Martina will need to take into consideration? a. Uniform fees, lunches, and gas for her car b. Credit union, Christmas club and carry in meals c. Fundraisers for co-workers children d. retirement and holiday gifts for the boss 5. If Martina plans to use her income primarily for paying bills the best place to put her money would be: a. money market b. checking c. savings d. certificate of deposit Katrina and Emmanuel are a young married couple who are trying to get a head start on their Christmas shopping for this holiday season. They have saved $1000.00 and will need an additional $500.00 to get a gift for everyone on their list. 1. While shopping at Wal-mart they were able to find a majority of the gifts the needed. The bill came to $1150.00 and they only have $1000.00 in cash. What would be the most financially responsible decision considering their situation? a. Put it on their Visa credit card b. Put the items in lay away c. Call their parents for a loan d. Put the items back and return when they have the full $1150.00 in cash 2. The advertised flat screen TV in the sale flyer they wanted to buy for Katrina's dad is listed at $300.00 was not available when Katrina and Emmanuel arrived at the store, but another TV that was similar is available for $399.00. This tactic used by stores to lure you in and sell you a more expensive item is referred to as: a. Close out sales b. Bandwagon technique c. Bait and switch method d. Rain Check method 3. Emmanuel found a unique collectors item that his mom wanted for Christmas while shopping on-line. Which of the following is most important when making on-line purchases? a. brand loyalty b. secure website, URL lock is shown c. testimonials and product reviews d. descriptions and photos of the product 4. Emmanuel wants to charge an I-pod touch for his nephew for Christmas. The cost of the Ipod is $212.00. Katrina is against the purchase using credit because they do not have the cash to pay the bill in full. The credit card has a 18.9% APR. If it takes them three months to pay the bill how much will the final cost of the I-pod be? a. $33.20 b. $120.20 c. $332.20 D. $424.00 5. At a local fashion retail store they find a beautiful sweater for Katrina's grandmother. The store clerk offers them an additional 20% off if they open a charge card. The original purchase price of the sweater is $29.99. The sales taxes where they live is 7.5%. How much will the sweater cost if they open the charge account? a. $23.99 b. $25.79 c.$31.79 d.$34.82 Malana notices charges on her monthly credit card statement that she did not make. She was also denied credit in a store recently. Malana is worried that her identity may have been stolen. She knows she needs to act quickly to stop the identity thief. 1. The first step that Malana should take is: a. Call the police b. Contact the credit card company c. Check her credit report d. Open a new credit card account 2. Which steps could have helped protect Malana? a. Keep pin number private b. Check her credit account regularly c. Put a lock on her purse d. both a and b 3. In order to stay on top of these types of events in the future one thing Malana should do is: a. Check her credit report annually at freecreditreport.com b. Check her credit report at annualcreditreport.com c. Cancel all her credit cards d. Check her credit report every four months using one of the three credit bureaus 4. The agency that handles concerns regarding Identity Theft is: a. Sheriff's Department b. Federal Trade Commission c. Police Department d. Credit Bureau 5. Which of the following is not a reliable credit reporting agency? a. Trans union b. Expedia c. Equifax d. Experian Pam Staub pkstaub@tippcity.k12.oh.us Patsy Burnside- patsy_burnside@newton.k12.oh.us Personal Finance I Evan is a high school student who is looking to purchase his first car. He has a part time job at a fast food restaurant earning $7.85 an hour and working 3 days a week totaling 20 hours. His part time job needs to cover all his expenses including car payment, gas, insurance, cell phone and entertainment. 1. What is his gross pay per week from his fast food job? A. $160.00 B. $ 137.00 C. $157.00 D. $471.00 2. Evan receives his paycheck and notices it is considerably less than he calculated. After the deductions, his take home pay is called: A. Gross Pay B. Deductions Pay C. Net Pay D. Real Pay 3. When Evan is considering the total cost of the car, he should include the following expenses: A. Loan payments, insurance costs, licensing and registration, and fuel B. Down payment minus the loan plus interest C. The amount of loan plus interest D. Only the price of the automobile is included in its cost 4. Evan is considering a loan for his first car. An automobile loan is considered what type of loan? A. Secured B. Unsecured C. Non-installment D. Revolving 5. A. B. C. D. What type of insurance is Evan required by law to carry for his car? Medical payments insurance Liability insurance Uninsured Motorists insurance Property damage insurance 6. Evan notices that his paycheck is considerably less than he expected. He notices many deductions; one of which is FICA. What is FICA? A. Medical deductions B. Total for state and federal income tax C. Overtime pay D. Social Security Tax withheld Seth has just graduated from college and has found a job. Seth took a Personal Finance class in high school and knows how important it is to invest his money wisely and early in life. As soon as he receives his first paycheck, he begins to consider his investment options. 1. Seth decides to put some of his money in savings. What is the recommended percentage of his net pay that he should put into a savings account? A. 5% B. 10% C. 15% D. 20% 2. When Seth decides to put his money in savings first, and then spend the rest on other things, he is practicing: A. Diversification B. Pay it forward C. Pay Yourself First D. Philanthropy 3. Seth invests $900.00 into a mutual fund that cost $45.00 per share. One year later is it worth $46.00 per share. How much money is the investment worth at the end of the year? A. $900.00 B. $20.00 C. $46.00 D. $920.00 4. Seth decides to take advantage of a retirement plan which is provided by his employer which includes several different types of investments. The money is tax sheltered. This is an example of a/an: A. CD B. IRA C. 401K D. Mutual Fund 5. Seth is looking to double his investments. What is the best formula for Seth to use to figure how long this will take? A. The rule of 72 B. The power of multiplication C. Double the dough D. The rule of investments Erin has a babysitting job twice a week. She has been keeping her savings in a piggy bank. She likes this method of saving because she can have immediate access to the money if she needs it. Recently, in a class at school, discussion focused on why depository institutions are safer than her piggy bank. 1. Some students’ comments were based on fact while others were based on myths. Which aspect of security at a depository institution is NOT TRUE? A. Depository institutions have insurance protection for up to $250,000 per depositor per account type so if something happened to the money in the bank, you would get it back as long as the deposited amount was no more than the insurance limit. B. All money stored at a depository institution is kept safe at all times by numerous security measures. C. Information about depositors and their account is kept in secure data storage. D. Depository institutions have insurance protection. Depositors can have multiple accounts at the same depository institution as long as each account has no more than $100,000. 2. Erin would like to be able to withdraw her money whenever necessary. What type of bank account should she open? A. Money Market Account B. Certificate of Deposit C. Mutual fund D. Savings account 3. Erin has decided to open a checking account. All of these facts are true EXCEPT: A. Checking accounts usually earn more interest than savings account. B. You may pay a monthly service charge as well as fees for check printing, overdraft and stop payment orders. C. You may be required to keep a minimum balance. D. You can withdraw funds using your debit card as well as writing a check. 4. Erin has saved at least $500.00 from her job. When she was comparing and contrasting savings and investing, which of the following would she have found to be true? A. Savings is used to pay for long term goals while investing is used to pay for emergencies. B. Savings is less liquid than investing. C. Savings provides the foundation for financial security, while investing is used to pay for long-term goals, such as retirement. D. Saving and investing both help a person stay at their current level of living. Chad is a college student that has a roommate. Chad has many bills to pay monthly. He is trying to build a positive credit history. Chad has been offered several credit cards. He wants to open a credit card account. 1. Which would result in Chad developing a negative credit history? A. Paying bills consistently and on time B. Applying for credit many times within a short period of time C. Having a criminal record D. Holding a low number of credit/store cards 2. How can Chad avoid paying interest on his credit card? A. Paying the minimum balance every month. B. Paying the balance in full every month. C. Only use a credit card for balance transfers. D. Interest is always paid on a credit card. 3. Chad has a credit card balance of $85.00. He makes a purchase for $25.00 and a payment of $50.00. He was charged $5.00 interest for the month. What is the new balance? A. $110.00 B. $90.00 C. $65.00 D. $85.00 4. What are the two biggest influences on Chad’s credit score? A. His SAT score and grade point average B. The number of credit cards and number of bank accounts he has. C. Who he works for and the BBB rating for the company D. Payment history and amount of debt 5. Chad has lost his credit card. He should take the following course of action: A. Call his friends and ask if they have his credit card. B. Call the bank and report a missing credit card C. Call 911 and report a missing credit card. D. Don’t worry -you are not responsible for any charges that someone else makes using your card. 6. Chad wants to see a copy of his credit report. He should contact: A. The president of the bank B. The president of the university C. The police department D. Equifax 7. Chad’s roommate forgot to pay the cable bill. It was entirely the roommates fault but Chad’s name was on the bill. Will this lower Chad’s credit score? A. No because you can miss a payment if you have basic cable B. No because it wasn’t Chad’s fault C. Yes D. No, if he pays double on the next bill Use the sample credit card offer to answer the following questions. 1.) What is the interest rate for purchases? A.)12.99% B.) 13.99% C.) 14.99% D.) All of the above depending on credit scores * 2.) What is the balance transfer APR? A.) 10.99% B.) 12.00% C.) 15.99% * D.) 21.99% 3.) How long will the penalty interest rate apply? A.) Until the balance is paid in full B.) Until 6 consecutive minimum payments are made on time* C.) When the prime rate changes D.) Until the annual fee is paid. 4.) What is the annual fee amount? A.) $5.00 B.) $12.00 C.) $20.00* D.) $35.00 5.) What is the balance transfer fee? A.) 2% of each transaction B.) $5 or 3% of the dollar amount, whichever is greater* C.) $29 D.) $35 6.) If a late payment is made, what is the charge? A.) $12 B.) $20 if the balance is less than or equal to $500 or $30 if the balance is more than $500 C.) $29 if the balance it less than or equal to $1000 or $35 if the balance is more than $1000* D.) $35 7.) What method does the credit company use to calculate your interest? A.) Adjusted balance B.) Average daily balance including new purchases* C.) Average daily balance excluding new purchases D.) Previous balance 8.) What is the cash advance Annual Percentage Rate? A.) 15.99% based on the prime rate* B.) 21.99% based on the prime rate C.) 28.99% D.) 29.99% based on the prime rate 9.) What is the charge for an additional card? A.) $5.00 one-time fee B.) $5.00 annually* C.) $12.00 annually ($1.00 per month) D.) $20 one-time fee 10.) What is the minimum interest charge per month? A.) $.75 B.) $1.50* C.) $3.00 D.) $5.00 11.) What can you do to avoid paying interest? A.) Pay your entire balance by the due date* B.) Pay your minimum payment by the due date C.) Pay your minimum payment by the end of each month D.) Keep your balance below the credit limit 12.) What will cause the penalty interest rate to be applied? A.) Make a last payment B.) Go over your credit limit C.) Make a payment that is returned D.) All of the above *