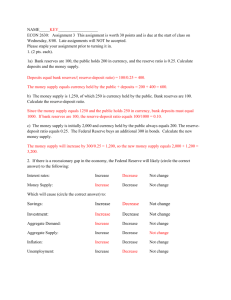

File

advertisement

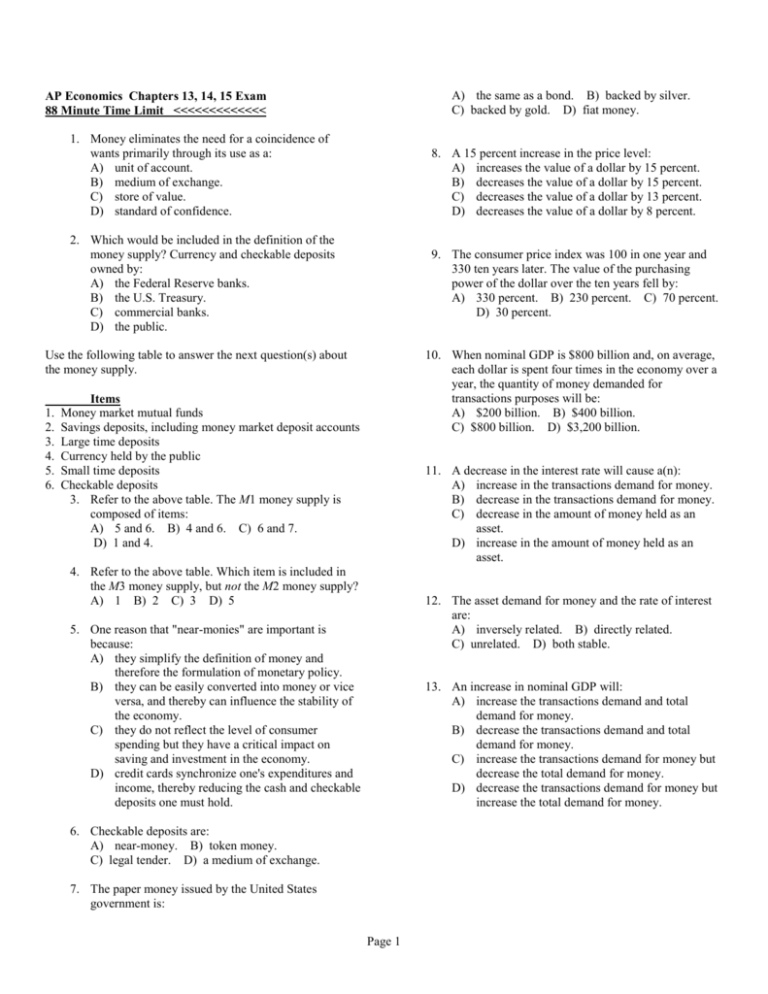

A) the same as a bond. B) backed by silver. C) backed by gold. D) fiat money. AP Economics Chapters 13, 14, 15 Exam 88 Minute Time Limit <<<<<<<<<<<<< 1. Money eliminates the need for a coincidence of wants primarily through its use as a: A) unit of account. B) medium of exchange. C) store of value. D) standard of confidence. 8. A 15 percent increase in the price level: A) increases the value of a dollar by 15 percent. B) decreases the value of a dollar by 15 percent. C) decreases the value of a dollar by 13 percent. D) decreases the value of a dollar by 8 percent. 2. Which would be included in the definition of the money supply? Currency and checkable deposits owned by: A) the Federal Reserve banks. B) the U.S. Treasury. C) commercial banks. D) the public. 9. The consumer price index was 100 in one year and 330 ten years later. The value of the purchasing power of the dollar over the ten years fell by: A) 330 percent. B) 230 percent. C) 70 percent. D) 30 percent. Use the following table to answer the next question(s) about the money supply. 1. 2. 3. 4. 5. 6. 10. When nominal GDP is $800 billion and, on average, each dollar is spent four times in the economy over a year, the quantity of money demanded for transactions purposes will be: A) $200 billion. B) $400 billion. C) $800 billion. D) $3,200 billion. Items Money market mutual funds Savings deposits, including money market deposit accounts Large time deposits Currency held by the public Small time deposits Checkable deposits 3. Refer to the above table. The M1 money supply is composed of items: A) 5 and 6. B) 4 and 6. C) 6 and 7. D) 1 and 4. 11. A decrease in the interest rate will cause a(n): A) increase in the transactions demand for money. B) decrease in the transactions demand for money. C) decrease in the amount of money held as an asset. D) increase in the amount of money held as an asset. 4. Refer to the above table. Which item is included in the M3 money supply, but not the M2 money supply? A) 1 B) 2 C) 3 D) 5 12. The asset demand for money and the rate of interest are: A) inversely related. B) directly related. C) unrelated. D) both stable. 5. One reason that "near-monies" are important is because: A) they simplify the definition of money and therefore the formulation of monetary policy. B) they can be easily converted into money or vice versa, and thereby can influence the stability of the economy. C) they do not reflect the level of consumer spending but they have a critical impact on saving and investment in the economy. D) credit cards synchronize one's expenditures and income, thereby reducing the cash and checkable deposits one must hold. 13. An increase in nominal GDP will: A) increase the transactions demand and total demand for money. B) decrease the transactions demand and total demand for money. C) increase the transactions demand for money but decrease the total demand for money. D) decrease the transactions demand for money but increase the total demand for money. 6. Checkable deposits are: A) near-money. B) token money. C) legal tender. D) a medium of exchange. 7. The paper money issued by the United States government is: Page 1 18. Refer to the above table. If the transactions demand for money is $400 billion, an increase in the money supply from $800 billion to $900 billion would cause the equilibrium interest rate to: A) rise to 7 percent. B) rise to 6 percent. C) fall to 4 percent. D) remain at 5 percent. 14. Refer to the above graph, in which Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. If the money market is in equilibrium at a 6 percent rate of interest and the money supply increases, then Sm2 will shift to: A) Sm3 and the interest rate will be 4 percent. B) Sm3 and the interest rate will be 8 percent. C) Sm1 and the interest rate will be 8 percent. D) Sm1 and the interest rate will be 4 percent. 19. Refer to the above graph which shows the supply and demand for money where Dm1, Dm2, and Dm3 represent different demands for money and Sm1, Sm2 , and Sm3 represent different levels of the money supply. The initial equilibrium point is A. What will be the new equilibrium point following a decrease in the asset demand for money? A) B B) E C) F D) I 15. Refer to the above graph, in which Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. If the money market is in equilibrium at the 6 percent rate of interest and the money supply decreases to Sm1, the transaction demand for money will be: A) $50. B) $100. C) $125. D) $175. 20. Refer to the above graph which shows the supply and demand for money where Dm1, Dm2, and Dm3 represent different demands for money and Sm1, Sm2 , and Sm3 represent different levels of the money supply. The initial equilibrium point is A. What will be the new equilibrium point following an increase in the money supply? A) C B) D C) G D) H 16. Refer to the above graph, in which Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. If the money market is in equilibrium at a 6 percent rate of interest and the supply of money increases to Sm3, then the asset demand for money will have increased by: A) $75. B) $125. C) $200. D) $325. Interest rate 7% 6 5 4 21. Which statement is true? A) Bond prices and the interest rate are directly related. B) A lower interest rate lowers the opportunity cost of holding money. C) The supply of money is directly related to the interest rate. D) The total demand for money is directly related to the interest rate. Asset demand for money (billions) $200 300 400 500 17. Refer to the above table. Suppose the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table. If the nominal GDP is $2000 billion, the equilibrium interest rate is: A) 4 percent. B) 5 percent. C) 6 percent. D) 7 percent. 22. A bond with no expiration has an original price of $10,000 and a fixed annual interest payment of $1000. If the price of this bond decreases by $2000, the interest rate in effect will: A) decrease by 1.5 percentage points. B) decrease by 2.5 percentage points. C) increase by 1.5 percentage points. D) increase by 2.5 percentage points. Page 2 23. The price of a bond with no expiration date was originally $1,000 with an annual fixed interest payment of $100. If the price of the bond rises by $200, the effective interest rate yield to a new buyer of the bond will be: A) 7.4 percent. B) 8.3 percent. C) 9.5 percent. D) 11.2 percent. multiplier. 31. If borrowers request that part of their loans be paid in currency, this would: A) increase the maximum checkable-deposit creation of the banking system. B) decrease the lending potential of the banking system. C) decrease the reserve ratio of the banking system. D) increase the excess reserves of banks. 24. The price of a bond with no expiration date is $10,000 and it has a fixed annual interest payment of $2,000. If the bond is sold to a new owner for a price of $12,500, then the effective interest rate yield on the bond is now: A) 22 percent. B) 18 percent. C) 17 percent. D) 16 percent. 32. The commercial banking system, because of a recent change in the required reserve ratio from 8 percent to 10 percent, finds that it is $50 million short of reserves. If it is unable to obtain any additional reserves, it must: A) increase the money supply by $500 million. B) decrease the money supply by $400 million. C) decrease the money supply by $500 million. D) decrease the money supply by $50 million. 25. Which is the most important function of the Federal Reserve System? A) setting reserve requirements B) controlling the money supply C) lending money to banks and thrifts D) acting as the fiscal agent for the U.S. government 33. If the Fed buys government securities from commercial banks in the open market,: A) the Fed gives the securities to the commercial banks, and they pay for them by writing checks that increase their reserves at the Fed. B) the Fed gives the securities to the commercial banks, and they pay for them by writing checks that decrease their reserves at the Fed. C) commercial banks give the securities to the Fed, and it pays for them by increasing the reserves of commercial banks at the Fed. D) commercial banks give the securities to the Fed, and it pays for them by decreasing the reserves of commercial banks at the Fed. 26. A single commercial bank must meet a 25 percent reserve requirement. If it initially has no excess reserves and then $2,000 in cash is deposited in the bank, it can increase its loans by a maximum of: A) $2,000. B) $1,500. C) $1,250. D) $1,000. 27. Assume the commercial banking system has excess reserves of $5,000 and can make new loans of $35,000 and just meet its legal reserve requirements. The required reserve ratio must be about: A) 7 percent. B) 14 percent. C) 20 percent. D) 26 percent. 34. If the Fed buys government securities from the public in the open market,: A) the Fed gives the securities to the public; the public pays for the securities by writing checks that when cleared will increase commercial bank reserves at the Fed. B) the Fed gives the securities to the public; the public pays for them by writing checks that when cleared will decrease commercial bank reserves at the Fed. C) the public gives the securities to the Fed; the Fed pays for the securities by check, which when deposited at commercial banks will increase their reserves at the Fed. D) the public gives the securities to the Fed; the Fed pays for the securities by check, which when deposited at commercial banks will decrease their reserves at the Fed. 28. Assume the required reserve ratio is 162/3 percent and that the commercial banking system has $110 million in excess reserves. The maximum amount of money which the banking system could create is: A) $110 million. B) $330 million. C) $660 million. D) $1,353 million. 29. If the required reserve ratio is 20 percent and commercial bankers decide to hold additional excess reserves equal to 5 percent of any newly acquired checkable deposits, then the effective monetary multiplier for the banking system will be: A) 3. B) 4. C) 5. D) 6. 30. Maximum checkable-deposit expansion is equal to: A) actual reserves minus excess reserves. B) assets plus net worth and liabilities. C) excess reserves times the monetary multiplier. D) excess reserves divided by the monetary Page 3 35. If the Fed sells government securities to commercial banks in the open market,: A) the Fed gives the securities to the commercial banks, and the commercial banks pay for them by writing a check that increases their reserves at the Fed. B) the Fed gives the securities to the commercial banks, and they pay for them by writing a check that decreases their reserves at the at the Fed. C) commercial banks give the securities to the Fed, and it pays for them by increasing the reserves of commercial banks at the Fed. D) commercial banks give the securities to the Fed, and it pays for them by decreasing the reserves of commercial banks at the Fed. money-lending potential of the commercial banking system will decrease by $120 million. B) decrease by $120 million and the maximum money-lending potential of the commercial banking system will decrease by $480 million. C) increase by $120 million and the maximum money-lending potential of the commercial banking system will increase by $480 million. D) increase because the securities are an asset to the commercial banks and a liability to the Federal Reserve. 39. Assume the commercial banking system has checkable deposits of $20 billion and excess reserves of $2 billion at a time when the reserve ratio is 25 percent. If the reserve ratio is lowered to 20 percent, we can conclude that the: A) bank now has excess reserves of $3.2 billion. B) bank now has neither an excess nor a deficiency of reserves. C) maximum money-creating potential of the banking system has been increased by $7 billion. D) Board of Governors has decided that the economy is experiencing a high rate of inflation. 36. If the Fed sells government securities to the public in the open market,: A) the Fed gives the securities to the public; the public pays for the securities by writing checks that when cleared will increase commercial bank reserves at the Fed. B) the Fed gives the securities to the public; the public pays for the securities by writing checks that when cleared will decrease commercial bank reserves at the Fed. C) the public gives the securities to the Fed; the Fed pays for the securities by check, which when deposited at commercial banks will increase their reserves at the Fed. D) the public gives the securities to the Fed; the Fed pays for the securities by check, which when deposited at commercial banks will decrease their reserves at the Fed. 40. Which increases the excess reserves of commercial banks? A) The central banks sell bonds to the public. B) The central banks sell bonds to commercial banks. C) The central banks buy bonds from commercial banks. D) The Board of Governors increases the discount rate. 37. Assume the required reserve ratio is 20 percent. If the Federal Reserve buys $80 million in government securities from the public, then the money supply will immediately: A) increase by $80 million, and the maximum money-lending potential of the commercial banking system will increase by $80 million. B) increase by $80 million, but the maximum money-lending potential of the commercial banking system will decrease by $80 million. C) increase by $80 million, and the maximum money-lending potential of the commercial banking system will increase by $400 million. D) decrease, because the securities are an asset to the commercial banks and a liability to the Federal Reserve. 41. Which of the following is correct? A) Excess reserves may be found by subtracting actual from required reserves. B) The supply of money declines when the public purchases securities from commercial banks. C) Commercial bank reserves are a liability to commercial banks but an asset to Federal Reserve Banks. D) Commercial banks reduce the supply of money when they "purchase" personal IOUs or government bonds from the public. 38. Assume the required reserve ratio is 25 percent. If the Federal Reserve sells $120 million in government securities to the public, the money supply will immediately: A) decrease by $120 million and the maximum Page 4 42. Assume that there is a 25 percent reserve ratio and that the Federal Reserve buys $200 million worth of government securities. If the securities are purchased from the public, then this action has the potential to increase bank lending by a maximum of: A) $600 million, and also by $600 million if the securities are purchased directly from commercial banks. B) $800 million, and also by $800 million if the securities are purchased directly from commercial banks. C) $600 million, but by $800 million if the securities are purchased directly from commercial banks. D) $800 million, but only by $600 million if the securities are purchased directly from commercial banks. 45. Refer to the above graphs, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are at point B on the investment demand curve. To achieve the goal of a noninflationary full-employment output Qf in the economy, the Fed should: A) decrease the interest rate from 10 to 8 percent. B) decrease the interest rate from 8 to 6 percent. C) decrease the interest rate from 6 to 4 percent. D) increase investment spending from $30 to $60 billion. 46. Refer to the above graphs, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are at point C on the investment demand curve. To achieve the goal of a noninflationary full-employment output Qf in the economy, the Fed should: A) increase aggregate demand by increasing the interest rate. B) decrease aggregate demand by increasing the interest rate. C) increase aggregate demand by decreasing the interest rate. D) make no change in the interest rate. 43. A television report states: "The Federal Reserve will lower the discount rate for the fourth time this year." This report indicates that the Federal Reserve is most likely trying to: A) reduce inflation. B) save the banking industry. C) stimulate the economy. D) improve the savings rate. 47. Refer to the above graphs, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The economy is at equilibrium at point X on the aggregate demand and aggregate supply graph. What should the Fed do to achieve the goal of a noninflationary full-employment output Qf in the economy? A) increase the interest rate from 2 to 4 percent B) increase the interest rate from 4 to 6 percent C) increase the interest rate from 6 to 8 percent D) decrease the interest rate from 6 to 4 percent 44. Refer to the above graphs, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are at point D on the investment demand curve. To achieve the goal of a noninflationary full-employment output Qf in the economy, the Fed should: A) decrease aggregate demand by increasing the interest rate from 2 to 4 percent. B) decrease aggregate demand by increasing the interest rate from 4 to 6 percent. C) increase aggregate demand by decreasing the interest rate from 4 to 2 percent. D) increase the level of investment spending from $120 billion to $150 billion. Page 5 48. Refer to the above graphs, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The economy is at equilibrium at point Y on the aggregate demand and aggregate supply graph. What should the Fed do to achieve the goal of a noninflationary full-employment output Qf in the economy? A) increase the interest rate from 6 to 8 percent B) decrease the interest rate from 8 to 6 percent C) decrease the interest rate from 6 to 4 percent D) decrease the interest rate from 4 to 2 percent with each curve. All figures are in billions. The economy is at equilibrium at point c on the aggregate demand curve. What policy should the Fed pursue to achieve a noninflationary full-employment level of real GDP? A) increase the money supply from $75 to $150 billion B) increase the money supply from $150 to $225 billion C) decrease the money supply from $225 to $150 billion D) make no change in the money supply 52. Refer to the above diagrams, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The economy is at point X on the investment demand curve. Given these conditions, what policy should the Fed pursue to achieve a noninflationary fullemployment level of real GDP? A) decrease aggregate demand from AD1 to AD2 B) increase the money supply from $75 to $150 billion C) increase interest rates from 4 to 8 percent D) make no change in monetary policy 49. Refer to the above graphs, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The level of investment spending in the economy is $90 billion. What should the monetary authorities do to achieve the goal of a noninflationary full-employment output Qf in the economy? A) increase the interest rate from 6 to 8 percent B) decrease the interest rate from 8 to 6 percent C) decrease the interest rate from 6 to 4 percent D) make no change in the interest rate 53. Refer to the above diagrams, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The economy is at point Y on the investment demand curve. Given these conditions, what policy should the Fed pursue to achieve a noninflationary fullemployment level of real GDP? A) increase aggregate demand from AD3 to AD2 B) decrease the money supply from $225 to $150 billion C) increase interest rates from 4 to 8 percent D) make no change in monetary policy 50. Refer to the above diagrams, in which the numbers in parentheses after the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The interest rate in the economy is 4 percent. What should the Fed do to achieve a noninflationary fullemployment level of real GDP? A) increase the money supply from $75 to $150 billion B) increase the money supply from $150 to $225 billion C) decrease the money supply from $225 to $150 billion D) make no change in the money supply 54. Refer to the above diagrams, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated with each curve. All figures are in billions. The economy is at point Z on the investment demand curve. Given these conditions, what policy should the monetary authorities pursue to achieve a noninflationary full-employment level of real GDP? A) decrease the reserve ratio B) decrease the discount rate C) sell government securities in the open market D) make no change in monetary policy 51. Refer to the above diagrams, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the level of investment spending associated Page 6 55. Refer to the above diagrams, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the levels of investment spending associated with each curve. All figures are in billions. A shift in the aggregate demand curve from AD3 to AD2 can be achieved by Federal Reserve action to: A) increase the reserve ratio. B) increase the discount rate. C) buy government securities in the open market. D) sell government securities in the open market. each other to achieve that objective? A) selling government securities and raising the discount rate B) selling government securities and lowering the discount rate C) buying government securities and lowering the discount rate D) buying government securities and lowering the reserve ratio 60. Suppose the economy is at full employment with a high inflation rate. Which combination of government policies is least likely to reduce the inflation rate? A) Buy government securities in the open market and increase taxes. B) Buy government securities in the open market and decrease taxes. C) Sell government securities in the open market and increase government spending. D) Sell government securities in the open market and decrease government spending. 56. Refer to the above diagrams, in which the numbers in parentheses after the AD1, AD2 , and AD3 labels indicate the levels of investment spending associated with each curve. All figures are in billions. What is the desired level of investment spending in this economy if it is to achieve a noninflationary fullemployment level of real GDP? A) $50 B) $100 C) $150 D) $225 57. The major problem facing the economy is high unemployment and weak economic growth. The inflation rate is low and stable. Therefore, the Federal Reserve decides to pursue a policy to increase the rate of economic growth. Which policy changes by the Fed would reinforce each other to achieve that objective? A) selling government securities and raising the discount rate B) selling government securities and lowering the discount rate C) buying government securities and lowering the discount rate D) buying government securities and raising the reserve ratio 61. The economy is experiencing inflation and the Federal Reserve decides to pursue a tight money policy. Which actions by the Fed would be most consistent with this policy? A) lowering the discount rate B) lowering the reserve ratio C) buying government securities D) selling government securities 62. An easy money policy would be least effective in the: A) horizontal range of the aggregate demand curve. B) horizontal range of the aggregate supply curve. C) intermediate range of the aggregate supply curve. D) vertical range of the aggregate supply curve. 58. The major problem facing the economy is high unemployment and weak economic growth. The inflation rate is low and stable. Therefore, the Federal Reserve decides to pursue a policy to increase the rate of economic growth. Which policy changes by the Fed would tend to offset each other in trying to achieve that objective? A) selling government securities and raising the discount rate B) selling government securities and raising the reserve ratio C) buying government securities and raising the discount rate D) buying government securities and lowering the reserve ratio 63. An increase in the money supply will have its most significant effect on the price level in: A) the horizontal range of the aggregate supply curve. B) the intermediate range of the aggregate supply curve. C) the vertical range of the aggregate supply curve. D) any of the three ranges of the aggregate supply curve. 64. A Federal Reserve official notes: "A tight money policy can force a contraction of the money supply, but an easy money policy may not achieve an expansion of the economy." The official has described the problem of the: A) inflexibility of monetary policy tools. B) change in velocity on monetary policy. C) cyclical asymmetry of monetary policy. D) political acceptability of monetary policy. 59. Inflationary pressure is a growing problem for the economy. Therefore, the Federal Reserve decides to pursue a policy to reduce the inflationary pressure. Which policy changes by the Fed would reinforce Page 7 65. The strengths of monetary policy compared to fiscal policy are generally thought to include all of the following except greater: A) speed. B) flexibility. C) impact on taxation. D) political acceptance. 66. A headline reads: "Fed raises the Federal funds rate by half a point." This indicates that: A) fiscal policy is being offset by monetary policy. B) monetary policy is being offset by fiscal policy. C) there has been a tightening of monetary policy. D) there has been an easing of monetary policy. 67. When the Fed sells government securities in the open market, it: A) decreases the excess reserves of the banking system, reducing excess reserves for overnight loan in the Federal funds market, and thus lowering the Federal funds rate. B) increases the excess reserves of the banking system, reducing excess reserves for overnight loan in the Federal funds market, and thus lowering the Federal funds rate. C) decreases the excess reserves of the banking system, reducing excess reserves for overnight loan in the Federal funds market, and thus increasing the Federal funds rate. D) increases the excess reserves of the banking system, raising excess reserves for overnight loan in the Federal funds market, and thus raising the Federal funds rate. 68. When the Federal Reserve increases the Federal funds rate, it: A) sells government securities to increase the excess reserve available for overnight loan. B) buys government securities to increase the excess reserve available for overnight loan. C) sells government securities to decrease the excess reserve available for overnight loan. D) buys government securities to decrease the excess reserve available for overnight loan. 69. An easy money policy will tend to: A) decrease net exports as will an expansionary fiscal policy. B) increase net exports as will an expansionary fiscal policy. C) decrease net exports but an expansionary fiscal policy will tend to increase net exports. D) increase net exports but an expansionary fiscal policy will tend to decrease net exports. 70. Net exports would most likely increase when there is a(n): A) easy money policy and a contractionary fiscal policy. B) tight money policy and a contractionary fiscal policy. C) tight money policy and an expansionary fiscal policy. D) easy money policy and an expansionary fiscal policy. 71. If the government pursues a tight money policy, then it will: A) increase domestic interest rates, cause the dollar to appreciate, and decrease net exports. B) decrease domestic interest rates, cause the dollar to depreciate, and increase net exports. C) increase domestic interest rates, cause the dollar to depreciate, and increase net exports. D) increase domestic interest rates, cause the dollar to appreciate, and increase net exports. 72. An easy money policy will most likely result in a(n): A) appreciation of the dollar and thus an increase in net exports. B) depreciation of the dollar and thus an increase in net exports. C) depreciation of the dollar and thus a decrease in net exports. D) appreciation of the dollar and thus a decrease in net exports. 73. Other things equal, an increase in taxes on business will: A) increase aggregate supply and decrease aggregate demand. B) increase aggregate supply and increase aggregate demand. C) decrease aggregate supply and decrease aggregate demand. D) decrease aggregate supply and increase aggregate demand. 74. Other things equal, an appreciation of the U.S. dollar would: A) increase productivity and increase aggregate supply. B) decrease net exports and decrease aggregate demand. C) increase the prices of imported resources and decrease aggregate supply. D) decrease the supply of money and decrease aggregate demand. 75. Other things equal, an increase in the prices of imported resources will: A) increase aggregate supply and increase real output. B) decrease aggregate supply and decrease real output. C) increase aggregate supply and decrease real output. D) decrease aggregate supply and increase real output. Page 8 Answer Key -- exam131415 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. B D B C B D D C C A D A A A C A B C C C B D B D B B B C B C B C C C B B C B 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. Page 9 C C B C C B B D B B D C A B D C C B C C A B D D C C C C C A D A A B C B B