Guidance Notes and Frequently Asked Questions

advertisement

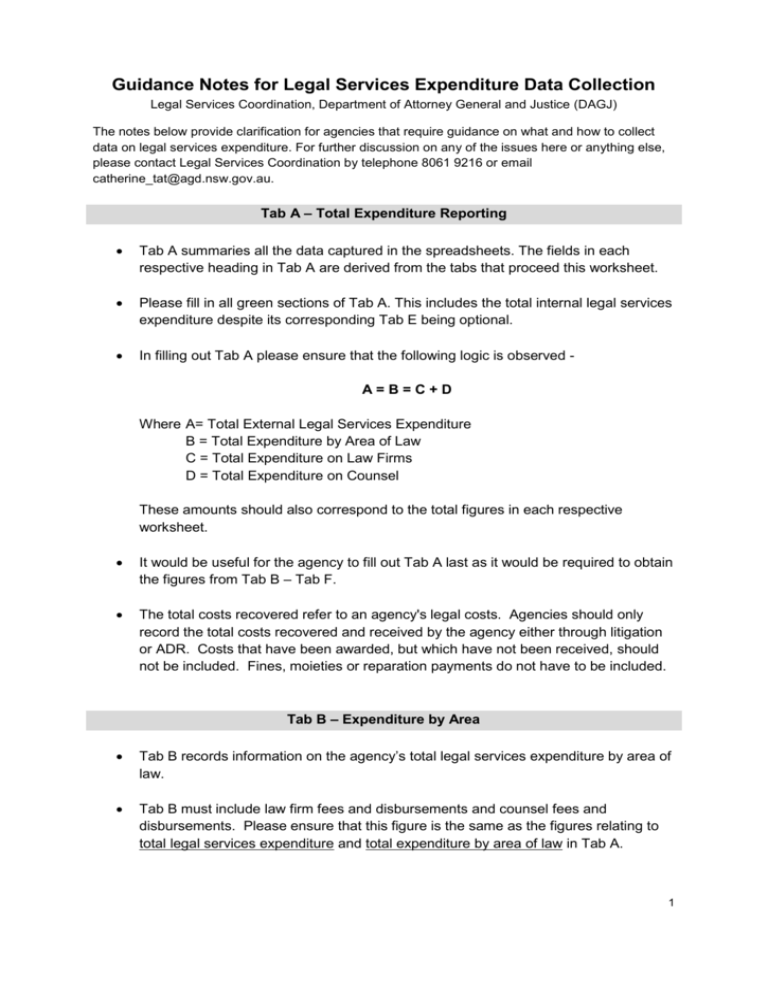

Guidance Notes for Legal Services Expenditure Data Collection Legal Services Coordination, Department of Attorney General and Justice (DAGJ) The notes below provide clarification for agencies that require guidance on what and how to collect data on legal services expenditure. For further discussion on any of the issues here or anything else, please contact Legal Services Coordination by telephone 8061 9216 or email catherine_tat@agd.nsw.gov.au. Tab A – Total Expenditure Reporting Tab A summaries all the data captured in the spreadsheets. The fields in each respective heading in Tab A are derived from the tabs that proceed this worksheet. Please fill in all green sections of Tab A. This includes the total internal legal services expenditure despite its corresponding Tab E being optional. In filling out Tab A please ensure that the following logic is observed A=B=C+D Where A= Total External Legal Services Expenditure B = Total Expenditure by Area of Law C = Total Expenditure on Law Firms D = Total Expenditure on Counsel These amounts should also correspond to the total figures in each respective worksheet. It would be useful for the agency to fill out Tab A last as it would be required to obtain the figures from Tab B – Tab F. The total costs recovered refer to an agency's legal costs. Agencies should only record the total costs recovered and received by the agency either through litigation or ADR. Costs that have been awarded, but which have not been received, should not be included. Fines, moieties or reparation payments do not have to be included. Tab B – Expenditure by Area Tab B records information on the agency’s total legal services expenditure by area of law. Tab B must include law firm fees and disbursements and counsel fees and disbursements. Please ensure that this figure is the same as the figures relating to total legal services expenditure and total expenditure by area of law in Tab A. 1 The sub areas are listed to give guidance as to what type of legal work is covered in that area of law. Only one total is required for each area of law. Reporting on each sub area is not required. In respect to the “Litigation” area of law, for the purposes of this data collection exercise, litigation arises when there is a statement of claim. As it relates to litigation arising from IRC matters and disciplinary actions, these matters should remain in the “Employment & Industrial” area of law. As it relates to litigation arising from child protection matters, these should remain in “Specialist State Responsibilities”. Tab C – Expenditure by Law Firm Tab C records information on the agency’s expenditure by law firm. This figure includes acceptable disbursements as per discussion on disbursements in FAQs above. If Counsel fees are included in disbursements, such fees should be separated from this figure and captured in Tab D instead. If the agency is not able to separate Counsel fees then this should be noted. Please ensure the removal of cost awards, settlement monies and other exclusions as discussed in the FAQs on disbursements. The total expenditure by law firm calculated in this Tab should also be noted in Tab A. Tab D – Counsel Reporting Tab D records information on the agency’s expenditure on Counsel in the financial year. It records information on gender, seniority, number of briefs issued to each Counsel and the amount paid. As well as monitoring expenditure on Counsel, this information is also required as part of the Equitable Briefing Policy. Going forward, the information provided here as part of the Equitable Briefing Policy will replace the equitable briefing recording sheet that DAGJ had previously collected from agencies. Tab D should also include the number of briefs given to each Counsel. If an agency briefs the same Counsel on three occasions, the agency should count this as three briefs to Counsel, not one. 2 Tab D should contain information on direct briefs to Counsel by the agency and indirect briefs to Counsel (ie. matters outsourced to a private law firm which subsequently briefs Counsel.) o In outsourced matters it may not possible to separate the figure paid to Counsel from the disbursements. In this case, agencies may find that Tab C will be inclusive of Counsel fees although it should ideally be in Tab D instead. As a result agencies should note that Counsel fees in Tab D do not include indirect briefs to Counsel and that this is included in Tab C. Although not required in this Tab, please ensure that data on the area of law in regard to each Counsel briefed matter is collected for Tab B. The total expenditure on Counsel calculated in this Tab should also be noted in Tab A. Tab D – Internal Legal Unit Costing Completing this Tab is optional. However, agencies are still required to calculate total internal legal services expenditure for Tab A. Moreover, agencies do not have to use the template if they already know their total internal legal services expenditure. Total Internal Legal Services Expenditure includes: o direct salary costs o indirect salary costs (superannuation, leave entitlements) often calculated as a percentage of direct salary (eg. 22.4%) o direct overhead (costs of desks, computer, stationary) o indirect overhead (including support staff costs, apportioned rent, electricity etc) o legal unit overhead (specialist software licences cost of law library). To calculate direct salary costs, please use the actual salary paid and not the maximum salary in which the position can pay. If the agency has a department-wide method to calculate indirect salary costs, please provide a comment on the method used. Further information can be found in the Australian National Audit Office's (ANAO) Better Practice Guide: Legal Service Arrangements in Australian Government Agencies published in 2006 which can be found at www.anao.gov.au. The provided template is based on the ANAO's worked example which may assist agencies. However, agencies will have to modify the template to fit with the establishment profile of their legal team. For instance, an agency may have no Legal Officers at Grade VI, or employ Legal Officers at Grade III/IV rather than Grade I - III. Agencies do not have to use the template if they already know their total internal legal services expenditure. 3 Tab F – ADR Reporting GIPA and PIPA matters should be included in this Tab. The agency should, to the best of its ability, provide savings estimates although LSC appreciates the problems with the overall template as it currently stands. It is suggested that the agency provide assumptions on: o how the savings estimates are calculated, and o the number and types of matters in which the ADR techniques were used. 4 Frequently Asked Questions (FAQs) What is the purpose of the data collection? What information does the data collection include? The spreadsheet captures both external and internal legal services expenditure. The spreadsheet also captures information on the agency’s use of ADR. What kind of expenditure should be captured under ‘external legal services expenditure’? For external legal services expenditure this means fees and disbursements paid to engage external law firms to undertake legal services for the agency/department and fees paid to counsel briefed. What expenditure should be excluded from this data collection? The following kinds of expenditure are not to be included in the data collection: Any settlement monies paid to the plaintiff. Any legal costs paid on behalf of the plaintiff or other party that is not the agency’s own legal fees. Any ex gratia payments. Other payments which are not related to the payment of the agency’s own legal fees or to fees paid to counsel. Eg. Amounts paid to the courts that are associated with cost awards/settlement payments. Amounts transferred to law firms to be held in trust for the agency/department. How are ‘legal services’ defined for the purposes of data collection? In addition, Legal Services Coordination will collect all agency legal services expenditure data related to the Crown Solicitor’s Office (CSO) and the Treasury Managed Fund directly from the CSO and SiCorp. If you are unsure about whether or not to include an item of expenditure, please contact Legal Services Coordination. Legal services means: Professional services for which legal qualifications are considered necessary in order to – determine a legal position on issues such as the provision of legal advice, on the legal meaning or legal effect of legislation or documents; manage legal processes including the preparation of documents involving legal rights and obligations; manage legal risks or achieve results lawfully; and conduct litigation or proceedings before a court or tribunal. Legal services do not generally include those resources used on the development or implementation of policy proposals including legal policy, except to the extent that professional legal services as outlined above are utilised in those processed. What types of disbursements should be captured? Disbursements are incidental costs paid on behalf of the client by the external law firm or counsel in the course of providing legal services. Disbursements include, but are not limited to costs for expert advice and reports, witness fees, interpreter/translation fees, 5 court filing fees, interpreter’s fees, travel costs, mediator fees, transcription fees, conduct money for subpoena documents, photocopying etc. Any disbursements which have payments relating to cost awards/settlement monies (or any other excluded amounts as discussed above) embedded within them must be removed. Do disbursements include Counsel costs? Our agency counsel costs can’t be broken down by Area of Law. What should I do? Should Counsel costs only include direct briefings? Must agencies include fees paid to the Crown Solicitor’s Office (CSO) Must agencies include fees incurred by the Treasury Managed Fund (TMF)? Which Tabs must be must be completed? Should GST be included? Does the legal services expenditure include accrued amounts? Is quarterly reporting per the Equitable Briefing Policy still required? No. Agencies should not include this data in their spreadsheets. Legal Services Coordination directly obtains this information from the Crown Solicitor’s Office and SiCorp. Agencies must complete all fields in: Tab A – Total Expenditure Reporting Tab B – Expenditure by Area Tab C – Expenditure by Law Firm Tab D – Counsel Reporting Tab E – Internal Legal Units (although providing a detailed breakdown is optional) Tab F – ADR Reporting (Tab F) Yes. All legal services expenditure data submitted to Legal Services Coordination must be GST inclusive. We understand that some financial management systems are exclusive of GST. However legal services are a taxable supply and should be reported as GST inclusive for the purposes of producing the legal services expenditure report. Yes, the spreadsheets are prepared on an accrual basis. For the financial year, please include all legal fees paid and incurred to law firms and counsel between 1 July and 30 June. This also applies to counsel who were briefed in the period but had not yet issued an invoice during that period. Agencies may need to make further inquiries with counsel about the amounts not yet invoiced. No. Going forward, the information required on counsel provided here will replace the equitable briefing recording sheet that DAGJ had previously collected from agencies on a quarterly basis. Agencies will only need to report on counsel once a year in these spreadsheets. 6 What is the deadline for data collection? What happens to the information I provide? Please submit the legal services expenditure data to nswlsc@agd.nsw.gov.au by 30 September 2013. 7