Finance functional competencies and behavioural indicators

advertisement

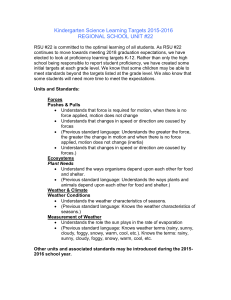

FINANCE FUNCTIONAL COMPETENCIES AND BEHAVIOURAL INDICATORS The five finance functional competencies included in the Administrative Competency Framework are designed to identify those behaviours that indicate an individual’s ability to perform successfully in a financially-oriented role. It should be noted that behaviours differ from skills, which are usually very task-specific, i.e. maintain cashbooks, and are included in the job description, which is then supported by these competencies. Competency Contextual Knowledge Financial Acumen Behaviour Indicators Understands the financial framework in which the University operates Is aware of and participates as appropriate in the University’s annual budgeting activity Is aware of the University’s Long Term Financial Plan, and associated strategic plans Understands and adheres to the University’s financial policies, procedures and standard practices Is aware of the configuration of the University’s financial services, and the roles of key financial staff Understands the structure of the University’s general ledger, and the relationship with subsidiary ledgers Working knowledge of the overall functionality of the University’s financial IT systems Demonstrates knowledge of financial terminology, standards, principles and practices, as relevant to the successful delivery of the individual role Has an awareness and understanding of the relevant laws and regulations applicable to financial practice General knowledge of accounting theory, techniques, processes and procedures including accrual, obligation, and cost Understands budget practices and concepts, and their applications in various settings Has a working knowledge of cash-flow management and debt administration Has an understanding of financial risks, and potential impacts Is aware of and adheres to University and legal responsibilities in terms of financial records management and retention, to support audit activity and robust practice Analysis and Reporting Political Acumen Personal Accountability Is able to gather, interpret and analyse financial information to verify facts or substantiate a business case Can produce and present financial data as required, including a level of detail appropriate to the needs of the audience Is able to break down complex financial data into meaningful and manageable components Provides financial advice to internal and external customers, in a timely and courteous manner Recognises financial trends and patterns for own area of activity, utilizes findings to support forecasting and budget-setting Is familiar with how the University applies for and receives funding, and the basic premise of how the total funding received is determined Understands the University’s accountabilities and obligations to the funding bodies Is aware of and understands the legislation the dictates how the University is funded Understands the financial and political climate in which the University operates Balances the need to disclose information and the requirement to maintain confidentiality Understands own and others’ roles and responsibilities, and contribution to financial processes Possesses well developed and accurate numerical skills, with strong attention to detail Monitors accuracy of own financial activity, rectifies errors as detected or alerts supervisor if unable to rectify Complies with general, legal and University financial standards and practices Continuously reviews and seeks to improve efficiency of financial processes and practices Aware of and adheres to University deadlines for all relevant aspects of financial processing Seeks feedback on the quality of own work, and amends working practices as necessary Ensures confidential or sensitive information is safe guarded Seeks to develop skills and abilities, participating in relevant training when available