Entry Decisions in Business-to-Business E-Commerce

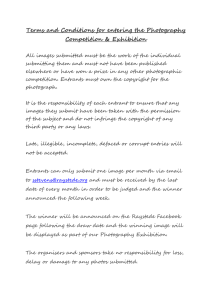

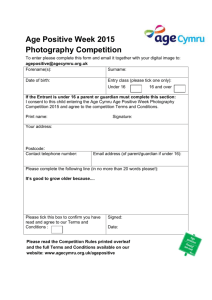

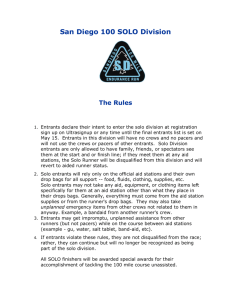

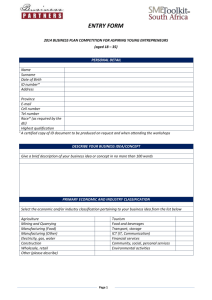

advertisement

Explaining Entry Decisions and Crowdedness in Business-to-Business Electronic Commerce Markets Dr David Croson, Dr Michael Jacobides, Dr Amy Nguyen Centre for the Network Economy CNE WP05/2002 Explaining Entry Decisions and Crowdedness in Business-to-Business Electronic Commerce Markets David C. Croson Assistant Professor of Operations and Information Management Senior Fellow, Financial Institutions Center The Wharton School of the University of Pennsylvania Michael G. Jacobides Assistant Professor of Strategic & International Management London Business School Amy T. Nguyen Associate, Financial Institutions Group AT Kearney, Inc. Version 2.1: October 31, 2001 Working Paper for the Centre for the Network Economy London Business School This document represents work in progress. Please do not cite or quote without permission. Comments are appreciated. Correspondence can be sent to David Croson [crosond@wharton.upenn.edu]. 2 Abstract: Billions of dollars of venture capital were committed in 1998-2000 to fund new entrants in business-to-business (B-to-B) electronic marketplaces. B-to-B marketplaces offer compelling value propositions (reducing both frictional and relational transactions costs, aggregating buyer power, etc.) and exhibit economies of scale, network externalities and winner-take-all effects, which suggest that industrial concentration should eventually be quite high. We show empirically, however, using a detailed survey data set collected in 2000 from over 300 business-to-business exchanges, that markets with larger potential revenues attract significantly more than proportional amounts of entrants’ attention, unambiguously predicting severe future shakeout. In particular, many of these new entrants are clustered in a small number of large, high-profile markets (such as chemicals and auto parts). We examine several competing theoretical explanations to assess compatibility with the observed data: economic analysis of market structure, under conditions of competition, oligopoly, and increasing return to scale; analysis of option value of early presence in markets requiring uncertain capabilities; and finally an agency explanation, with entrepreneurs seeking markets where fundability is assured, even at the expense of future profitability, which turns out to be largely supported. 3 I. Motivation One of the most prominent types of new players in the e-conomy has undoubtedly been business-to-business (B-to-B) firms. With $5.4 billion of venture capital committed in 2000 (Morgan Stanley Dean Witter, 2000; Goldman Sachs, 2000) to their founding and expansion, they have risen to the forefront of business attention. Each of these entrants perceived that there were rents to be had through establishing a B-to-B electronic commerce presence in their chosen markets. With often purely hypothetical business plans, B-to-Bs tried to formulate various revenue models to capture a sizable part of the efficiencies they would bring by joining together supply and demand in a novel way. Yet while both the popular business press and online sources were replete with B-to-B success stories (and, of late, populated with stories of abject failure as well), we still lack a consistent explanation of the motivation of potential entrants to these markets – and hence the drivers of the resulting industry structure, the predicted intensity of rivalry in these markets and ultimately the competitive prospects of the firms who chose to enter. Focusing on prospective B-to-B entrants’ motivations poses some interesting puzzles. Business-to-business e-commerce markets have been broadly characterized as large, potentially profitable markets with low barriers to entry encouraging multiple entrants, but with network externalities and economies of scale encouraging consolidation. Assuming these characterizations are correct, existing theory predicts unambiguously that in these types of markets, only the very few “best” firms will survive and grow to dominate the market, thanks to network externalities and the corresponding increasing returns to scale (David, 1985; 1992; Varian and Shapiro, 2000). Anecdotal evidence shows, however, an astoundingly persistent number of new entrants – far more than these markets can support, even if all were to peacefully coexist without price rivalry destroying industry profitability. What makes this empirical problem of explaining the entry patterns in B-to-B markets even harder is that we lack a consistent theory that would explain de novo entry in new industries. While entry has been studied for existing markets (e.g., Shapiro and Khemani, 1987; Carree and Thurik, 1996; Amel and Nellie, 1997) we do not have any body of theory that can help us explain the rate and dynamics of entry in new industries.1 Note that the analyses of firm “turnover” and the evolution of industry structures along industry life cycles (Klepper, 1996; Utterback and Suarez, 1993), as well as discussion of “entry through diversification” (e.g., Teece et al., 1994) bear on drivers of the initial entry decision only tangentially for the case of new markets. 1 4 In this paper, we try to take the first step towards filling this empirical and theoretical gap by generating a number of internally consistent theories of entry into B-to-B markets and performing preliminary empirical tests of these theories’ plausibility using a dataset captured at the height of the Internet bubble. Our dataset collects information on B-to-B entrants’ perceptions of requirements for success and allows calculation of the relative crowdedness of various B-to-B marketplaces. We thus (a) offer alternative models to explain the “crowdedness” of particular B-to-B markets induced by various entry criteria, thus providing some theory of entry into new markets, and (b) examine the influence of perceived drivers of success on such entrants, emphasizing the relative roles of firm capabilities and market structure. We conclude with an opportunity for a natural experiment on the determinants of exit in overcrowded markets. II. Defining the Drivers of Entry into and Crowdedness of B-to-B Markets Our first major set of questions is: “What affects the decision to enter any particular market? Is it true that firms in general try to avoid populated markets – or are such markets actively sought out, and why?” We explore three different theoretical justifications, documenting the specific predictions of each on the “crowdedness” (defined as the number of entrants for a given dollar amount of market size) of these new B-to-B markets. II-1: Entry under Perfect Competition Economic theory predicts entry based on market-structure characteristics and the opportunity for profitable operations. In perfectly competitive markets, the absolute size of the market does not matter other than to determine how many entrants will arrive; each firm that enters will operate at the point of minimum long-run average cost, earning zero economic profits. (See Mankiw and Whinston, 1986, for an analysis of the strategic entry decision under price competition but costly entry.) The number of firms in the market is uniquely determined by the market size divided by this minimum efficient scale. Given that the number of entrants thus increases linearly in market size, the resulting hypothesis on crowdedness is thus that H1a: We expect no relationship between crowdedness and market size; and Such attempts to use industry history to predict industry evolution, as with all backwards-looking explanatory models, miss revolutionary changes in industry structure – as business-to-business e-commerce is claimed to be by its proponents. 5 H1b: Crowdedness should be decreasing in the size of barriers to entry/minimum efficient scale. II-2: Entry under Oligopoly In markets with oligopolistic competition (wherein profit-maximizing firms decide whether to enter or not taking into account the actions of other firms in their own strategic decisions), economic theory predicts both that prices and margins fall with the entry of more firms, and that the number of active firms should rise less than proportionately with market size (formally, in an increasing and concave relationship). Given that fewer entrants enter the market than in perfect competition, this result, predicted by many theories of oligopoly (see Waterson, 1984; Tirole, 1985 for summaries) and validated empirically by Bresnahan and Reiss (1991) and Campbell and Hopenhayn (1999), suggests that under oligopoly, H2a: Crowdedness should be negatively related to market size. II-3: Entry under Network Externalities or Increasing Returns to Scale Structural market characteristics other than size may play a significant role in the incentives for entry. We may expect B-to-B markets to display strong network externalities (i.e., increases in any individual buyer’s valuation for the exchange’s service given the presence of other buyers), increasing returns to scale (i.e., decreasing average costs of service provision as quantity increases) or demand-based economies of size (i.e., factors inducing buyers to choosing the largest among a group of competitors), markets with a few players will be significantly more profitable than markets with many. As there will eventually be only one (or a very few) dominating firms, new entrants would be foolish to try to invade relatively densely populated industries, preferring to attack industries that are less fragmented. We would thus expect to see a strong negative correlation between existing crowdedness and the marginal entrant’s desire to get in the market. Furthermore, we would expect that the absolute size of the market will not be particularly important; beyond a certain minimum size, getting 100% of the market will always be worth the costs of entry. These two basic properties of profitability under network externality or increasing/demand-based returns to scale suggest both that H3a: Crowdedness should be unrelated to absolute market size; H3b: Crowdedness should be decreasing in barriers to entry; and H3c: Entry should be strongly negatively related to the existing amount of players. 6 II-4: Entry into Nascent B-to-B Markets as Real Options The second theoretical perspective on B-to-B entry motivations comes from real options theory (Dixit and Pindyck 1994, 1995; Amram and Kulatilaka, 1999). Under the real-options theory, early investment in these nascent markets permits a range of future strategies not available to late entrants. The total volume expected to be transacted in business-to-business marketplaces is large -- covering hundreds of billions of dollars of transactions per year in the USA alone, and trillions worldwide (Morgan Stanley Dean Witter, 2000; Lucking-Reiley and Spulber, 2001). Many proposed B-to-B marketplaces offer compelling value propositions to their clients if they cover a sufficiently large fraction of the market’s buyers and sellers -- reducing frictional and relational transactions costs (Lee and Clark, 1997), driving total acquisition prices down both through search and reverse-auction capabilities (Segev and Gebauer, 2001) and intermediating trades to match buyers and suppliers according to specific attributes (Lucking-Reiley and Spulber, 2001). Given a proper match between their value propositions and revenue models (Amit and Zott, 2001), we would expect such value-creators in large markets to be able to overcome their fixed costs of entry. Finally, there are large economies of scale created by liquidity concerns, large development costs and required advertising expenditure to build critical mass of buyers and sellers (Narayandas, 1999; Sculley and Woods, 2000). Given these economies of scale, we would expect high industrial concentration to appear in the long run, with commensurately attractive returns on equity. The extraordinarily large potential value of dominating a large, profitable market is substantially larger (possibly by one or more orders of magnitude) than the actual expenditures required to enter these markets with some (not necessarily complete) set of technological capabilities. Given that the market is new, the critical capabilities that will form the cornerstone of the IT-enabled dominant design, as in McKenney et al. (1994) are yet unknown. It is thus unsurprising that many entrants would want to “take a shot” at being dominant — exchanging their modest entry costs for a lottery-like gamble that returns 0 most of the time, but which offers a low probability of a large payoff.2 2 Note that for this option value to be real, substantial uncertainty about drivers of future profitability is needed - for example, the required competences for long-term success being unknown at the time of entry. Each player knows that some player(s) will make extraordinary profits, but no player knows whether she will. Nor does any player know initially that she is not the one, and thereby faces a high opportunity cost of not staying in the market. This leads to rent-seeking entry behavior (Tullock, 1989) and suggests that too many firms will enter compared to the social optimum (Mankiw and Whinston 1986). This places a premium on firms learning that they are not the ones who possess the critical capabilities, and swiftly exiting the business which will just 7 Consider, for example, the following highly stylized model of a winner-take-all market in which only a minimal investment is required to enter, but increasing levels of investment improve the chances of success. (Compare this simple rent-seeking entry model to the psychological model of entry motivation proposed by Kahneman and Lavallo, 1993, or the rent-seeking model of political influence developed by Tullock, 1989). Let the expected total market size (in the sense of the amount of transactions expected to be conducted therein) be s. There is some unknown critical capability which, if possessed, results in complete market dominance. c is the indivisible unit of cost required to enter the market, or to extend the capabilities of an entry already made. All firms invest some multiple of c in their entry attempts; a given firm may invest c, 2c, 3c or any other positive multiple. Each investment of c creates one capability, any of which might be the critical capability required to dominate the market. The probability that a given firm i wins dominance of the market, as a function of its investment is thus equal to firm i’s share of the total costs devoted to entry in the market: pi ci n c j 1 j A one-time random event (the exogenous determination of the required capabilities) occurs (or its result becomes publicly known) after all potential entrants have had the opportunity to sink their entry costs. After this random event occurs, the entrant who holds the winning “ticket” – that is, who has made the investment in the critical capability -- will reap positive return on sales , making profits per period of s; their discount rate of = (1/1+r), where r is the per-period cost of capital, makes this profit stream worth s/(1-. We ignore the possibility that multiple players will have the critical capability and thus model a “winnertake-all” or “superstar” environment (Rosen, 1981; Frank and Cook, 1995; Varian and Shapiro, 2000). A risk-neutral individual firm, which seeks to maximize expected profit through entry, will thus choose its ci to maximize expected profit, net of investment: continue to be unprofitable (see Jovanovic, 1982, which accounts for “infant mortality” among firms in highrisk industries: Inefficient firms learn of their lack of capabilities only through experience in the market and exit when they are sufficiently certain that they will not be profitable at any point in the future. For uncensored examples of company mortality, along with accounts of the death throes of unsuccessful e-commerce entrants, see www.f—edcompany.com.) 8 Max ci s ci (1 ) c j j yielding an optimal choice for ci of ci* s cj (1 ) j i 2 for each of the n firms who enter. Given n identical firms, the optimal choice of ci for each firm simplifies to ci* s (n 1)ci* (1 ) 2 and thus n s c (1 ) * i 1 The total cost sunk by all entrants in this rent-seeking game is ns ( n n )c (1 ) nc 2 2 * i * i which exceeds the profit achieved by the winner whenever the number of entrants exceeds 1. Taking the derivative of the number n of entrants with respect to s, the market size, gives us n * 0, s ci (1 ) Clearly, n is increasing in s: the number of entrants is larger in a market of larger absolute size. If n 1, n is increasing more slowly than s as s increases and thus s crowdedness will be decreasing in market size. Conversely, if n 1, n is increasing faster s than s as s increases, and thus crowdedness is increasing in market size. This occurs when is relatively large, c is relatively small, and is high. Let us compare the mathematical conditions under which crowdedness is increasing in market size with the state of the B-to-B market in late 1999. First, for most B-to-B ecommerce markets, the return on sales (revenues less variable costs, as a fraction of revenues) approaches 100%, as variable costs of serving an additional $1 of transaction volume are negligible once the exchange capabilities are built. Second, the required investment c to 9 establish a minimal presence (perhaps only a business plan) is relatively small. Third, crowdedness should increase in market size when is high – that is, when the opportunity cost of capital, r, is low. One could argue that this characterizes the overall economic climate of late 1999-early 2000, when traditional stocks were reaching all-time highs (lowering their expected returns), bond yields were at all-time lows, and a flood of venture capital chased a relatively small number of high-quality investment opportunities. Given the limited appreciation potential of public-market securities and the abundance of private equity, the opportunity cost of capital was arguably indeed quite low – despite venture capitalists’ return goals in excess of 20% per annum. This simple “winner-take-all lottery” thus indicates that we expect: (a) The number of firms that enter a market will be increasing in market size; (b) Crowdedness will be increasing in market size, under economic conditions experienced in 1999-2000; (c) Crowdedness will be increasing in the expected return on sales after the uncertainty is resolved; and (d) Crowdedness will be increasing as the opportunity cost of capital decreases. Although not all of these theoretical propositions can be tested with our dataset, we can test H4a: There will be a significant positive relationship between absolute market size and number of entrants; and H4b: Crowdedness (the density with which firms populate a new market) should be increasing in market size. II-5: B-to-B Entry and Inefficient Capital Inflows – the Agency View An alternate theory of entry into heavily venture-backed, high-profile industries involves managerial preferences for forms of success other than long-term shareholder value. We note that the standard compensation for a B-to-B CEO was heavily weighted towards stock and option-based compensation in lieu of a market salary, rather than the traditional balance of cash, noncash benefits, pension contributions and a stock purchase plan. He or she thus stands to capture a substantial portion of the upside from a successful IPO but little of the downside of squandered venture capital provided from outside the firm (cf. Jensen and Meckling, 1976 for the analogous story with corporate debt and equity holders’ desire to take 10 on overly risky projects_. If an entrepreneur’s true motive (either inborn or induced by such a high-powered incentive scheme) is to generate a windfall capital gain on low-cost shares through an IPO, rather than stick around for long-term sustainable extraordinary return on equity, he or she may prefer to maximize the probability of such a successful IPO, rather than maximize the expected return on capital. While we will emphasize the distortion of the entry decision, we should note in fairness that the agency costs of this distortion may be sharply limited simply because the actions undertaken by the entrepreneur to maximize the IPO probability may not diverge significantly from those desired either by the venture capitalist or by the fund’s underlying investors [Jacobides and Croson, 2001]. This theory would imply that entrepreneurs want to enter markets of proven “fundability” or “IPO-ability” rather than ones that offer profits from operation. In this respect, the selection of the market to enter is similar to Sutton’s Law, named after noted bank robber Willie Sutton: “Why do I rob banks? Because that’s where the money is.” This selection mechanism contrasts sharply to capital-allocation theories of entry based on market attractiveness (e.g., Porter, 1980), where the goal is to commit capital to markets that will deliver sustainably extraordinary returns on equity – effectively going to where the money can be earned, not where it happens to be now.3 Sutton’s law indicates that markets that are receiving high levels of venture funding even before the entrant in question makes its bid would be the most attractive to target. This funding level may be high for two levels: first, because entry may be expensive on an absolute level (representing a barrier to entry, or at least a high minimum investment required); second, because many entrants have already come in at a given entry cost. The agency theory explanation would thus predict: H5a: There will be a positive relationship between the size of the market and the rate of entry; H5b: There will be a positive relationship between the crowdedness of the market and the rate of entry; H5c: There will be a positive relationship between the amount of venture funding committed to the market and the rate of entry; and 3 Hockey great Wayne Gretzky is heavily quoted by would-be B-to-B entrepreneurs for support via two aphorisms. First, “Some people skate to where the puck is. I skate to where the puck is going to be.” Only slightly less popular is his quote “You miss 100% of the shots you never take.” 11 H5d: There will be a positive relationship between barriers to entry in a market and its crowdedness. III. Extension: Is Entry Driven by Resources or Market Attributes? Having considered the possible drivers of any firm to enter, and having examined the econometric analysis at the industry level, we next look at the perennial strategic question of “What determines success?” From the mix of firms that could enter, what determines who will succeed? Is success mostly an issue of market positioning, of resources, or of capabilities? Our survey examined the relative importance of design (capability) and market-based features. We asked that companies rate how much these features relatively impact the success of their business by allocating a fixed percentage across the categories offered. The other questions in the first section of the survey ask the respondents for data regarding these features. To get at this important question, we asked the respondents of our survey to identify what matters most in this new B-to-B environment. We can thus analyze the primary perceived performance drivers of online marketplaces – those which affect the entry decisions and strategy selection of B-to-B entrepreneurs – classified by two characteristics: target market features and design and execution features. Target market features are characteristics of the industry or target market that the online marketplace serves, ranging from market size to market inefficiencies. Given that these are characteristic of the market served, they form commonly attractive (or unattractive) features to all potential entrants regardless of idiosyncratic capabilities. Design and execution features include the online marketplace’s business model and assets (people, proprietary technology, relationships, etc.) – which essentially capture the importance of firm–specific factors of success (i.e., the critical resources anticipated to be deployed in pursuit of the operating strategy of these businesses). IV. Description of Dataset To test these hypotheses and explore the motivations of entry in B-to-B e-commerce marketplaces, we assembled an extensive list of online B-to-B intermediaries, created through direct search of sites as well as by poring through Internet and industry trade journals, major newspapers, financial and industry analyst reports, and research from major technology and Internet research and consulting firms such as Forrester Research, Gartner 12 Group and NetMarketMakers (www.nmm.com). Following individual examination of each candidate’s site, 313 could be classified as online marketplaces — online B-to-B intermediaries that facilitate the matching of many buyers with many sellers. The estimates of other research organizations who track the creation of online marketplaces suggest that this number captures nearly all B-to-B intermediaries who had begun operations as of December 1999. A survey composed of twenty questions on performance drivers and measurements was sent (via mail and e-mail) to executive and senior managers of all the identified online Bto-B marketplaces for which contact information was available — 292 in total. The survey could be completed online (via FlashBase) as well as on paper. We promised (and delivered) an aggregate-level summary of the survey results (responses to all survey questions) to all survey participants, attached as Appendix A. Although only aggregate-level results were released to maintain confidentiality, sector information was provided only where the number of sites in that sector exceeded two to prevent deducing opponents’ information in sparselypopulated markets. Completed surveys (paper-based and online) were received over a span of approximately 8 weeks between December 1999 and February 2000. 81 survey responses were received during this period — a response rate of 28%. Although the responses clearly do not form a comprehensive view of the population of online B-to-B intermediaries, we believe they comprise the largest data set of online B-to-B intermediaries gathered to date. V. Quantitative Results: Presentation & Statistical Analysis of Survey Data While the full results of our survey cannot be presented in this brief paper, a few overall descriptive statistics should be noted. First, in terms of the overall division of subjective importance of performance drivers, the sample divided nearly evenly (51.9% favoring design-and-execution features, and 48.1% favoring market characteristics). Most respondents, however, ascribed a higher role to specific market characteristics than they did to specific design or capability-based advantages, as shown in Tables 1 and 2. 13 Table 1: Importance of Design and Execution Features Question Asked: How much do the following design and execution features impact the success of your business? Please allocate a percentage across the features; the total allocation should equal 100%, but you can allocate 0 points to one or more features. Average % allocated Feature Cited 16.9 Critical mass of users 11.9 11.8 11.2 9.7 9.7 6.2 5.5 Domain expertise of management, senior staff Brand awareness in target market Quality of management execution Revenue model Content Proprietary technology Provision of offline services (order fulfillment, logistics, etc.) Table 2: Specific High-Importance Metrics Question Asked: “This metric would be assigned a rank of high importance on a low-medium-high scale.” % 72.7% 72.7% 66.2% 54.5% 46.8% 45.5% 39.0% 39.0% 36.4% 35.1% 31.2% 26.0% 26.0% 9.1% Specific High-Importance Metric Number of transactions Total revenues Number of registered users Number of repeat transactions Average transaction size Number of sales leads converted to transactions Number of unique visitors Number of inquiries/sales leads Revenue impact or cost savings generated for users Operating profits Return visits per registered user Number of page views Customer satisfaction Number of hits As shown in Table 2, the metrics identified as “high importance” by the most respondents were total revenues (73%), number of transactions (73%), number of registered users (66%) and number of repeat transactions (55%). The most commonly tracked performance metrics from the list presented were the number of registered users (91%), total revenues (85%), number of transactions (84%) and average transaction size (73%). Furthermore, within the design-and-execution-based advantages noted for their contribution to success, the items that managers cited had more to do with improving the perception of the firm by outsiders, rather than the exploitation of specific managerial skills – 14 which also points to the dominance of factors external to the firm.4 Note the dramatic lack of profit-based measures from metrics tracked (or assigned importance) by B-to-B managers, supporting the widely-held attitude that “profits matter less than revenues” in early stages of e-commerce ventures. Of particular interest to our “crowdedness” question is the average percentage weight allocated by market characteristic that affects the success in entering a new market. In Table 3, we see that “market size” (the most heavily weighted criterion) was rated twice as important as “presence of other online B-to-B intermediaries in the same market” (the seventh-most heavily weighted criterion, exceeding only “technology penetration in the market” in perceived importance). Furthermore, the prominence of “degree of market fragmentation” indicates — since fragmentation is the opposite of concentration — that these new entrants were actively seeking markets with many “brick-and-mortar” rivals and were not particularly concerned (either positively or negatively) with rivalry in the online market. Table 3: Impact of Target Market Features on Success Question Asked: How much do the following target market features impact the success of your business? Please allocate a percentage across the features; the total allocation should equal 100%, but you can allocate 0 points to one or more features. (N=79) Average % allocated 17.0% 16.1% 14.9% 14.5% 12.0% 9.0% 8.7% 8.0% Feature Cited Market size Degree of market fragmentation Procurement inefficiencies Information inefficiencies Distribution inefficiencies Degree of product specialization Presence of other online B-to-B intermediaries in the same market Technology penetration (EDI/VAN, e-commerce capabilities of incumbents) Finally, B-to-B entrants seem to have targeted only very large markets. 50% of the online marketplaces in our sample are targeting markets in excess of $100 billion in sales. Only 20% of the online marketplaces are targeting markets with $15 billion or less in sales, and only 2% targeting markets with less than $1 billion in sales. While it is possible that this effect is a remnant of the venture-capital funding decision – that is, that the economies of scale in B-to-B are perceived to be so important that no small market will be funded, thus censoring the sample of smaller markets -- evidence corroborates our statistical findings in pointing to significant agency problems and mis-allocation of investment capital. 4 This extreme external focus may be exacerbated by the competitive necessities of an environment characterized by increasing returns to scale and/or network externalities, as noted above. 15 VI. Basic Results of Hypothesis Testing In the following correlational analyses, the crowdedness metric comes from the original diligence performed on the B-to-B marketplace market -- that is, crowdedness and number of entrants in a market were measured unconditionally on the decision to complete our survey. The other two metrics (market size and minimum efficient scale) come directly from our survey results. Five simple correlational analyses suffice to distinguish among the theories of competition, oligopoly, winner-take-all and agency, as seen in Table 4.5 Table 4: Basic Correlational Testing of B-to-B Entrant Dataset Dependent Variable Independent Variable Sign Significance at 5% Level Crowdedness Crowdedness Market Size (total) BTE/MES Yes No Crowdedness # entrants # of entrants Market size (total) Market size (e-only) No No BTE/MES # entrants 5 No Yes Note that the test of statistical significance for a simple correlation is equivalent to the overall significance of the single-variable regression Y=a+bX+e, where Y and X are the variables to be correlated – that is, rejecting the “all slopes null” hypothesis. All five regressions passed the associated F-test for significance at the 10% level; two (Crowdedness on market size and Number of entrants on BTE) passed at the 1% and 5% level, respectively. 16 Table 5: Summary of Hypothesis Durability under Correlational Testing Hypothesis Framework ? Comments H1a: Crowdedness independent of market size H1b: Crowdedness decreasing in BTE/MES Competition Competition N N Two-sided test Crowdedness increases in BTE/MES H2a: Crowdedness decreasing in market size H3a: Crowdedness independent of market size H3b: Crowdedness decreasing in BTE/MES H3c: Crowdedness decreasing in # entrants H4a: # entrants increasing in market size Oligopoly Inc Returns Inc Returns Inc Returns Winner-take-all N N N N (Y) One-sided test of H1a is rejected Same as H1a Same as H2a Empirical contradiction of Share Lemma (Monotonicity – compare H3b) H4b: H4c: H4d: H5a: H5b: H5c: H5d: Winner-take-all Winner-take-all Winner-take-all Agency Agency Agency Agency Y N N (Y) Y Y (Y) (Convexity – compare H3a) (Contrast H4c) (Contrast H4d) Same as H3a Same as H3b (Contrast H3c) (Contrast H3d) Crowdedness increasing in market size # entrants decreasing in BTE/MES Crowdedness decreasing in BTE/MES # entrants increasing in market size Crowdedness increasing in market size # entrants increasing in BTE/MES Crowdedness increasing in BTE/MES Legend: “N” means hypothesis is rejected by correlation test at the 5% level of significance “Y” means hypothesis is supported by correlation test at the 5% level of significance “(Y)” means hypothesis is supported by correlation test at less than a 5% level of significance From Table 5, we make the following observations: (a) The hypothesis that rational competitive behavior (either in perfect competition or in oligopoly) explains entry patterns in B-to-B e-commerce is soundly rejected; (b) Although the “Winner-take-all” model explains the effects on crowdedness of market size, this model cannot be the only explanation of crowdedness, as it fails to predict correctly the effects of barriers to entry/minimum efficient size; and (c) The agency model alone predicts the signs of all five tests. We thus tentatively conclude that agency issues, and in particular the asymmetry between gains and losses for the entrepreneurs, is a necessary driving explanatory force for B-to-B entry decisions over the 1999-2000 period. In addition, the “winner-take-all” model, combined with the agency model, is compatible with the observed data. Our analysis above, despite its direct relevance to our hypotheses, is admittedly an industry-level analysis of average propensity to enter a market, rather than a firm-level analysis of the actual entry decision process. To answer the question “On the margin, how does market size affect a firm’s propensity to enter?”, we would need to formulate and estimate a basic reduced-form model of the relationship between market size and the 17 entrant’s decision to enter. Our dependent variable would be a measure of “crowdedness” (number of entrants per dollar of market transaction volume), whose relationship with market size should be negative, nonexistent or positive, depending on whether we accept the competitive/oligopoly analysis, real-option theory or agency cost/fundability approach, respectively. As a proxy for barriers to entry, we could use the minimum scale perceived by entrants to be required to break even. We would thus need to estimate the following equation for each market i: Crowdednessi = (# of Entrants in Market i)/(Market Size of Market i) = + (Market Size)i+ (Barriers To Entry)i+ (Size)i*(BTE)i + I Given that the hypotheses from the above theories predict different signs of the coefficients, we could use this regression to discuss the relative validity of the theories in explaining the observed empirical regularities in B-to-B e-commerce. Such a market-level analysis would, however, make the assumption that all entrants within the market were homogeneous in their capabilities and probabilities of success – which eliminates much of the explanatory power of managerial theories of entry. Unfortunately, data scarcity makes industry-by-industry regression analysis problematic using firm-level data. Even had all 292 identified e-marketplaces provided us with extensive data, the 57 distinct markets they occupy would imply that this regression would be overspecified for all but the 13 markets with the largest numbers of entrants (agriculture, automotive, chemicals, food, commercial printing, electronic components, energy, finance, healthcare, industrial supplies, small business services, telecommunications and transportation). VII. Conclusion Our paper features empirical evidence from one of the most visible, and perhaps meteoric new segments: B-to-B intermediaries. We have also attempted to contribute to the theoretical understanding of entry in new markets, examining the real drivers of entry decision, and focusing on considerations of economically inefficient yet privately lucrative motives tied to the characteristic B-to-B entry structure of venture-capital financing, highpowered incentives and uncertainty in required capabilities for success. While our empirical analysis is admittedly an early stage, the evidence so far is that some heretofore unexplored factors are important determinants of the B-to-B entry decision. In particular, crowdedness seems to be driven by winner-take-all and agency effects, rather than profit-maximizing entry 18 intent. It appears, from our empirical investigation of data collected during the 1999-2000 peak of the B-to-B intermediaries’ market, that entry in B-to-B markets has been largely driven by the visibility of the market and the potential for extraordinary financial returns via IPO, rather than a cold-blooded tradeoff of the required entry costs vs. the expected “prize” for successful implementation. While these entry decisions may be privately economically rational for their decisionmakers (in this case, entrepreneurs) they do not improve the prospects for returns on invested equity – and, in some cases, virtually guarantee investor losses until the number of firms equilibrates to that supportable by the market. Extraordinarily high crowdedness, especially caused by reasons other than high expected profitability, predicts a severe shakeout once uncertainty about required capabilities is resolved. Note that scarcity of further venture capital places a distinct cap on entry, but does not necessarily affect the severity of the shakeout (or the incentive to take desperate measures to maximize the probability of IPO) among those already in. We therefore speculate that the future profitability of segments characterized by entry-induced crowdedness will be even lower than what is currently anticipated by financial analysts. To be examined in future research is a guide for managerial action in new markets with significant network externalities and a taxonomy of policy and strategy implications for the evolution of this new market now that the entry wave has abated. 19 References Amit, R. and C. Zott. “Value Creation in E-Business.” Forthcoming, Strategic Management Journal. Amel, D. F and J.N. Nellie, 1997 “Determinants of Entry and Profits in Local Banking Markets”, Review of Industrial Organization, 12(1): 59-78. Amram, M. and N. Kulatilaka. Real Options: Managing Strategic Investment in an Uncertain World. Boston: Harvard Business School Press, 1999. Bresnahan, T.F. and P.C. Reiss, 1991. “Entry and Competition in Concentrated Markets.” Journal of Political Economy 99 (5): 977-1009 Cabral, L. M. 1997, “Competitive Industry Dynamics: A Selective Survey of Facts and Theories.” Mimeo, London Business School. Campbell, J. and H. Hopenhayn, 1999. “Market Size Matters.” Working Paper, University of Chicago. 1999. Carree, M. and R. Thurik, 1996, “Entry and Exit in Retailing: Incentives, Barriers, Displacement and Replacement”, Review of Industrial Organization,11(2): 155-72.. Caves, R.E., 1998, “Industrial Organization and New Findings on the Turnover and Mobility of Firms.” Journal of Economic Literature 36 (4): 1947-1982 Croson, D.C. ,J.F. Fox, and V.L. Ashurkov. 1998. “Flexible Entry Strategies for Emerging Telecom Markets.” Technological Forecasting and Social Change 57: 35-52. Das, S and S.P. Das, 1996, “Dynamics of Entry and Exit of Firms in the Presence of Entry Adjustment Costs.” International Journal of Industrial Organization 15 (2): 217-241 David, P.A.,1985, “Clio and the Economics of QWERTY”, American Economic Review, 75(2): 332-37 David, P.A.,1992, “Information Network Economics: Externalities, Innovations and Evolution”, in C. Antonelli, ed The Economics of Information Networks. London: NorthHolland Dixit, A.K. and R.S. Pindyck, 1994. Investment under Uncertainty. Princeton, NJ: Princeton University Press. 20 Dixit, A.K. and R.S. Pindyck, 1995. “The Options Approach to Capital Investment.” Harvard Business Review (May-June): 105-115. Frank, R.H. and P.J. Cook, 1995. The Winner-Take-All Society. New York: Martin Kessler Books at the Free Press. Goldman Sachs, 2000, B-to-B: Collaborative Commerce, Report of the US Technology Group . Hopenhayn, H.A., 1992. “Entry, Exit and Firm Dynamics in Long Run Equilibrium.” Econometrica 60(5): 1127-1150. Jacobides, M.J. and D.C. Croson, 2001. “Information Policy: Shaping the Value of Agency Relationships.” Academy of Management Review 26: 35-52. Jensen, M.C. and W.H. Meckling, 1976. “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure.” Journal of Financial Economics 3: 305-360. Jovanovic B, 1982. Selection and the Evolution of Industry, Econometrica, 50 (3): 649-670. Kahneman, D. and D. Lavallo, 1993. “Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking.” Management Science 39: 17-31. Klepper, S., 1996. “Entry, Exit, Growth and Innovation over the Product Life Cycle.” American Economic Review 86(3): 562-583. Lee, H.G. and T.H. Clark, 1996. “Impacts of the Electronic Marketplace on Transaction Cost and Market Structure.” International Journal of Electronic Commerce 1(1): 127-149. Lucking-Reiley, D. and D. Spulber, “Business-to-Business Electronic Commerce.” Journal of Economic Perspectives 15(1):55-68. Mankiw, G.N. and M.D. Whinston, 1986, “Free Entry and Social Inefficiency”, Rand Journal of Economics, 17(1), Spring: 48-58. McKenney, J.L., D.C. Copeland, and R.O. Mason, 1994. Waves of Change: Business Evolution through Information Technology. Boston: Harvard Business School Press. MSDW (Morgan Stanley Dean Witter), 2000. The Internet and the Financial Services Report. Narayandas, D., 1999. VerticalNet. Harvard Business School Case #9-500-041. 21 Pakes, A and R. Ericson, 1998. “Empirical Implications of Alternative Models of Firm Dynamics.” Journal of Economic Theory 79(1): 1-45. Porter, M.E. 1980. Competitive Strategy. New York: The Free Press. Rosen, S., 1981. “The Economics of Superstars.” American Economic Review 71: 845-858. Sculley, A.B. and W. A. Woods. B-to-B Exchanges : The Killer Application in the BusinessTo-Business Internet Revolution. New York: HarperBusiness, 2000. Segev, A. and J. Gebauer, 2001. “B-to-B Procurement and Marketplace Transformation.” Forthcoming, Journal of Information Technology & Management. Shapiro, D.M. and R.S. Khemani, 1987, “The Determinants of Entry and Exit Reconsidered”, International Journal of Industrial Organization 5(1): 15-26. Teece, D.J., R. Rumelt, G. Dosi and S.G. Winter, 1994 “Understanding Corporate Coherence: Theory and Evidence”, Journal Of Economic Behavior & Organization, 23(1). Tirole, J. The Theory of Industrial Organization. Boston: MIT Press, 1988. Tullock, G., 1989, “The Economics of Special Privilege and Rent Seeking” in Norwell, M.A. Studies in Public Choice. London: Kluwer Academic Press. Utterback, J. and F. Suarez, 1993, “Innovation, Competition, and Industry Structure.” Research Policy 22(1): 1-21. Varian, H.R. and C. Shapiro, 2000, Information Rules, Boston: Harvard Business School Press. Waterson, N., 1984. Economic Theory of the Industry. Cambridge: Cambridge University Press. 22