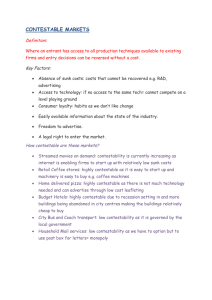

Contestable Markets – Killer facts

Contestable Markets – Killer facts

• One in which there is one firm (or a small number of firms)

• Because of freedom of entry and exit, the firm faces competition and might operate in a way similar to a perfectly competitive firm

• The threat of “hit and run entry” from new firms may be sufficient to keep the industry operating at a competitive price and output

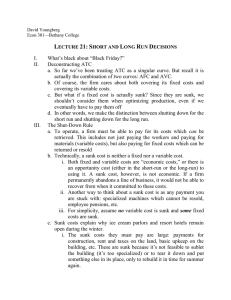

• The key requirement for a contestable market is the absence of sunk costs – I.e. costs that cannot be recovered if a business decides to leave a market

• When sunk costs are high, a market is more likely to produce an price and output similar to monopoly (with the risk of allocative inefficiency and loss of economic welfare)

• A perfectly contestable market occurs only when entry and exit into and out of a market is perfectly costless

• Contestable markets are different from perfect competitive markets

• It is possible for one incumbent firm to dominate the industry

• Each existing firm in the market produces a differentiated product (i.e. goods and services are not perfect substitutes for each other)

• There are 3 conditions for market contestability

– Perfect information and the ability and or legal right to use the best available technology

– Freedom to market / advertise and enter a market

– The absence of sunk costs

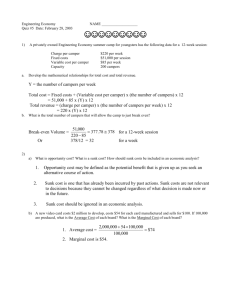

• Sunk costs are those costs which a business incurs in setting up or running a business which are irrecoverable to the owners of the firm should it decide (a) to close down or (b) leave the market

• A sunk costs is a past expense or loss that cannot be altered by current or future actions

• Sunk costs represent a barrier to entry in an industry because they scare potential entrants from entering - should they fail, they would have wasted all the sunk costs