Association of Accounting Technicians

Exam

NVQ/SVQ in Accounting

Level 4

Preparing Business Taxation

Computations

–

Botswana

(BTC-B)

Diploma pathway

Diploma level

Preparing Business Taxation

Computations

–

Botswana

(BTC-B)

2003 Standards 2003 Standards

Tuesday 17 June 2008 (morning)

Time allowed - 3 hours plus 15 minutes’ reading time

Please complete the following information in BLOCK CAPITALS:

Student member number Desk number

Venue code Date

Venue name

Important:

This exam paper is in two sections. You should try to complete every task in both sections.

We recommend that you use the 15 minutes’ reading time to study the exam paper fully and carefully so that you understand what to do for each task. However, you may begin to write your answers within the reading time, if you wish.

We strongly recommend that you use a pen rather than a pencil.

You may not use programmable calculators or dictionaries in the exam.

Do NOT open this paper until instructed to do so by the Supervisor.

BTC-B

Note:

You may use this page for your workings.

2

Note:

This page is perforated. You may remove it for easy reference.

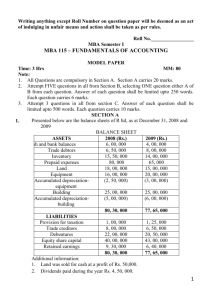

Taxation tables for business tax

– 2007/08

Capital allowances

Writing down allowance –

Motor vehicles

Plant and machinery

Industrial buildings – initial allowance

Industrial buildings

Capital gains

National Cost of Living Indices:

October 2000

June 2008

Individual capital gains tax rates:

Taxable income (Pula) Tax

%

25

15

25

2.5

576.0

995.2

0

15,001

60,001

- 15,000

60,000

- 90,000

0

5% of excess over 15,000

2,250+ 12.5% of excess over 60,000

90,001 - 120,000 6,000 + 18.75% of excess over 90,000

120,001 and over

Corporation tax

Manufacturing company basic tax rate

Additional company tax rate

Individual income tax rates

Taxable income (Pula)

11,625 + 25% of excess over 120,000

Tax

5%

10%

0 - 30,000 0

30,001 60,000

60,001 - 90,000

90,001 - 120,000

120,001 and over

5% of excess over 30,000

1,500 + 12.5% of excess over 60,000

5,250 + 18.75% of excess over 90,000

10,875 + 25% of excess over 120,000

3

Note:

This page is perforated. You may remove it for easy reference.

This exam paper is in TWO sections.

You must show competence in BOTH sections. So, try to complete EVERY task in BOTH sections.

Section 1 contains 6 tasks and Section 2 contains 7 tasks.

You should spend about 90 minutes on each section.

There is blank space for your workings on pages 2, 12 and 21 to 23, but you should include all workings and essential calculations in your answers.

Section 1

Data

You work in the tax department of a firm of chartered accountants.

Dean and Thato are new clients who commenced trading as a partnership on 1 May 2006. You have been asked by your supervisor to do the tax computations for the business.

3.

2.

The accounting department supplies you with the following information.

1. Adjusted trading profits, before deducting capital allowances:

Period ended 31 December 2006

Year ended 31 December 2007

Fixed asset additions and disposal:

Additions:

May 2006

June 2006

June 2006

Plant and machinery

Car for Dean, 30% private usage

Car for Thato, 40% private usage

December 2006 Plant and machinery

August 2007 Plant and machinery

Disposal:

February 2007 Plant and machinery

(original cost P109,200)

P

591,132

696,720

P

296,120

183,600

121,080

149,400

97,200

83,640

The partnership agreement states that each partner receives a salary of P180,000 per year, and the remainder of the profits is divided in the ratio 3:2 between Dean and Thato respectively.

4

Task 1.1

(a) Calculate the capital allowances for the partnership for the period ended 31 December 2006.

5

Task 1.1, continued

(b) Calculate the capital and balancing allowances for the partnership for the period ended

31 December 2007.

6

(b)

Task 1.2

For the period ended 31 December 2006 calculate:

(a) the total taxable trading profits of the partnership each partner ’s share of these profits

7

(b)

Task 1.3

For the year ended 31 December 2007 calculate:

(a) the total taxable trading profits of the partnership each partner ’s share of these profits

8

Task 1.4

Calculate the total tax payable by Dean for the 2007/08 tax year.

Data

On 12 June 2008 Dean telephoned the office saying that he had just received his income tax return for the

2007/08 tax year. He does not know when this form needs to be returned to BURS, and has asked you to ring him back to explain.

Task 1.5

State what information you need to give Dean to fully answer his query.

9

Data

You have received the following email from Thato.

From: Thato@hotbox.net

To: AATstudent@boxmail.net

Sent: 13 June 2008

Subject: Help

I know that you are currently dealing with our tax affairs, and wondered if you could help us with some advice.

The business is doing really well this year, and we want to expand by investing some money. I own a block of four offices and I am happy to sell one of them so that I can put some money into the business, but I am worried that I will need to pay a lot of tax on any money that I make.

I bought the offices in October 2000 for P3,000,000 and the biggest one has a market value of about

P1,800,000. The other three are worth about P4,200,000 between them. These offices are business assets –

I don’t know if this is relevant information.

I would therefore be grateful if you could explain to me what the tax implications of selling the biggest office for P1,800,000 would be, so that I can make an informed decision on the best thing to do.

Much appreciated

Thato

Task 1.6

Reply to Thato ’s email, explaining the capital gains tax implications if she sells the office. Assume that rollover relief will not be available on this gain.

From:

To:

Sent:

Subject:

AATstudent@boxmail.net

Thato@hotbox.net

17 June 2008

Re: Help

10

This page is for the continuation of your email. You may not need all of it.

11

Note:

You may use this page for your workings.

12

Note:

This page is perforated. You may remove it for easy reference.

Section 2

You should spend about 90 minutes on this section.

Data

2.

3.

You work in the tax department of a manufacturing company trading as Tagger Ltd, a company that has traded for many years. The company’s accounting year end was changed from September to December.

The first financial statements to December cover the 15-month period to 31 December 2007.

The following information is available for the 15-month period ended 31 December 2007.

1. A summary of the accounts shows:

P

10,083,840 Gross profit

Depreciation

Expenses

P

672,600

4,899,996

Salaries

Net profit

3,005,520 8,578,116

1,505,724

The expenses include:

Speeding fines incurred by an employee

Staff entertaining for Christmas party

Gifts of wine to customers

P

1,200

4,800

9,600

(P120 per bottle with no company advertisement)

Gifts of stationery to customers

(P60 per item, with company advertisement)

Political donation

6,000

14,160

Gift Aid payment made (P1,200 per month) 18,000

The capital allowances on plant and machinery have already been calculated at P386,700.

In December 2006, Tagger Ltd bought a new industrial building for P1,680,000. The building was brought into use immediately.

4.

5.

Tagger Ltd has trading losses brought forward of P217,200.

In January 2007, Tagger Ltd sold some business assets that resulted in a chargeable gain of

P80,400.

6.

7.

Tagger Ltd has additional company tax (ACT) brought forward of P350,000.

During the 15-month period, Tagger Ltd received the following dividends from companies not associated with Tagger Ltd (the dividends are not included in the income statement in point 1 above):

November 2006

April 2007

November 2007

P

54,400

64,800

27,000

13

Note:

This page is intentionally blank. You should NOT use it for workings.

14

Task 2.1

Calculate the industrial buildings allowances for the 15-month period ended 31 December 2007.

Task 2.2

Calculate the adjusted trading profits, after capital allowances, for the 15-month period ended

31 December 2007.

15

Task 2.3

Calculate the taxable income for the 15-month period ended 31 December 2007.

Task 2.4

Calculate the tax payable for the 15-month period ended 31 December 2007.

16

(b)

Task 2.5

(a) Calculate the total additional company tax carried forward to the year ending

31 December 2008.

For how long and to which tax year can additional company tax arising in the 15-month period to 31 December 2007 be carried forward?

17

(c)

(b)

Task 2.6

(a) State the dates on which SAT for the 2008 tax year was due and the minimum SAT payment that should have been made per quarter in order to avoid incurring penalty interest.

At what rate will penalty interest be charged on any late SAT payments?

What is the filing due date of the corporate tax return for the 15-month period ended

31 December 2007?

18

Data

You have received the following email from the Managing Director of Tagger Ltd.

From: Daniel.tag@tag.co.uk

To: AATtax@tag.co.uk

Sent: 16 June 2008

Subject: Assets

I am hoping that you can give me some advice on a taxation issue.

As you know, we bought a building in December 2006 for P1,680,000. As the business is growing, I feel that we have already outgrown the building, and I am thinking of selling it to replace it with a bigger one.

I think we could sell the current building for about P2,160,000 and I have seen a new one which looks ideal for P2,760,000.

However, I am concerned that there could be a large tax bill if we sell our current building.

Any advice or information would be most welcome.

Daniel

Task 2.7

Reply to Daniel’s email, explaining the tax implications of these capital transactions. You do not need to calculate any figures.

From:

To:

Sent:

Subject:

AATtax@tag.co.uk

Daniel.tag@tag.co.uk

17 June 2008

Re: Assets

19

This page is for the continuation of your email. You may not need all of it.

20

Note:

You may use this page for your workings.

21

Note:

You may use this page for your workings.

22

Note:

You may use this page for your workings.

23

NVQ/SVQ qualification codes

Technician (2003 standards) - 100/2942/4 / G794 24

Unit number (BTC) – K/101/8115

Diploma pathway qualification codes

Diploma (2003 standards) – 100/5925/8

Unit number (BTC) – M/103/6454

© Association of Accounting Technicians (AAT) 06.08

140 Aldersgate Street, London EC1A 4HY, UK t: 0845 863 0800 (UK) +44 (0)20 7397 3000 (non-UK) e: aat@aat.org.uk w: www.aat.org.uk