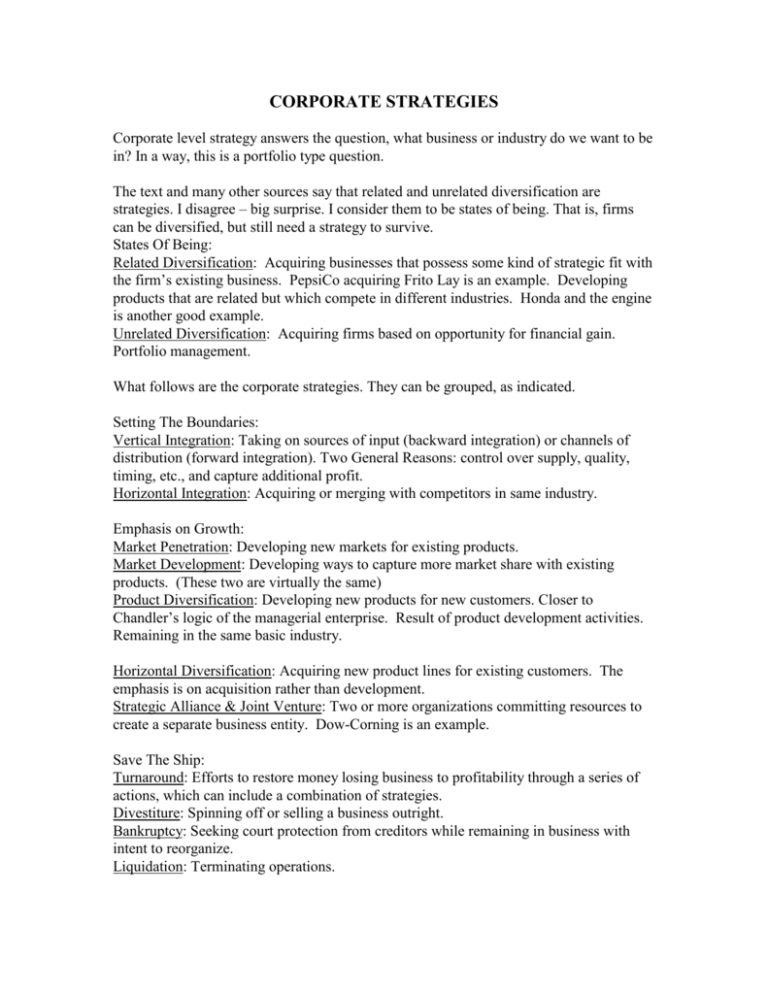

MASTER OR CORPORATE STRATEGIES

advertisement

CORPORATE STRATEGIES Corporate level strategy answers the question, what business or industry do we want to be in? In a way, this is a portfolio type question. The text and many other sources say that related and unrelated diversification are strategies. I disagree – big surprise. I consider them to be states of being. That is, firms can be diversified, but still need a strategy to survive. States Of Being: Related Diversification: Acquiring businesses that possess some kind of strategic fit with the firm’s existing business. PepsiCo acquiring Frito Lay is an example. Developing products that are related but which compete in different industries. Honda and the engine is another good example. Unrelated Diversification: Acquiring firms based on opportunity for financial gain. Portfolio management. What follows are the corporate strategies. They can be grouped, as indicated. Setting The Boundaries: Vertical Integration: Taking on sources of input (backward integration) or channels of distribution (forward integration). Two General Reasons: control over supply, quality, timing, etc., and capture additional profit. Horizontal Integration: Acquiring or merging with competitors in same industry. Emphasis on Growth: Market Penetration: Developing new markets for existing products. Market Development: Developing ways to capture more market share with existing products. (These two are virtually the same) Product Diversification: Developing new products for new customers. Closer to Chandler’s logic of the managerial enterprise. Result of product development activities. Remaining in the same basic industry. Horizontal Diversification: Acquiring new product lines for existing customers. The emphasis is on acquisition rather than development. Strategic Alliance & Joint Venture: Two or more organizations committing resources to create a separate business entity. Dow-Corning is an example. Save The Ship: Turnaround: Efforts to restore money losing business to profitability through a series of actions, which can include a combination of strategies. Divestiture: Spinning off or selling a business outright. Bankruptcy: Seeking court protection from creditors while remaining in business with intent to reorganize. Liquidation: Terminating operations.