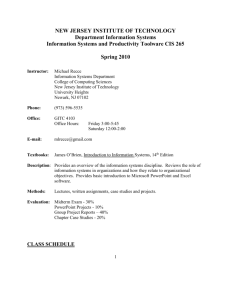

BPA434: ADVANCED TOPICS IN CORPORATE FINANCE

advertisement

BPA434: ADVANCED TOPICS IN CORPORATE FINANCE Spring, 2003 class time: TTh 2:00-3:30 e-mail: llivingston@ups.edu office/voice mail: (253) 879-3471 Lynda Livingston office: McIntyre 111-J office hours: WF 1:00-2:30 TTh 12:30-2:00 and by appointment COURSE OUTLINE DESCRIPTION: Corporate finance is concerned with a corporation’s acquisition and allocation of capital. In this course, we consider these interrelated issues, building on the foundation laid in BPA315. In 315, our consideration of the acquisition of capital revolved around calculation of the weighted average cost of capital (WACC), using the assumptions that the firm’s project risk and financing risk remained unchanged. What if those assumptions are violated? Even if they’re not, how do we determine the optimal degree of leverage? Should we use retained earnings or new stock issues for new equity funds? What sorts of options should we consider for our debt? We consider these more advanced questions about capital acquisition in this class. Once we have our capital, how do we deploy it? We discussed the basic net present value approach to capital budgeting in 315. Here, we extend our analysis to consider project interrelationships and abandonment options. We evaluate alternative methods of capital budgeting. We consider the valuation not only of projects, but also of whole firms, when we discuss mergers and acquisitions. After our discussion of these and related issues, you should have a much better understanding of how corporations productively employ their resources to create value. PREREQUISITE: As discussed above, our analysis will draw extensively on the background you received in BPA315. You will be expected to be thoroughly conversant with WACC, capital budgeting, and valuation techniques. If you need supplemental resources to bolster your knowledge (or simply your confidence), please see me. OBJECTIVES: When you leave this class, you should be able to: create a marginal cost of capital schedule for a firm incorporate decision tree analysis, including abandonment options, into standard NPV methodology understand the advantages and disadvantages of the using internal rate of return for capital budgeting evaluate a bond refunding opportunity appreciate both the lessee’s and the lessor’s rationale for leasing assets apply valuation techniques to target firms for analyzing merger and acquisition opportunities understand the applications of option theory to corporate finance address the theoretical and practical difficulties of the capital structure and dividend decisions BPA434/SPRING, 2003/SYLLABUS TEXT: 2 Principles of Corporate Finance, 6th edition, Richard A. Brealey and Stewart C. Myers, Irwin/McGraw-Hill, 2000. This is the best finance book ever written. It can also help you in the following classes: International Finance (BPA435): Financial Statement Analysis: Investments (BPA432): Financial Markets (BPA431): Introductory Corporate (BPA315—too late!): Ch.28 Ch. 29-32 Chs. 7, 8, 13, 20, 21, 27 Chs. 14, 15, 23 Chs. 1-12 COURSE REQUIREMENTS EXAMS: There will be two exams during the semester and a comprehensive final. (The exams may contain some take-home parts.) For each in-class exam, you may bring one 8 1/2 x 11" sheet of paper with whatever essential trivia you desire. This sheet must contain hand-written notes ONLY. No make-up exams will be given without a written excuse (such as a doctor's note) for the original absence. You must inform me ON OR BEFORE the exam date that you will need a make-up. All make-ups must be completed within one week of the original exam date. The same material will be covered on a make-up, but the format may be different. HOMEWORK: There will be homework assignments required throughout the semester. Homework will be handed out in class. Different assignments will have different preparation times and point totals; some will be due the class period following their distribution, and some will be due later. The exact number of assignments will vary according to my interpretation of your degree of comfort with the material. Some of these homework assignments will be old test questions, so that you can get an idea of what the tests are like. Homework is due at the beginning of class on the due date. NO LATE HOMEWORK ASSIGNMENTS WILL BE ACCEPTED. I will be handing out homework answers on the same day that the assignments are due, and I obviously cannot accept homework handed in after answers have been given out. You will be allowed to drop one homework score. The homework assignments will have different point totals. Your homework grade will be determined by forming the following ratio: (points earned on kept assignments)/(total points available on kept assignments). (Any extra credit points earned are simply added into the NUMERATOR only.) For example, say you had the following homework scores: ASSIGNMENT 1 2 3 TOTAL POINTS 100 55 200 YOUR POINTS 93 50 150 BPA434/SPRING, 2003/SYLLABUS 3 COURSE RQEUIREMENTS: HOMEWORK (continued) Say you chose to drop HW#1. Then, the total points available on the assignments you kept (#2 and #3) would be 255, out of which you earned 200. Your ratio would therefore be 200/255 = .7843. I would therefore use a grade of 78 for you homework grade. If, on the other hand, you dropped HW#3, your score would be (93+50)/(100+55) = .9226, or 92. You are responsible for determining which homework assignment to drop. You'll tell me on the last day of the quarter. If you do not tell me, I will arbitrarily drop HW#1. You may work with others in developing answers to homework problems, but you must write up your assignments yourself. Any suggestion of scholastic dishonesty will result in a NONDROPPABLE grade of 0 for that assignment for both the author of the original and the copy. QUIZZES: I reserve the right to give any number of unannounced quizzes during the semester. These quizzes may count as extra credit, or they may count as homework. The number of quizzes will be negatively related to the class’s level of preparation and participation. CASE ANALYSES: Case analyses throughout the semester will allow you the opportunity to think critically, to demonstrate your grasp of relevant concepts, and to present a cogent argument both written and orally. Several cases are specified in the syllabus; others will be added as appropriate. We will discuss your requirements thoroughly as we get to each case. However, all cases will require preparation outside of class; many will benefit from exposure to small-group discussion. PRESENTATION: There is a great body of literature in corporate finance. To enrich your appreciation for the topics covered in your textbook, and to introduce you to empirical and theoretical studies as they are conducted in finance, you will be required to read one article from the attached list. Note that some of these articles represent state-of-the-art applications and empirical analyses, while others are “classic,” often theoretical papers, that for decades have defined the scope of the discourse on a particular topic. You will then lead a 10- to 20-minute discussion on your paper, first giving a summary (covering its research question, empirical methods or theoretical model, and major findings), then explaining its practical applicability to the topics we have discussed. You also will provide each of your classmates with a 1-page summary of your paper on the day of your presentation. This summary may be all your classmates will know about the important work you have read, so create it carefully as a teaching tool for them. At least a week before your presentation, you will provide me with a copy of your paper. (You may also give me a copy of your summary sheet, if you would like comments.) I will be happy to discuss your papers with you: there may be parts of them that are especially relevant, and that we would want to emphasize; there may also be parts best left for a doctoral program. We can go over your papers together to identify these areas. However, be sure that you have thoroughly read your paper before requesting such a meeting. BPA434/SPRING, 2003/SYLLABUS 4 COURSE REQUIREMENTS: PRESENTATION (continued) Although you will not be required to read all of the papers that are presented, you will be expected to be conversant with them (read: you may be tested on them). (This is why the summary sheets are so important.) You will also be expected to ask relevant questions of the presenters: they are you best line to clarity on their paper’s issues. Some of the possible paper choices are listed at the end of this syllabus. You will receive additional choices during the second week of class. You may also choose your own paper—just see me if you think you’ve found a suitable candidate. We will make our choices final by the fourth week of class. TERM PROJECT: You will participate in the creation of a corporate finance case, suitable for use in future sections of BPA 434. This case will be submitted for possible presentation at the October, 2003 annual meeting of the North American Case Research Association (assuming that we finish it—we may not). Details on this project to follow. MISSED HANDOUTS: All handouts will be put into a box outside of my office door after their original handout class period. I will not be bringing old handouts to class. You may pick up any handouts you need at any time. DO NOT PUT YOUR HOMEWORK ASSIGNMENTS IN THIS BOX! Many of our handouts and class materials will be available on line. I encourage you to become familiar with the retrieval of documents from our BPA432 website: http://www.ups.edu/bpa/Llivingston.html (then choose the document you want). GRADING: The total points you earn in the course will be determined according to the schedule below. At the end of the course, I will rank all students in the class and determine grades by starting with top grades for the top students and working my way down. I do not target an average grade. You should understand that your grade is determined by your relative class standing and not by any particular number of points. If the average score on a given exam were 50 (we shall hope that won't happen), and you received a 50, you'd have an average score, which would then translate into an average grade (NOT a failing grade). Don't be overly concerned with points! Also, realize that I cannot estimate your grade during the course-- I need all the scores before making any such determination. Course grades will be determined as follows: SEMESTER EXAMS FINAL EXAM HOMEWORK/CASES PRESENTATION TERM CASE PROJECT 20% for better score; 15% for lower score 20% 15% 10% 20% I reserve the right to award extra credit for superior class participation. BPA434/SPRING, 2003/SYLLABUS 5 TENTATIVE CLASS SCHEDULE: PLEASE NOTE THAT THIS SCHEDULE IS TENTATIVE. We will address the topics in the order described below, but our timing may be off a bit, as we adjust the pace of the class to your needs. We will not sacrifice thoroughness or clarity simply to remain on this schedule. Please be ready for minor scheduling adjustments that will be announced in class. (Note: we will NOT change the exam days, however; if necessary, we will simply adjust an exam’s coverage.) In addition to the textbook chapters listed below, you will have journal articles and excerpts from other books to address each of the topics below. You will be given a detailed list of these additional sources at the beginning of each section of the course. BACKGROUND READING: I expect you to be familiar with the material in the following chapters. If you find anything about which you’re unclear, please tell me as soon as possible so that we can create a refresher for the class. Chapters 1, 2, 3, 4 (p. 58-70), 25 (p. 701-713), 35 (p. 994-998) SCHEDULE IN BRIEF: TOPIC WEEK(S) DATES I: CAPITAL BUDGETING 1-4 1/21-2/14 TEXT READING Chs. 5, 6, 9, 10-12 II: DIVIDEND AND CAPITAL STRUCTURE POLICY 5-6 2/17-2/28 Chs. 16-19 III: DEBT AND OPTIONS 7-10 3/3-4/4 Chs. 22-26 IV: MERGERS, ETC. 11-15 Ch. 27, 33, 34 4/7-5/6 BPA434/SPRING, 2003/SYLLABUS 6 READING LIST/PRESENTATION PAPERS Jensen, Michael C., “Value Maximization, Stakeholder Theory, and the Corporate Objective Function,” Journal of Applied Corporate Finance, Fall 2001, Vol 14, No 3, 8-21. CAPITAL BUDGETING: Samuel C. Weaver, “Measuring Economic Value Added: A Survey of the Practices of EVA Proponents,” Journal of Applied Finance, Vol. 11, No. 1, 2001. LEASING: Lawrence D. Schall, “The Evaluation of Lease Financing Opportunities,” Midland Corporate Finance Journal, Spring 1989. MERGERS AND ACQUISITIONS/CORPORATE CONTROL: Harry DeAngelo and Edward M. Rice, “Antitakeover Charter Amendments and Stockholder Wealth,” Journal of Financial Economics, Vol. 11, 1983, p. 329-360. C.G. Holderness and D.P. Sheehan, “Raiders or Saviors? The Evidence on Six Controversial Investors,” Journal of Financial Economics, Vol. 14, 1985, p. 555-579. Koeplin, John, Atulya Sarin, and Alan C. Shapiro, “The Private Company Discount”, Journal of Applied Corporate Finance, Winter 2000, Vol 12, No 4 94-101 DIVIDENDS: Franco Modigliani and Merton Miller, “Dividend Policy, Growth, and the Valuation of Shares,” Journal of Business, October 1961. CAPITAL STRUCTURE: Franco Modigliani and Merton Miller, “The Cost of Capital, Corporate Finance, and the Theory of Investment,” American Economic Review, June 1958. Titman, Sheridan, “The Modigliani and Miller Theorem and the Integration of Financial Markets,” Financial Management, Spring 2002, 101-115 D’Souza Julia and John Jacob, “Why Firms Issue Targeted Stock,” Journal of Financial Economics, June 2000, Vol 56, No 3, 459-483 OPTIONS: Mark Rubinstein and Hayne E. Leland, “Replicating Options with Positions in Stock and Cash,” Financial Analysts Journal, July/August 1981. C.R. Narayanaswamy, David Schirm, and Ravi Shukla, “Financial Distress and the StockholderBondholder Conflict: Application of Binomial Option Pricing Methodology,” Journal of Applied Finance, Vol. 11, No. 1, 2001. BPA434/SPRING, 2003/SYLLABUS 7 1 introduction/ review of bond and stock valuation Chs. 1-3 (this should be a review) 2 corporate financing: basics Chs. 13, 14 3 dividend policy Ch. 16 4-6 7-9 leverage and WACC capital budgeting: alternatives to NPV NPV (application: bond refunding) incorporating uncertainty Chs. 17-19 Ch. 5 Ch. 6 EVA Ch. 10 Chs. 9 and 11 (excerpts) Ch. 12 (excerpts) 10 leasing Ch. 25 11-12 mergers and corporate control Ch. 33 Ch. 12 (excerpts) Ch. 34 BPA434/SPRING, 2003/SYLLABUS SCHEDULE IN BRIEF (continued) WEEK(S) DATES TOPIC 13-15 options: basics real options warrants and convertibles 8 TEXT READING Ch. 20 Ch. 21 Ch. 22