ACCOUNTING UNIT 2 Unit 2 revision questions and tasks Sasha

advertisement

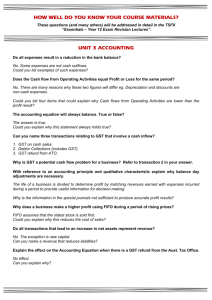

ACCOUNTING UNIT 2 Unit 2 revision questions and tasks Sasha Mildenhall Taylors Lakes Secondary College This VCE Accounting Unit 2 revision booklet includes a combination of both theory-type questions and practical tasks. The booklet can be printed for each student and the questions and tasks completed individually in class or as homework, or they can be completed by the class as a whole. Solutions are provided. Disclaimer: This resource has been written by the author (Sasha Mildenhall) for use with students of VCE Accounting. This does not imply that it has been endorsed by the Victorian Curriculum and Assessment Authority (VCAA). While every care is taken, we accept no responsibility for the accuracy of information or advice contained in Compak. Teachers are advised to preview and evaluate all Compak classroom resources before using or distributing them to students. VCTA © Sasha Mildenhall Published October 2012 page 1 ACCOUNTING UNIT 2 Test your knowledge Accounting Unit 2 revision 2012 Name: _______________________ VCTA © Sasha Mildenhall Published October 2012 page 2 ACCOUNTING UNIT 2 Accounting system Decisions Made by users Based on accounting information Determined by the accounting system INPUTS Source documents List the source documents we have used in this unit. VCTA © Sasha Mildenhall PROCESSING OUTPUTS Journals Reports List the journals we have used. List the balance day adjustments. What are the three major accounting reports we complete? Published October 2012 page 3 ACCOUNTING UNIT 2 All are based on accounting principles and qualitative characteristics: Conservatism Historical cost Entity Reporting period Monetary unit Consistency Going Concern VCTA © Sasha Mildenhall Comparability Understandability Relevance Reliability Published October 2012 page 4 ACCOUNTING UNIT 2 Accounting Elements Current Asset Non-current Asset Controlled by the business Future economic benefit within the next 12 months As a result of a past transaction Controlled by the business Future economic benefit for more than 12 months As a result of a past transaction Provide four examples. Why is a Debtor an example of a current asset? Current Liability Non-current Liability Obligation owed by the business A future economic sacrifice within the next 12 months As a result of a past transaction Obligation owed by the business A future economic sacrifice after the next 12 months As a result of a past transaction Why is a Creditor an example of a current liability? Provide two examples. Owner's Equity Profit = Assets – Liabilities The residual interest in the business after deducting the Liabilities Example: Capital, Net Profit/Net Loss and Drawings Define Profit. Revenue Expenses Inflows of economic benefits, e.g. Sales OR Savings in outflows, e.g. Discount Revenue Assets or Liabilities that OE Other than capital contribution Why is Sales considered to be revenue? Outflows of economic benefits OR Reductions in inflows Assets or Liabilities that OE Other than Drawings Why is Stock Loss considered an expense? Note: The following accounts can be classified as either a Current Asset or Current Liability, depending on which side the balance falls: Cash at Bank and GST Clearing. VCTA © Sasha Mildenhall Published October 2012 page 5 ACCOUNTING UNIT 2 Accounting Equation: Assets = Liabilities + Owner’s Equity Challenge time: How well do you know the accounting equation? Credit sales of $2 000 plus GST (stock is marked up 100%) Increase/Decrease/No change Amount Assets Liabilities Owner's Equity Accounting Principles Complete this table to show your understanding of the accounting principles. Examples What H When applied When breached Historical cost E Entity R Reporting period M Monetary unit C Conservatism C Consistency G Going concern VCTA © Sasha Mildenhall Published October 2012 page 6 ACCOUNTING UNIT 2 Proving the I-D-L response Challenge time: Explain with reference to an accounting principle why a physical stocktake is necessary. Principle Justification Qualitative characteristics Complete this table to show your understanding of the qualitative characteristics. Examples What C When applied When breached Comparability U Understandability R Relevance R Reliability VCTA © Sasha Mildenhall Published October 2012 page 7 ACCOUNTING UNIT 2 Challenge time: Explain the conflict between relevance and reliability using an example. Goods and Services Tax Calculating GST GST is calculated at the rate of 10%. If the price does not include GST If GST is already included in the price The GST is calculated as 10% of the cost price Take the price and divide by 11 to get the GST GST = Cost Price x 0.1 GST = Price (including GST) / 11 Cost Price = Price (including GST) – GST When is GST used? Complete the table by providing three examples for each situation. Items that attract GST Items that don’t include GST Common theory questions—use I-D-L response Challenge time: Can you answer these questions? Explain why GST can be classified as either a Current Asset or Current Liability. VCTA © Sasha Mildenhall Published October 2012 page 8 ACCOUNTING UNIT 2 Distinguish between GST on cash payments and GST paid to the ATO. How is GST reported? Cash Flow Statement Income Statement Balance Sheet VCTA © Sasha Mildenhall Published October 2012 page 9 ACCOUNTING UNIT 2 Completing Journals Total amount received (incl. GST) Cash Receipts Journal Date Mar. 1 Details Rec No. Bank Debtors Sales 235 891 5 Debtor: S. Bennie 236 750 9 Sales 237 16 Sales 19 Sales Sundries GST 810 81 3 333 3 030 303 238 1 815 1 650 165 Debtor: L. San 239 1 400 23 Capital 240 12 000 26 Sales 241 1 254 Totals 31 $21 443 750 1 400 12 000 1 140 $2 150 $6 630 114 $12 000 $663 Items that don’t occur regularly Cash Payments Journal Date Mar. 1 Details Chq No. Bank Stock Control 101 4 400 3 Loan: ANZ 102 2 000 7 David’s Disc 103 600 15 Wages 104 1 500 24 Stock Control 105 2 750 28 Diana’s Deals 106 500 30 Wages 107 1 500 31 Totals $13 250 Creditors Stock Wages Sundries 4 000 GST 400 2 000 600 1 500 2 500 250 500 1,500 $1 100 $6 500 $3 000 $2 000 $650 Items that don’t Each item that occurs occur regularly regularly has its own column VCTA © Sasha Mildenhall Published October 2012 page 10 ACCOUNTING UNIT 2 Sales Journal Date Debtor Mar. 1 Invoice No. Sales GST Total Debtors S. Bennie A434 900 90 990 L. San A435 1 800 180 1 980 13 S. Bennie A436 750 75 825 16 R. Michaels A437 1 500 150 1 650 19 L. San A438 3 750 375 4 125 24 S. Bennie A439 4 500 450 4 950 29 R. Michaels A440 2 700 270 2 970 $15 900 $1 590 $17 490 4 Totals 31 Purchases Journal Date Creditor Mar. 2 5 Invoice No. David’s Discounts Diana’s Deals Stock GST Total Creditors 1440 2 200 220 2 420 445 3 100 310 3 410 11 David’s Discounts 1560 4 500 450 4 950 15 David’s Discounts 1589 1 900 190 2 090 19 Diana’s Deals 899 2 500 250 2 750 22 David’s Discounts 1642 3 000 300 3 300 $17 200 $1 720 $18 920 31 VCTA © Sasha Mildenhall Totals Published October 2012 page 11 ACCOUNTING UNIT 2 Using Stock Cards By now you are probably thinking that you can successfully complete a Stock Card. Would you be as confident if you were given one that was already completed and were asked some questions about it? Try answering the following questions based on the Stock Card below. Tickle Me Elmo Item: Method: FIFO In Out Unit Date Details Dec. 1 Balance 3 9 13 18 22 23 24 31 Qty Price Unit Total Rec. 476 INV. X391 35 Memo 242 Rec. 477 20 37 VCTA © Sasha Mildenhall 35 2 520 Qty Price Total 92 36 3 312 40 39 1 560 22 36 792 40 39 1 560 22 36 792 40 39 1 560 80 35 2 800 22 36 792 32 39 1 248 8 39 312 80 35 2 800 5 39 195 27 39 1 053 80 35 2 800 72 35 2 520 72 35 2 520 20 37 740 32 35 1 120 20 37 740 38 35 1 330 20 37 740 27 39 1 053 8 35 280 40 6 36 Total 740 Rec. 478 Memo 243 Price Unit 2 800 INV. A0200 INV. 7432A Qty 70 80 Balance 210 Published October 2012 35 1 400 page 12 ACCOUNTING UNIT 2 Challenge time: a. Calculate the value of Tickle Me Elmo’s that would appear in the Balance Sheet on 30 November. $ b. Calculate the value of Tickle Me Elmo’s that would appear in the Balance Sheet on 31 December. $ c. Suggest one reason for each of the following Memos. Explain how and where it would be reported. i. Memo 242 ii. Memo 243 Memo 242 Reason Reported Memo 243 Reason Reported d. Calculate the value of Cash Sales, assuming that Elmo’s are sold for $77 (incl. GST). $ VCTA © Sasha Mildenhall Published October 2012 page 13 ACCOUNTING UNIT 2 e. Calculate the value of Credit Sales, assuming that Elmos are sold for $77 (incl. GST). $ f. Calculate the value of Cost of Sales for Elmo’s. $ Stock losses: Stock gains: occur when the physical stocktake reveals an amount of stock on hand that is less than the amount shown in the Stock Card occur when the physical stocktake reveals an amount of stock on hand that is more than the amount shown in the Stock Card Stock losses are caused by: Stock gains are caused by: Mark-Up Read questions carefully: Mark-up information is often provided as an additional note or in the blurb at the start of the question. So look carefully and highlight the information as soon as you locate it. Cost Price to Selling Price Selling Price Cost Price 50% Mark-up 100% Mark-up 200% Mark-up $100 $250 VCTA © Sasha Mildenhall Published October 2012 page 14 ACCOUNTING UNIT 2 Selling Price to Cost Price Cost Price Selling Price 50% Mark-up 100% Mark-up 200% Mark-up $600 $900 Why is it important to ensure that a business maintains an adequate mark-up level? Challenge task: Explain the factors that may need to be considered when deciding on the level of mark-up for a particular product? Balance Day Adjustments Accrual accounting: Requires that all revenue earned in a reporting period be matched against the expenses incurred in the same period to accurately report Net Profit for the period. Balance day adjustments are prepared and recorded on the last day of the reporting period. Accounting principle Reporting period—the business’s history is broken up into periods of time so that the performance of the business can be determined. Revenue and expense amounts should relate only to the current reporting period. Qualitative characteristic Relevance—the expenses and revenues included in the calculation of profit should relate to the current reporting period. VCTA © Sasha Mildenhall Published October 2012 page 15 ACCOUNTING UNIT 2 How well do you know your balance day adjustments? Complete the following table. Adjustment Items and Effect Cash Flow Income Statement Balance Sheet Prepaid Expenses Accrued Expenses Depreciation Stock Loss Stock Gain Cash Flow Statement Operating Activities Investing Activities Financing Activities VCTA © Sasha Mildenhall Cash received from Revenues Cash paid for Expenses Cash received from Current Assets Cash paid for Current Liabilities Cash received from the sale of Non-current Assets Cash paid when purchasing Non-current Assets Cash received from Non-current Liabilities Cash paid for Non-current Liabilities Cash Drawings Cash Capital Contributions Published October 2012 page 16 ACCOUNTING UNIT 2 BUSINESS NAME Cash Flow Statement for the year ended 30 June 2012 Important bits Cash Flows from Operating Activities Cash Sales 40 000 Receipts from Debtors 35 000 GST Collected Payments to Creditors Total of the Cash Sales column GST Column from CRJ 4 000 (15 000) GST Paid (5 000) GST Column from CPJ GST Paid to the ATO (2 000) GST from the Sundries column—this could be replaced with GST received from the ATO. Never have both in the one report Wages Paid (10 000) Beware—do not include any accrued wages Prepaid Rent (9 000) Beware—include all amounts paid, no BDAs Interest Expense Paid (2 000) Cash Purchases of Stock (3,000) Never include Cost of Sales, Disc. Exp. 33 000 Net Cash Flows from Operating Activities Disc. Rev. or any BDAs (e.g. Stock Loss, Depreciation) in the Cash Flow Statement Cash Flows from Investing Activities Cash Paid for New Vehicle Cash Received from Sale of Vehicle This could be the full amount or a deposit paid at the time of purchase (18 000) 4 000 (14 000) Net Cash Flows from Investing Activities Cash Flow from Financing Activities Instalment Loan: NAB Drawings Capital Contribution Loan repayments paid during the year. Never include interest here. Beware— interest-only loans only go here when finally paid (6 000) (15 000) 20 000 Net Cash Flows from Financing Activities (1 000) Net Surplus/Deficit 18 000 Balance as at 1 July 2011 Balance as at 30 June 2012 VCTA © Sasha Mildenhall 5 500 Net Operating + Net Investing + Net Financing Usually found near the beginning of the question. Beware—overdraft would be shown in brackets $23 500 Published October 2012 page 17 ACCOUNTING UNIT 2 Income Statement BUSINESS NAME Income Statement for the year ended 30 June 2012 Important bits Revenue Cash Sales 50 000 Credit Sales 60 000 These could be combined into one figure 110 000 Less Cost of Goods Sold Cost of Sales If no other buying expense, use Cost of Sales as the heading 55 000 Cartage In 2 000 Customs Duties 1 000 Gross Profit Other buying expenses that could exist 58 000 Buying Expense is anything to get stock ready for sale 52 000 Less Stock Loss 2 000 Adjusted Gross Profit OR plus Stock Gain—never both 50 000 Add Other Revenue Discount Revenue Commission revenue Interest Revenue These are some examples of other revenue 500 If no other revenue in question, leave this section out 2 000 500 3 000 53 000 Less Other Expenses Advertising Discount Expense 2 500 Depreciation of Vehicle 2 000 Delivery Expense 1 000 VCTA © Sasha Mildenhall Discount to encourage Debtors to pay on time 500 Wages Net Profit All expenses should be recorded 1 000 7 000 Delivery to customers—selling expense not COS $46 000 Don’t forget to label this line—either Net Profit or Net Loss Published October 2012 page 18 ACCOUNTING UNIT 2 Balance Sheet BUSINESS NAME Balance Sheet as at 30 June 2012 Important bits Current Assets Cash at Bank May be a CL if an Overdraft and would appear under CLs 3 000 Debtors Control 10 000 Stock Control 60 000 Prepaid Rent 2 000 75 000 Non-current Assets Term Deposit Vehicles NCA is not due during next 12 months 20 000 40 000 Less Acc. Depn. of Vehicles (10 000) Equipment 120 000 Less Acc. Depn. of Equipment (20 000) 30 000 100 000 Total Assets 150 000 225 000 Current Liabilities Creditors Control 8 000 Accrued Wages 2 000 GST Clearing 4 000 Loan: NAB 20 000 May be a CA if the balance is on the DR 34 000 Non-current Liabilities Loan: NAB Must be broken into current and non-current components 90 000 Owner’s Equity Capital 91 000 Plus Profit 46 000 Less Drawings 137 000 (36 000) Total Equities VCTA © Sasha Mildenhall 101 000 From Income Statement—Net Profit. If loss, then less loss instead $225 000 Published October 2012 page 19 ACCOUNTING UNIT 2 Business Performance Financial indicators Ratio Formula What it measures? Gross Profit Margin = Gross Profit x 100 Net Profit Margin = Net Profit The amount of each dollar of revenue that is left after COGS and Stock Loss are taken into account. This money is left to cover operating expenses and profit. Measures the amount of profit earned compared to revenue. Sales 1 x 100 Sales 1 For every dollar of revenue, how many cents are profit—17% would mean that 17 cents in every dollar of sales is profit. Return on Assets = Net Profit x 100 Avg Total Assets Return on Owner’s Investment = Net Profit 1 x 100 Avg Capital 1 Shows how profitably the assets have been used by the business. Calculates the profit made by the business as a percentage of the owner’s investment in the business. This ratio can be compared to other forms of investment to assess whether it is beneficial to stay in business or whether more money could be made from other sources, e.g. shares, fixed-term investments. Asset Turnover = Sales Average Total Assets Shows how productively assets have been used by the business to earn revenue. = times per reporting period Creditors Turnover = Avg. Creditors x 365 Credit Purchases = days Debtors Turnover = Avg. Debtors x 365 Credit Sales = days Stock Turnover = Avg. Stock x 365 Cost of Goods Sold Cash Flow Cover The average number of days it takes the business to pay its creditors. This must be compared to the credit terms offered by suppliers. Days—the average number of days it takes debtors to pay their accounts. This should be compared to the credit terms of the business. The average number of days that stock sits on the shelf before it is sold. = days The longer stock sits on the shelf, the longer cash is tied up and, sometimes, the less likely stock will sell. = Net Cash Flows from Operating Activities The ability of the business to generate day-to-day cash flow in order to meet its short-term debts as they fall due. Average Current Liabilities = times per reporting period Quick Assets Ratio = Current Assets— (Stock Prepayments) Current Liabilities— Bank Overdraft A more immediate measure than working capital because it shows the quickest items to turn to cash. It acknowledges that some current assets and liabilities are not easily transferred to cash. = quick assets : 1 VCTA © Sasha Mildenhall Published October 2012 page 20 ACCOUNTING UNIT 2 Working Capital = Current Assets The ability of a business to pay its short-term debts (Current Liabilities) with the funds generated from its short-term assets (Current Assets). Current Liabilities = Current Assets : 1 Debt Ratio = Total Liabilities x 100 Total Assets 1 The percentage of a business’s liabilities compared to its assets. Complete the following tables for each of the ratios listed. Occurs when? A positive effect would be … Occurs when? A positive effect would be … VCTA © Sasha Mildenhall Effects? Increased Stock Turnover A negative effect would be …. Effects? Decreased Creditors Turnover Published October 2012 A negative effect would be … page 21 ACCOUNTING UNIT 2 Occurs when? A positive effect would be … Effects? Increased Return on I Owner’s Investment A negative effect would be … Can you interpret graphs? Try interpreting the following graph. VCTA © Sasha Mildenhall Published October 2012 page 22 ACCOUNTING UNIT 2 Describe the change in Debtors Turnover shown in the graph above and provide two possible reasons for the change. Description Reason 1 Reason 2 Describe the change in the Debt Ratio Turnover shown in the following graph and outline one positive and one negative effect of this change. Description Positive effect Negative effect VCTA © Sasha Mildenhall Published October 2012 page 23 ACCOUNTING UNIT 2 Solutions to Accounting Unit 2 revisions questions and tasks Accounting System Decisions Made by users Based on accounting information Determined by the accounting system INPUTS Source documents List the source documents we have used in this unit. Cash receipts Cheque butts Sales invoice Purchase invoice Bank statements Memos Statement of Account VCTA © Sasha Mildenhall PROCESSING OUTPUTS Journals Reports List the journals we have used. Cash Receipts Journal Cash Payments Journal Purchases Journal Sales Journal List the balance day adjustments What are the three major accounting reports we complete? Cash Flow Statement Income Statement Balance Sheet Depreciation Stock loss and gain Prepaid expenses Accrued expenses Published October 2012 page 24 ACCOUNTING UNIT 2 Accounting Elements Current Assets Non-current Assets Controlled by the business Future economic benefit within the next 12 months As a result of a past transaction Why is a Debtor an example of a current asset? Controlled by the business Future economic benefit for more than 12 months As a result of a past transaction Provide four examples. A debtor is the result of a credit sale (past transaction) that the business has made and should be paid back within set credit terms, which will be less than 12 months. Current Liabilities Equipment Vehicle Building Machinery Non-current Liabilities Obligation owed by the business A future economic sacrifice within the next 12 months As a result of a past transaction Why is a Creditor an example of a current liability? Obligation owed by the business A future economic sacrifice after the next 12 months As a result of a past transaction Provide two examples. A creditor is an entity that the business owes money to as a result of buying stock on credit. The creditor must be paid back within a specified time (credit terms), which will be less than 12 months. Mortgage Loan Owner’s Equity Profit = Assets – Liabilities The residual interest in the business after deducting the Liabilities e.g. Capital, Net Profit/ Net Loss and Drawings Define Profit. Revenue Expenses Inflows of economic benefits—e.g. Sales OR Savings in outflows—e.g. Discount Revenue Assets or Liabilities that OE Other than capital contribution The excess or deficit of revenue over expenses within a reporting period. Outflows of economic benefits OR Reductions in inflows Assets or Liabilities that OE Other than Drawings Why is Sales considered a revenue? Why is Stock loss considered an expense? It is an inflow of economic benefit in the form of an increase in assets (Bank or Debtors) that increases profits and therefore Owner’s Equity. It is an outflow of economic benefit in the form of an decrease in assets (Stock) that decreases profits and therefore Owner’s Equity Note: The following accounts can be classified as either a Current Asset or Current Liability, depending on which side the balance falls: Cash at Bank and GST Clearing. Accounting Equation: Assets = Liabilities + Owners Equity VCTA © Sasha Mildenhall Published October 2012 page 25 ACCOUNTING UNIT 2 Challenge task: How well do you know the accounting equation? Credit sales of $2 000 plus GST (stock is marked up 100%) Increase/Decrease/No change Amount Assets Increase 1 200 Liabilities Increase 200 Owner’s Equity Increase 1 000 Accounting Principles Complete this table to show your understanding of the accounting principles. Examples What H When applied Historical cost To assets When assets are not recorded at their original value Drawings or Capital contribution The owner records personal expenses as business expenses Balance day adjustments for prepaid and accrued expenses When expenses are recorded as being incurred in the wrong reporting period To all journals and reports Any recording in a currency other than $A Stock loss/gains If stocktakes are not completed Consistency Depreciation, FIFO The accounting methods used by the business should be applied consistently from one reporting period to another. Analysis and interpretation If accounting methods change from one reporting period to the next Going concern Balance day adjustments If it is assumed the business will fail All transactions are recorded at their original value. Therefore, items are shown in the accounting records at their historical (original) price. E Entity The business must be a separate accounting entity from its owner and from other entities. R Reporting period The ongoing life of a business is broken into regular intervals of time for the preparation of financial reports. M Monetary unit In order to record financial events and understand the meaning of reported information, it is necessary to use a common unit of measurement. Australian businesses use Australian dollars. C Conservatism It is acknowledged that gains will not be recognised until earned and losses will be recognised as soon as they are likely to occur. C G When breached It is assumed that the business will be ongoing; that is, that it will have an indefinite life. VCTA © Sasha Mildenhall Published October 2012 page 26 ACCOUNTING UNIT 2 Proving the I-D-L response Challenge task: Explain with reference to an accounting principle why a physical stocktake is necessary. Principle: Conservatism Justification: To recognise a stock loss or stock gain as soon as it occurs in order to not overstate profit or the value of stock on hand. Qualitative characteristics Complete this table to show your understanding of the qualitative characteristics. Examples What C U R When applied Comparability FIFO Users must be able to compare the financial reports of an entity through time in order to identify trends in its financial position and performance. Users must be able to compare reports between different entities. Depreciation Understandability Layout of reports Incorrect report layouts An essential quality of the information provided in financial reports is that it is readily understandable by users. Analysis and interpretation Analysis that is too difficult for a non-accountant to understand Relevance Prepaid and accrued expenses Information that does not help evaluate past, present or future events or relates to another period Information must be relevant to the decision-making needs of users. Information has the quality of relevance when it influences the economic decisions of users by helping them evaluate past, present or future events or confirming, or correcting, their past evaluation. R When breached Reliability Analysis and interpretation Different depreciation percentage or figures used for calculations between periods FIFO not followed Important information omitted Source documents Not using source documents Information has the quality of reliability when it is free from material error and bias and can be depended upon by users to represent faithfully what has actually occurred in the business. VCTA © Sasha Mildenhall Published October 2012 page 27 ACCOUNTING UNIT 2 Challenge task: Explain the conflict between relevance and reliability using an example. Depreciation—reliability requires all information to be reliable and should be verified by a source document. Depreciation is an estimate that can contain bias and there are no source documents, but depreciation needs to be calculated and included for its relevance to aid decision-making. Goods and Services Tax Calculating GST GST is calculated at the rate of 10%. If the price does not include GST If GST is already included in the price The GST is calculated as 10% on the cost price Take the price and divide by 11 to get the GST GST = cost price x 0.1 GST = price (including GST) / 11 Cost Price = Price (including GST) – GST When is GST used? Complete the table by providing three examples for each situation. Items that attract GST Items that don’t include GST Most sales Purchase of stock Purchase of Non-current Assets Fresh food Financial services Most education services Common theory questions: use I-D-L response Challenge time: Can you answer these questions? Explain why GST can be classified as either a Current Asset or a Current Liability. It will depend on whether the business has collected more GST from sales (on behalf of the government) than it has paid to suppliers. If GST from sales is greater, the business owes this to the government and therefore it is a Current Liability. If GST paid to suppliers is greater than GST collected from sales, the government will owe the business this amount and therefore it will be classified as a Current Asset. VCTA © Sasha Mildenhall Published October 2012 page 28 ACCOUNTING UNIT 2 Distinguish between GST on cash payments and GST paid to the ATO. GST on cash payments has been paid to a supplier for goods or services in the current reporting period, whereas GST paid to the ATO is for the settlement of the amount owed to the ATO or GST payable for the previous reporting period. How is GST reported? Cash Flow Statement Cash flows from Operating Activities Income Statement Not reported in this report Balance Sheet As either a Current Asset or Current Liability, depending on whether the business owes the ATO (CL) or the ATO owes the business (CA) Using Stock Cards Challenge time: a. Calculate the value of Tickle Me Elmo’s that would appear in the Balance Sheet on 30 November. 3 312 + 1 560 $ 4 872 b. Calculate the value of Tickle Me Elmo’s that would appear in the Balance Sheet on 31 December. 1 330 + 740 $ 2 070 VCTA © Sasha Mildenhall Published October 2012 page 29 ACCOUNTING UNIT 2 c. Suggest one reason for each of the following Memos? Explain how and where it would be reported. i. Memo 242 ii. Memo 243 Memo 242 Reason Drawings, advertising—do not accept stock loss as this memo is during the reporting period Reported Drawings—Balance Sheet Advertising—Income Statement Memo 243 Reason Stock gain Reported Income Statement d. Calculate the value of Cash Sales, assuming that Elmo’s are sold for $77 (incl. GST). (70 + 27 + 8 + 40) * 70 $ 10 150 e. Calculate the value of Credit Sales, assuming that Elmo’s are sold for $77 (incl. GST). (22 + 8) * 70 $ 2 100 VCTA © Sasha Mildenhall Published October 2012 page 30 ACCOUNTING UNIT 2 f. Calculate the value of Cost of Sales for Elmo’s. 2 520 + 792 + 312 + 1 053 + 280 + 1 400 $ 6 357 Stock losses: Stock gains: occur when the physical stocktake reveals an amount of stock on hand that is less than the amount shown in the Stock Card occur when the physical stocktake reveals an amount of stock on hand that is more than the amount shown in the Stock Card Stock losses are caused by: Stock gains are caused by: Theft Over-supply to customers Under-supply by suppliers Recording error Under-supply to customers Over-supply by suppliers Recording error Mark-Up Read questions carefully: Mark-up information is often provided as an additional note or in the blurb at the start of the question. So look carefully and highlight the information as soon as you locate it. Cost Price to Selling Price Selling Price Cost Price 50% Mark-up 100% Mark-up 200% Mark-up $100 150 200 300 $250 375 500 750 VCTA © Sasha Mildenhall Published October 2012 page 31 ACCOUNTING UNIT 2 Selling Price to Cost Price Cost Price Selling Price 50% Mark-up 100% Mark-up 200% Mark-up $600 400 300 200 $900 600 450 300 Why is it important to ensure that a business maintains an adequate mark-up level? To ensure that predetermined profits are maintained so that other expenses are covered and a net profit is achieved. Challenge task: Explain the factors that may need to be considered when deciding on the level of mark-up for a particular product. The profit the business wishes to be made The expenses that must be covered VCTA © Sasha Mildenhall Published October 2012 page 32 ACCOUNTING UNIT 2 Balance Day Adjustments How well do you know your balance day adjustments? Complete the following table. Adjustment Items and Effect Cash Flow Income Statement Balance Sheet Prepaid Expenses Prepaid expenses (Assets) increase Operating outflow Not included Current Asset No effect Expenses increase Current Liability No effect Expenses increase Owner’s Equity decreases No effect Expenses increase Owner’s Equity decreases No effect Revenues increase Owner’s Equity increases Bank (Asset) decreases Accrued Expenses Expenses increase Depreciation Expenses increase Liability increases Non-current Assets decrease Stock Loss Expenses increase Current Assets decrease Stock Gain Revenue increases Current Assets increase Business Performance Complete the following tables for each of the ratios listed. Occurs when? Effects? Stock is sold at a quicker rate Profits—Owner’s Equity Current Assets—Stock Increased A positive effect would be … Stock Turnover Increased profits if stock is being sold at faster rate as long as mark-up is being maintained A negative effect would be …. Added costs to constantly reorder stock Better liquidity VCTA © Sasha Mildenhall Published October 2012 page 33 ACCOUNTING UNIT 2 Occurs when? Effects? Pay creditors more quickly Current Liabilities—Creditors When there is a decrease in stock and Debtors Turnover Current Assets—Bank A positive effect would be … The business may be eligible for a discount Decreased Creditors Turnover A negative effect would be … If the Creditors Turnover is less than the creditor’s terms, the business could be using the money within its business to generate more profits Occurs when? Effects? Profits increase Owner’s Equity Decrease in Capital A positive effect would be … The owner would be extremely happy making more money VCTA © Sasha Mildenhall Increased Return on I Owner’s Investment A negative effect would be … The owner may still be able to earn more in another form of investment Published October 2012 page 34 ACCOUNTING UNIT 2 Can you interpret graphs? Try interpreting the following graph. Describe the change in Debtors Turnover shown in the graph above and provide two possible reasons for the change. Description The number of days it takes Debtors to pay has decreased slightly from 2010 to 2011 but there was a large decrease of four days from 2011–2012. Reason 1 Better follow-up by the business in relation to slow-paying Debtors Better screening of potential Debtors Reason 2 Discounts offered to encourage early payment Describe the change in the Debt Ratio Turnover shown in the following graph and outline one positive and one negative effect of this change. VCTA © Sasha Mildenhall Published October 2012 page 35 ACCOUNTING UNIT 2 Description The percentage of liabilities to assets has increased over the three years and the business is now in a worse position with regard to stability—just over 10% in 2010 and up to 60% in 2012. Positive effect The debt may be due to an expansion of the business and in the long-term will make the business more profitable. Negative effect The business is relying more heavily on external sources to fund the business, which will result in Interest expense that will decrease Net Profit, VCTA © Sasha Mildenhall Published October 2012 page 36