Deferred Salary Scheme Provisions

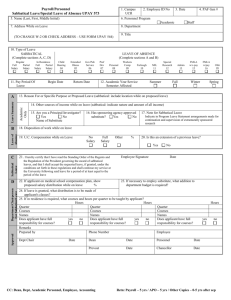

advertisement

Deferred Salary Scheme Deferred Salary Scheme Provisions Sabbatical year Sabbatical year is self-funded leave for the fifth year of the Deferred Salary Scheme. The period of leave is granted in accordance with provisions of Extended Special Leave (No Pay). Leave commences on the first student free day of the year and cannot be less than 12 months. Salary deferred in the initial four years is paid to the participant in 26 fortnightly installments. Withdrawal from scheme Participants may withdraw from the scheme at any time. Postponement of sabbatical year Postponement of sabbatical leave year is limited to one school year, after which the participant must take sabbatical leave or withdraw from the scheme. Where it is agreed to postpone the sabbatical year deferred salary will not be released until leave commences. Interim salary payments will return to normal. Qualifying period for sabbatical leave Participants must complete four years recognised service within the Scheme before undertaking sabbatical year. Appointments and periods of leave not considered as Deferred Salary Scheme service include: Special Leave without pay; Unpaid Maternity Leave and Parental Leave; Other forms of Unpaid Leave, such as Study Leave; Temporary appointment or secondment to a position outside the Department; Service within a Department position not subject to the Department of Education, Training and Employment’s Teachers Certified Agreement 2003 or subsequent certified agreements covering Education Queensland teachers , i.e: Public Servant and Senior Officer positions. Salary during a temporary appointment or secondment where not recognised as service is not subject to deferred salary arrangements. Sabbatical year will be postponed if an employee has greater than 30 days of non-recognised service. On accumulating four years service normal salary arrangements will recommence until the employee takes sabbatical leave the following year/semester. Leave Employees may apply for any form of paid leave during years preceding sabbatical year and without detriment to their participation in the scheme. Deferred salary arrangements will continue during periods of paid leave. Employees cannot apply for any paid leave during the sabbatical leave year, except maternity leave or specific approvals of sick leave in lieu of extended special leave (no pay) under Extended Special Leave procedures. Employee may elect to postpone sabbatical leave if an employee applies for maternity leave and sabbatical leave has not commenced. If sabbatical year is not postponed they may proceed on sabbatical leave with salary for the period of paid maternity leave. Salary arrangements Deferred salary component of 20% is calculated on award salary (i.e: classification and level paypoint) amount after tax has been deducted. Tax and superannuation will be calculated on 100% of award salary. Uncontrolled copy. Refer to the Department of Education, Training and Employment Policy and Procedure Register at http://ppr.det.qld.gov.au to ensure you have the most current version of this document. Page 1 of 3 Each fortnight, employees receive 80% of their post-tax salary with 20% being retained by Department of Education, Training and Employment for a period of four years. Example: Gross salary = $1000 Tax 20% = $200 Deferred amount = $160 Superannuation (EQ contribution) = $127.50 Superannuation (Employee contribution) = $50 Total amount deferred Year 1 (26 fortnights) = $4160 Employees participating in the scheme will commence their contribution from the first full pay cycle of the following school year. No interest will be paid to employees on deferred monies held by the Department on employees’ behalf. Miscellaneous automated payroll deductions (medical funds; union fees) from the fortnightly instalments will continue unless otherwise requested by the employee. Deduction arrangements remain the responsibility of the employee to manage. Taxation Employees will be taxed on gross fortnightly salary earned during the four year period before sabbatical year. As employee taxation obligations were met as earned over the previous four years, fortnightly payments of deferred salary remitted during the sabbatical year should not be subject to taxation. Any payment resulting from withdrawal from the scheme or return of residual banked monies should not be subject to income tax. Superannuation Employee and employer contribute superannuation on salary earned during the first four years, including 20% deferred salary component. No superannuation (employee and employer) contributions are made during sabbatical year. QSuper Defined Benefit Account members should note that advice provided by QSuper indicates that sabbatical year will not be considered a multiplier year for the purpose of calculating benefits within the Defined Benefit account. Additional impacts on superannuation may include reduced benefit for Accumulation Account holders. For example an employee’s benefit may be reduced if the employee chose to retire soon after accessing Deferred Salary Scheme. Employees applying for the Deferred Salary Scheme are required to consult QSuper regarding to their superannuation. Salary packaging Employees must seek independent financial advice regarding Deferred Salary Scheme and salary packaging. Salary packaging is available for first four earning years of the scheme. Salary packaging will not be available in the sabbatical year as employees are not in receipt of a salary It is the employee’s responsibility to withdraw from salary packaging arrangements prior to sabbatical leave. Salary increases Any salary increases i.e: Enterprise Bargaining Agreements, to which employee is entitled during the scheme will be managed by Payroll Services Unit according to relevant industrial instruments. Under Extended Special Leave policy and principles of the scheme sabbatical leave period will not be recognised as service for salary incrementing purposes. Employment during sabbatical year Employees must suspend work for Department of Education, Training and Employment during sabbatical leave including casual relief work in schools, contract work or other forms of employment. Subject to departmental approval, employees may undertake paid employment with an employer other than Department of Education, Training and Employment during sabbatical leave. Uncontrolled copy. Refer to the Department of Education, Training and Employment Policy and Procedure Register at http://ppr.det.qld.gov.au to ensure you have the most current version of this document. Page 2 of 3 It is the employee’s responsibility to be aware of their taxation, superannuation and workers compensation obligations if employed during sabbatical leave. Recreation leave or other entitlements accrued with another employer during sabbatical leave will not be recognised by the department. Return to duty Teachers will return to duty on the first student free day of the year following sabbatical leave to their regular duties and relevant remuneration level. On return to duty, teachers will be required to complete a Commencement Advice. Placement following sabbatical leave year will be according to section 13.28 Extended Special Leave policy and Teacher Transfer Guidelines. Teachers returning from sabbatical leave may be placed in a vacancy at their most recent school or be required to transfer to a vacancy located at another school in the same geographic area within the district. Any transfer of teachers outside of the district will be according to Teacher Transfer Guidelines. Return to most recent position will be considered on a case-by-case basis if a participating teacher seeks to combine other leave with sabbatical leave, or commences sabbatical leave immediately following a temporary appointment, i.e: relieving or a secondment. Eligibility for transfer or promotion Participation in the scheme will not affect eligibility to apply for transfer or promotion however, participants will need to withdraw from the scheme if appointed to commence in Semester two unless the new location is prepared to accommodate the second half of the sabbatical period. Workcover Participants are only covered by department’s WorkCover policy during the four work years and not during sabbatical leave, under Workers Compensation and Rehabilitation Act 2003. Uncontrolled copy. Refer to the Department of Education, Training and Employment Policy and Procedure Register at http://ppr.det.qld.gov.au to ensure you have the most current version of this document. Page 3 of 3