Basic Terms in Contract and Grant Administration

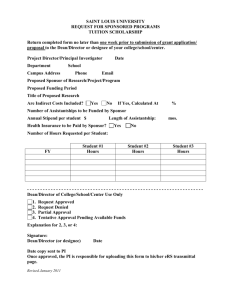

advertisement

Basic Terms in Contract and Grant Administration A-21 "Cost Principles for Educational Institutions," a circular published by the Federal Office of Management and Budget (OMB) that establishes the principles for determining the costs applicable to grants, contracts, and other government agreements with educational institutions (also known as Sponsored Projects).OMB Circular A-21 defines allowable costs as those that are: 1. Reasonable; 2. Allocable to the project; and 3. Given consistent treatment by use of generally accepted accounting principles. They must also conform to any limitations or exclusions set forth by the sponsor award terms or OMB Circular A-21. Accelerated Work: Expenses that need to be charged to a project because work planned for a future budget period is begun in the current budget period. ACCOUNT (EFS): Account is used to specify the balance sheet, expenditure, revenue, or statistical account on financial transactions. The account table stores an account type identifier that indicates whether the account is an asset, liability, equity (fund balance), expense, revenue, or statistical type account. Account classifies the nature of the transaction. It answers the questions: “What type of activity generated this income?” “What did we incur expenditures for?” “Is this an asset or liability?” Account is always required on all financial transactions, and consists of six numeric characters. Actuals Ledger (EFS): The Actuals Ledger is where detailed transactions are stored. (Other types of ledgers include Budget, Summary, Consolidated, etc.). Advance Account: An account established before the award process has been completed in order to facilitate administrative establishment of the project. Advance Payment: A type of payment in which payment is received before financial reports are submitted. ALLOCABLE COSTS are costs that (1) are applicable to subaward work, (2) benefit both the subaward and other work and can be distributed in reasonable proportion to the benefits received, and (3) are necessary to the overall operation of the business ALLOWABLE COSTS are costs that the sponsor will reimburse under the subaward (i.e.: subcontract, subagreement, subrecipient agreement, subgrant) to which they are charged. In general, a cost is allowable if it is (1) reasonable, (2) allocable (see below), (3) applicable to subaward work, (3) in conformity with the requirements and limitations of the subaward and, (4) in conformity with generally accepted sound business practices. A cost that requires the sponsor’s prior consent is not an allowable cost until that consent has been obtained. Amendment: Any change made to an existing sponsored agreement. Animal and/or human subjects approval: University approval obtained by a PI to conduct research that involves experiments on or treatment of animal or human subjects. If animals are involved, approval is obtained from the IACUC Committee. If humans are involved, approval is obtained from the IRB Committee. Asset (EFS): The entries on a balance sheet showing all properties, both tangible and intangible, and claims against others that may be applied to cover liabilities of the business. Assets can include cash, stock and inventories. Attribute (EFS): Attribute is an optional feature that can be used to provide additional information about a ChartField. An attribute is not tied to an individual transaction and cannot be used in trees or combo edits. Award Amount: Funds that have been obligated by a funding agency for a particular project. This term is used for both original award and supplements; it can mean monies or equipment. Award Notification: Prepared by the SPA, summarizes the essential terms of the grant or contract, including the period of performance, the amount of funding and method of payment, the F&A rate, and the dates on which any technical and financial reports are due. Balance Sheet Account (EFS): Balance sheet account indicates assets, liabilities, and fund balances within a fund. Assets minus liabilities must equal fund balance within each fund. When transactions are made between funds, the system automatically creates an offsetting balance sheet account entry (intraunit processing). Bilateral Agreement: An agreement that both parties must sign before the award is granted. Broad Agency Announcement (BAA): An announcement that is general in nature and that identifies areas of research interest, including criteria for selecting proposals, and soliciting the participation of all offerers capable of satisfying the government’s needs. Budget: The detailed statement outlining estimated project costs to support work under a grant or contract. Budget Period: The interval of time--usually twelve months--into which the project period is divided for budgetary and funding purposes. Budget Reference (EFS): A ChartField used to identify unique budgets where there are overlapping budget periods. Budget Unit (EFS): An identification code that represents a high-level organization of business information. A business unit maintains its own set of books, ledger and financial transactions Carryforward (EFS): Carryfoward is the sum of inception-to-date revenues, less expenses, less net transfers. Carryforward will be key to defining balancing within PeopleSoft. All ChartFields are capable of “balancing” within PeopleSoft; however, there is a need to separate the need to balance from the ability to roll forward an end of year balance. CAS: Cost Accounting Standards CFR: Code of Federal Regulations CFDA (The Catalog of Federal Domestic Assistance) is a government-wide compendium of Federal programs, projects, services, and activities that provide assistance or benefits to the American public. It contains financial and nonfinancial assistance programs administered by departments and establishments of the Federal government. Number assigned to the program As the basic reference source of Federal programs, the primary purpose of the Catalog is to assist users in identifying programs that meet specific objectives of the potential applicant, and to obtain general information on Federal assistance programs. In addition, the intent of the Catalog is to improve coordination and communication between the Federal government and State and local governments. Chartfield (EFS): A PeopleSoft term describing a field that stores a value, chosen from a table of valid values. PeopleSoft uses ChartField functionality to capture, access, and report its financial information; a sequence of ChartField values identifies a financial transaction. Each ChartField operates independently functioning similar to a “slot machine” and may have a many-to-one relationship with other ChartFields. Chartfield String (EFS): Indicates a combination of ChartFields and the level at which accounting charges/credits are applied. The terms “ChartField string” and “account string” are used interchangeably. Class (EFS): A ChartField that identifies the purpose of a program or project. Class codes are defined based on reporting requirements from external sources. For example, a value for Class would be established for the purpose of instruction. This is similar to the function code in CUFS. Classified Research: Research sponsored by a Federal government entity that involves restrictions imposed, by agreement or otherwise, on the distribution or publication of the research findings, or results for a specified period or for an indefinite duration following completion of the research. Clinical Trial(CT)/Clinical Study(CS): A special category of activity that combines research with the testing of practical applications in biomedicine. Clinical trials/studies are usually funded by commercial sponsors seeking approval of new pharmaceutical products or treatments. Close-out: The completion of all work on a sponsored project, followed by the accounting of all costs and the filing of all required final reports; financial, technical, patents and inventions, and any other reports required by the sponsor. Competing Proposals: Proposals that are submitted for the first time or unfunded proposals that are resubmitted; must compete for research funds. Ongoing projects must compete again (renewal) if the term of the original award has expired. Conflict of Interest: A conflict of interest occurs when an employee compromises professional judgment in carrying out University teaching, research, outreach, or public service activities because of an external relationship that directly or indirectly affects the financial or business interests of the employee, an immediate family member, or an associated entity. Continuation Project (Non-Competing): Applicable to grants and cooperative agreements only. A project approved for multiple-year funding, although funds are typically committed only one year at a time. At the end of the initial budget period, progress on the project is assessed. If satisfactory, an award is made for the next budget period, subject to the availability of funds. Continuation projects do not compete with new project proposals and are not subjected to peer review after beyond the initial project approval. Consortium: A consortium includes two or more institutions working on the same research project. Each institution may be funded directly by the supporting agency or one prime institution may subaward out the funds to the other members of the consortium. Contract: A contract is an agreement to acquire services that primarily benefit the sponsor. For an award to be considered a contract, it normally must contain all of the following elements: • Detailed financial and legal requirements and a specific statement of work to be performed. • A specific set of deliverables and/or reports to the sponsor. • Separate accounting procedures. • Legally binding contract clauses. • Benefits of the project accrue first to the sponsor, then to the University, then to the nation. CONTRACT (Procurement): A contract is the appropriate agreement to be used in a relationship between the federal government and a recipient whenever (1) the principal purpose of the relationship is to acquire, by purchase, lease, or barter, property or services for the direct benefit or use of the federal government; or (2) an executive agency determines in a specific instance that the use of a type of procurement contract is appropriate. COOPERATIVE AGREEMENT (financial assistance/support): A cooperative agreement is the appropriate agreement to be used in a relationship between the federal government and a recipient whenever (1) the principal purpose of the relationship is the transfer of money, property, services or anything of value to the state or local government or other recipient in order to accomplish a public purpose of support or stimulation authorized by federal statue, rather than acquisition, by purchase, lease, or barter, of property or services for the direct benefit or use of the federal government; and (2) substantial involvement is anticipated between the executive agency, acting for the federal government, and the state or local government or other recipient during performance of the contemplated activity. Copyright: A copyright protects an original work, set down in a fixed form or medium of expression, e g., texts, computer software, visual and audio materials. It protects the embodiment of an idea, as opposed to the idea itself. A copyright term is 75 years from the date of publication or 100 years from the time the work was created. Cost Accounting Standards (CAS): Federally mandated accounting standards intended to ensure uniformity in budgeting and spending funds. Incorporated into the 1996 A-21 Revision, cost accounting standards include requirements for acceptable and consistent cost accounting practices for recipients of Federal funds. COST ANALYSIS: Cost Analysis is the review, evaluation and analysis of each of the elements of the subawardee's cost proposal, including lower-tier subawards/subcontracts and purchase orders proposed. COST CONTRACT: A cost reimbursement contract in which the contractor receives no fee. Such a contract may be appropriate for research and development work, particularly with educational institutions, hospitals or other nonprofit organizations. COST OVERRUN: Direct costs incurred and charged to a sponsored project in excess of the awarded amount. COST REALISM STUDY: Cost Realism Study is the process of independently reviewing and evaluating specific elements of the subawardee’s proposed cost to determine whether the estimated proposed cost elements are realistic for the work to be performed, reflect a clear understanding of the requirements; and are consistent with the various elements of the subawardee’s technical proposal. Cost Reimbursement (CR): A type of agreement whereby payments are based on actual allowable costs incurred in performance of the work. Cost-Sharing: A general term, used as a noun or adjective, that can describe virtually any type of arrangement in which more than one party supports research, equipment acquisition, demonstration projects, programs, or institutions. Example: A University receives a grant for a project estimated to have a total cost of $100,000. The sponsor agrees to pay 75% ($75,000) and the University agrees to pay 25% ($25,000). The $25,000 is the cost-sharing component. Cost Transfer: A cost transfer is a system that allows department administrators to correct objects and move or transfer payroll and non-payroll expenses from one account/fund to a different account/fund source. DeptID (EFS): DeptID identifies the organization at the University where budgets, staff, or academic programs are managed. It represents one or more of the following • A management unit of fiscal responsibility, OR • A hiring authority for staff or a unique department designation required for effective human resource management (Human Resource system), OR • A distinct academic program which requires a unique department designation for effective management of academic programs (Student Administration system). One set of DeptID values will be shared by all Enterprise systems (Financial, Student, and Human Resources). A DeptID value answers the question, “What is the level of responsibility at which I need to be able to isolate a group of financial resources, employees, or academic programs to support effective management of financial, human, and academic resources?” DeptID is required on all transactions, and consists of five numeric characters. Use of ranges, sight recognition, and smart coding for DeptID are notsupported. Deficit (also known as Overdrafts): The condition where total expenditure and encumbrances exceed an appropriation. Direct Costs: Clearly identifiable costs related to a specific project. General categories of direct costs include, but are not limited to, salaries and wages, fringe benefits, supplies, contractual services, travel and communication, equipment, and computer use. EFS The Enterprise Financial System The new PeopleSoft financial system will replace and integrate virtually all the University’s financial systems on all campuses in July 2008: CUFS, Financial Forms Nirvana, Electronic Grants Management System internal (EGMSi), JD Edwards, and a variety of subsidiary and redundant systems. Also starting at that time, the new financial system will be used for financial reporting and financial data retrieval, replacing the financial reporting and data currently provided by the Data Warehouse, UM Reports, and Financial Reports on the Web. Effort: The amount of time, usually expressed as a percentage of total effort (100%) that a faculty member or other employees spend on a project. Effort is certified and documented through the Effort Reporting System. EFFORT CERTIFICATON: Federal requirement of OMB Circular A-21 that all effort applied to federally-sponsored contracts or grants be verified after the fact to see that effort reasonably reflects the planned distribution of pay. Electronic Research Administration (ERA): Conducting research administration by utilizing electronic resources such as the internet, the web, form templates, databases, and other electronic tools. Encumbrance (also known as a lien): A transaction that reflects University’s legal obligation to pay for goods or services ordered through a formal purchase order or various maintenance, consultant, rental and lease agreements. Expanded Authorities: Policy implementation by some Federal granting agencies which delegate certain prior approval authorities to grantee institutions. This delegation allows for internal University approval of administrative and spending actions, thus avoiding delays in project progress Expense (EFS): Account type used to describe an item of business outlay chargeable against revenue for a specified period. Equipment: Any item purchased at a unit consistent with University policies for capitalization. (The capitalization level is $2500 and greater and a useful life of over two years). External Sales: An exchange of tangible or intangible property or services between the University and external customers for monetary consideration. External sales may be subject to federal and state taxes. Facilities and Administrative Costs (F&A or Indirect Costs): Facilities and Administrative Costs are actual costs incurred during the normal business activities of an organization that cannot be readily identified with or directly charged to a specific project or activity. Include instruction and departmental research, library services, public service, and other institutional activities. F&A costs are real, auditable costs incurred by the University each time it accepts an award for a sponsored project. If the University does not collect full reimbursement for these costs, other University resources must be used to subsidize them. Federal Acquisition Regulations (FAR): FAR was established to codify the uniform policies for the acquisition of supplies and services by executive agencies, normally applied to RFPs and Federal contracts. Federal Demonstration Partnership (FDP): The Federal Demonstration Partnership is a cooperative initiative among Federal agencies and institutional recipients of Federal funds. It was established to increase research productivity by streamlining the administrative process and minimizing the administrative burden on PIs while maintaining effective stewardship of Federal funds. Under the FDP a researcher, as a recipient of Federal grants, has management flexibility which includes ninety-day pre- spending authority, institutionally approved no-cost extensions up to one additional year, and automatic carryover of unobligated funds from one budget period to the next. FFATA: The Federal Funding Accountability and Transparency Act (FFATA) was signed on September 26, 2006. The intent is to empower every American with the ability to hold the government accountable for each spending decision. The end result is to reduce wasteful spending in the government. The FFATA legislation requires information on federal awards (federal financial assistance and expenditures) be made available to the public via a single, searchable website. Federal awards include grants, subgrants, loans, awards, cooperative agreements and other forms of financial assistance as well as contracts, subcontracts, purchase orders, task orders, and delivery orders. Final Report: The final technical or financial report required by the sponsor to complete a research project Fin EmplID (EFS): Fin EmplID is a conditional ChartField to be used when the financial activity must be identified with a specific employee. Fin EmplID provides an additional level of detail below DeptID or Program, or cross-DeptID or cross-Program information pertaining to a single employee. Fin EmplID answers the question, “If this financial activity needs to be tracked by individual employee, to which employee should this transaction be assigned?” Fin EmplID consists of eight numeric digits, assigned by Human Resources. Its use in a ChartField String is conditional, depending on the program value used. Units may set internal policies requiring the use of Fin EmplID without the requirement becoming a system edit. In this situation, monitoring, enforcement, and ensuring data integrity is the responsibility of the unit, not central administration. In some instances, specific program values have been established to require use of Fin EmplID. Firm Fixed-Price (FFP): A type of agreement whereby payment is not based on actual cost expended but upon a mutually agreed upon price. Fiscal Year (FY): Any twelve-month period for which annual accounts are kept (at UCM, July 1 through June 30). FIXED FEE: In a "fixed fee" award, the PI agrees to accomplish project objectives within a specific timeframe for a set dollar amount per patient, per hour, or other unit. The total award amount is based on an estimated number of units and is subject to downward adjustment based on the actual number of units completed. Sponsor approval is required to exceed the estimated number of units. The fee per unit remains constant, even if the actual cost per unit is above or below that amount. Any overexpenditures are the responsibility of the department, and earned unspent revenue does not revert to the sponsor. If the deliverables are not completed within the award period, the contract must be extended. FIXED PRICE: In a "fixed price" award, the PI agrees to accomplish project objectives within a specific timeframe for a set dollar amount. If the deliverables are not completed within the award period, the contract must be extended. The award amount also remains constant, even if actual costs for the project are above or below it. Any overexpenditures are the responsibility of the department, and unspent funds do not revert to the sponsor. Function (EFS): The Function code indicates the purpose of a project or program, such as instruction or research. Instruction and research are different functions, and departments would need a separate program or project for each. Function codes are grouped into the following categories: -Instruction Function Codes • Research Function Codes • Public Service Function Codes • Institutional Support Function Codes • Academic Support Function Codes • Student Services Function Codes • Auxiliary Enterprises Function Codes • Scholarships and Fellowships Function Codes • Agency Activity Function Codes Function codes are four characters long and identify the purpose of an expenditure. They answer the question, “How does this transaction accomplish the mission of the University?” Function codes are always required on all transactions when program or project are applicable. However, function code will not be entered on individual transactions. Instead, function is attached to either Program or Project and is inferred when either of these ChartFields is chosen. Each program or project can have only one function code attributed to it. Whenever a department or unit starts performing tasks that are different from the nature of the work they have been doing, the impact on function coding must be taken into consideration. For example, if a department that typically instructs starts to conduct research activities as well, a new Program must be identified with a research function code. As a rule of thumb, any single activity that is equal to or greater than both $100,000 and 25 percent of the total program or project costs should be separated for the assignment of the appropriate Function code. To identify and code federally unallowable costs, departments should separately budget and expend the salaries and benefits for any person who spends more than 25 percent of total effort in any particular month performing any of the OMB Circular A-21 unallowable activities (see University Policy, Charging of Direct and Facilities and Administrative [Indirect] Costs for details). Fund (EFS): Fund accounting classifies resources for accounting and reporting purposes in accordance with regulations, restrictions, or limitations imposed by donors, parties outside of the University, or the Board of Regents. A fund is an accounting entity with self-balancing sets of accounts that record cash and other financial resources (assets), with related liabilities, fund equity (net assets) and other corresponding changes. The Fund ChartField answers the question: “What broad restrictions or reporting requirements have been imposed on these funds?” Fund values are always required on transactions, and consist of four numeric characters. Fund Balance (EFS): Fund balance is equal to assets minus liabilities within a fund. General Ledger (EFS): The General Ledger of the U of MN is the official record of the University’s budgeting and financial transactions. The General Ledger includes budget transactions, revenue and expense transactions, encumbrances, assets, liabilities and fund balances. u General Purpose Equipment: Equipment that is not limited to use for research, scientific, or other technical activities. Examples of general purpose equipment include office equipment and furnishings, air conditioning equipment, reproduction and printing equipment, motor vehicles, and automatic data processing equipment. GIFT: A unilateral transfer of money, property, or other assets to the recipient for the recipient’s ownership and use, by a donor who makes no claims on the recipient in connection with the gift. Gifts normally have the following characteristics: • The circumstances of the gift allow the recipient significant freedom. • No deliverables are involved. • Separate accounting procedures are not required. • Benefits of the project are to accrue to the nation and the world. • The donor receives no audit reports. GRANT: An agreement to transfer money, property, services, or anything of value to accomplish a purpose, such as provide support or assistance in an area of interest to the grantor. For an award to be considered a grant, it normally will contain the following elements: 1. The statement of work allows the project director significant freedom to change emphasis within the general area of work as the project progresses. 2. Deliverables are minimal, usually consisting of reports only. 3. Separate accounting procedures are required. Grant/Contract Administrator: University employee who helps manage the sponsored project. Grant/Contract Officer: Sponsor’s employee who is officially responsible for the project’s business management. Grantee: A grantee is the recipient of a grant. When the University accepts a grant award, on behalf of an individual, it becomes the grantee. IACUC: Institutional Animal Case and Use Committee IBC: Institutional Biosafety Committee Inception to date: A time period reflecting information collected since the inception or start of an award. Indirect Costs: See “Facilities and Administration” The Federal government has replaced “indirect costs” with the term ‘facilities and administration(F&A) costs.” Indirect Cost Rate or F&A Cost Rate: A composite rate applied to sponsored projects as a percentage of the sponsored project's direct costs for the purpose of charging the sponsored project its share of the University's indirect/F&A costs. The Federally negotiated Indirect/F&A Cost Rates for research and other sponsored activities are developed by the University in accordance with OMB Circular A-21 and negotiated with the Department of Health and Human Services (DHHS), the University's Federal cognizant agency. Example: "The indirect costs for a project are computed by multiplying the direct costs by the indirect cost rate." The University uses the term "F&A cost rate" on its forms. Informed Consent: The voluntary agreement obtained from a subject (or the subject’s legally authorized representative) who is agreeing to participate in research or related activity, before participating in that activity. The consent must permit the individual (or legally authorized representative) to exercise free power of choice without undue inducement or any element of deceit, fraud, force, duress, or other form of coercion or constraint. In-Kind Contribution: A non-cash commitment (such as contributed effort, facilities use, or supplies) to share the costs of a sponsored project. The University considers "inkind" to be interchangeable with "matching" but the term may refer to costs borne by an external organization, for example when individuals at another organization volunteer their time. Institutional Authorized Officials: Your contract and grant officer/analyst: individuals authorized by the Regents of the University of California to sign grants, contracts, and agreements on behalf of the Regents. Intellectual Property (IP) : Results of research conducted by the University that have potential value for practical applications or other uses by the public. Major examples of intellectual property are inventions, computer software, biological materials, and original writings. When is it in the interest of the University, or otherwise necessary, a patent or copyright is obtained to protect intellectual property rights. Inquiry (EFS): Delivered on-line reporting tool to view financial information from the journal or ledger. Internal Services Organization (ISO): University unit whose primary mission is to provide goods and/or services to other University units. Invention: A patentable invention is any new and useful process, machine, article of manufacture, or composition of matter, or new and useful improvement thereof (35 United States Code 101). Inventor: All personnel who produce a development that must be disclosed to the Office of Technology Commercialization in accordance with the Regents' Patents and Technology Transfer Policy. Invoicing: For some extramural awards, the sponsor initiates payment only after receiving an invoice with or without expenditure breakdown. Invoices are prepared based on general ledger expenses and are submitted to sponsors and payments of invoices are recorded. IPAS: Institutional Prior Approval System IRB: Institutional Review Board (for human subjects research) Journal Entry (EFS): Journal Entry (JE) represents a document type and journal source. The document type JE would be used to indicate journal entries involving transfer of funds, moving expenses and correcting entries. Key Personnel: The personnel considered to be of primary importance to the successful conduct of a research project. The term usually applies to the senior members of the project staff. Letter of Credit: A type of payment in which funds to cover project expenses are transferred to the University's commercial bank from the Federal Reserve Bank. Liability (EFS): A financial obligation recorded in the general ledger. License: Legal permission from a patent owner to practice an invention. The license term is negotiated with the licensee. Mandatory Cost Sharing: Matching that is required by the sponsor, is stated on the Notice of Grant/Contract Award (NOGA), must be documented, and must be reported to the sponsor. Mandatory Matching: Matching that is required by the sponsor, is stated on the Notice of Grant/Contract Award (NOGA), must be documented, and must be reported to the sponsor. Matching: The terms "cost sharing," "matching," and "in-kind" refer to that portion of the total project costs not borne by the sponsor. The University generally refers to matching when looking at nonlabor items. Cash funds are usually required by sponsors for equipment acquisition programs, specialized research centers, or other multidisciplinary programs. Typically these funds are provided by the institution. Material Transfer Agreement (MTA): A Material Transfer Agreement (MTA) is a written agreement entered into by a provider and a recipient of research material. The purpose of the MTA is to protect the intellectual and other property rights of the provider while permitting research with the material to proceed. Memo Liens: Unofficial commitment based on spending requests that have not yet been approved or encumbered. Modification: Any change made to an existing sponsored agreement. Modified Total Direct Cost (MTDC): Base upon which the Federally negotiated F&A rates are applied. MTDC is derived by excluding certain costs from the direct cost total. Exclusions include: equipment, patient care, alterations and renovations, space rental, tuition remission, subawards to other UC campuses, and in all other subawards, any amount beyond the first $25,000. NACUBO: National Association of College and University Business Officers Non-Competitive Renewal: For multiyear projects, sponsors may require annual applications for continued funding. These applications do not compete for funds. Non-Service Payroll: All non-activity-based items which appear in gross earnings for eligible employees and are not to be included when certifying effort. Notice of Grant Award (NOGA): A document that provides information regarding the award's important terms and conditions. It should be referred to by PIs and departments to provide guidance in managing the project. No-Cost Extension(NCE): Provides for an additional period of performance to accomplish project goals. Requests may be handled internally by SPO in certain circumstances or sought externally from the sponsor. Non-Payroll Cost Transfers: Also known as Non-PEAR, are non payroll expenditure adjustment requests. They provide a chance to adjust financial transactions on the general ledgers. The adjustment requests must be fully explained, justified and approved. OMB Circular A-21: Office of Management and budget (OMB) circulars give instructions to the Federal agencies that they are required to implement. The effect is to provide guidance regarding the maximum requirements for Government agencies and the minimum standards for institutions. OMB Circular A-110: Office of Management and Budget Circular A-110, Uniform Administrative Requirements for Grants and Agreements with Institutions of Higher Education, Hospitals, and Other Non-Profit Organizations. This document establishes uniform regulations for each Federal agency to follow in regards to the administration of projects sponsored by the Federal government. In addition, each Federal agency has its own regulations that are listed in the Code of Federal Regulations (CFR) and explained in its policy handbook (if it has one). Other Sponsored Activities: A broad range of activities that are integral to the University’s educational, research and public service missions. Some major examples are art exhibitions, performing art productions, continuing education projects, and the provision of special resources to the public. Other Support: All financial resources, whether Federal, non-Federal, commercial or institutional, available in direct support of an individual's research endeavors, including but not limited to research grants, cooperative agreements, contracts and/or institutional awards. Training awards, prizes, or gifts are not included. Patent: A patent is a grant of property by the United States government to the inventor giving the owner of the patent the right to exclude others from making, using, offering for sale, or selling the invention in the U.S. or importing it to this country. A U.S. patent is granted for 20 years. PRF Form (Proposal Routing Form): A unique UofM term that refers to the “Proposal Approval and Submission Sheet” form that must be completed and signed by the PI, the department head and school dean, before a proposal can be submitted to SPA for review and submission to a sponsor. PRICE ANALYSIS: Price Analysis is the process of examining and evaluating a prospective price without performing cost analysis; that is without evaluating the separate cost elements and profit of the subawardee included in the proposal. Principal Investigator (PI): Typically, a faculty member who submitted a proposal that was funded by an external sponsor, may be referred to as the project director. The PI has primary responsibility for technical compliance, completion of programmatic work, and fiscal stewardship of sponsor funds. Co-PI (Co-PI): Investigators sharing equal responsibility for the direction of a research program. (PHS/NIH does not recognize the concept of Co-PI.) Preaward Account: An account established to begin working on a project before the project start date. Preaward Costs: Costs incurred prior to the effective date of an award or budget period. Prior Approval: The requirement for prior written approval to use project funds for purposes not in the approved budget, or to change aspects of the program from those originally planned and approved. Prior approval must be obtained before the performance of the act that requires such approval. PROGAM (EFS): Program answers the question, “What is the activity for which I need to capture financial information?” Program describes what is being done – the activity, or what is being accomplished. Program is required whenever the Project ChartField is not applicable, and it consists of five alphanumeric characters. Program is used to track transactions in order to capture information on a particular activity that is subject to only general budgetary or regulatory restrictions. Program identifies activities not identified by a project value. (Project identifies activities that use the project costing module. The project costing module provides functionality to manage activities with specific budgetary, accounting, or regulatory requirements. See project definition for further detail.) There are a few points to keep in mind when working with Programs: 1. Function codes are an essential element of some of the Universitywide reporting done by central offices. However, there are other, more specific activities that also need to be tracked/managed on a University-wide level. Examples include: the President’s Scholarship Match program, Grant in Aid of Research, Artistry or Scholarship, and Extension’s collegiate partnerships. 2. Within some Functions, a number of Programs may sound quite similar—some describe an activity in general terms, while others describe an activity in finer detail. For example, within Function 0100 (Instruction–Credit Courses) Programs have been set up for: 10031–Credit Instruction, 10038–Credit Inst Undergraduate,10033–Credit Inst Summer Session, etc. While one aspect of credit instruction may be important to one unit, a different parameter may be important for the management of another unit. In these cases, the RRC Manager (or a leader at the level of a vice president) can determine the strategy for use of program values within that function code. That person can determine the level of detail needed to support effective decision-making and financial management. Program There are three main types of Program codes: 1. Programs utilized by central administration for uniform use University-wide 2. Programs defined for common activities and designed for shared use by multiple departments (Program indicates an activity below the DeptID level, but may be used by multiple departments). 3. Programs requested for a unique activity within a specific department. Alphanumeric values are used for centrally-defined Programs requiring uniform usage University-wide. These codes are restricted in their use, and are established by central administration. Alphanumeric codes are not recommended when a significant volume of data entry is expected. Numeric values are used for all activities not tracked within the Projects module which do not fit the requirements for Alphanumeric codes. Numeric program values can and will be used by multiple users. In all cases, the Program description and the Function code must accurately reflect the activity. Required for transactions on all revenue, expense, and transfer Accounts for all activity not defined by a Project in the Projects Module. A Program value is used in conjunction with a Project value when Program activities are used as matching/cost-share. Program is also required for all balance sheet transactions except cash (10XXXXaccounts), accounts payable (20XXXX accounts), and fund balance (30XXXX). Program Announcement: Describes existence of a research opportunity. It may describe new or expanded interest in a particular extramural program or be a reminder of a continuing interest in an extramural program. Program Income: Program income is gross income earned by a research grant recipient from the activities of the grant, support for which was borne as a direct cost by the grant. Examples are fees for services performed under the grant, rental or usage fees charged for use of equipment purchased with grant funds, third party patient reimbursements for hospital or medical services paid from the grant, funds generated by the sale of commodities, such as cell lines or research animals developed for or paid for from the grant, and patent or copyright royalties. Program/Project Officer: A sponsor's designated official responsible for the technical, scientific, or programmatic aspects of a particular grant, cooperative agreement, or contract. Serving as the counterpart to the PI/project director of the grantee/contractor organization, the program/project officer deals with the grantee/contractor organization staff to assure programmatic progress. Progress Report: Periodic, scheduled reports required by the sponsor summarizing research progress to date. Technical, fiscal, and invention reports may be required. PROJECT (EFS): Projects are used to track a unique group of accounting transactions in order to capture information on a particular project activity with specific budgetary, accounting, or regulatory requirements that are supported by the the Financial System Project Costing module. Characteristics of valid project types are identified below. Only those activities managed in the Project Costing module use the Project ChartField. (A program value identifies activities that do not use the Project Costing module.) Each project value has an attribute that identifies a function code. The Project Costing module is required for use with the following project types: • Sponsored projects – projects with an external sponsor managed through the University’s Sponsored Projects Administration • Construction in progress – building projects which will result in a capitalized item managed through Facilities Management Use of the Project Costing module for other project types requires approval by the Office of the Controller. Approved project types will demonstrate a business need for the functionality provided in the Project Costing module, and the projects will have at least four of the following characteristics: • A separate budget with line item budgetary restrictions (by Account or budget-only Account) • A defined life cycle (specific begin and end dates) independent of the University’s fiscal year • Support from revenue received through letter of credit processing • A clearly defined outcome • A principal investigator Approval for a project type may only be requested by the unit with primary authority for the project type. If approved, all activity of a project type uses Project rather than Program. A project value is used in conjunction with a program value when program activities are used as matching/cost-share. Project answers the question, “What is the project activity for which I need to capture financial information?” Project consists of eight numeric characters. All sponsored projects are assigned values through Sponsored Project Administration (SPA) while nonsponsored values are assigned by Accounting Service Project Period (PP): The total time for which support of a project has been programmatically approved. A project period may consist of one or more budget periods. Proposal: A set of documents containing a descriptive narrative of an idea and a budget to be submitted to a funding agency for sponsored support. Some agencies require that proposals be submitted on preprinted forms, while others have no specific format. Public Service: Provides support for the purpose of organizing, establishing, providing or enhancing the delivery of services to a particular community or non-University audience. Examples: Musical or dramatic productions; tutorial services to potential University. OTC: Office for Technology Commercialization. The administrative office that seeks proprietary protection for University technology, including inventions and copyrightable materials, and negotiates their transfer to the private sector through licensing or by participating in starting new companies. Purchase Order: Authorization sent to a vendor to supply goods or services in return for payment. It is a document used to encumber funds to be spent in the future and record obligations prior to REASONABLE COSTS: A cost is reasonable if, in its nature and amount, it does not exceed that which would be incurred by a prudent person in the conduct of competitive business. Re-budgeting: Process by which funds available for spending are reallocated between budget categories to allow best use of funds to accomplish project goals. Request for Applications (RFA): Announcements that indicate the availability of funds for a research area of specific interest to a sponsor. Proposals submitted in response to RFAs generally result in a grant award. Specific grant announcements may be published in the Federal Register and/or specific sponsor publications. The RFA instructions include the information necessary to complete the application and mailing instructions Request for Proposal (RFP): Announcements that specify a topic of research, methods to be used, product to be delivered, and appropriate applicants sought. Proposals submitted in response to RFPs generally result in a contract award. Notices of Federal RFPs are published in the Commerce Business Daily. Research: Diligent and systematic inquiry or investigation into a subject in order to discover or revise facts, theories or applications Revision: A modified and resubmitted request for funding for a project that was previously not funded because it was either denied by the sponsor or withdrawn by the PI RSPP: Research Subjects' Protection Programs SFR: Sponsored Financial Reporting SPA (Sponsored Projects Administration): The University of Minnesota system-wide office authorized to submit research proposals and receive awards from external sources on behalf of the Board of Regents of the University of Minnesota. SPA is also the fiduciary for the U on grant-related matters. Special Purpose Equipment: Equipment which can be used only for research or other technical activities. SPIN: Sponsored Projects Information Network Sponsor: An external funding agency which enters into an agreement with the University to support research, instruction, public service or other sponsored activities. Sponsors include private businesses, corporations, foundations and other not-for-profit organizations, other universities, and Federal, state and local governments. Sponsored Research (also referred to as extramural support/funding): Funding for research, training or public service programs provided by Federal or private sources outside the University, usually requiring formal acceptance of terms and conditions by the University related to the performance of the research. Stipend: A payment made in accordance with preestablished levels, to an individual to provide for their living expenses during the training period of a fellowship or training project. Sub and Object codes: 2 digit Sub codes are general cost categories such as salaries (sub 00, 01, 02), supplies (sub 03), equipment (sub 04), overhead (sub 9H) etc. 4 digit Object codes are further break downs of sub codes. Examples are 1XXX-salaries and wages, 2XXX-travel costs, 30XX-transportation of things etc. Allowability of expenditure on extramural funds are monitored by analyzing these cost categories. Subaward, Subcontract, Subgrant, or Subagreement: A document written under the authority of, and consistent with, the terms and conditions of an award (a grant, contract or cooperative agreement), that transfers a portion of the research or substantive effort of the prime award to another institution or organization. SUBCONTRACT: FAR (Federal Acquisition Regulations) Part 44.101 defines a subcontract as follows: “Subcontract”, as used in this part means any contract as defined in Subpart 2.1 entered into by a subcontractor to furnish supplies or services for performance of a prime contract or a subcontract. It includes but is not limited to purchase orders, and change orders and modifications to purchase orders. SUBCONTRACTOR: FAR Part 44.101 defines a subcontractor as follows: “Subcontractor”, as used in this part means any supplier, distributor, vendor, or firm that furnishes supplies or services to or for a prime contractor or another subcontractor. SUBRECIPIENT: OMB Circular No A-133 Subpart A 105 definitions a subrecipient as follows: A subrecipient means a non-federal entity that expends Federal awards received from a pass-through entity to carry out a Federal program, but does not include an individual that is a beneficiary of such a program. A subrecipient may also be a recipient of other Federal awards directly from a Federal awarding agency. SUBRECIPIENT AGREEMENT: A Subrecipient agreement is a complex form of procurement which (1) is generally issued under a MIT WBS element, (2) provides for the acquisition of experimental, developmental or research work, and (3) is generally issued on a cost reimbursement basis. Supplemental (Rebudgeting or Modification) Proposal: A request to the sponsor for additional funds for an ongoing project during an already approved performance period. A supplemental proposal may result from increased costs, modifications in design, or a desire to add a closely related component to the ongoing project Terms of Award: All legal requirements imposed on a recipient by the sponsor, whether by statute, regulation(s), or terms in the award document. The terms of an agreement may include both standard and special provisions that are considered necessary to protect the sponsor's interests. Transaction Type: Loan/cooperative agreement/contract/grant, etc. Transfer of Funds (TOF): Transfers of funds are initiated to establish budgetary appropriations and adjust budgetary appropriations. Tree (EFS): Trees are structures that define various roll-ups in PeopleSoft by using levels and nodes. Each tree applies to a specific ChartField. Reports access tree nodes to specify selection criteria and use tree levels for roll-ups and subtotals. Total Direct Cost (TDC): The total of all direct costs of a project. Total Project Costs: The total allowable direct and indirect costs of a project. Trademark: A name, work, symbol, or device which allows the trademark owner to dictate its use in identifying a product, e.g., logos and brand names. Unallowable Costs: Unallowable cost means any cost which, under the provisions of any pertinent law, regulation, or sponsored agreement cannot be included in prices, cost reimbursements, or settlements under a Government sponsored agreement to which it is allocable. (CAS 9905.505). Unilateral Agreement: A type of sponsored agreement that the University does not have to sign in order to receive funds. Unobligated or unexpended balance: Unspent fund balance. Unrestricted Funds: Monies with no requirements or restrictions as to use or disposition. Grants, contracts, and cooperative agreements are considered to be restricted funds, while gifts are considered unrestricted funds. Unsolicited Proposal: Proposals submitted to sponsors that are not in response to an RFP, RFA, or program announcement. Voluntary Cost Sharing: Cost sharing that is not required by the sponsor, is stated on the Notice of Grant/Contract Award (NOGA), and although not reported to the sponsor, must be documented through established procedures. Voluntary Matching: Matching that is not required by the sponsor, is stated on the Notice of Grant/Contract Award (NOGA), and although not reported to the sponsor, must be documented through established procedures.